The main category of All News Articles.

You can use the search box below to find what you need.

The main category of All News Articles.

You can use the search box below to find what you need.

The USD/JPY pair maintained its upward trajectory after Japan released encouraging inflation data on Friday. According to the Statistics Bureau, Japan’s core consumer price index declined by 0.3% in September, following a 0.5% increase in the previous month. Obviously, this translated into a year-on-year increase of 2.5%, lower than the previous 3.0%.

The core CPI came in at 2.4% in September, above the median estimate of 2.3%. also, it was an improvement from the previous increase of 2.8%. The figures suggest that inflation in Japan is moving in the right direction and is likely to reach the Bank of Japan’s 2.0% target in the coming months. Analysts expect the Bank of Japan to adopt a wait-and-see approach before committing to raising interest rates at upcoming meetings. Furthermore, unlike other global central banks, the Bank of Japan has adopted a relatively hawkish tone in the past few months. It first raised interest rates by 0.10% earlier this year and then by another 0.25% in July. Also, the 0.25% rise caused major global volatility as investors began to unwind the carry trade on the Japanese yen. A carry trade is a situation where investors borrow a currency with a lower return and invest in another currency with a higher return. For a long time, investors have borrowed the negative-yielding Japanese yen and invested in other assets in the United States, Australia and other countries. Therefore, with the Japanese economy weakening and inflation moving in the right direction, the Bank of Japan is likely to keep interest rates at the current rate for some time.

Moreover, this explains why Japanese government bond yields continue to rise. The 10-year bond yield rose to 0.97% on Friday, its highest level since August 7, and a 32% increase from its September low.

Also, The USD/JPY exchange rate made a strong comeback due to the Fed’s actions. At its last meeting, the bank decided to cut US interest rates by 0.50%, the largest rate in more than four years. Since then, the US has posted strong economic figures. Data released earlier this month showed that the unemployment rate fell to 4.1% in September, the lowest level in two months.

The US economy added more than 254,000 jobs in September while wage growth continued to expand during the month. Meanwhile, inflation in the US fell at a slower pace than expected. The US headline CPI fell from 2.5% in August to 2.4% in September. On the other hand, core inflation remained unchanged at 3.2%. Overall, the latest US economic data showed that core retail sales rose by 0.5%. Meanwhile, the headline figure rose to 0.4%. Both initial and continuing jobless claims figures were better than expected last week. Therefore, the Fed is likely to act in two ways at the next meeting: cut interest rates by 0.25% or keep them steady.

This explains why the US Dollar Index (DXY) rose to 103.87 dollars, its highest level since August 2. It has risen by more than 3.52% from its yearly low. Also, US Treasury bond yields have risen. The yield on 10-year bonds rose to 4.088%, its highest level since July 31. Similarly, the yield on 5-year bonds rose to 3.9%.

The daily chart shows that the USD/JPY exchange rate made a strong comeback this week. It rose to 150, its highest level since July 31, and 7.15% from the August low. The pair moved above the 38.2% Fibonacci retracement point. Also, it crossed the 50- and 100-day exponential moving averages (EMA). The Relative Strength Index (RSI) moved above the neutral point at 50, while the MACD crossed the zero line. Therefore, the USD/JPY pair is likely to continue its rise as bulls target the next point at 153.70, which is the 23.6% retracement point.

Ready to trade our daily USD/JPY forex forecast? Here are the best forex brokers in Japan to choose from.

SPONSORED POST*

Leading analysts say the Dogecoin price is set for some big moves this Uptober. The meme coin has had an ambiguous trajectory throughout September, but market watchers believe that is about to change. Nevertheless, they recommend ETFSwap (ETFS), a presale crypto token with a 300x projection, as the most profitable opportunity for investors this Uptober.

The Dogecoin price has been stuck in a ranging movement for over a mont, with brief breakouts that slowly declined over time. At the time of writing, Dogecoin price was $0.1211 after descending over 3% from $0.1291. This brief analysis represents much of the Dogecoin price action in Q4 2024 – long, uncertain periods, followed by sucker rallies and prolonged declines.

