Category: Forex News, News

USD/JPY Forecast: Japanese Economy Contracts in Q1 Affecting BoJ Rate Hike Hopes

Short-term Forecast

Near-term trends for the USD/JPY will hinge on GDP numbers from Japan, US labor market data, and FOMC member chatter. Weaker-than-expected labor market data and support for a September Fed rate cut could further affect buyer demand for the USD/JPY. However, the contraction in the Japanese economy could leave interest rate differentials firmly favoring the US dollar.

USD/JPY Price Action

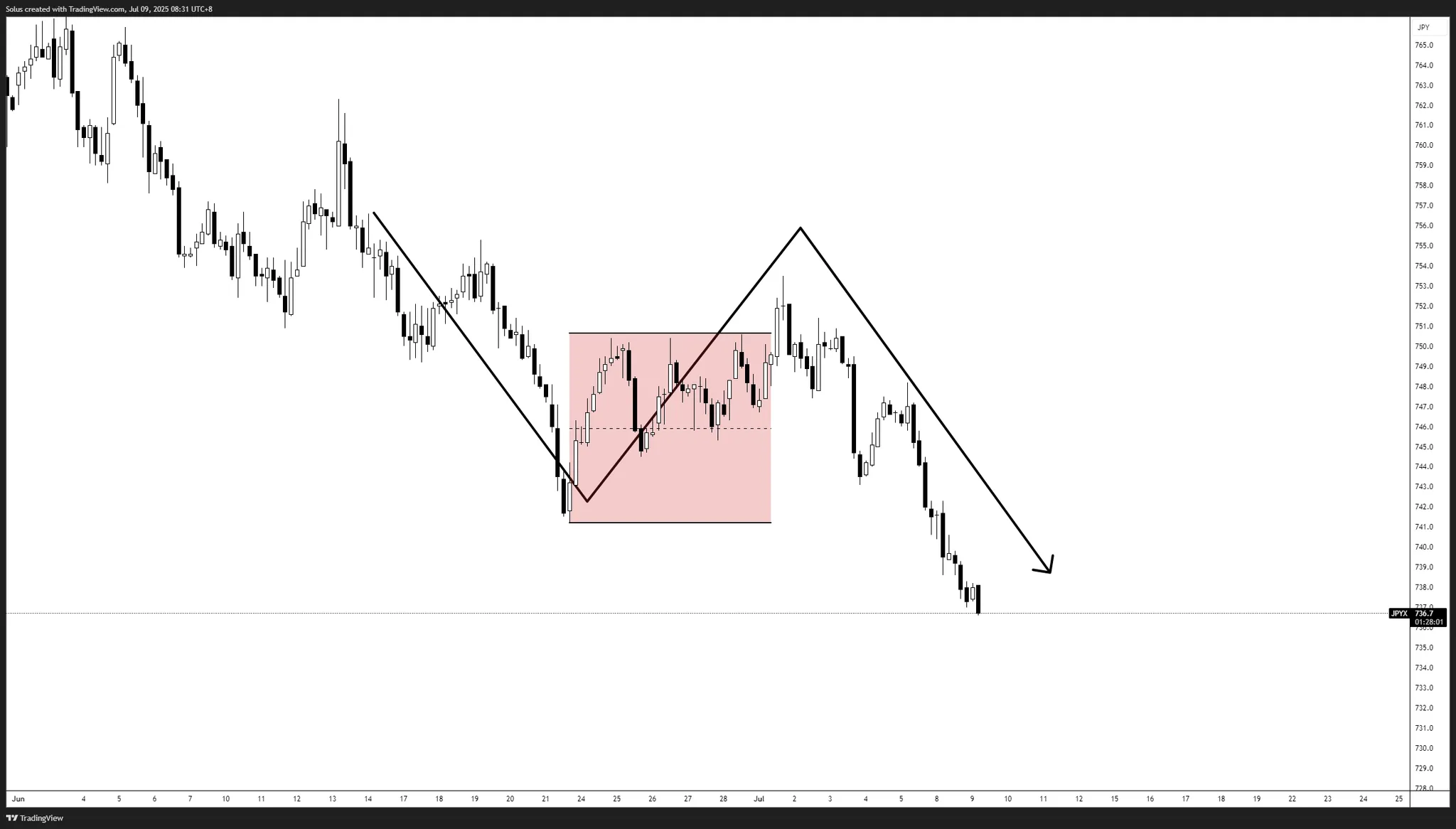

Daily Chart

The USD/JPY held above the 50-day and 200-day EMAs, sending bullish price trends.

A USD/JPY return to the 155 handle could support a move toward the 156 handle. A breakout from 156 would bring the April 29 high of 160.209 into view.

On Thursday, the Bank of Japan, US economic data, and FOMC member reaction to the US CPI Report need consideration.

Alternatively, a USD/JPY fall through the 50-day EMA could signal a drop toward the 151.685 support level.

The 14-day RSI at 48.73 suggests a USD/JPY fall to the 151.685 support level before entering oversold territory.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: