Category: Forex News

What’s Happening In Crypto Today? Daily Crypto News Digest

Get your daily, bite-sized digest of blockchain and crypto news today – investigating the stories flying under the radar of today’s news.

In crypto news today:

- Why is crypto down today?

- Americans Lost $1.56B in Cryptocurrency to Fraud in 2023

- Marathon Eyes $1.5B Offering

- Advanced Phishing Kit Targeting Crypto Exchanges and US Federal Agency

__________

Why is crypto down today?

After several days of green fields, the crypto market is back in red – though just a bit.

The total crypto capitalization is down 1.7% over the past 24 hours.

It now sits at $2.41 trillion, according to CoinGecko.

As is to be expected, most of the top 100 coins by market capitalization are down.Looking at the top ten coins, we find that the price of only one of them has appreciated in the past day.

Solana (SOL) is up 8.5% to $133. This makes it the day’s best performer.

Yesterday’s winner, Dogecoin (DOGE), has seen the biggest loss today: 6.5% to $0.124.

Meanwhile, Bitcoin (BTC) is down 1.9%, still holding above the $60,000 level, at $61,649.

Ethereum (ETH) trades at $3,390, with a drop of 2.1%.

The rest of the list is down between XRP’s 0.6% and Cardano (ADA)’s 3%.

Notably, all coins in the top ten category are still green over the 7-day period.

Dogecoin leads the list with a 44% increase, Bitcoin is at 20%, and Ethereum at 14.5%.

Today’s slight market drop is not unusual. Actually, most analysts expect the bull to continue running.

Moreover, BTC’s latest rise is aligned with the introduction of spot Bitcoin exchange-traded funds (ETFs) by major financial institutions, including Bank of America’s Merrill Lynch and Wells Fargo.

This shows BTC’s acceptance and potential for significant growth.

Furthermore, analysts predict that Bitcoin could reach between $100,000 and $200,000, driven by institutional adoption and the halving anticipation.

However, Michael Novogratz, the CEO of digital asset services firm Galaxy Digital, warned investors that there may be a dip coming in Bitcoin’s value amidst its current rally.

“I wouldn’t be surprised to see some corrections and some consolidation,” said Novogratz. “If it corrects, it might correct to the mid-$50,000s, before taking off to the new high.”

Americans Lost $1.56B in Cryptocurrency to Fraud in 2023

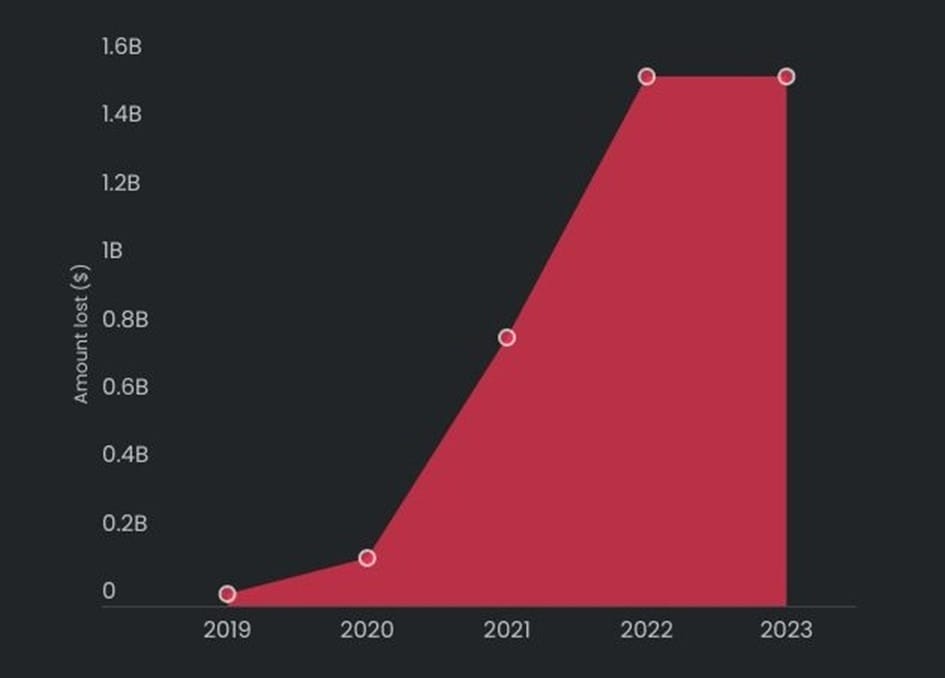

In top crypto news today, 15% of all fraud-related losses in the US in 2023 were in crypto, affecting 55,000 people, according to a recent report by the cybersecurity company Surfshark.

Surfshark collected data from the ‘Consumer Sentinel Network Data Book ‘by the Federal Trade Commission (2019-2023). Importantly, this data includes cases in which crypto was the payment method, but the scams themselves were not necessarily crypto-related.

That said, what the company found is that crypto fraud accounted for over $1.555 billion in losses in this country over 2023.

