The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

USD/JPY Forecast Today 14/05: Pulls Back Slightly (Video)

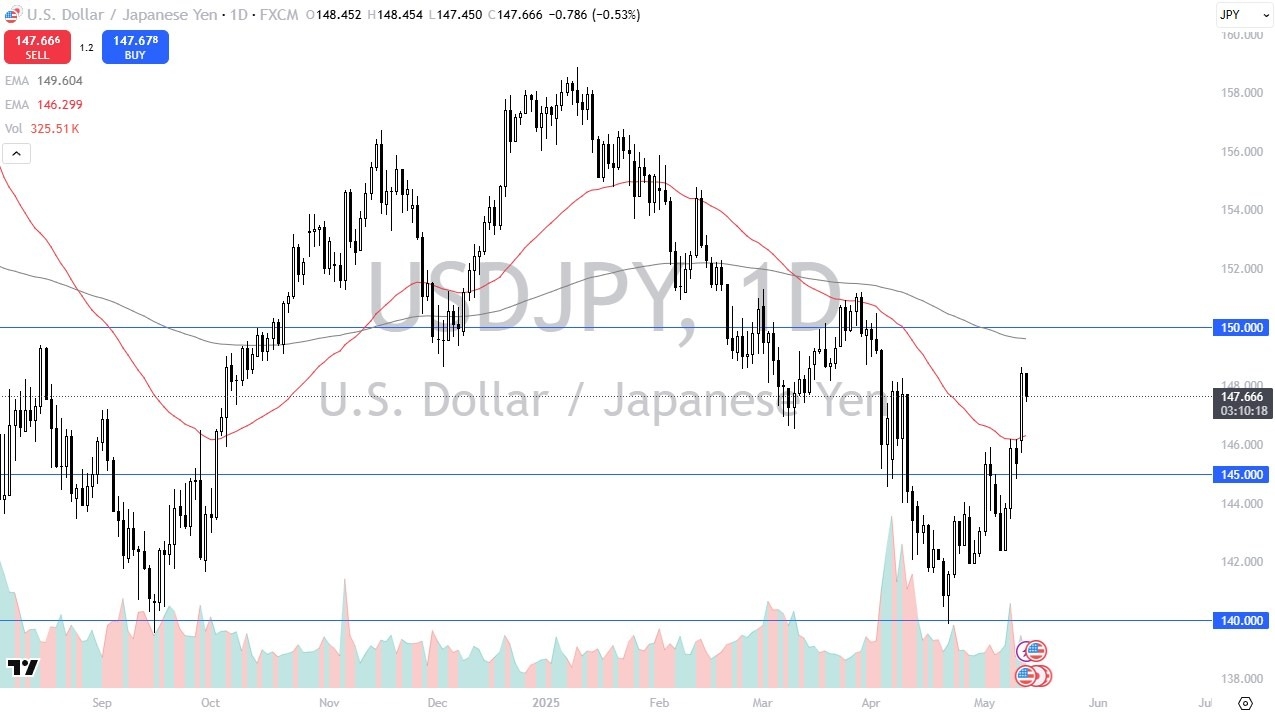

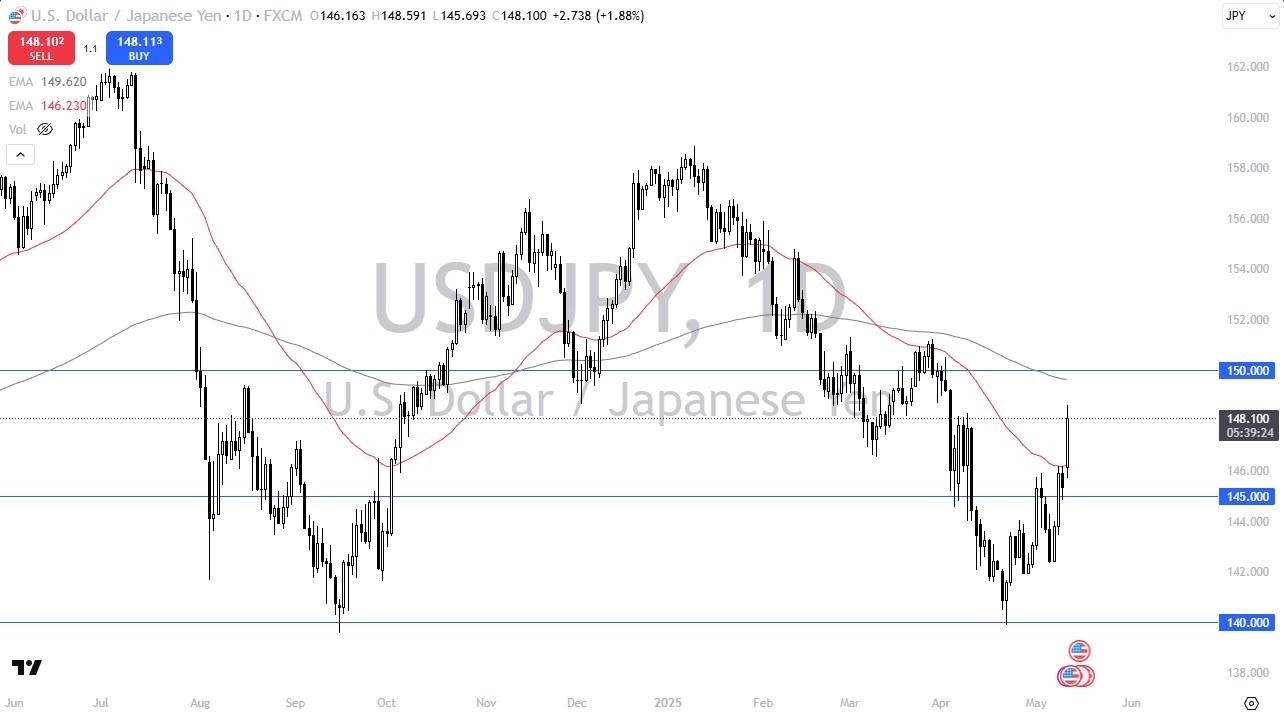

- Looking at the US dollar against the Japanese yen, we did pull back just a bit during the trading session here on Tuesday, as the market may have gotten a little bit ahead of itself on Monday.

- At this point in time though, short-term pullback should end up being a buying opportunity in this currency pair, as the Japanese yen itself is being sold off against most things.

It’s also worth noting that speculators are net long, but commercials, the so-called smart money, is short three to one in the Japanese yen in the futures market. So that’s an extraordinarily bearish sign for the Japanese yen for this pair. The US dollar pulled back against most things. So, when you look around the horn here against the Japanese yen, most currencies had a very good day.

Despite the USD Dropping, this is About the Yen

So, this is a Japanese yen weakness type of story. The US dollar was sold off pretty drastically. So that’s the only reason this chart looks the way it does. Ultimately though, I think you’ve got a situation where traders will continue to look at this through the prism of a market that needs to sort out a lot of questions when it comes to risk appetite as is the main driver of this market, but you do get paid to hang on to it at the end of the day. And I do think that we are going to try to get 150 yen.

The 200 day EMA sits just below there. So, it’s possible that it could be a bit of a significant barrier. All things being equal, short-term pullbacks, I do think offer plenty of support near the 50 day EMA as well as the 145 yen level underneath offer in support. I am bullish in this pair. think we just made a major double bottom. We’ll have to wait and see if I’m right. But when you look at the longer term charts, you can see that it’s actually not even a double bottom. It’s a triple bottom that’s held at 140 yen. So that’s something to consider.

Want to trade our USD/JPY forex analysis and predictions? Here’s a list of forex brokers in Japan to check out.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.