$0.5 in Uptober as Maxi Doge Prepares to 100x

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

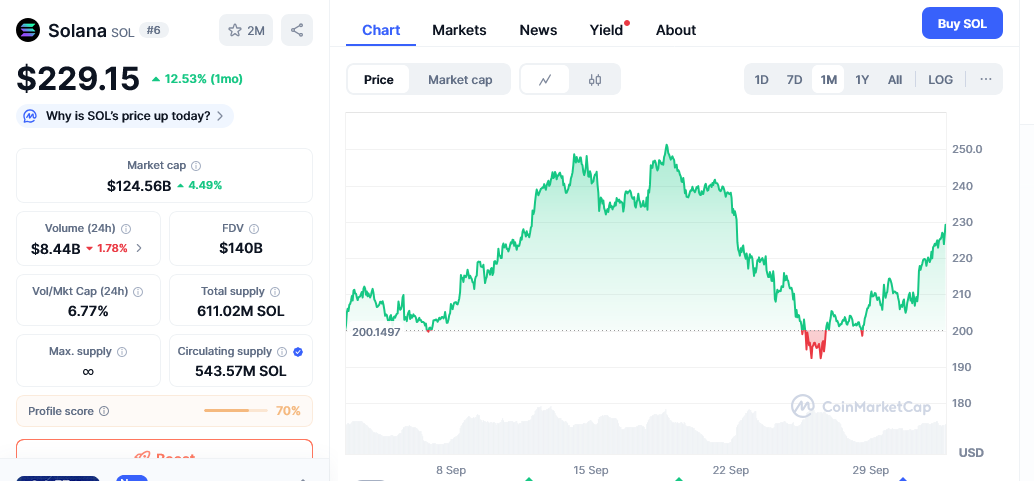

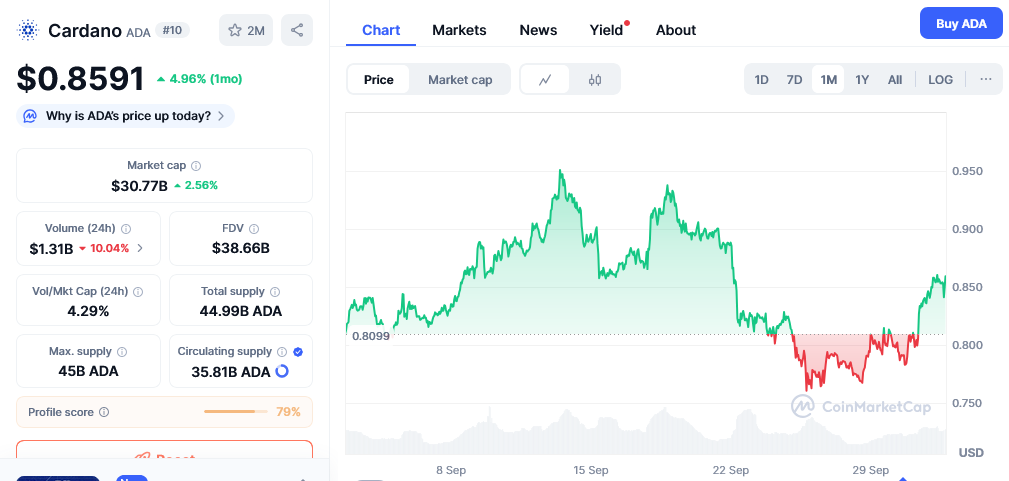

Meme coins have had a choppy run lately. September started hot, then fizzled as mid-month sellers took the edge off of early gains. Sentiment heading into Q4 was split – there was plenty of interest in meme coins, but not a lot of conviction.

Yet the start to October has been promising. Dogecoin is back in the green, spot trading volumes are picking up again, and crypto traders are testing the waters after September’s interest rate cut.

So, the big question: can DOGE keep pushing higher from here – and for how long? And if DOGE does continue to rise, can it reach $0.50 by the end of October?

There’s also a lot of buzz around Maxi Doge (MAXI), a presale meme coin that has raised $2.7 million in early funding. Some investors are already predicting that MAXI could have 100x price potential once it launches on a DEX later this quarter.

Dogecoin Surges to $0.255 as Buyers and Sellers Battle

Dogecoin is trading around $0.255 today, up 13% over the past week after bouncing off $0.22 support last Friday. That bounce erased most of the week’s losses and pulled liquidity back into the market: spot volumes reached $3.1 billion in the previous 24 hours.

Meanwhile, open interest has started to climb again – a constructive signal when gauging follow-through. But despite these positive signs, it won’t be a straight line up for DOGE.

Looks like a prolonged government shutdown would definitely impact the launch of new spot crypto ETFs…

ETF Cryptober might be on hold for a bit.

From SEC’s “Operations Plan Under a Lapse in Appropriations & Government Shutdown”… pic.twitter.com/Z6gY1bJbUt

— Nate Geraci (@NateGeraci) October 1, 2025

A mild pullback today coincides with reports that the SEC’s review of altcoin ETF applications has been delayed due to the government shutdown, putting more than 90 applications – including ones for DOGE – on ice. Losing that near-term catalyst has prompted some profit-taking.

Yet Dogecoin’s technical backdrop is improving, and support held where bulls needed it to. So, while the ETF delays are undoubtedly a drag on sentiment, the underlying setup remains bullish.

Dogecoin Price Prediction – Can DOGE Hit $0.50 in October?

From today’s price, a rally to $0.50 would be a 96% move – and represent DOGE’s highest value since May 2021. That sounds unrealistic, but October does have a habit of rewarding those who take risks.

The ETF hope hasn’t vanished, and even minor updates on DOGE-linked funds have tended to attract fresh demand. Whale activity matters too: large DOGE holders have been adding since early spring, which is a bullish signal.

Looking at the technicals, the $0.28–$0.30 zone is the nearest resistance area. Clear that and there’s an open path toward $0.50 – a psychological round number that traders are often drawn to.

Add the ongoing speculation around X (Twitter) payments integration for DOGE, and you’ve got enough potential catalysts to keep $0.50 on the table this month. Although it’s not the likeliest outcome, Dogecoin has proven time and again how quickly momentum can snowball.

Why Maxi Doge Could Outrun DOGE as Presale Hits $2.7M Milestone

If DOGE is the blue-chip meme coin, Maxi Doge is the plucky upstart. Built on Ethereum, MAXI leans into high-energy “gym bro” branding and 1,000x trading culture, with features designed to keep holders engaged.

The project’s presale has gathered momentum – more than $2.7 million raised so far – with the MAXI price now sitting at $0.0002605. That’s expected to be lower than the eventual DEX listing price.

Utility is where the coin tries to separate itself. High-yield staking (with an APY of 125% in the presale), weekly trading competitions, and ROI leaderboards aim to incentivize engagement. The team has also hinted at a push into leverage trading – up to 1,000x – and potential futures exposure.

Audits from SolidProof and Coinsult add a layer of transparency that’s uncommon in this area of the market. And the Maxi Doge whitepaper lays out a large budget for exchange liquidity, marketing, and project development.

So, why position it against DOGE now? MAXI’s near-term catalysts are mostly internal – presale progress, DEX/CEX listings, and community growth – instead of being dependent on ETF news. That could translate to cleaner upside if the exchange launch goes well.

YouTuber Crypto Tech Gaming believes that will be the case, calling MAXI one of the “best altcoins” to go live in Q4. For investors seeking asymmetric returns this Uptober, Maxi Doge offers the kind of early-stage upside that Dogecoin can’t match.

Visit Maxi Doge Presale

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>