However, analysts believe things might be turning around for the Dogecoin price as the meme coin is receiving renewed interest from its community. Dogecoin price action, like those of other meme coins, is largely determined by the community’s sentiment toward the crypto at any given time. As such, the recent shift in the Dogecoin community to a more positive disposition toward the meme coin has led analysts to believe Dogecoin price could break out of its stagnancy and make some big moves this Uptober.

ETFSwap (ETFS) has received more favorable price predictions than the Dogecoin price, and analysts say it is not a close difference. The Ethereum token has been predicted to see a whopping 300x surge in value in a few days as Uptober kicks into full swing. ETFSwap’s (ETFS) ongoing crypto presale has also seen massive increases since receiving the huge prediction. So far, over 33 million units have been sold and over $5 million has been raised in revenue.

Both the ETFSwap (ETFS) platform and its native crypto token have also received favorable critical acclaim. The platform has been touted as a revolutionary bridge between decentralized and traditional finance. The DeFi platform provides institutional investors and crypto traders access to tokenized exchange-traded funds (ETFs). These institutional assets provide investors with a fine opportunity to diversify their portfolios to hedge against losses.

ETFSwap (ETFS) eliminates such hurdles as mandatory user KYC verification, enabling users to enjoy true transparency and security while trading on the platform. Additionally, ETFSwap (ETFS) cuts out centralized exchanges and other intermediaries so users can invest in or trade tokenized ETFs without the interference or manipulation of central authorities. This helps users trade the digital representations of these ETFs at a lower premium since they do not need to pay any fees to centralized exchanges.

Meanwhile, ETFSwap (ETFS) reassured users of the security of their assets by ordering several audits of its infrastructure from leading auditing firms. Cyberscope, a cybersecurity auditing firm, thoroughly audited ETFSwap (ETFS) to identify any significant vulnerabilities. The auditors found none. Additionally, SolidProof, a smart contract auditing firm, audited the platform’s smart contract, certifying it as secure. ETFSwap’s (ETFS) smart contract address has since been displayed prominently on its website.

Leading analysts agree with ETFSwap’s (ETFS) 300x price forecast and encourage crypto traders to invest in the token’s ongoing presale so they can buy ETFSwap (ETFS) tokens for cheap now and position themselves for massive gains soon. To avail themselves of the opportunity, however, they must invest now before the crypto presale ends in a few days. The token is priced at $0.0384, and the ongoing 50% bonus promo allows interested investors to buy more tokens for maximum gains.

For more information about the ETFS Presale:

*This article was paid for. Cryptonomist did not write the article or test the platform.

Silver price hit new highest since November 2012 on Monday, in extension of last Friday’s record daily rally of 6.4%, with psychological $34.00 barrier being cracked.

Increased safe haven demand dragged silver price, as geopolitical situation is overheated and markets pricing around 90% chance of Fed rate cut in November FOMC policy meeting.

Strong bullish signal has been generated on monthly chart after bulls eventually broke above key barriers at $30.00/50 (psychological / 50% retracement of $49.78/$11.23, 2011/2020 downtrend) which where the price was stuck for four months.

Firmly bullish daily studies continue to contribute to positive structure, underpinned by favorable fundamentals.

The price is currently riding on extended fifth wave of five wave sequence from $26.39 (Aug 8 low) with FE 161.8% (33.89) being cracked.

Close above this level to verify fresh signal and open way for attack at next targets at $35.00/05 (psychological / Fibo 61.8% of $49.78/$11.23) and $35.369 (FE 200%).

Meanwhile, bulls may take a breather under these barriers as daily studies are overbought, with limited dips to be ideally contained above $32.20 zone and to offer better buying opportunities.

Res: 33.89; 34.26; 35.00; 35.36

Sup: 33.51; 32.95; 32.23; 32.00

The 1.08 level underneath of course is a large round psychologically significant figure and that of course, I think, will have a certain amount of influence. We are currently below the 200 day EMA, but at this point, I think that the 1.08 level of course will continue to matter. And if we can turn around and bounce back to the upside, then I think it’s just more of the same working off the froth. The US dollar has exploded in value against the euro, and therefore the downtrend has been rather massive. If the market were to turn around and take out the 200 day EMA above, then I think it’s possible that we could go looking to the 1.10 level.

