The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

British Pound to Dollar Forecast: BoE Easing Outlook to Cap GBP/USD Gains

– Written by

Frank Davies

STORY LINK British Pound to Dollar Forecast: BoE Easing Outlook to Cap GBP/USD Gains

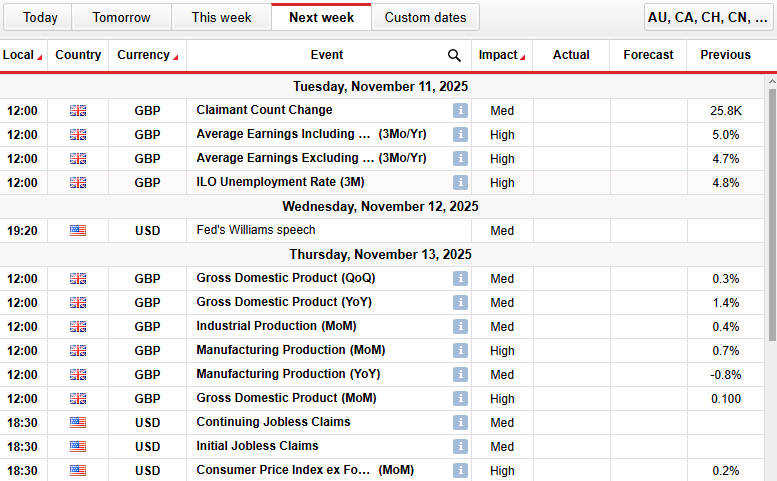

The Pound to Dollar (GBP/USD) exchange rate recovered modestly to around 1.3165 after testing six-month lows near 1.30, but upside momentum remains fragile as investors weigh the growing risk of a December Bank of England rate cut.

GBP/USD Forecasts: December BoE cut?

Credit Agricole now forecasts that the Pound to Dollar (GBP/USD) exchange rate will be held to 1.32 by the end of 2026.

Rabobank has a 12-month forecast of 1.35.

GBP/USD dipped sharply to 6-month lows at 1.3000 during the week before a recovery to 1.3165 as the dollar retraced gains.

Credit Agricole commented; “We revise down our GBP forecasts for a second time this year because downside risks to the UK growth outlook have intensified further and fuelled expectations of more aggressive BoE easing from here, in a blow to the GBP across the board.”

The Bank of England held interest rates at 4.00%, but there was a dovish vote split and comments from Governor Bailey suggested that he will back a cut in December once the budget has been delivered.

Save on Your GBP/USD Transfer

Get better rates and lower fees on your next international money transfer.

Compare TorFX with top UK banks in seconds and see how much you could save.

Danske Bank commented; “We now expect the BoE to deliver the next cut in the Bank Rate in December, where we also think fresh government spending cuts will call for further easing.”

The bank, however, expects only one further cut next year; “we expect the April meeting to conclude the easing cycle with the Bank Rate at 3.50%.”

Rabobank notes the dovish shift and hints from Bailey that he would back a cut next month. The bank is still hesitant to bring forward the call for the next rate cut from February to December.

It did, however, add; “if the Budget delivers front-loaded and meaningful consolidation, it could strengthen the MPC’s confidence that rates can be cut further. That, in turn, could prompt us to revise our forecast and bring the next cut forward to December.”

The US labour-market data was mixed during the week.

ADP reported an increase in private payrolls of 42,000 for October following a revised 29,000 decline the previous month.

Challenger, however, reported a surge in layoffs for October with an increase of 175% from the previous year.

The government shutdown continued which increased uncertainty over the current situation and triggered fresh reservations over the outlook, both factors undermining the dollar.

Investment banks are increasingly uncertain over the outlook amid the lack of official data.

Rabobank commented; “Clearly it is difficult for Fed officials and the market to form strong opinions on how the US economy is developing given the near absence of fresh, official US data. That said, Powell’s remark at his October press conference that he does not see the weakening in the labour market accelerating is a warning to USD bears.”

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Pound Dollar Forecasts