I wrote on 7th September that the best trades for the week would be:

- Long of the S&P 500 Index if we saw a daily (New York) close above 6,515. This set up Tuesday, and from there over the rest of the week the price rose by 0.91%.

- Long of Gold or following a daily (New York) close above $3,500 for more cautious traders. Gold rose by 1.43% over the week.

- Long of Silver or following a daily (New York) above $40 for more cautious traders. Silver rose by 3.05% over the week.

These trades produced an overall gain of 5.57%, equal to 1.86% per asset.

A summary of last week’s most important data:

- US CPI – the month-on-month rate was a fraction higher than expected, at 0.4% instead of 0.3%, although the annualized rate reached 2.9% as expected. Despite the slightly higher rate, US stock markets gained following this data, and the US Dollar also declined.

- US PPI- the data was much lower than expected, showing a month-on-month contraction of 0.1% while an increase of 0.3% was widely expected. This may have reinforced bullishness in US stock markets as it gave a tailwind to US rate cuts.

- US Preliminary UoM Inflation Expectations – 4.8% as expected.

- US Preliminary UoM Consumer Sentiment – this was lower than expected, with some analysts seeing the US heading into a period of “stagflation” where inflation remains elevated but growth collapses.

- European Central Bank Main Refinancing Rate & Monetary Policy Statement – rates were kept on hold as expected.

- UK GDP – zero growth, as expected.

- US Unemployment Claims – worse than expected, at 263k about 30k higher than the consensus forecast.

A narrative of slowing growth in the USA is building.

There was more directional volatility than has been usual over recent weeks. Perhaps the Forex market is starting to wake up.

There were record highs in Gold and in the major US stock market indices the S&P 500 and the NASDAQ 100, and a 14-year high in Silver. The US economy is seen as starting to weaken, and this has boosted the market’s expectation of Fed rate cuts at its next meetings. Markets now see a 100% chance of a cut in September, an 85% chance of a cut in October, and a 79% chance of a cut in December – a bit higher than the sentiment this time last week. There is even a minority expecting a 0.50% rate cut at the next meeting later this calendar month. These expectations are dovish and should logically weaken the US Dollar over the coming weeks, in line with the Greenback’s long-term bearish trend, and strengthen US stock markets, in line with that bullish trend.

This is likely to be a good time to trade or invest.

The coming week will almost certainly be busier, because there are four major central bank policy meetings, as well as some other key data including inflation readings. This is likely to produce a further increase in volatility, building on last week’s increase.

This week’s important data points, in order of likely importance, are:

- Federal Reserve Policy Meeting

- Bank of Japan Policy Meeting

- Bank of England Policy Meeting

- Reserve Bank of Canada Policy Meeting

- US Retail Sales

- UK CPI

- Canadian CPI

- US Unemployment Claims

- New Zealand GDP

- Australian Unemployment Rate

It is a public holiday in Japan on Monday.

For the month of September 2025, I forecasted that the EUR/USD currency pair will rise in value if we get a daily close above $1.1806.

This has not yet set up.

I made no weekly forecast last week.

There were no unusually large price movements in currency crosses last week, so I have no weekly forecast this week.

The Australian Dollar was the strongest major currency last week, while the Japanese Yen was the weakest. Volatility was higher last week, with 26% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week’s volatility is likely to increase as we have four major central bank policy meetings, and at least two of them are expected to produce rate cuts.

You can trade these forecasts in a real or demo Forex brokerage account.

Last week, the US Dollar Index printed yet another bearish pin bar (the fourth consecutive one!), so we are now seeing extremely bearish price action, which is in line with the long-term bearish trend. Lower prices in the US Dollar look likely technically with all these repeated upper wics, however the price action is congested within its current area which may mean there is not much further downside to come. But a short-term fall is supported by more dovish market sentiment which arose last week following worse than expected US PPI data, even though the CPI data was a tick higher than expected.

Markets are now expecting rate cuts at each of the forthcoming Fed meetings remaining in this calendar year, with some even expecting a rate cut of 0.50% at the meeting this month. There is increasingly a feeling that the Fed has come to cutting rates a bit late. So. sentiment might be working with the trend and could trigger a downwards move now to the next support level at 94.61. We have a Fed meeting this week and a rate cut then is practically a certainty, so we might see Dollar action at or before this event.

I think it is wise to trade with the long-term trend and short-term price action right now, so trades short and not long of the US Dollar will probably be a good idea over the coming week.

The AUD/USD currency pair rose strongly last week, powering up to new 11-month high prices. It was the strongest weekly rise since June, and the price closed quite near its high. These are bullish signs.

