Report Overview

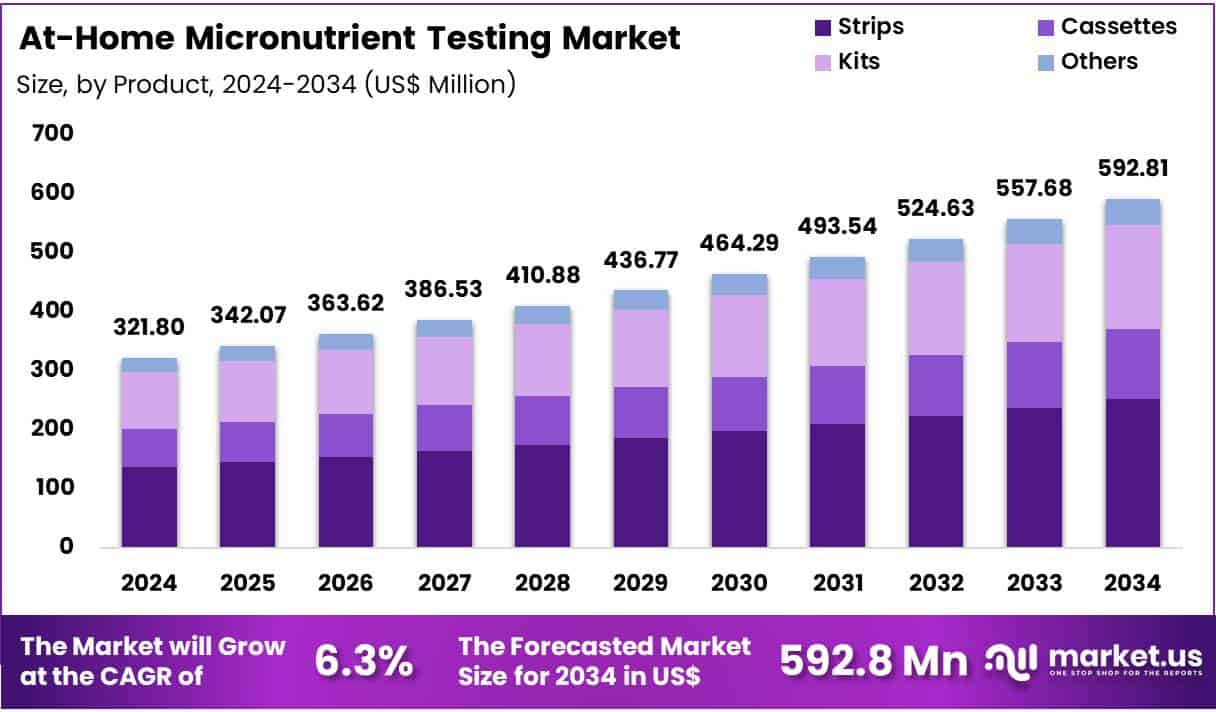

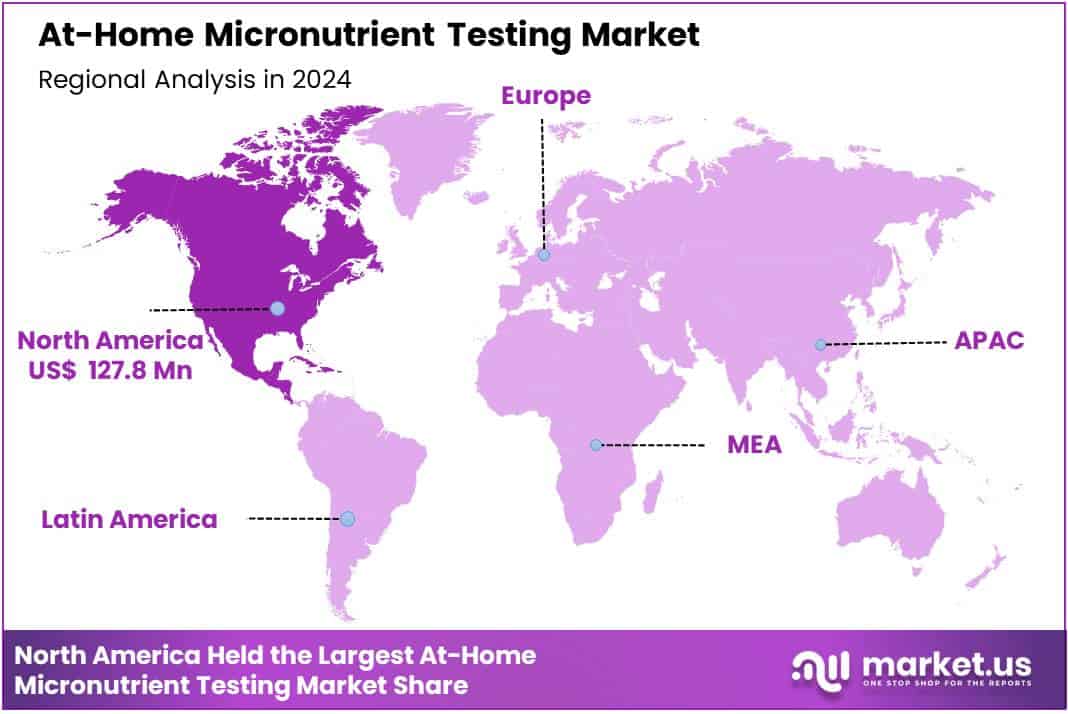

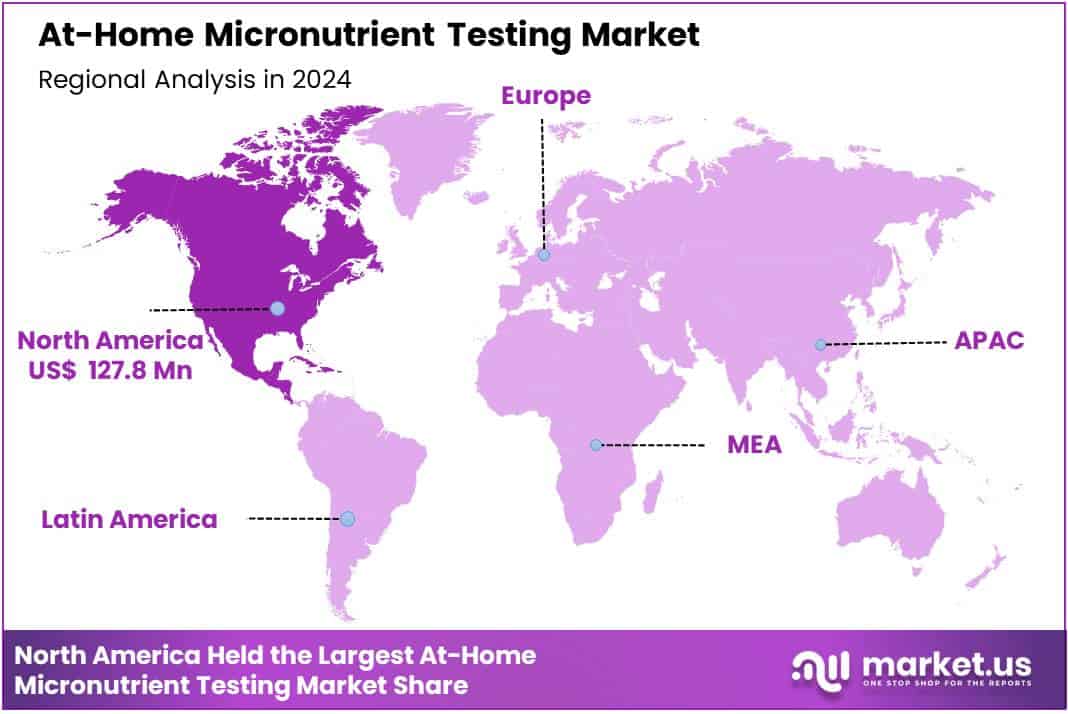

Global At-Home Micronutrient Testing Market size is expected to be worth around US$ 592.8 Million by 2034 from US$ 321.8 Million in 2024, growing at a CAGR of 6.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.7% share with a revenue of US$ 127.8 Million.

