Category: Forex News

US Dollar (DXY) Index News: Rate Cut Anticipation Sets Stage for Next Major Move

Federal Reserve’s Rate Cut Expectations

Market sentiment is shaped by the anticipated Federal Reserve rate cut in June. This expectation is currently keeping the U.S. Dollar Index’s gains in check. A deviation from these expectations, potentially driven by unanticipated economic results, could significantly affect the dollar’s strength.

Recent U.S. Economic Performance

Recent U.S. economic indicators present a mixed picture. Durable goods orders in February outperformed expectations with a 1.4% increase. Additionally, the housing market continues to show vigor, as evidenced by a 6.0% annual rise in the S&P/Case-Shiller U.S. National Home Price Index for January.

Global Currencies and Market Reactions

Internationally, the Japanese yen is approaching a 34-year low, with Japan’s financial authorities hinting at possible interventions. The euro and pound have seen modest gains, indicating an active and interconnected global currency market.

Short-Term Market Forecast

In light of the current economic environment and pending PCE data, the U.S. dollar’s short-term direction seems highly reliant on forthcoming data. The potential for a Fed rate cut in June is crucial, but this could be swayed by unanticipated inflation figures. Consequently, the immediate forecast for the dollar is characterized by prudence, with a focus on how new economic reports might alter Fed policy and market expectations.

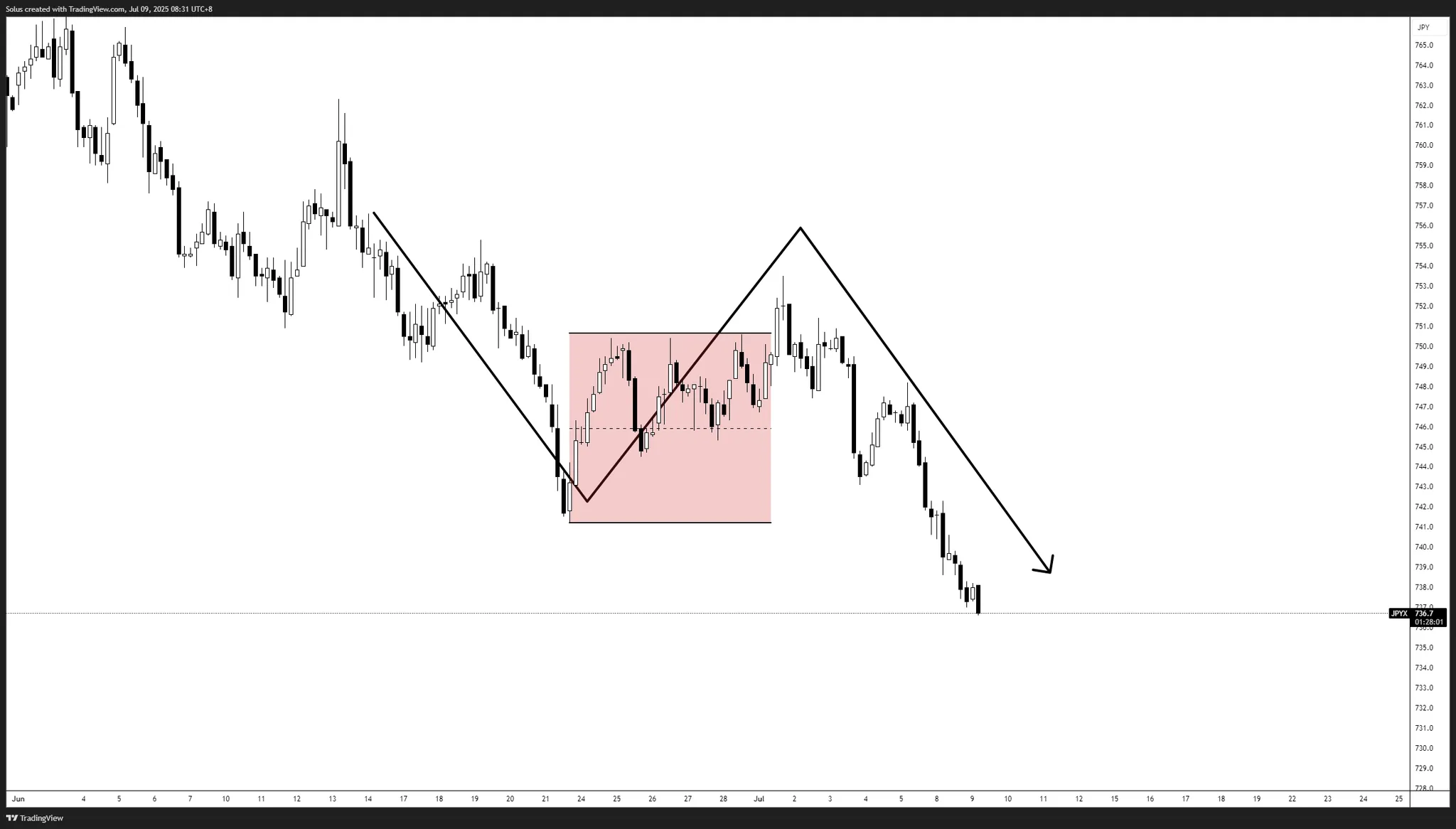

Technical Analysis

Source link

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: