The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Falls After Trade Deal (Video)

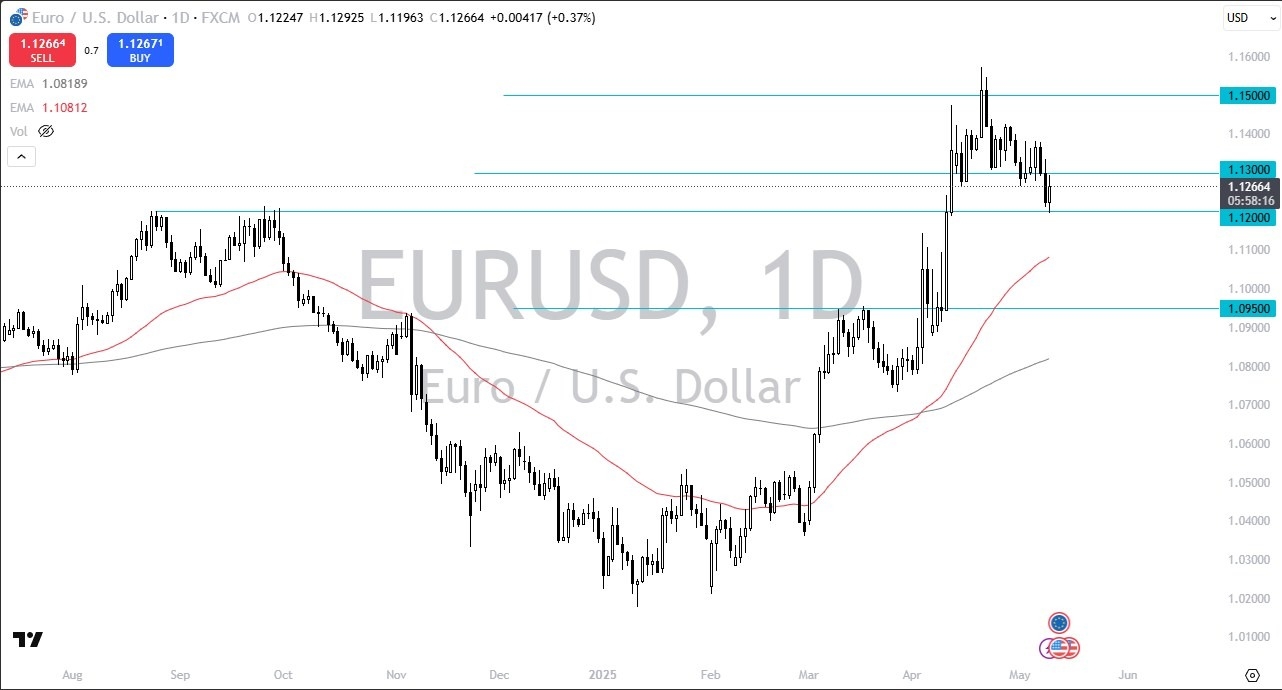

- The Euro gapped lower to kick off the trading session on Monday, only to turn around to fill the gap and then start falling again.

- We’re well below the 1.12 level, but it does look like the 50-day EMA is trying to offer a bit of support.

- Breaking down below the 50-day EMA opens up the possibility of a move to the 1.0950 level, which was a major area of demand.

Anything below there opens up the possibility of a move to the 1.0750 level. On the other hand, if we turn around and rally from here, the 1.12 level is an area of potential resistance as we have seen over the last several months, a couple of different times. Ultimately, the euro has gotten a little bit of a barrier to deal with due to the fact that the China and US trade tariff talks actually went fairly well over the weekend. And this could isolate Europe if they are not careful.

The US Will Not Be Starved of Capital

After all, a lot of this comes down to the idea of the United States starving itself of capital coming in and goods coming in, which of course will not be the case regardless. But at this point in time, Europe is starting to show signs of cracks in several places. It’s more risk on in Europe in the indices than it is the currency.

The Euro, you know, it probably settles back into the range that we had been in for several years now between 1.05 and 1.09 or so. We’ll just have to wait and see. But at this point, I’m still relatively bearish. I do recognize there may be a bounce or two, but I think going down to the 1.0950 level at the very least makes the most sense. I would not be looking to buy this market, at least not right now.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.