Category: Forex News, News

USD/JPY Forecast – US Dollar Continues to Look For Floor

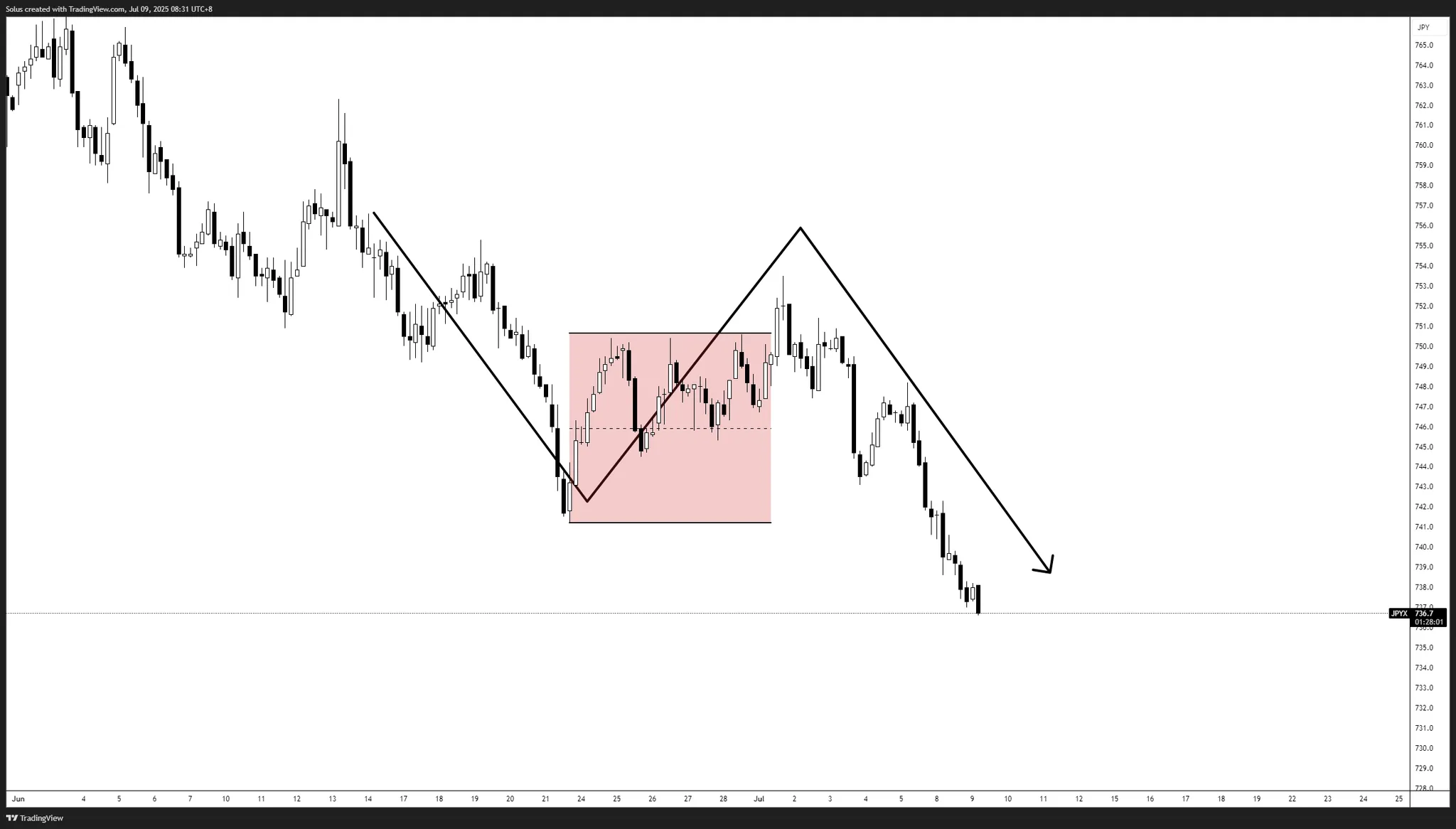

US Dollar vs Japanese Yen Technical Analysis

The US dollar has fallen rather hard against the Japanese yen in early trading on Tuesday to test the crucial 155 yen level, an area that I’ve mentioned more than once. This is a very interesting area for the market to find itself in, and we could see value hunters coming back into the picture, trying to take advantage of this value. The 50-day EMA was touched, and now it looks like we are trying to turn things around. The market may have gotten a little ahead of itself, and we have had a few ugly economic numbers coming out of the United States, but really at the end of the day, we are light years away from the Federal Reserve cutting.

And even if they did, the interest rate difference between the US dollar and the Japanese yen still gets you paid quite handsomely at the end of every session. So not much has changed really. A little bit of panic selling, I suppose, had some people nervous, but right now I’m just looking for an opportunity to get long. 158 yen above could be the target. If we can break above there, then we could be looking at the 160 yen level. Breaking down below the 50 day EMA.

It just has me looking for potentially an entry at 152 yen below. This is a pair, like I said, you get paid at the end of every day and institutional traders love that. So, it makes quite a bit of sense that we should continue to see traders jump in and take advantage of this dip.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article: