I wrote on the 11th January that the best trades for the week would be:

- Long of the USD/JPY currency pair following a daily close above ¥158. This set up the next Monday, but produced a loss of 0.04% over the week.

- Long of the S&P 500 Index. This produced a loss of 0.23% by the end of the week.

- Long of Silver following a daily close above $81.25. This set up on Monday and produced a gain of 5.82% by the end of the week.

- Long of Gold following a daily close above $4,533.21. This set up on Monday and produced a loss of 0.03% by the end of the week.

- Long of Copper (CPER) following a daily close above $37.27. This set up on Wednesday and produced a loss of 4.16% by the end of the week.

Overall, these trades gave a gain of 1.36% (0.27% per asset).

A summary of last week’s most important data that caused any surprise or uncertainty in the market:

- US Final GDP data came in a tick higher than expected, showing an annualized rate of 4.4% compared to 4.3%. However, although the broader US stock market (represented by the Russell 2000 Index) enjoyed a strong rise in January while the S&P 500 Index has traded mostly sideways, this data does not seem to have made much difference to the market.

- The Bank of Japan held a policy meeting last Friday and left its Policy Rate at 0.75% as widely expected. The Japanese Yen continued to weaken quite strongly over the week, with the Bank of Japan effectively trapped by huge debt. However, later on Friday, the Japanese authorities called major banks and threatened intervention to prop up the Yen, and this alone was enough to send the Yen sharply higher over the final hours of the week’s trading session.

- UK CPI (inflation) was expected to rise from 3.2% to 3.3%, it rose to 3.4%.

- New Zealand CPI (inflation) was expected to fall from 1.0% to 0.5%, it came in slightly higher at 0.6%.

Last week’s data had very limited impact. It is likely that continuing geopolitical tensions between the USA and Iran, following the USA’s successful abduction of President Maduro of Venezuela, had more impact last week than any of the above items, excepting the Bank of Japan’s threat to intervene by buying Yen.

The USA has continued to send military assets towards Iran and build up what look like preparations for a war. The internet remains blocked in Iran, but limited information emerging from medical sources suggest that far more than the officially admitted 3,500 killings have taken place, and continue to take place, with some estimates placing the civilian death toll as high as 80,000. What does seem clear is that the regime is determined to survive and is willing to kill unarmed protestors in significant numbers to do so.

President Trump continues to hint at helping and protecting the protestors. Most neighboring countries are publicly opposed to any US military action in support of the protestors, and it remains unclear exactly what the US could do to improve the situation by military action. There is also concern that Iran could launch a pre-emptive strike, with reports that China has airlifted a significant amount of advanced military equipment to Iran in recent days.

In addition to Iran, we also saw President Trump continue to express a desire to acquire Greenland, severely straining ties between the USA and the EU. Although Trump ruled out using force, his behaviour towards the EU and by extension NATO is extremely disrespectful.

Strong geopolitical tension has helped the astonishing rise of Gold and especially Silver to continue over the past week, with Silver reaching a new record high above $103 and Gold ending the week very close to $5,000, also at a fresh all-time high price. These precious metals have seen incredible gains, with Silver doubling in price within just a few weeks. Platinum also rose strongly over the week to close at a new record high price.

These factors have also shaken the US Dollar, whose sharp drop last week seems to have nothing to do with the Fed at all, even though the Fed will be holding a policy meeting this week.

On a final note, President Trump over the weekend began to threaten Canada with a new 100% tariff over its potential trade deal with China. If implemented, this could cause turbulence for the greenback and serious turbulence for the Canadian Dollar as well.

The coming week’s most important data points, in order of likely importance, are:

- US Federal Reserve Policy Meeting

- US PPI

- Bank of Canada Policy Meeting

- Australia CPI (inflation)

- Canadian GDP

- US Unemployment Claims

Although there are not a lot of data items, the first few are highly important for the Forex market, so it could be an important week. Monday is a public holiday in Australia.

Currency Price Changes and Interest Rates

For the month of January 2026, I forecasted that the USD/JPY currency pair would rise in value.

January 2026 Monthly Forecast Performance to Date

Two weeks ago, I made no forecast, as there were no recent excessive moves in currency crosses. However, last week saw three crosses with excessive volatility, so I made the following weekly forecast this week:

- Short NZD/JPY

- Short AUD/JPY

- Short NZD/CAD

The Australian and New Zealand Dollars were the strongest major currency last week, while the US Dollar was the weakest. Directional volatility rose significantly last week, with 67% of all major pairs and crosses changing in value by more than 1%. This is the most volatility we have seen in the Forex market since April 2025.

