Vitamin D is one of those nutrients we all know we need, for strong bones, better immunity, good mood, muscle strength, and overall energy. Yet, despite popping supplements religiously, many people still find their vitamin D levels stubbornly low. Sounds familiar? You’re not alone. A lot of us start taking vitamin D tablets or weekly sachets without really understanding what affects absorption, when to take it, or what lifestyle factors could be blocking results. So if your reports still show deficiency even after months of supplements, doctors say there are some crucial details you might be missing.We at TOI spoke to Dr Shovana Veshnavi, Principal Consultant- Internal Medicine, Max Super Speciality Hospital, Noida; Dr. Dhruv Kant Mishra, Consultant- Gastroenterology & Hepatology, Yatharth Super Speciality Hospital, Faridabad; Dr. Amogh Dudhwewala, Senior Consultant- Gastroenterology, Medanta Hospital Noida to shed light on why some people continue to lack this essential vitamin in their body even after taking pills and supplements regularly.

Easy ways to increase your Vitamin D intake

What is considered an optimal range of vitamin D for different age groups?

When it comes to Vitamin D, balance is everything, too little weakens bones and immunity, and too much can actually be harmful. Experts say knowing your ideal range can make all the difference.Dr. Shovana Veshnavi explains that for overall health, the sweet spot for 25(OH)D (25-hydroxyvitamin D) levels is usually between 30–50 ng/ml for most age groups.Echoing similar views, Dr. Dhruv Kant Mishra says older adults need a little more support. He also reminds that infants and pregnant women should monitor their levels closely.Meanwhile, Dr. Amogh Dudhwewala suggests 40–65/70 ng/ml for athletes, pregnant women, and elders with osteoporosis. He cautions that levels above 100 ng/ml risk toxicity, and 150 ng/ml is clinically dangerous.

Calcium & Vitamin D Deficiency in India: Bridging the Nutritional Absorption Gap

Many people take Vitamin D supplements regularly but still show low levels. What are the most common reasons behind this?

If you’ve been popping Vitamin D supplements faithfully and your reports still show low levels—don’t worry, you’re not alone. Experts say there are several hidden reasons why Vitamin D doesn’t always rise the way we expect it to.Dr. Shovana Veshnavi explains that low Vitamin D often persists because of inadequate or inconsistent dosing, or because people take Vitamin D without dietary fat, which is essential for absorption. She also highlights that obesity can trap Vitamin D in fat tissues, making less available for the body to use. Conditions like intestinal disorders, genetic differences, and medications such as anticonvulsants or corticosteroids can all interfere with Vitamin D metabolism.Adding to this, Dr. Dhruv Kant Mishra says that even regular supplementation can fail if there are absorption problems, organ-related issues like kidney or liver disease, poor dosing, or low-quality supplements. Timing and consistency matter more than many people realize, he adds.Dr. Amogh Dudhwewala points out that many people take only 1,000 IU per day, which may simply not be enough for them. He stresses that Vitamin D is fat-soluble, so taking it on an empty stomach reduces absorption.

How do nutrients like magnesium, Vitamin K2, and calcium interact with Vitamin D, and why are they important for absorption and function?

When it comes to Vitamin D, it doesn’t work alone, it teams up with a few key nutrients to actually do its job well. If you’re low on any of those, Vitamin D may not activate properly, no matter how much you supplement.Dr. Amogh Dudhwewala says that magnesium is a major cofactor in Vitamin D activation in the liver and kidneys, and without it, Vitamin D stays inactive. Vitamin K2 helps prevent vascular calcification by directing calcium to the right place, and adequate calcium intake is crucial because Vitamin D and calcium are partners in bone health.

5 Signs you are having too much Vitamin D

Echoing this, Dr. Dhruv Kant Mishra says that magnesium, Vitamin D, and Vitamin K2 function as a team—magnesium activates Vitamin D, Vitamin K2 ensures calcium goes to the bones (not arteries), and calcium needs Vitamin D to be absorbed and built into bone. When all three are aligned, bone health improves and Vitamin D works more efficiently.

Can gut health or digestive issues affect Vitamin D absorption? If so, how can individuals improve this?

Since Vitamin D is absorbed in the small intestine, anything that interferes with digestion can interfere with absorption too.Dr. Shovana Veshnavi explains that gut issues such as celiac disease, Crohn’s disease, IBS, SIBO, chronic pancreatitis, or fatty liver can significantly reduce Vitamin D absorption.Supporting this, Dr. Dhruv Kant Mishra says that conditions like chronic diarrhoea, inflammatory gut diseases, or previous intestinal surgeries can severely impair the body’s ability to absorb Vitamin D. Adding more detail, Dr. Amogh Dudhwewala emphasizes that Vitamin D absorption requires proper fat digestion. In diseases of the small intestine, pancreatic insufficiency, cholestatic liver disease, obstructive jaundice, or after bariatric surgery, absorption drops sharply. To improve it, he advises taking Vitamin D with the day’s largest fatty meal, ensuring enough magnesium, eating whole grains, fruits, and fermented foods, and addressing malabsorption medically when needed.