The Australian Dollar has gained mostly as a risk proxy, with stock markets mostly rising and risk-on sentiment remaining bullish. It was the biggest-gaining currency of last week. The Aussie has also benefited from higher than expected inflation data recently which has effectively ruled out any rate cuts over the near term, and this has helped to increase its value.

On the other side of this pair, the US Dollar is in a long-term bearish trend and has shown bearish price action over recent weeks as it fails again and again to rise. Although there is little momentum lower, the price does look likely to break down and it is a valid trend.

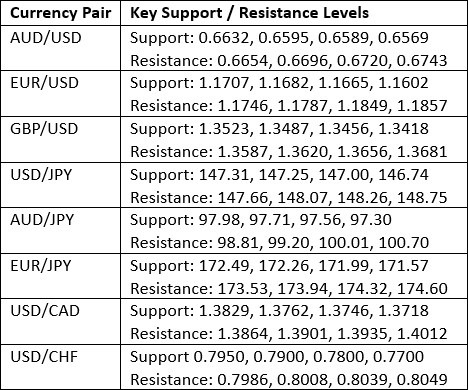

For these reasons, I think there is further upside here, although it is important to be careful when trying to trend the Aussie as it tends not to trend very reliably. The key level to watch out for is probably $0.6654 – if we get a sustained break above that, we could see a further significant gain, as that is the initial strong technical obstacle. However, Wednesday’s Fed meeting might cause volatility which could send the price into unpredictable areas.

The S&P 500 Index had a great week, rising strongly and closing not far from the top of its range well into blue sky at a new record high, almost touching 6,600. The way the price was able to overcome the big round number at 6,500 was another bullish sign.

US stock markets are rising strongly due to increasing expectation that the Fed will make at least 0.75% worth of rate cuts over the rest of 2025, and on the bearish price action and trend we are seeing on the other half of this trade – the US Dollar.

The index has risen by about 10% since the start of 2025 and by 36% since the April low caused by the Trump tariff panic. It is an open question how much further the current bull run will go, but betting against new record highs in the US stock market is a brave and probably foolish move, unless it’s a cautious play in individual underperforming stocks.

I am bullish on the S&P 500 Index.

The NASDAQ 100 Index had a great week, rising strongly and closing very near the top of its range well into blue sky at a new record high, above 24,000. The way the price was able to overcome the big round number at 6,500 was another bullish sign, as was this tech index’s outperformance of the broader S&P 500 Index, while showing more bullish price action, too.

US stock markets are rising strongly due to increasing expectation that the Fed will make at least 0.75% worth of rate cuts over the rest of 2025, and on the bearish price action and trend we are seeing on the other half of this trade – the US Dollar.

The index has risen by about 14% since the start of 2025 and by 47% since the April low caused by the Trump tariff panic. These are above-average numbers, even in a bull market, especially the increase from April. It is an open question how much further the current bull run will go, but betting against new record highs in the US stock market is a brave and probably foolish move, unless it’s a cautious play in individual underperforming stocks.

I am very bullish on the NASDAQ 100 Index.

Silver had a stunning week, showing another outsize rise in value, again closing near the top of its weekly range, and powering up to a new 14-year high. It also outperformed Gold and all other precious metals. These are bullish signs, as is the general weakness in the US Dollar and that currency’s long-standing bearish trend on the other side of this trade, and the breakout from the linear regression analysis shown within the price chart below.

With Silver’s outperformance against Gold, it is probably worth being bold on the long side here.

Having said, if you are only just entering a new long trade here, as the move is quite extended, a smaller position size might be wise. Bulls might also be wary of the major quarter-number just ahead at $42.50.

I am very bullish on Silver.

Gold rose last week to print a new all-time high price just below $3,675. However, it is worth noting that Gold underperformed Silver, and left a bit of an upper wick on the weekly candlestick, as can be seen in the price chart below.

The long-term bullish trend and break to new record highs are bullish factors, as is the bearish trend in the US Dollar and the strong US stock market, as the US stock market has tended to be positively correlated with Gold, to the surprise of many who it as a hedge against inflation or whatever.

It may be that we are due a pullback, but I think the combination of rising stock markets and a likely more aggressive rate cutting approach from the Fed, could provide the bullish sentiment needed to drive this strong advance to even higher all-time high prices.

For anyone who is only entering a long trade now, it might be wise to use a smaller position size to account for any sudden high-volatility snapback towards lower prices.

I am bullish on Gold.

I see the best trades this week as:

- Long of the S&P 500 Index.

- Long of the NASDAQ 100 Index.

- Long of Silver.

- Long of Gold.

Ready to trade our weekly Forex forecast? Check out our list of the best Forex brokers.