Next week’s volatility is likely to remain relatively high.

You can trade these forecasts in a real or demo Forex brokerage account.

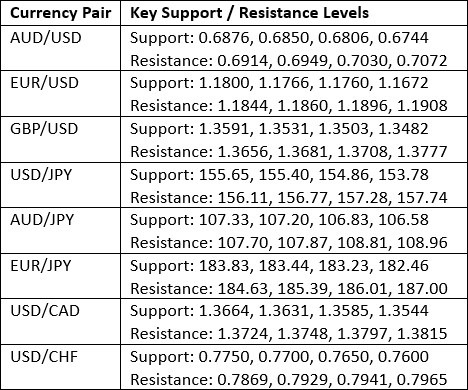

Key Support and Resistance Levels

Last week, the US Dollar Index printed an unusually large bearish candlestick which closed right on its low. This was the largest bearish candlestick since April 2025, and lowest weekly close since June 2025. These are very bearish signs. The price action suggests a long-term bearish trend with the price below its levels of both 13 and 26 weeks ago. However, it is worth noting that the lows made last autumn and in the summer remain intact below the current price.

The slightly stronger than expected US economic data released last week helped firm up the Dollar, as it has given a slightly hawkish tilt against rate cut expectations in 2026, although two rate cuts of 0.25% are still widely seen as likely to happen.

I take a weakly bullish bias on the US Dollar right now and am comfortable being long of the greenback.

US Dollar Index Weekly Price Chart

The AUD/USD currency pair advanced very strongly last week, powering up with unusually high volatility to a new 15-month high.

The price closed very near its high, which is another bullish sign.

There is a long-term bullish trend here which has been in force for about 9 months.

There is also a fundamental reason for the Australian Dollar’s strength – it is practically the only major currency except the US Dollar where there is a credible belief that its central bank is going to raise interest rates soon.

This move high is probably a bit over-extended, but I think that after an orderly bearish pullback, we could see a good opportunity for a long swing trade on the bounce.

AUD/USD Weekly Price Chart

The EUR/USD currency pair has been range-bound, trading sideways on low volatility, for many months now. Last week, it suddenly jumped, as the US Dollar made its strongest fall in almost 9 months.

The price closed right on the high of the week’s range, which is a bullish sign.

Despite these bullish signs, a few months ago there was a strong inflection point which closed at $1.1866, and this has not yet been tested. I would like to see bulls overcome this price level before going long.

This currency pair has a good propensity to trend, but with deep and frequent retracements.

So, I think this pair is worth keeping an eye on with a potential long trade entry, but I am not ready to enter just yet.

I will take a long trade if we get a daily (New York) close above $1.1866.

EUR/USD Daily Price Chart

Silver is still showing very high volatility, and it rose like crazy over the week, reaching and breaching the magic round number at $100. This is a very big deal. It closed right on its high, and its sister precious metal Gold also rose strongly. These are very bullish signs. Just look at the weekly price chart below!

I had thought that we would see major profit-taking at $100 but this does not seem to have happened at all.

If you are not long already, you might have missed the party, but there is no reason why this metal won’t go substantially higher, possibly even to $125.

I think it makes sense to think about getting long here, but with a smaller than usual position size.

Silver Weekly Price Chart

Gold saw a strong rise last week, as did all other precious metals, notably Silver. Gold ended the week right on its high after making its strongest weekly gain in many months. Although these seem to be bullish factors, there might be some fear that this large candlestick could be a pre-exhaustion peak. My suspicion here is enhanced by the fact that the price stopped just short of the huge round number at $5,000.

Still, we are seeing record high prices in Gold, Silver, and Platinum, and extremely powerful bullish momentum, especially here in Silver.

I am prepared to enter another long trade if we do get a new record high daily (New York) closing price above $5,000.

Gold Daily Price Chart

I see the best trades this week as:

- Long of the EUR/USD currency pair following a daily close above $1.1866.

- Long of Silver.

- Long of Gold following a daily close above $5,000.

Ready to trade our Forex weekly forecast? Check out our list of the top 10 Forex brokers in the world.