Ottawa, Nov. 17, 2025 (GLOBE NEWSWIRE) — The global berberine API market size was valued at USD 523 million in 2024 and is predicted to hit around USD 973.13 million by 2034, rising at a 6.45% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research. The global berberine API market is driven by the expanding healthcare applications and growing innovations.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6313

Key Takeaways

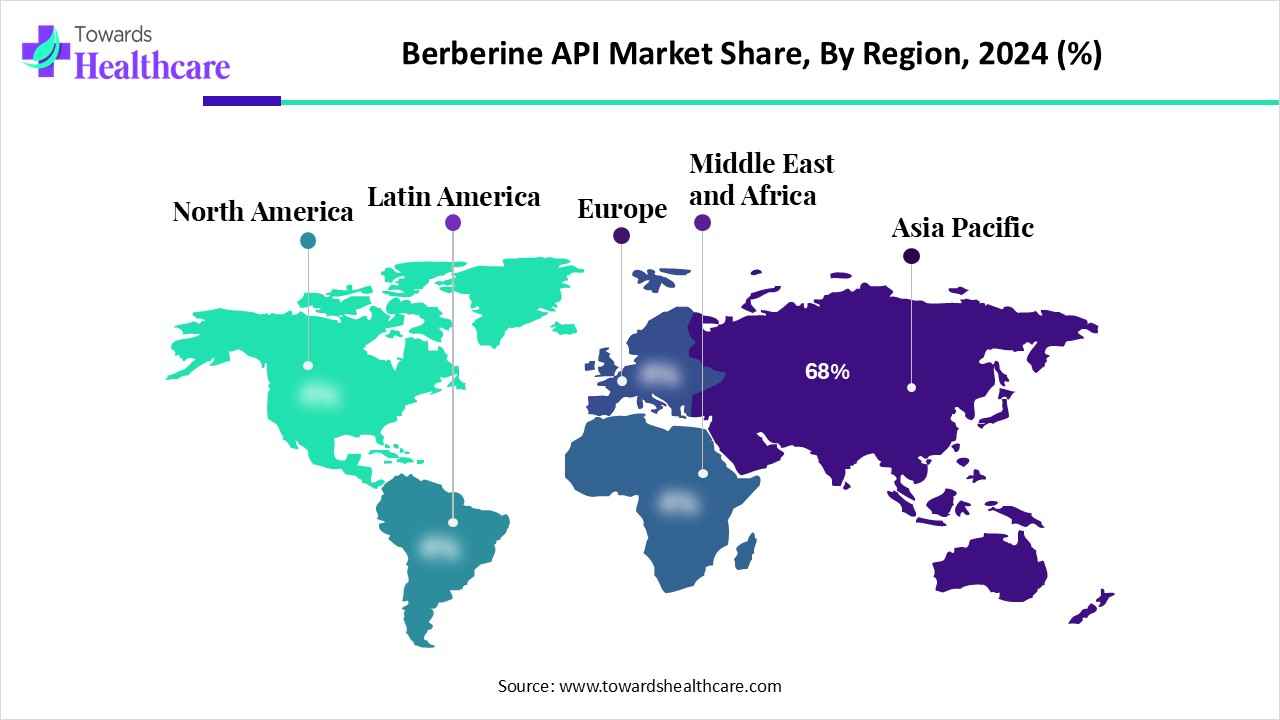

- Asia Pacific held a major revenue of 68% share of the market in 2024.

- North America is expected to witness the fastest growth in the berberine API market during the forecast period.

- By product grade/quality, the nutraceutical/dietary-supplement grade segment held a major revenue of 58% share of the market in 2024.

- By product grade/quality, the custom/formulation-ready premixes & blends segment is expected to witness the fastest growth in the market from 2025 to 2034.

- By source/manufacturing route, the plant-extracted segment held a major revenue of 72% share of the market in 2024.

- By source/manufacturing route, the semi-synthetic/synthetic segment is expected to witness the fastest growth in the market from 2025 to 2034.

- By form/salt type offered, the berberine chloride/berberine HCl segment held a major revenue of 62% share of the market in 2024.

- By form/salt type offered, the micronized/particle-engineered berberine segment is expected to witness the fastest growth in the market from 2025 to 2034.

- By application/end use, the dietary supplements & nutraceuticals segment held a major revenue of 60% share of the market in 2024.

- By application/end use, the pharmaceutical/prescription products segment is expected to witness the fastest growth in the market from 2025 to 2034.

- By business model/sales channel, the bulk API sales to formulators/brand owners segment held a major revenue of 55% share of the market in 2024.

- By business model/sales channel, the direct-to-brand white-label & co-packing segment is expected to witness the fastest growth in the market from 2025 to 2034.

What is the Berberine API?

The berberine API market is driven by increasing consumer interest in natural remedies for the management of chronic diseases and growing dietary supplement applications. The berberine API refers to the concentrated form of berberine alkaloids, which are used in the development of dietary supplements or pharmaceutical products. They are used to improve insulin sensitivity, lipid profiles, cardiovascular health, and gut health.

Executive Summary Table

| Table |

Scope |

| Market Size in 2025 |

USD 556.74 Million |

| Projected Market Size in 2034 |

USD 973.13 Million |

| CAGR (2025 – 2034) |

6.45 |

% |

| Leading Region |

North America by 68% |

| Market Segmentation |

By Product Grade / Quality, By Source / Manufacturing Route, By Form / Salt Type Offered, By Application / End Use, By Business Model / Sales Channel, By Region |

| Top Key Players |

Spectrum Chemical / Spectrum Nutraceuticals, Ningbo / Zhejiang regional botanical extract manufacturers, Hunan / Anhui botanical extract suppliers, Nutraceutical API trading houses & distributors, AdvanSix, Contract API CDMOs, Sabinsa-style formulators, Lonza / Catalent / other large CDMOs, Nutraceutical brand, Botanical farms, Natural ingredient brokers |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Major Growth Drivers in the Berberine API Market?

Growing metabolic disease is the major driver in the market. This is increasing the demand for natural or plant-based treatment options for their management, increasing their use. Additionally, expanding the nutraceutical sector, technological innovations, and increasing sustainability trends are some of the other market drivers.

What are the Key Drifts in the Berberine API Market?

The market has been expanding due to the growing collaborations to launch and enhance the use of various berberine solutions.

- In October 2025, a collaboration between Gencor and Pharmako Biotechnologies launched BioBerb, which is a cold-water dispersible berberine at SupplySide Global, held in Las Vegas.

- In March 2025, an Access and Benefit Sharing (ABS) agreement was signed between Himachal Pradesh Department of Biodiversity and Botanic Healthcare, which is a leader in the nutraceutical sector, committed to sustainability by ethically producing and sourcing Berberis aristata (Kashmal).

What is the Significant Challenge in the Berberine API Market?

Quality and standardization issues act as the major challenge in the market. This may affect the purity, quality, and effectiveness of the products, decreasing their acceptance rates. Moreover, poor bioavailability, drug interactions, competition from synthetic alternatives, and regulatory challenges act as other market limitations.

Regional Analysis

Why did Asia Pacific Dominate the Berberine API Market in 2024?

In 2024, the Asia Pacific captured the biggest revenue share of 68% in the market, due to its long history as a traditional medicine. They were used for the treatment of diabetes, metabolic disorders, and as dietary supplements, where the growing awareness also increased their use as nutraceuticals. This increased their production rates as well as innovations, which were backed by investments. This contributed to the market growth.

What Made North America the Fastest Growing Region in the Berberine API Market in 2024?

North America is expected to host the fastest growth in the market during the forecast period, due to the presence of a robust supply market. The growing consumer awareness is also increasing their use as preventive and natural health products. The growing diseases and R&D are also increasing their demand and innovations, where their availability is being enhanced through online platforms, which is promoting the market growth.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By product grade/quality analysis

Why Did the Nutraceutical/Dietary-Supplement Grade Segment Dominate in the Berberine API Market in 2024?

By product grade/quality, the nutraceutical/dietary-supplement grade segment led the market with 58% share in 2024, as they were used as natural products for weight management as well as metabolic health. They were affordable and easily accessible, which increased their use.

By product grade/quality, the custom/formulation-ready premixes & blends segment is expected to show the fastest growth rate in the market from 2025 to 2034, due to their improved bioavailability. The ready-use blend saves time and contains multi-ingredient formulations, which is increasing their acceptance rates.

By source/manufacturing route analysis

Which Source/Manufacturing Route Type Segment Held the Dominating Share of the Berberine API Market in 2024?

By source/manufacturing route, the plant-extracted segment held the dominating share of 72% in the market in 2024, driven by its traditional medicinal use. Moreover, as they are naturally occurring and consist of target alkaloids, their use has increased, driving their production and cultivation.

By source/manufacturing route, the semi-synthetic/synthetic segment is expected to show the highest growth in the market from 2025 to 2034, due to its better standardization and purity. They are easy to scale up, and new novel analogues or delivery systems can be easily developed to enhance their applications.

By form/salt type offered analysis

What Made Berberine Chloride/Berberine HCl the Dominant Segment in the Berberine API Market in 2024?

By form/salt type offered, the berberine chloride/berberine HCl held the largest share of 62% in the market in 2024, driven by its better water solubility. Additionally, they also provided accurate dosing, which increased their use in the forms of tablets, capsules, and other nutraceutical formulations.

By form/salt type offered, the micronized/particle-engineered berberine segment is expected to show the fastest growth rate in the market from 2025 to 2034, due to its enhanced bioavailability. This is increasing their use as fast-acting health products, driving their demand in nutraceuticals.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By application/end use analysis

How the Dietary Supplements & Nutraceuticals Segment Dominated the Berberine API Market in 2024?

By application/end use, the dietary supplements & nutraceuticals segment led the market with 60% share in 2024, due to its increased use in blood sugar control and weight management. They were also used as natural products, where their increased availability prompted their use.

By application/end use, the pharmaceutical/prescription products segment is expected to show the highest growth in the market from 2025 to 2034, due to their increasing R&D. They are also being formulated for the treatment of diabetes and lipid disorders, which is increasing their acceptance rates.

By business model/sales channel analysis

Which Business Model/Sales Channel Type Segment Held the Dominating Share of the Berberine API Market in 2024?

By business model/sales channel, the bulk API sales to formulators/brand owners segment held the dominating share of 55% the market in 2024, due to their focus on product development. Therefore, the large-scale production helped in producing affordable berberine solutions, which increased their use.

By business model/sales channel, the direct-to-brand white-label & co-packing segment is expected to show the fastest growth rate in the market from 2025 to 2034, due to its low upfront investments and faster product launches. Moreover, their flexibility provides varied batch sizes, which is increasing their use.

Recent Developments in the Berberine API Market

- In August 2025, Metaberine, a green process-enriched berberine, was developed with the use of BioSOLVE Technology, which was launched by Zeus Hygia Lifesciences, a leader in nutraceutical solutions.

Browse More Insights of Towards Healthcare:

The global insulin API market size is calculated at US$ 4.51 billion in 2025, grew to US$ 4.94 billion in 2026, and is projected to reach around US$ 10.21 billion by 2034. The market is expanding at a CAGR of 9.52% between 2024 and 2034.

The global oncology API market size is calculated at USD 41.79 billion in 2024, grew to USD 43.95 billion in 2025, and is projected to reach around USD 69.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

The global steroid hormone API market size is calculated at US$ 3.54 billion in 2024, grew to US$ 3.74 billion in 2025, and is projected to reach around US$ 6.06 billion by 2034. The market is expanding at a CAGR of 5.54% between 2025 and 2034.

The global small molecule API market size is calculated at US$ 206.9 billion in 2025, grew to US$ 219.52 billion in 2026, and is projected to reach around US$ 374.03 billion by 2035. The market is expanding at a CAGR of 6.1% between 2026 and 2035.

The global serum gonadotrophin API market size was estimated at US$ 131 million in 2024, projected to increase to US$ 137.1 million in 2025 and reach US$ 202.93 million by 2034, showing a healthy CAGR of 4.64% across the forecast years.

The global non-ionic contrast media API market size is calculated at US$ 1.81 billion in 2024, grew to US$ 1.92 billion in 2025, and is projected to reach around US$ 3.32 billion by 2034. The market is projected to expand at a CAGR of 6.34% between 2025 and 2034.

The clavulanic acid series API market was estimated at US$ 385 million in 2023 and is projected to grow to US$ 777.66 million by 2034, rising at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2034.

Berberine API Market Key Players List

- Hunan/Anhui botanical extract suppliers

- Spectrum Chemical/Spectrum Nutraceuticals

- AdvanSix

- Ningbo/Zhejiang regional botanical extract manufacturers

- Sabinsa-style formulators

- Nutraceutical API trading houses & distributors

- Botanical farms

- Contract API CDMOs

- Lonza/Catalent/other large CDMOs

- Natural ingredient brokers

- Nutraceutical brand

Segments Covered in The Report

By Product Grade/Quality

- Nutraceutical/Dietary-Supplement Grade

- standard extract powders

- Pharmaceutical / GMP API Grade

- Research/Analytical Standards

- Custom/Formulation-ready Premixes & Blends

By Source/Manufacturing Route

- Plant-extracted

- Semi-synthetic/Synthetic

- Biotechnological / Fermentation routes

- Blends & standardized extracts

By Form/Salt Type Offered

- Berberine chloride/berberine HCl

- Berberine sulfate / free base

- Micronized/particle-engineered berberine

- Encapsulated/coated API premixes for direct fill

By Application/End Use

- Dietary Supplements & Nutraceuticals

- Functional Foods & Beverages

- Pharmaceuticals/Prescription Products

- Cosmeceuticals & OTC topical uses

- Research, clinical trials & CRO supplies

- Veterinary formulations

By Business Model/Sales Channel

- Bulk API Sales to Formulators/Brand Owners

- Toll-manufacturing / private-label supply

- Packaged ingredient (premixes, blends) sales

- Direct-to-brand white-label & co-packing

- Distributor/trading house resale

By Region

North America

- U.S.

- Canada

- Mexico

- Rest of North America

South America

- Brazil

- Argentina

- Rest of South America

Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6313

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Leah and her father at her wedding, June 2025. (Photo/Aisley Herndon)

Leah and her father at her wedding, June 2025. (Photo/Aisley Herndon)