The report argued that,

“This positions cryptocurrency as the second-highest payment type in terms of monetary losses following bank transfers.”

Cybercriminals have been increasingly targeting crypto, said the report, but “losses have been especially dire since 2022.”

In 2022, the losses totaled $1.558 billion, marking a twofold increase from 2021.

Therefore, 2023 was the second consecutive year of crypto losses exceeding $1 billion.

Furthermore, the loss per victim has increased over these two years. While this number stood at $18,000 in 2021, it reached $26,000 in 2022, followed by $28,000 in 2023.

Additionally, over half of all fraud losses in crypto in 2023 came from miscellaneous investments and investment advice fraud. There was $829 million in total losses, or $34,000 per victim.

Romance scams and business imposter scams follow with losses of $179 million and $140 million, respectively.

“The overall increase in losses has plateaued in 2023, showing minimal deviation from the figures in 2022,” the report stated. “Even if this trend of stalled growth continues into 2024, the scope of losses in cryptocurrency positions it as a significant threat for the year, warranting caution for all current and future crypto holders.”

According to Lina Survila, a spokeswoman at Surfshark, “to minimize the number of cryptocurrency victims, education and supported cryptocurrency adoption, coupled with investment in infrastructure improvements, are crucial.”

Advanced Phishing Kit Targeting Crypto Exchanges and US Federal Agency

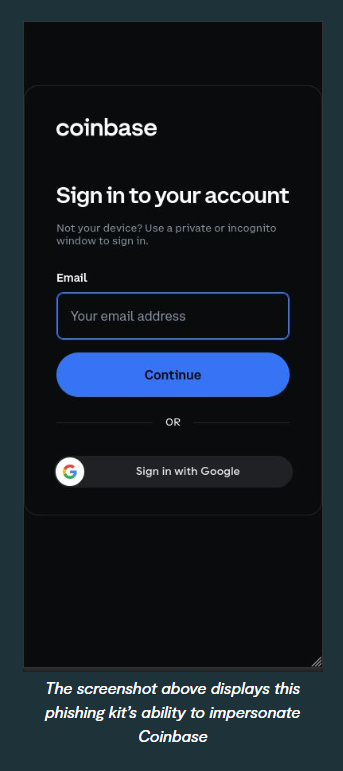

Data-centric cloud security company Lookout, Inc. announced the discovery of an advanced phishing kit, called CryptoChameleon, which targets crypto platforms and the Federal Communications Commission (FCC) via mobile devices.

According to the press release, the intended targets are mostly crypto users and single sign-on (SSO) services in the United States. However, these include Binance and Coinbase employees.

According to David Richardson, Vice President of Endpoint and Threat Intelligence at Lookout,

“We’re seeing a trend of financially motivated threat actors – who typically target cryptocurrency and direct financial fraud – move into breaching enterprise and government organizations for ransom. We urge cryptocurrency and single-sign-on users and organizations to take steps to protect their devices, work and personal data.”

The phishing kit first asks the victim to complete a captcha using hCaptcha. This prevents automated analysis tools from identifying the phishing site.

Notably, these scammers take their time. Unlike typical phishing kits that seek to harvest credentials as quickly as possible, CryptoChameleon is aware of modern security controls, such as multi-factor authentication, and allows bad actors to respond accordingly, said the report.

Also, bad actors utilize text messages and voice calls, personally reaching out to the victim to build a sense of trust and encourage them to follow the steps of the attack. Per the report,

“This has resulted in a high success rate, leading to the collection of quality data, including usernames, passwords, password reset URLs and even photo IDs.”

Moreover, CryptoChameleon uses phone numbers and websites that appear legitimate and reflect a real company’s support team. Lookout said that it has noticed an increase in the frequency of this style of attack – it has become more prevalent and is evolving.

The company warned that,

“With more corporate data residing in the cloud and a change in how users interact with that data, an increasing number of bad actors are now leveraging social engineering, targeting a user’s mobile phone to steal credentials that provide legitimate and immediate access to critical corporate data as part of the modern cyber kill chain.”

More than 250 phishing sites are using this kit, and their number is increasing.

