I wrote on the 4th January that the best trades for the week would be:

- Long of the USD/JPY currency pair following a daily close above ¥157.75. This did not set up until Friday’s close.

- Long of the S&P 500 Index following a daily close above 6,940. This set up on Tuesday and produced a gain of 0.24% by the end of the week.

- Long of Silver following a daily close above $80. This set up on Tuesday and produced a loss of 1.67% by the end of the week.

- Long of Gold following a daily close above $4,533.21. This did not set up.

Overall, these trades gave a loss of 1.43% (0.36% per asset).

A summary of last week’s most important data:

- US Average Hourly Earnings – as expected, a month-on-month increase of 0.3%.

- US Preliminary UoM Inflation Expectations – no change on last month.

- US Non-Farm Employment Change – very slightly below expectations.

- US JOLTS Job Openings – a little below expectations, but not significantly.

- US Preliminary UoM Consumer Sentiment – just a fraction above expectations.

- US ISM Services PMI – this was better than expected, suggesting a buoyant services sector.

- US ISM Manufacturing PMI – very slightly worse than expected.

- Australian CPI (inflation) – this was the surprise of the week: Australian inflation was expected to fall from 3.8% to 3.6% but it fell even further, to 3.4%.

- Swiss CPI (inflation) – zero as expected.

- US Unemployment Rate – this was expected to fall to 4.5%, but it fell a little further, to 4.4%.

- US Unemployment Claims – this was as expected.

- Canada Unemployment Rate – this unexpectedly rose to 6.8%, suggesting the Canadian economy is slowing, sending the Canadian Dollar lower.

Last week’s data had limited impact. You can say there were two effects:

- The resilience of the US economy continues and gives a very slight hawkish tilt on Fed rate expectations. This has helped send the US Dollar a bit higher.

- A weaker Canadian economy, with the market now asking if the Bank of Canada will cut rates more quickly.

The major geopolitical event right now is likely to be the unrest in Iran. Despite the internet blackout of the past 48 hours, and very limited coverage by much of the media, it seems as if the unrest is threatening the survival of the Islamic Republic.

The USA has threatened to intervene if the regime cracks down with a great deal of violence, and this is raising tensions. President Trump has also raised the possibility of acquiring Greenland by force, even though it is under the control of a NATO ally! However, risk-on sentiment seemed to be strong and healthy right up to Friday’s close, with the major US equity Index the S&P 500 closing at a fresh all-time high.

The other major story of the week was the continuing bullishness in all metals, not just precious metals, with Gold notably closing very near $4,500 which is within sight of its record high. Silver also traded above $80 on Friday before closing a little below that round number.

The coming week’s most important data points, in order of likely importance, are:

- US CPI (inflation)

- US PPI

- US Retail Sales

- UK GDP

- US Unemployment Claims

Although there are not a lot of data items, the first few are highly important for the Forex market, so it could be an important week. Monday is a public holiday in Japan.

Currency Price Changes and Interest Rates

For the month of January 2026, I forecasted that the USD/JPY currency pair would rise in value.

January 2026 Monthly Forecast Performance to Date

Last week, I made no forecast, as there were no recent excessive moves in currency crosses. I again make no forecast, as low volatility persists.

The US Dollar was the strongest major currency last week, while the Canadian Dollar was the weakest. Directional volatility remained low last week, with only 11% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility will probably be considerably higher.

You can trade these forecasts in a real or demo Forex brokerage account.

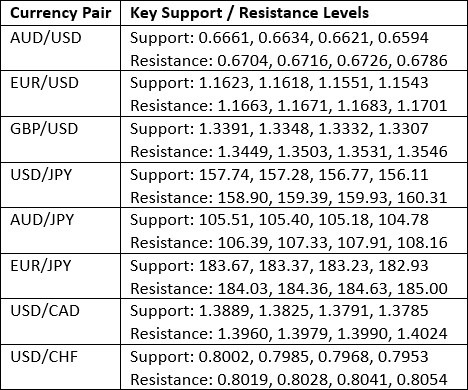

Key Support and Resistance Levels

Last week, the US Dollar Index printed a relatively large bullish candlestick which closed near the high of its range. These are moderately bullish signs. The price action is still suggesting a long-term bullish trend with the price above its levels of both 13 and 26 weeks ago.