How does lifestyle—such as screen time, indoor living, and sunscreen use—impact Vitamin D synthesis from sunlight?

Today, most of us spend more time under roofs and behind screens than under the sun, and experts say that shift has dramatically affected natural Vitamin D production.

Vitamin D deficiency: Doctor explains causes, symptoms and prevention

Dr. Shovana Veshnavi explains that indoor living and excessive screen time have reduced how much UVB exposure our body gets during the day. UVB is the wavelength the skin needs to make Vitamin D, but it cannot penetrate glass, meaning sitting by a sunny window doesn’t count. She adds that sunscreen can block up to 95% of Vitamin D synthesis, and air pollution also filters UVB rays, making sunlight even less effective.Agreeing on the impact of modern habits, Dr. Dhruv Kant Mishra recommends 10–30 minutes of direct sunlight exposure, three to four times a week, to help restore levels naturally.Dr. Amogh Dudhwewala emphasizes that air pollution is a major factor in preventing UVB rays from reaching the skin.Bottom line? Step outside more often, catch some gentle sunlight, and let your body do what it’s designed to do.

Are there certain medical conditions or medications that interfere with Vitamin D levels?

Experts say that certain medical conditions and long-term treatments can prevent the body from absorbing, storing, or activating Vitamin D properly.Dr. Shovana Veshnavi explains that a range of medications—like anticonvulsants, glucocorticoids, rifampicin, antiretrovirals, antifungals, and long-term PPIs (acid-reducing drugs)—can either speed up the breakdown of Vitamin D or interfere with fat absorption, which is essential for Vitamin D utilization.Echoing this, Dr. Dhruv Kant Mishra says that kidney disease, liver disease, and obesity commonly disrupt Vitamin D storage and activation. Some medicines, including steroids, anticonvulsants, and cholestyramine, can further reduce absorption, meaning levels stay low even with consistent supplementation.Adding more detail, Dr. Amogh Dudhwewala highlights that conditions like hyperparathyroidism, hyperthyroidism, malabsorption disorders can all interfere with Vitamin D status. He notes that anti-epileptic medications, tuberculosis drugs such as rifampicin, steroids, and HIV medications may also significantly lower Vitamin D levels.

What form of Vitamin D supplement (D2 vs D3) is most effective, and how should it ideally be taken, timing, dosing, with or without food?

When it comes to boosting Vitamin D levels effectively, not all forms, and not all dosing habits, are created equal. Experts agree that Vitamin D3 is the superior choice for raising and maintaining healthy levels.Dr. Shovana Veshnavi explains that Vitamin D3 is more effective than Vitamin D2 in elevating Vitamin D levels and sustaining them over time. To get the best results, she recommends taking D3 with a high-fat meal and preferably in the morning or afternoon. She adds that daily or weekly dosing works far better than extremely high monthly doses, and combining D3 with Magnesium and Vitamin K2 helps maintain balance and long-term stability.Dr. Amogh Dudhwewala adds that weekly D3 dosing is commonly preferred and more stable than taking a huge monthly dose. For people with malabsorption issues, he suggests considering calcifediol (25-hydroxy D), which can be more effective than regular cholecalciferol.Supporting this, Dr. Dhruv Kant Mishra points out that Vitamin D3 (cholecalciferol) stays active longer in the body compared to D2. While timing isn’t critical, taking it at the same time each day is helpful.