Marathon Eyes $1.5B Offering

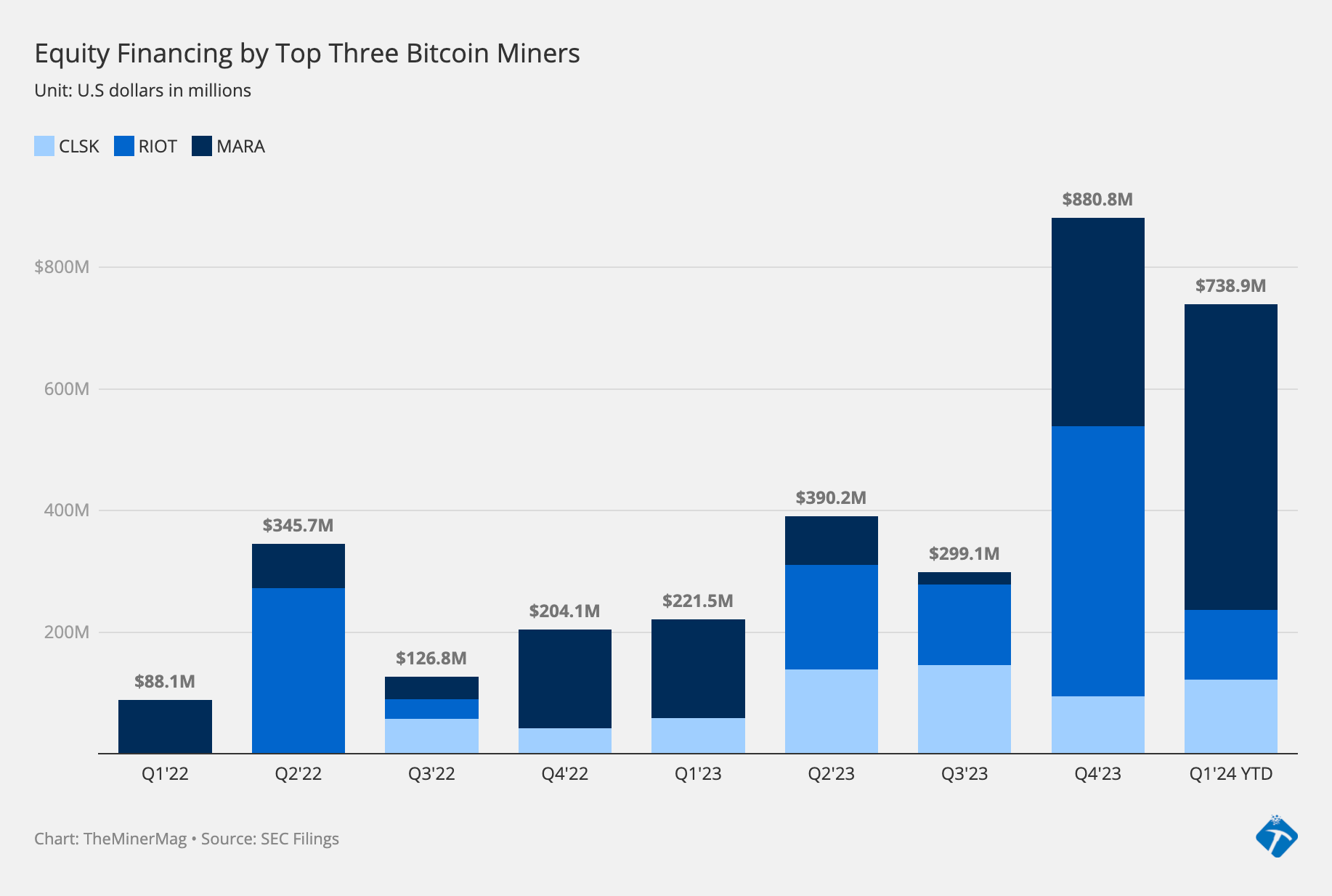

In other crypto news today, stock offerings by publicly traded mining companies are rallying, according to the latest Miner Weekly report by BlocksBridge Consulting.

Bitcoin mining firm Riot Platforms received $115 million in the first quarter so far. Meanwhile, it raised more than $500 million in equity in the last quarter of last year.

Furthermore, Bitcoin miner Marathon Digital reported that as of December 31, it had raised $248.1 million from its 2023 at-the-market (ATM) offering program since October. It had a cap of $750 million.

Then, since New Year’s Day, Marathon sold additional shares under the 2023 ATM to reach the maximum limit.

“[This implies] that it managed to raise an additional $500 million year-to-date.”

Moreover, the company said it planned to start a new ATM offering program with a maximum offering of $1.5 billion.

All in all, the top three bitcoin mining stocks per market capitalization – Marathon, Riot, and CleanSpark – raised $880 million in Q4 2023 and $739 million in the first two months of 2024.

Other companies, including HIVE and Iris Energy, also continued to raise additional funds since the New Year.

A majority of the raised funds will be used to pay for miner commitments and infrastructure buildout during 2024 and 2025.

Meanwhile, CleanSpark continued its preorders of Bitmain’s Antminer S21s in early January.

Riot, on the other hand, seems to be switching to MicroBT’s products as some of its existing Antminers have been causing issues.

And while Marathon hasn’t made any major miner purchases from Bitmain or MicroBT, it paid $15 million in September to its portfolio company Auradine to secure certain rights to future purchases of its Bitcoin ASIC miners.

Source link

Discover more from BIPNs

Subscribe to get the latest posts sent to your email.

Written by : Editorial team of BIPNs

Main team of content of bipns.com. Any type of content should be approved by us.

Share this article:

Discover more from BIPNs

Subscribe to get the latest posts sent to your email.