The at-home micronutrient testing market has grown into a transformative segment of modern healthcare, reshaping how individuals track and manage their nutritional well-being. By offering convenient tools for evaluating micronutrient levels without requiring a clinic or laboratory visit, the market enables consumers to oversee their health directly from home.

These solutions allow users to understand their vitamin, mineral, and antioxidant status through technologically advanced testing methods, helping them make informed choices about diet, supplementation, and lifestyle improvements. Most kits rely on simple collection techniques such as finger-prick blood spots or saliva samples which are processed in certified laboratories to generate detailed reports. Many platforms now complement results with personalized nutritional insights, dietary guidance, and supplement suggestions tailored to each individual’s needs.

By focusing on ease of use, affordability, and wide availability, the market has expanded access to micronutrient assessments across diverse age groups and health profiles. Its value lies in strengthening preventive healthcare by enabling early recognition of nutrient deficiencies and metabolic imbalances before they progress into more serious health issues. As consumer awareness increases, at-home micronutrient testing continues to support proactive, data-driven approaches to everyday wellness.

At-home kits enable users to collect finger-prick blood, saliva, or urine samples and receive digital reports that explain deficiencies in vitamins, minerals, and essential biomarkers linked to immunity, metabolism, and energy levels. For instance, platforms offering vitamin D and B12 testing have seen rising adoption among people experiencing fatigue or low immunity, especially after lifestyle disruptions during the pandemic.

Companies increasingly integrate these tests with telehealth consultations, supplement recommendations, and fitness tracking apps to provide a complete wellness ecosystem. Examples include home kits paired with mobile dashboards that compare past and present nutrient levels, helping users understand dietary gaps.

The convenience of doorstep delivery and lab-verified results strengthens consumer trust, while expanding e-commerce channels improves accessibility. Growing interest from athletes, individuals following vegan diets, and people managing chronic conditions also contributes to market traction. As personalized nutrition advances, at-home micronutrient testing becomes a key entry point for continuous health monitoring.

Key Takeaways

- In 2024, the market generated a revenue of US$ 321.8 Million, with a CAGR of 6.3%, and is expected to reach US$ 592.8 Million by the year 2034.

- The Product segment is divided into Strips, Cassettes, Kits, and Others, with Strips taking the lead in 2024 with a market share of 42.5%.

- The Micronutrient Type segment is divided into Vitamins, Minerals, and Comprehensive panels, with Vitamins taking the lead in 2024 with a market share of 51.7%

- The Distribution Channel segment is divided into Hospital pharmacies, Online pharmacies, Retail pharmacies, Hypermarkets, and Others, with Online pharmacies taking the lead in 2024 with a market share of 43.5%

- North America led the market by securing a market share of 39.7% in 2024.

Product Analysis

Strips account for the largest share of the at-home micronutrient testing market with 42.5% because they offer quick, low-cost, and user-friendly testing for common nutrients such as vitamin D, iron, and B-vitamins. Consumers prefer strips due to their simplicity—most require only a drop of blood or urine and provide results within minutes without the need for specialized equipment.

This convenience aligns well with the growing trend of routine self-monitoring, especially among individuals managing fatigue, immunity concerns, or dietary restrictions. Fitness-focused users and people following vegan or low-nutrient diets frequently adopt strip-based tests to track essential biomarkers associated with energy metabolism.

For example, vitamin D and iron deficiency strips are widely used in regions with limited sunlight exposure or among menstruating women, where deficiency risks are higher. The affordability of strips also expands adoption among younger users and first-time testers. Manufacturers continue to enhance strip sensitivity and colorimetric accuracy, making them more reliable for home use. As preventive healthcare awareness increases, strips remain the entry-level product preferred by a broad demographic, sustaining their dominant market position.

In August 2024, Quest Diagnostics, a major provider of diagnostic information services, introduced 13 new blood tests aimed at assessing micronutrient deficiencies. These tests help individuals determine whether they lack essential vitamins and minerals required for maintaining overall health. The panels are offered directly to consumers and can be purchased exclusively through questhealth.com.

Micronutrient Type Analysis

Vitamins form the leading micronutrient testing segment with 51.7% market share because deficiencies in vitamin D, B12, and folate are widely recognized and frequently screened by both consumers and healthcare providers. These nutrients directly influence immunity, bone strength, mood regulation, neurological function, and overall metabolic performance, making them central to preventive health routines. For example, vitamin D insufficiency is prevalent among indoor workers and older adults, driving high demand for simple at-home vitamin D tests.

Vitamin B12 testing is also growing among individuals following plant-based diets, where deficiency risk is higher due to limited dietary sources. Home-based vitamin tests are often bundled in easy-to-use kits that allow users to collect finger-prick samples and access digital reports with actionable insights.

The widespread availability of vitamin-specific panels through online pharmacies and consumer wellness platforms reinforces their dominance. As wellness programs and tele-nutrition services increasingly emphasize personalized vitamin optimization, this category continues to attract both routine and first-time users, solidifying its position as the most sought-after micronutrient testing type.

Distribution Channel Analysis

Online pharmacies dominated the distribution channel landscape with 43.5% market share as consumers increasingly prefer digital platforms for purchasing home diagnostic kits due to convenience, privacy, and wider product availability. The ability to compare brands, read reviews, and order tests without visiting physical stores drives strong adoption, especially among tech-savvy urban populations.

Many leading online health platforms also integrate value-added services such as subscription testing plans, sample-collection guides, teleconsultations, and personalized supplement recommendations. For example, companies offering vitamin D, B12, or multinutrient panels often provide mobile dashboards that track historical test trends, enhancing engagement and repeat usage.

Online channels are particularly effective for reaching individuals with busy schedules or limited access to diagnostic labs. They also support direct-to-consumer marketing, enabling emerging brands to scale rapidly without relying on retail presence. Seasonal promotions and automated re-ordering features further stimulate consistent demand.

Key Market Segments

By Product

- Strips

- Cassettes

- Kits

- Others

By Micronutrient Type

- Vitamins

- Minerals

- Comprehensive panels

By Distribution Channel

- Hospital pharmacies

- Online pharmacies

- Retail pharmacies

- Hypermarkets

- Others

Drivers

Growing consumer shift toward preventive and personalized nutrition

The rise of preventive healthcare and personalized nutrition is expected to strengthen demand for at-home micronutrient testing as consumers increasingly monitor deficiencies that influence energy, immunity, cognitive performance, and metabolic health. A growing volume of clinical literature highlights the widespread prevalence of micronutrient gaps, such as vitamin D insufficiency affecting more than one-third of adults in several countries, which encourages individuals to seek convenient and affordable testing options without visiting a clinic.

The shift toward virtual care ecosystems further accelerate home-based testing adoption, as digital platforms integrate micronutrient reports with supplement recommendations, teleconsultations, and lifestyle guidance. Companies offering finger-prick vitamin D, B12, iron, or magnesium tests have expanded online distribution, enabling rapid purchase, doorstep delivery, and seamless digital result interpretation.

Examples include platforms providing personalized dashboards that show trends over time, correlating diet patterns with test outcomes. Consumers engaged in fitness programs, weight-loss regimens, or immunity-focused lifestyles increasingly prefer home tests to understand nutrient gaps that influence performance or fatigue levels.

With rising awareness through health campaigns and educational content from healthcare providers, the driver gains momentum as more individuals adopt proactive monitoring rather than waiting for clinical symptoms to emerge. This structural consumer behavior shift continues to anchor growth.

