The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

GBP to USD Forecast: Pound Sterling Softens on UK Economic Concerns

– Written by

Tim Boyer

STORY LINK GBP to USD Forecast: Pound Sterling Softens on UK Economic Concerns

The Pound to US Dollar exchange rate (GBP/USD) pulled back from a one-month peak on Thursday as volatility picked up following the Federal Reserve’s final policy decision of 2025.

At the time of writing, GBP/USD was hovering around $1.3358, roughly 0.2% below the day’s opening levels.

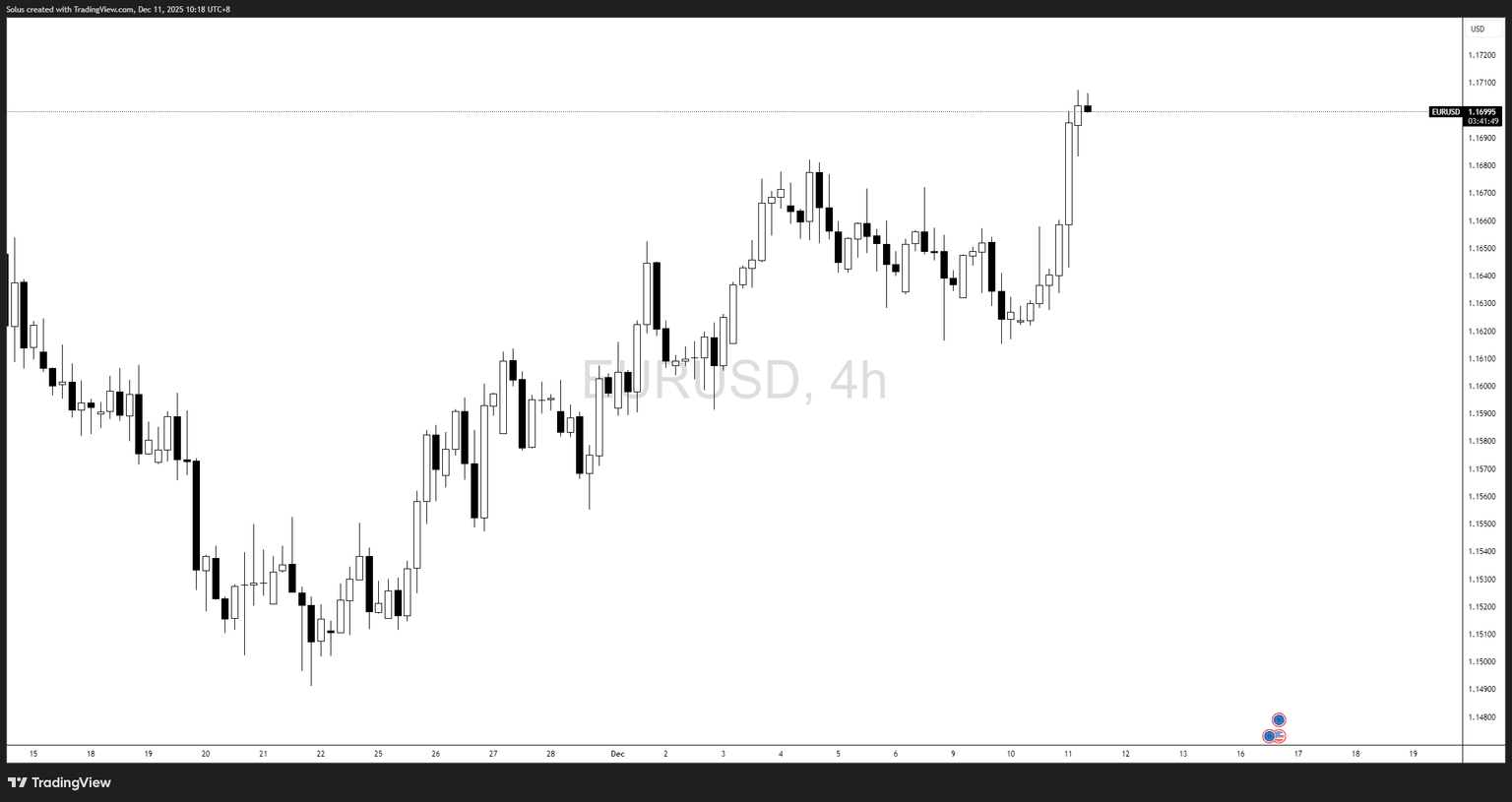

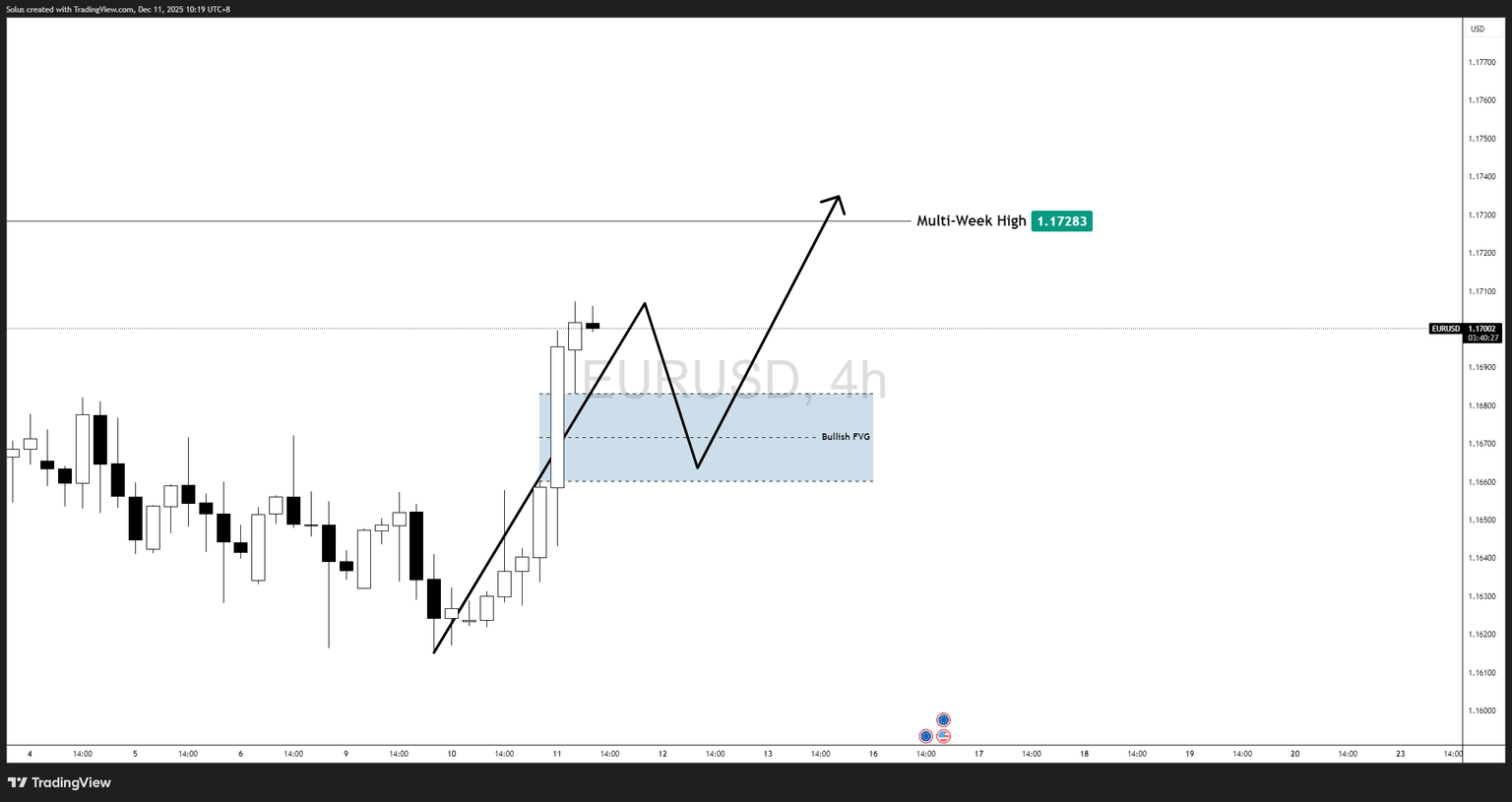

The US Dollar (USD) saw sharp, uneven swings on Thursday as markets attempted to digest the Fed’s December rate cut.

As widely expected, the central bank lowered its benchmark rate to 3.5–3.75%.

However, traders were taken aback by the voting distribution. Ahead of the decision, markets had anticipated as many as four dissents, reflecting deep division within the Federal Open Market Committee. Instead, just two members opposed the move, while another unexpectedly argued for a larger cut.

This dovish surprise sent the Dollar sharply lower in the immediate aftermath, amplifying speculation that the Fed may deliver additional easing through 2026.

The ‘Greenback’ later reclaimed some ground, though its recovery was uneven as investors continued to debate the likely pace of next year’s policy trajectory.

Save on Your GBP/USD Transfer

Get better rates and lower fees on your next international money transfer.

Compare TorFX with top UK banks in seconds and see how much you could save.

The Pound (GBP) struggled for support on Thursday as concerns around the UK’s economic resilience resurfaced.

Investors remain uneasy about signs of a weakening labour market and mounting pressure on household spending. A new Barclays report underscored these concerns, revealing the sharpest decline in consumer expenditure in five years.

Such developments have strengthened expectations that the Bank of England (BoE) will need to adopt a more accommodative stance, with further rate cuts anticipated over the coming months.

GBP/USD Exchange Rate Forecast: Underwhelming GDP to Weigh on Sterling?

Looking ahead, Friday’s UK GDP release will take centre stage for Pound traders.

Economists expect October’s monthly GDP to show a modest 0.1% rise — the first growth since June — but such a muted improvement is unlikely to shift the broader narrative of a sluggish UK economy.

A soft reading may reinforce expectations that the BoE will cut rates at its upcoming meeting, potentially placing renewed pressure on Sterling.

Meanwhile, with the US schedule light on major data, Dollar movement may be guided largely by broader risk appetite. A risk-on environment could leave the ‘Greenback’ on the defensive, while any deterioration in sentiment may help USD find renewed support.

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Dollar Forecasts