The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Dogecoin (DOGE) Price Prediction: Dogecoin Analysts Reassess Historical Patterns as 2026 Outlook Remains Uncertain

Dogecoin enters late 2025 at a critical inflection point, as analysts revisit its historical patterns and reassess whether current technical signals support a sustainable recovery into 2026.

While Dogecoin is drawing renewed market attention, experts emphasize that its price structure remains mixed—showing early stabilization signs but also notable uncertainty tied to liquidity, sentiment swings, and broader macroeconomic conditions. This has led researchers and traders to approach cycle-based forecasts with increased caution despite improving short-term signals.

Technical Patterns Show Conditional Upside but Require Confirmation

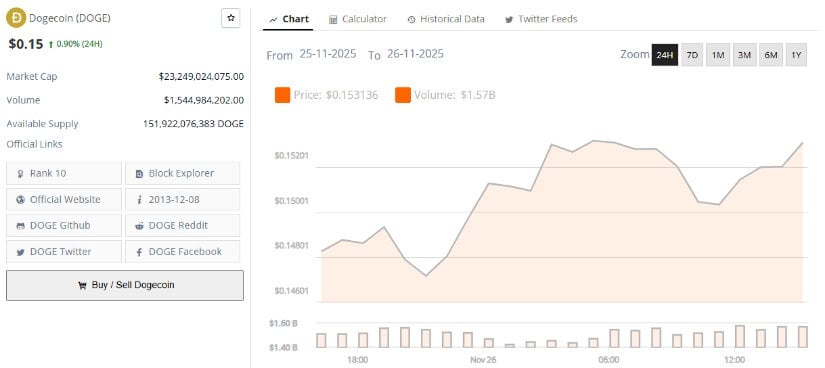

Recent TradingView analysis highlights Dogecoin moving within a falling wedge pattern on the 12-hour timeframe, a structure traditionally associated with possible trend reversals. As of November 27, 2025, DOGE trades near $0.15 after recovering from a brief dip toward $0.14.

Dogecoin’s historical cycle suggests the potential for a significant upswing, with some analysts projecting a possible move toward $5 in 2026. Source: @barkmeta via X

Alan T., an independent market technician who has published multi-year pattern studies across major altcoins, notes that the 4-hour chart’s inverse head-and-shoulders structure may imply a measured move toward $0.18—if momentum and volume align:

“The structure suggests room for a relief push, but wedge breakouts on DOGE historically struggle when volume fails to expand above the 20-period average.”

This contextualizes the pattern within real trading behavior, acknowledging that Dogecoin’s past wedge formations often lacked follow-through unless liquidity conditions improved.

Historical Cycles Offer Insight—But Not Predictive Certainty

A log-scaled weekly chart, widely shared by TradingView researchers, compares Dogecoin’s prior exponential cycles. Historical rallies include:

Some community analysts outline a hypothetical “third cycle” projection that could place DOGE near $5 by 2026. However, cycle-based modeling remains highly debated, especially in meme-driven assets that rely heavily on liquidity, market conditions, and social catalysts.

DOGE is trading within a 12H falling wedge, and analysts suggest waiting for a confirmed breakout before targeting potential upside levels ranging from $0.16728 to https://x.com/barkmeta/status/1993737989214577049$0.26603.Source: Bithereum_io on TradingView

Crypto researcher @Bitcoinsensus, known for macro-fractal commentary but not for precision forecasting, emphasized the limitations:

“Fractals can illustrate market rhythm, but they are not forward-tested predictive models. Cycle validity varies significantly across assets and environments.”

This clarification reinforces that long-range targets should be viewed as scenarios, not expectations.

Short-Term Structure and Levels Traders Are Watching

Intraday traders are monitoring Dogecoin’s response to wedge resistance and short-term liquidity pockets. Chart analyst @krisspax—who frequently publishes scalping-level setups on Binance data—highlighted that a retest of $0.154 as support could precede a short-lived relief rally. Common reference levels include:

-

$0.160–$0.162: Minor resistance cluster

-

$0.173: 38.2% retracement + previous rejection area

-

$0.185: Upper channel boundary

If DOGE maintains its current support zone, a short-term price rebound appears likely. Source: Leo524 on TradingView

These levels can help traders understand where liquidity may concentrate, but they should not be viewed as guaranteed targets. Community enthusiasm—such as optimism from the Doginal Dogs NFT group—reflects sentiment rather than analytical evidence.

Risk Framing and Analytical Outlook

Analysts agree that Dogecoin’s short-term momentum remains fragile. Key support between $0.133–$0.147 is essential to maintain to avoid a deeper retracement.

Dogecoin has surpassed $0.154 resistance, with a potential minor retracement before confirming a relief rally. Source: @krisspax via X

CoinCodex and other model-based platforms outline scenario ranges of $0.39–$0.73 under favorable late-2025 conditions. Meanwhile, speculative long-term models projecting $1–$5 depend heavily on historical analogs and lack strong empirical reliability.

Final Thoughts

Dogecoin’s current technical landscape shows early signs of stabilization, with wedge patterns, channel dynamics, and volume clusters worth monitoring. Short-term rallies toward $0.20–$0.23 remain possible if bullish catalysts align, but such moves require verification from volume and broader market flows.

Dogecoin was trading at around $0.15, up 2.57% in the last 24 hours. Source: Brave New Coin

Long-term projections, particularly cycle-based targets such as $5, should be interpreted as speculative scenarios rather than reliable forecasts. As of the latest update, DOGE trades near $0.15, with a market capitalization of approximately $23.1 billion and a circulating supply exceeding 151.9 billion coins.

Traders should approach Dogecoin with disciplined risk management, viewing technical analysis as one tool among many—not a predictive guarantee—especially in a meme-driven asset class.