The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana Price Prediction: Can SOL Rebound Towards $150 as Liquidity Resets and Key Support Holds Firm?

Solana price is stabilizing above a major support zone, with tightening structure and improving liquidity, hinting at a potential rebound towards the $145–$150 region.

Solana price is drawing renewed interest this week as price action stabilizes above a major multi-year support zone, forming a structure that several analysts believe could mark the beginning of a new accumulation phase. After a choppy start to December, SOL is attempting to reclaim bullish momentum while broader market liquidity undergoes a notable reset.

Solana current price is $137.58, up -3.44% in the last 24 hours. Source: Brave New Coin

As of today, Solana trades around $137.59, up 3.44% in the last 24 hours according to Brave New Coin. The asset briefly touched a daily low near $132 before recovering, reinforcing the importance of the $120–$130 support area that has historically acted as one of SOL’s strongest demand zones.

Support at $120 Holds as Buyers Begin Defending Structure

Recent long-term charts show Solana price forming a tight consolidation above $120, with sellers repeatedly failing to break the structure. The hold is particularly important because this level previously served as the midpoint for major reversal cycles dating back to late 2023.

Source: SOL has repeatedly rebounded from this horizontal demand band through 2024–2025. Source: Gem Detector via X

At the same time, momentum is beginning to shift. Crypto TA King identified an ascending triangle pattern, a structure that statistically favors bullish continuation when support holds. The chart highlights a rising trendline from the $130 to $134 region, suggesting buyers are steadily stepping in at higher lows.

Solana’s ascending triangle continues to tighten, with higher lows forming between $130–$134 as buyers steadily build pressure beneath resistance. Source: Crypto TA King via X

The analyst notes that a confirmed breakout above the $145–$148 resistance band could trigger the next expansion phase, aligning with historical reaction points seen earlier this year.

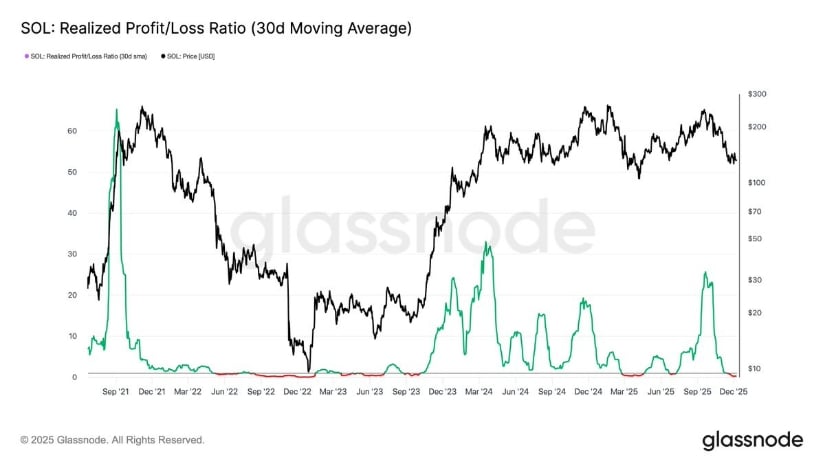

On-Chain Data Hits Peak Bear Levels While SOL Defends Key Support

Solana’s realized profit-to-loss ratio has now traded below 1 since mid-November, according to Glassnode, meaning realized losses are consistently outweighing realized profits. This type of reading typically appears during deep bear-market conditions, when liquidity contracts and participants capitulate into weakness.

Solana’s liquidity dynamics now resemble early phases of prior recovery cycles. Source: Glassnode via X

What makes this significant is that price is simultaneously holding the critical $120 to $130 support, a level Solana has not lost in nearly two years. Historically, when major supports hold while on-chain metrics print extreme negative conditions, sellers often run out of momentum first. If capitulation pressure fails to push the Solana price below support, the setup can reverse sharply as liquidity normalizes.

While confirmation still requires a breakout above the $145 to $148 resistance band, the on-chain environment now reflects the same exhaustion conditions seen near Solana’s previous cyclical turning points.

Technical Outlook: Breakout Models Point Towards $145–$150

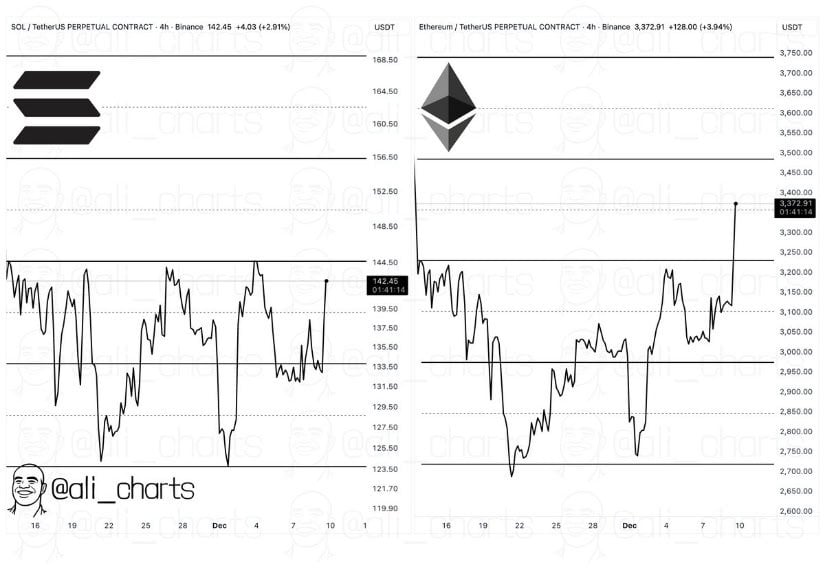

Ali Martinez’s comparative model shows Solana’s recent structure closely tracking Ethereum’s breakout pattern from last month. According to his analysis, if the correlation continues, the breakout projection for Solana sits around $150.

SOL may mirror ETH’s earlier breakout path towards the $150 region. Source: Ali via X

Several technical factors support this level as the short-term inflection point:

-

ETH-mirroring models indicate a clean breakout structure targeting $150.

-

Liquidity maps show minimal resistance between $142 and $150, increasing the probability of a rapid move if momentum builds.

-

The ascending triangle is targeting $145–$148.

Immediate support sits at $130–$134, with the major structural floor still anchored at $120. A breakdown below $120 would invalidate the bullish models, but current data suggests buyers remain firmly in control above this threshold.

Final Thought: Can Solana Extend Towards $150 and Beyond?

Solana price now sits at a critical intersection of technical and on-chain dynamics. The $120–$130 support continues to act as one of the most important structural floors of the entire 2024–2025 cycle, and the latest Glassnode readings show that realized losses have reached levels typically associated with late-stage seller exhaustion. When price stability converges with peak bearish on-chain conditions, markets often enter a phase where momentum can shift faster than sentiment anticipates.

From a broader Solana price prediction standpoint, the next reaction from this support band will likely define the remainder of December’s trajectory. A sustained hold above $130 combined with improving liquidity, could open room towards $145 and $150. However, failure to maintain this base would expose the lower demand zones near $120, delaying any meaningful rebound.

Regardless of the short-term noise, Solana’s current structure reflects a market approaching an important decision point. Confirmation will ultimately depend on whether buyers can convert this compression phase into a trend reversal, or whether sellers attempt one final push before volatility expands again.