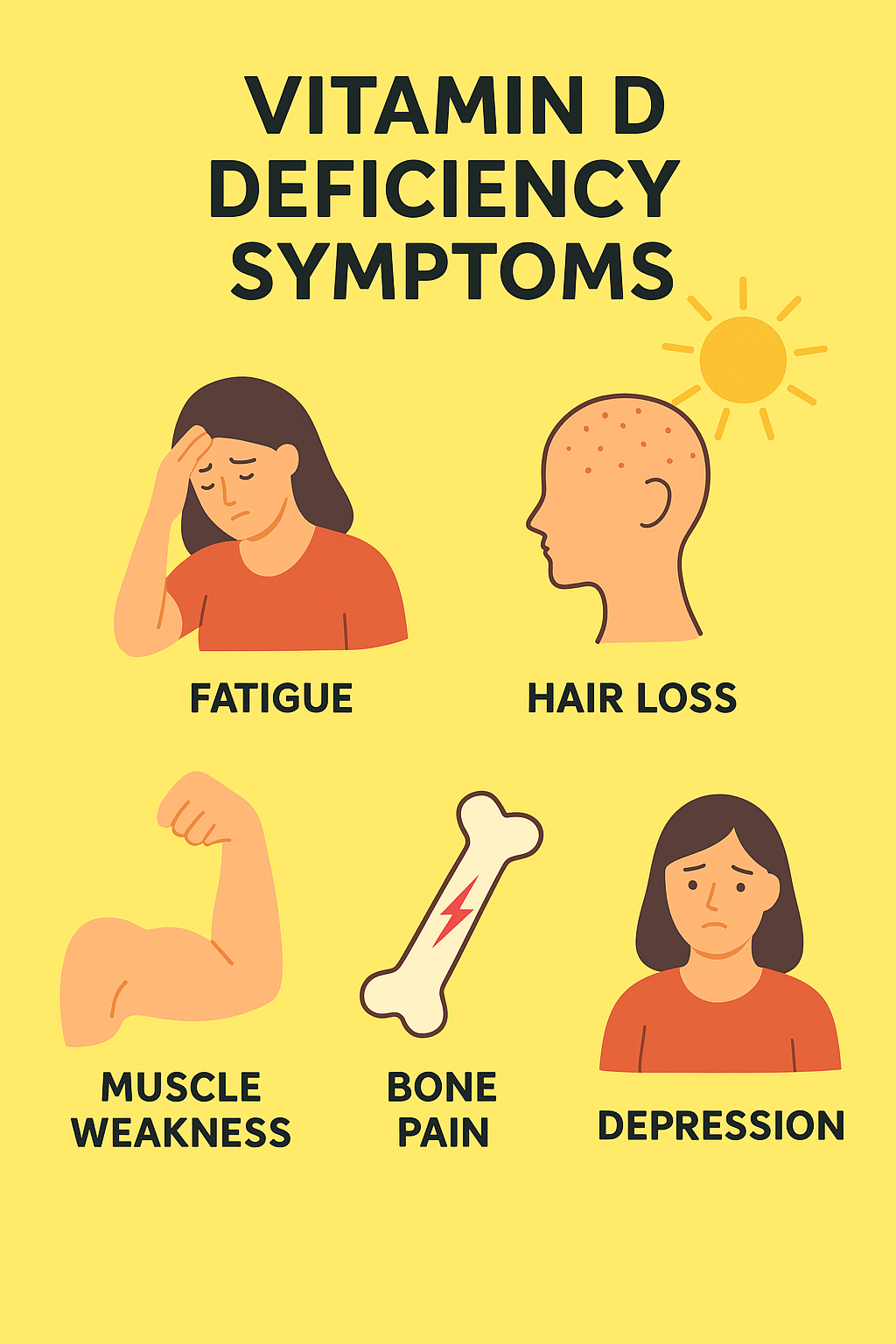

What symptoms should people watch for if they suspect Vitamin D deficiency despite supplementation?

If you’ve been popping vitamin D supplements regularly but still feel drained and achy, you’re definitely not alone. According to Dr. Shovana Vaishnavi, persistent fatigue, muscle or bone pain, low stamina, hair loss, recurrent infections, low mood, sleep disturbances, chronic back pain, stress fractures, or slow recovery after surgery could all be red flags that your vitamin D levels are still low. Women may even notice menstrual irregularities as a sign of deficiency. If symptoms continue despite supplementation, she says there might be underlying issues like poor absorption or incorrect dosing.Adding to this, Dr. Amogh Dudhwewala stresses that supplements alone aren’t magic—daily lifestyle habits matter too. Safe sun exposure, strength training, weight-bearing exercises, and a nutrient-rich diet make a big difference. Think fish, egg yolks, fortified milk, nuts, legumes, greens, fermented foods and cheese—foods rich in calcium, magnesium, and vitamin K.Meanwhile, Dr. Dhruv Kant Mishra points out that continuing symptoms like low immunity, frequent infections, and mood changes may indicate that the body still isn’t absorbing vitamin D properly.

Apart from supplements, what everyday practices or foods can naturally support better Vitamin D utilisation and overall bone and immune health?

When it comes to getting the most out of your vitamin D supplements, lifestyle plays a bigger role than most people realize. Dr. Amogh Dudhwewala explains that improving gut health is key because a healthy gut supports better nutrient absorption—including vitamin D. He also strongly advises cutting down on smoking and heavy alcohol consumption.Meanwhile, Dr. Shovana Vaishnavi highlights the power of safe sunlight exposure, particularly on the arms and legs, as one of the most natural and effective ways to boost vitamin D levels. She also recommends adding more vitamin-D-rich foods to your plate, like salmon, egg yolks, cod liver oil and UV-exposed mushrooms. She points out that lifestyle habits such as adequate sleep, stress management, strengthening exercises, maintaining a healthy waistline, including omega-3s, eating fermented foods, and prioritizing gut health all improve how effectively the body uses vitamin D.