The slightly stronger than expected US economic data released last week helped firm up the Dollar, as it has given a slightly hawkish tilt against rate cut expectations in 2026, although two rate cuts of 0.25% are still widely seen as likely to happen.

I take a weakly bullish bias on the US Dollar right now and am comfortable being long of the greenback.

US Dollar Index Weekly Price Chart

The USD/JPY currency pair advanced last week, making a significant bullish breakout on Friday which pushed the price near to a fresh 1-year high.

The price closed quite near its high, but below the round number at ¥158, which might be a little worrying for bulls.

Another thing for bulls to worry about is that the price chart below shows there is a major inflection point just ahead which made the high of 2025. The price has still not got beyond this.

Despite these fears, we have a long-term bullish trend, a bullish breakout, and reasons to be bullish on the US Dollar (strong US economy) and bearish on the Japanese Yen (too much debt to hike rates significantly), so I am very comfortable being long of this currency pair, even if the trade is requiring patience.

USD/JPY Weekly Price Chart

After reaching a new record high three weeks ago, and making a meaningful dip last week, the US stock market has recovered, and this Index broke to a new all-time high last Friday.

I think the bullish momentum in the US stock market has slowed, and I was even thinking we were starting to see a top, but it seems that bulls have further to go.

I am already long here as a trend trader, but the real test for bulls will be the big round number at 7,000 – more cautious traders or market timing investors might want to see a close above this level before entering a long trade.

S&P 500 Index Daily Price Chart

Silver is still showing very high volatility, but it rose quite strongly over the past week, making a new record high close on Tuesday, then pulling back, then advancing again.

The most discouraging thing for bulls last week was the fact that the price was unable to close the week above the big round number at $80, which is a mildly bearish sign.

Volatility is much higher here than in Gold, but it is still possible that we could see a bullish breakout and new record highs, and the price possibly even reaching $100 or beyond within a few days or weeks.

All precious metals are advancing, so I think it is worth going long if we get another record daily closing price. As we had one on Tuesday, I am already long, but only with half of my normal position size.

I think it makes sense to think about getting long here, but with a smaller than usual position size.

Silver Daily Price Chart

Gold saw quite a firm rise last week, as did all other precious metals. However, Gold has still not made a fresh record high, although it is within sight of the high. Possibly the most bullish signs were that it closed near the top of its weekly range above the big round number at $4,500.

I am prepared to enter another long trade if we do get a new record high daily (New York) closing price (above $4,533.21), and I think it might happen this week.

The new record high made Friday in the S&P 500 Index also makes me more bullish on Gold, as recent years have seen a strong positive correlation between these two assets.

Gold Daily Price Chart

The industrial metal Copper has reached new long-term high prices, due partly to supply (mining) problems, and partly due to massive demand from the technology sector, as well as general industrial demand.

Monday and Tuesday saw Copper futures advance strongly, before pulling back over most of the rest of the week. Friday saw a fresh advance but the highs earlier in the week were not recaptured.

We are seeing industrial metals starting to advance strongly as an asset class just as we saw earlier with precious metals – and precious metals have advanced again, so it looks as if money is flowing into all metals.

For this reason, I think a long Copper trade is worth looking out for, once we get a new fresh daily high close.

If you can’t afford Copper futures (there is a CME micro future sized at about $15,000), you could try a Copper ETF like CPER.

Copper (ETF CPER) Daily Price Chart

I see the best trades this week as:

- Long of the USD/JPY currency pair following a daily close above ¥158.

- Long of the S&P 500 Index. More cautious traders might want to wait for a daily close above 7,000.

- Long of Silver following a daily close above $81.25.

- Long of Gold following a daily close above $4,533.21.

- Long of Copper (CPER) following a daily close above $37.27.

Ready to trade our Weekly Forex forecast? Check out our list of the best Forex brokers in the world.