Restraints

Limited accuracy compared to laboratory-based diagnostics

Despite rising demand, accuracy challenges associated with home-based micronutrient tests act as a restraint, as results may vary due to collection inconsistencies, environmental exposure, or limitations of finger-prick sampling for certain analytes.

For example, blood spot tests may not perfectly reflect serum concentrations for markers such as zinc or magnesium because micronutrient distribution differs between plasma and whole-blood compartments. This discrepancy leads some clinicians to caution against using home kits for complex deficiency assessment, especially for patients with underlying conditions or those requiring high-precision monitoring.

Additionally, improper collection techniques, such as insufficient blood volume or contamination during sample drying, can lead to errors or invalid results. Users without medical training may find it difficult to follow exact procedural steps, increasing the probability of variability compared to standardized phlebotomy in diagnostic labs. Regulatory considerations also restrict certain biomarkers from being offered outside professional settings, limiting the scope of nutrients measurable at home.

For example, some markets allow only specific vitamin assays through direct-to-consumer channels, while others require physician involvement. These combined concerns reduce confidence among healthcare professionals, potentially slowing adoption among populations that rely on clinically validated results. The restraint persists as long as testing accuracy remains uneven across nutrient categories.

Opportunities

Integration of AI-enabled personalized nutrition ecosystems

A major opportunity emerges from integrating at-home micronutrient testing into AI-driven personalized nutrition platforms that combine biomarker data, dietary habits, genomic markers, and lifestyle inputs into tailored recommendations. As consumers increasingly adopt digital health tools, companies are developing algorithms that correlate micronutrient levels with sleep quality, activity performance, stress responses, and dietary intake patterns.

For example, vitamin D trends can be linked with sunlight exposure data from wearable devices, while iron or B12 levels may be analyzed alongside menstrual cycle tracking or diet logs to predict depletion risks. This integrated ecosystem creates recurring revenue models through subscription-based testing, supplement delivery programs, and personalized meal planning applications.

Startups are exploring AI-generated supplement formulation systems that adjust dosage recommendations based on follow-up test results, enabling dynamic correction of deficiencies. Partnerships between diagnostics firms, nutrition technology companies, and wellness platforms present opportunities to expand market reach across fitness, corporate wellness, and preventive health services.

As governments and health organizations emphasize chronic disease prevention through nutrition, digital micronutrient monitoring platforms align with population-level health goals. The rise of remote care and tele-nutrition services strengthens this opportunity, allowing micronutrient testing to function as a foundational component of long-term health optimization.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the At-Home Micronutrient Testing Market by shaping consumer spending, supply chain stability, and access to diagnostic materials. Periods of economic slowdown typically shift household spending toward essential healthcare, which benefits at-home testing because it offers a lower-cost alternative to clinical diagnostics.

However, inflation-driven increases in raw material and logistics costs can raise kit prices, affecting affordability in price-sensitive markets. Geopolitical tensions also impact the sourcing of assay components, microfluidic cartridges, reagents, and lateral-flow materials, which are often manufactured across multiple countries. Disruptions in global trade routes or restrictions on chemical exports may slow production timelines and limit inventory availability for online and retail channels.

Public health policy changes in response to geopolitical events further influence demand. For example, global energy and food supply uncertainties increase consumer awareness of immunity, fatigue, and nutritional well-being, contributing to higher self-monitoring behavior.

Shifts in labor markets, such as the rise of remote work, encourage more people to adopt home diagnostics rather than visiting clinics. At the same time, increased government scrutiny over cross-border data transfers and digital health privacy may affect how testing companies store and process user data.

Latest Trends

Rapid adoption of home-based finger-prick vitamin and mineral panels

A prominent trend in the market is the rapid adoption of home-based finger-prick testing panels that allow individuals to measure multiple vitamins and minerals in a single kit with minimal effort. These panels often include vitamin D, B12, folate, ferritin, magnesium, zinc, and other commonly deficient nutrients, offering a broader view of nutritional status than single-analyte tests.

Consumers increasingly prefer bundled panels because they provide deeper insight into health drivers such as fatigue, hair thinning, muscle performance, and immune resilience. The convenience of collecting a small blood sample at home and shipping it to certified laboratories aligns well with work-from-home lifestyles and the broader acceptance of telehealth services.

Companies expanding test portfolios frequently promote user-friendly sampling devices designed to reduce discomfort and improve sample accuracy, which enhances trust and repeat usage. In addition, the trend is reinforced by growing online health communities where individuals share experiences, compare deficiency patterns, and seek advice on restoring optimal nutrient levels.

Regional Analysis

North America is leading the At-Home Micronutrient Testing Market

North America represents the largest regional share in the At-Home Micronutrient Testing Market due to its strong digital health adoption, high prevalence of vitamin and mineral deficiencies, and widespread integration of home-based diagnostics into consumer wellness routines. The region benefits from advanced telehealth frameworks, making it easier for users to combine at-home testing with remote consultations and personalized supplement plans.

For example, at-home vitamin D and B12 testing is commonly used in the US among individuals with limited sun exposure or plant-based diets, two groups where deficiency risks are significantly higher. The presence of major consumer-focused diagnostic brands with nationwide distribution further supports market concentration.

Online pharmacies and direct-to-consumer wellness platforms also have strong penetration, enabling rapid purchasing and access to multi-panel micronutrient kits. High disposable income and growing interest in preventive health contribute to continued regional dominance.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region due to rising health awareness, expanding middle-class populations, and rapid adoption of digital wellness services. Increasing urbanization and lifestyle changes in countries such as China, Japan, and South Korea contribute to higher rates of nutrient deficiencies, prompting more individuals to use home-based vitamin and mineral testing kits.

At-home diagnostics are also gaining traction due to crowded healthcare systems, where consumers prefer convenient self-testing to avoid long clinic wait times. For example, vitamin D deficiency screening demand has surged in urban centers with indoor-dominant lifestyles.

The region’s strong e-commerce infrastructure accelerates accessibility, with online pharmacies offering bundled micronutrient panels at competitive prices. Local wellness brands are increasingly partnering with diagnostic labs to launch culturally tailored tests such as iron panels for women or B-vitamin screenings for vegetarian populations further boosting growth.

Key Regions and Countries

North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Everlywell, LetsGetChecked, Thorne, Labcorp, Quest Diagnostics, ZRT Laboratory, MyLabBox, Genova Diagnostics, Nutritional Testing Services, Vitagene, GenePlanet, imaware, and Other key Players.

Everlywell is a US-based at-home testing company offering micronutrient panels (e.g., vitamin D, B12) that use CLIA-certified labs, mail-in self-collection kits and digital results within days. LetsGetChecked is a direct-to-consumer provider whose micronutrient test covers vitamins D, B12, E and minerals like copper and selenium, with home blood-sample kits and results in 2-5 days plus board-certified clinical support.

Thorne is a wellness brand offering at-home biomarker and micronutrient tests tied to its nutrition/supplement ecosystem, including home sample collection and personalized follow-up via its health intelligence platform.

Top Key Players

- Everlywell

- LetsGetChecked

- Thorne

- Labcorp

- Quest Diagnostics

- ZRT Laboratory

- MyLabBox

- Genova Diagnostics

- Nutritional Testing Services

- Vitagene

- GenePlanet

- imaware

- Other key Players

Recent Developments

- In May 2022 Everlywell announced the expansion of its nutritional health suite, launching a line of vitamins and supplements alongside its at-home micronutrient test offerings.

- In September 2022 LetsGetChecked announced a US $20 million strategic investment from Morgan Health (a unit of JPMorgan Chase & Co.) aimed at scaling access to at-home diagnostics and personalised health services.

Report Scope