On the other hand, if we break down below the 1.08 level, perhaps closing on a daily candlestick underneath the 1.0775 level, then I think it opens up a move down to the 1.07 level, followed by the 1.06 level. This is a market that has got far too ahead of itself, so it does make a certain amount of sense. Therefore, I think you’ve got a situation where people are trying to sort out where they’re going next. But right now, I think it’s more or less trying to find stability and looking for that next catalyst. Yes, the Monday candlestick has been very ugly so far, but we haven’t broken through anything significant as far as support is concerned. So, I’m not sure how much this will change my analysis other than I think we still have some work to do before we make our next big move.

Ready to trade our EUR/USD Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

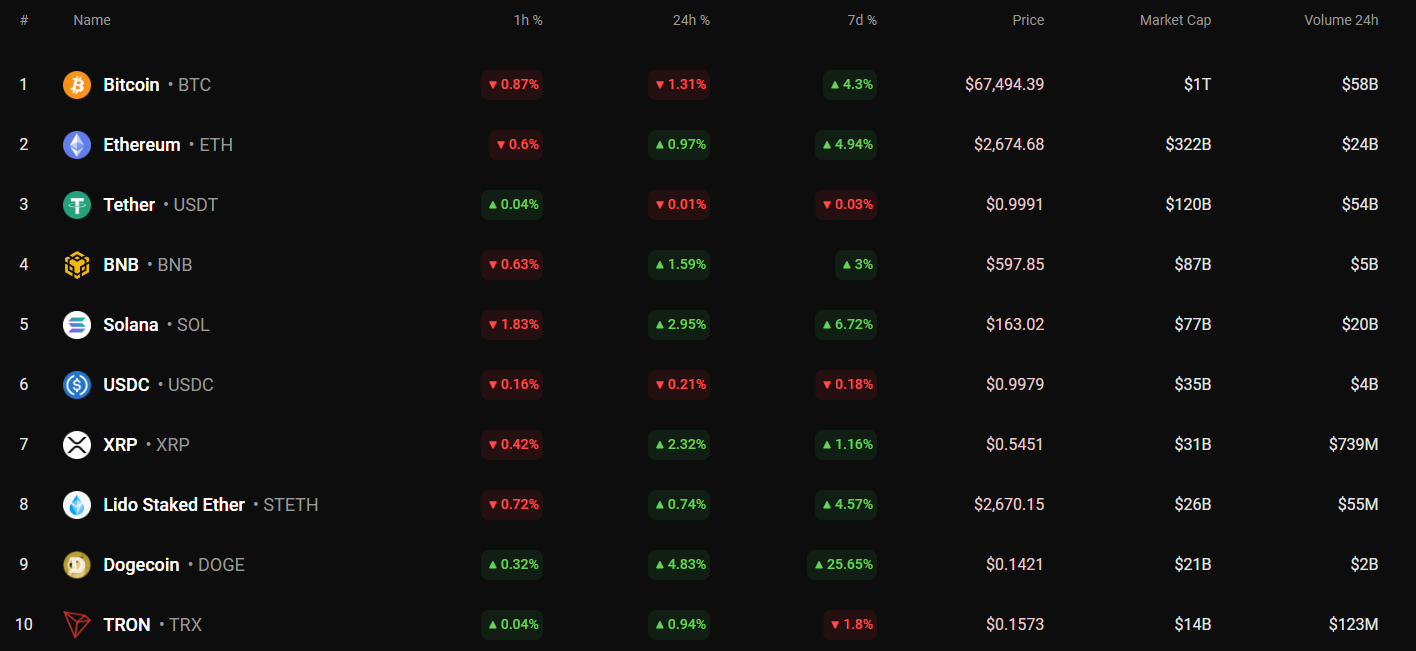

Some coins have returned to the red zone by now, according to CoinStats.

The rate of Cardano (ADA) has risen by 2.62% over the last 24 hours.

On the daily chart, the price of ADA is falling after a false breakout of the resistance of $0.3711. If buyers cannot seize the initiative shortly, one can expect a test of the $0.35 zone by the end of the week.

ADA is trading at $0.3561 at press time.

The rate of Binance Coin (BNB) has followed the growth of ADA, going up by 1.59%.

The price of the native exchange’s coins is falling after yesterday’s bullish closure.

If nothing changes by the end of the day, there is a chance to see a test of the support of $583.10 soon.

BNB is trading at $596.20 at press time.

Disclaimer: Opinions are our own and not financial or investment advice

A lot is written about gold and silver predictions, there is hardly any research on platinum predictions.

At jpost.com, we try to fill that gap by presenting readers with our platinum prediction research readout.

We look at the following topics in this article. Readers who are only interested in the specific platinum predictions for 2025, not in the research, may scroll down to the bottom to find our best case and base case platinum forecast 2025.

Platinum, a precious metal known for its luster and durability, is also a cornerstone of modern industry. Its unique properties and versatility make it indispensable in various applications.

Platinum, a precious metal often overshadowed by its more well-known counterparts, gold and silver, offers unique investment opportunities due to its distinct characteristics and market dynamics. As a component of a diversified portfolio, platinum can provide several advantages:

1. Diversification Benefits:

2. Precious Metals Synergy:

3. Long-Term Investment Potential:

4. Tactical Allocation Strategy:

5. Chart Analysis: A Long-Term Perspective

As we gain an understanding of the importance of having some exposure to physical platinum, we now pivot to platinum’s leading price indicators as well as intermarket dynamics.

Platinum, being one of the 4 precious metals, has a rather strong correlation with other precious metals, particularly gold and silver.

However, there are some specific things that investors should know about intermarket dynamics between platinum and the precious metals universe. This is critical, both from an investor perspective and also to set the expectations right for a platinum forecast for 2025.

The chart below, exhibiting all 4 precious metals, over a period of 30 years, helps us create a framework for a reasonable platinum prediction for 2025 and beyond.

Take-away – Platinum is expected to have a bullish bias in 2025 as gold’s bull market is now here to stay.

The platinum price chart will ultimately have the answers for a reasonable platinum price prediction in 2025.

The platinum market is consolidating around the $1,000 mark for nearly 8 years. That’s remarkable.

What’s even more remarkable is the obvious falling trendline combined with ultra strong support around $800 on the platinum chart. Anyone can spot this, no PhD needed.

Chart-wise, platinum is creating what is called a bullish triangle:

The bullish triangle on the platinum chart makes it very simple for investors – as long as $800 is respected, platinum is supposed to be working on a bullish resolution.

Now that is an important input into a 2025 platinum price prediction. Moreover, it looks also bright for investors that can exhibit patience.

Take-away – For as long as platinum respects support, the base case platinum prediction 2025 is a move to $1,200. Visibly, this chart suggests that whenever a breakout occurs, clearing the 16-year falling trendline, a quick move to $1,440 is the obvious outcome. Based on this chart, we consider $1,200 to be the base case platinum forecast for 2025, and $1,440 the best case prediction.

The platinum chart messages are clear – support at $800, first higher target $1,200 followed by $1,440 which where the real platinum market starts.

Now, let’s look at potential intermarket drivers, within the precious metals universe.

Based on our own research, it appears that platinum has the strongest correlation with silver.

The next chart, showing both platinum (candlesticks) and silver (line), over a period of 40 years, makes is it crystal clear – silver and platinum are strongly correlated.

What is absolutely crucial is the long term aspect of this intermarket dynamic – the chart shows a correlation over 40 years. Investors should not compare both silver and platinum on a day-by-day basis. Rather, it is a quarter-by-quarter comparison that should be applied to discover the correlation.

Essentially, the key question to resolve to understand whether intermarket dynamics will push platinum higher, is what silver will do.

This authority in silver forecasting has a high confidence level result from this research – silver is set to move higher in 2025. The research underpinning this bullish silver prediction is based on lots of data points, but it also considers a variety of angles.

Take-away – It is fair to say that silver is set to move higher, creating bullish intermarket dynamics for platinum. This increases confidence is a sustained move higher in platinum in the coming years. The $1,200 platinum price prediction for 2025 is rightfully a base case prediction, and the best case forecast of $1,440 is likely a reasonable platinum target either in 2025 or 2026, provided $800 holds strong.

Next up is the physical platinum market.

We consult World Platinum Investment Council (WPIC), a specialist in analyzing the physical platinum market.

Their latest research suggests that platinum is entering a period with supply deficit.

This should sound like music in the ears of smart investors, looking to pick up physical platinum at discounted prices, around $1,000.

Below is the platinum market prediction for 2025 and beyond, particularly physical demand and supply data, on aggregate level.

Visibly, 2023 and 2024 are pivotal years for platinum. Equally important is the adjusted forecast by the WPIC, as seen below, suggesting even tighter physical market conditions in 2025 and beyond (compared to their previous forecast).

It seems like there is a trend – a sustained supply deficit in the physical platinum market.

Now, let’s combine the data points we presented in this research:

All of the above are visible on the platinum price charts:

Because of this, it is fair to say that the $1,200 platinum price prediction for 2025 is a base case prediction, likely even a conservative prediction.

The best case platinum price forecast for 2025 and 2026 is $1,440 followed by $1,800.

So far, among financial institutions, only ANZ Research has published a platinum prediction for 2025. ANZ Research expects platinum to rise to $1,273/oz in 2025.

Their platinum prediction sits somewhere in-between our price targets, so it’s fair to say that it seems a rather conservative target, based on the data at hand at the time of writing.

Over time, we plan to add more platinum price predictions of financial institutions as more of them decide to publish their annual platinum forecast.

“Best Overall” by Money Magazine, Award-Winning for 6 Years, Thousands of 5-Star Rankings

Renowned for its exceptional customer service and commitment to transparency, Augusta Precious Metals has garnered numerous accolades, including “Best Overall” from Money magazine and “Most Transparent” from Investopedia. The company’s dedication to educating and supporting its clients has earned it top ratings from organizations such as A+ from BBB and AAA from BCA.

Industry leader with over $2 Billion in gold and silver. Top rated precious metals company with buy back guarantee

From precious metals iras to direct purchases of gold and silver, goldco have helped thousands of americans place over $2 billion in gold and silver. Top-rated precious metals company rated A+ by the better business bureau rated triple a by business consumer alliance earned over 6,000+ 5-star customer ratings Money.Com 2024 best customer service 2024 inc. 5000 regionals: pacific ranked #17 2024 gold stevie award, fastest growing company inc. 5000 award recipient, 8+ years

American Hartford Gold, ranked #1 Gold Company on Inc. 5000, boasts thousands of A+ BBB ratings and 5-star reviews, endorsed by Bill O’Reilly and Rick Harrison..

With over $2 billion in precious metals sold, American Hartford Gold helps individuals and families diversify and protect their wealth. Their expert team provides investors with the latest market insights and a historical perspective, ensuring informed decisions. Trusted by public figures and praised for exceptional customer service, the company offers competitive pricing on top-tier gold and silver coins, backed by a 100% customer satisfaction guarantee

Market research and industry experts suggest that the answer to continued growth for the dietary supplement industry rests in the science — and developing communication strategies. In an era in which consumers increasingly seek products backed by rigorous scientific evidence and are savvier about marketing hype, brands must find a way to stay ahead of the confusion around the regulations and science behind the supplements.

This new report from Inside the Bottle examines how committing to science at every stage of product development, in all parts of the supply chain and process — from raw materials to finished products — and communicating these commitments, credibly positions brands and the entire industry for market momentum and long-term loyalty.

Understanding this, Inside the Bottle has created this report to help your business prioritize key areas for communications. Inside you’ll read more about creating a strategy that includes:

Communicating efficacy and time required to feel it

Importance of raw materials testing

Manufacturing for cGMP compliance and consumer trust

Testing techniques for identity, purity, actives, potency and quality

Types of clinical trials and how they differ

Clarity on the rigorous process behind clinical studies

How to evaluate the quality of clinical studies in 5 steps

U.S. supplement regulation primer at-a-glance

Plus, take away tangible techniques and information about how to address common misconceptions and highlight the rigorous scientific backing required for labeling claims.

Download the report for this concrete advice and much more.

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

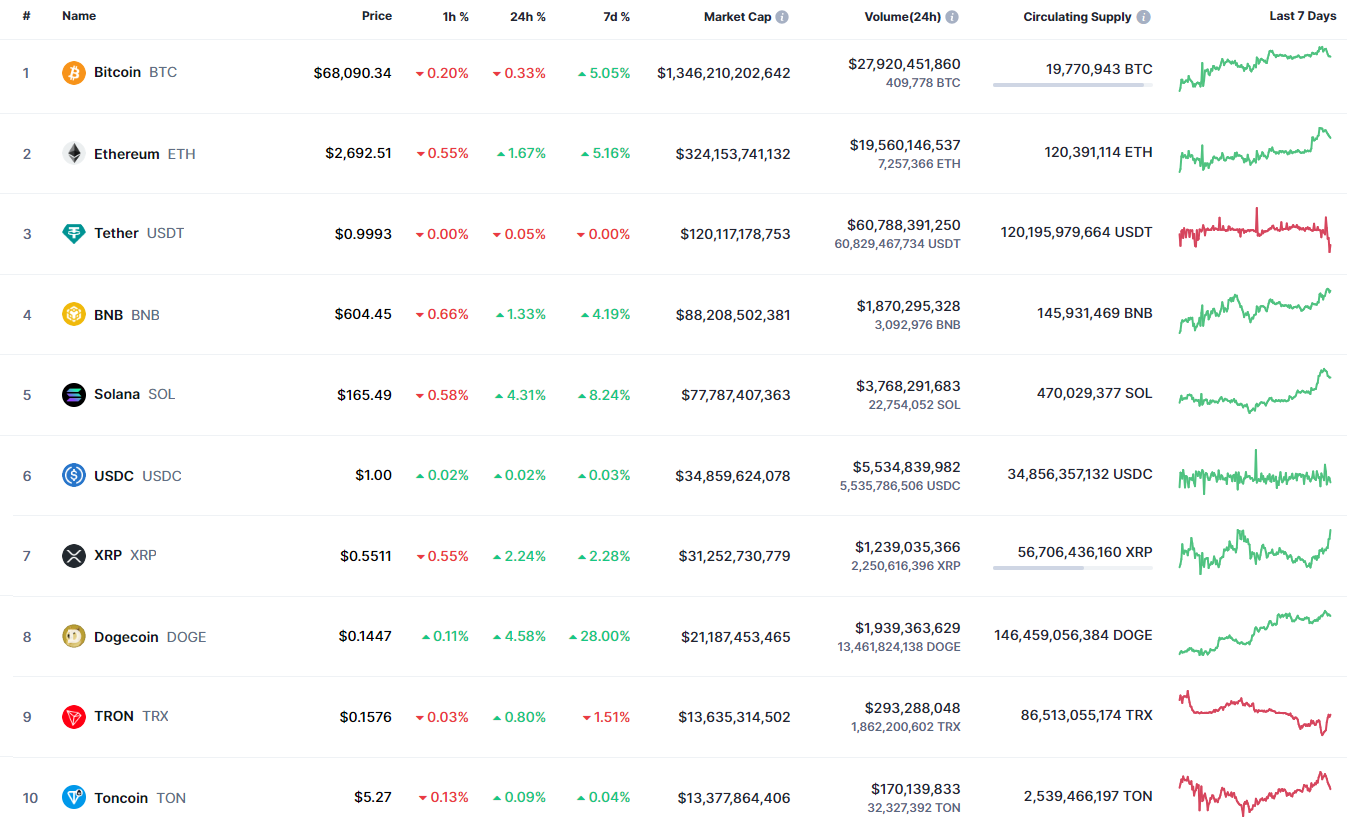

A new week has started with ongoing bulls’ dominance, according to CoinMarketCap.

Unlike most other coins, the rate of Bitcoin (BTC) has dropped by 0.33% over the last day.

On the daily chart, the price of BTC is falling after a false breakout of the formed resistance of $69,363.

If the bar closes below yesterday’s candle low, the correction is likely to continue to the $66,500-$67,000 zone soon.

Bitcoin is trading at $67,855 at press time.

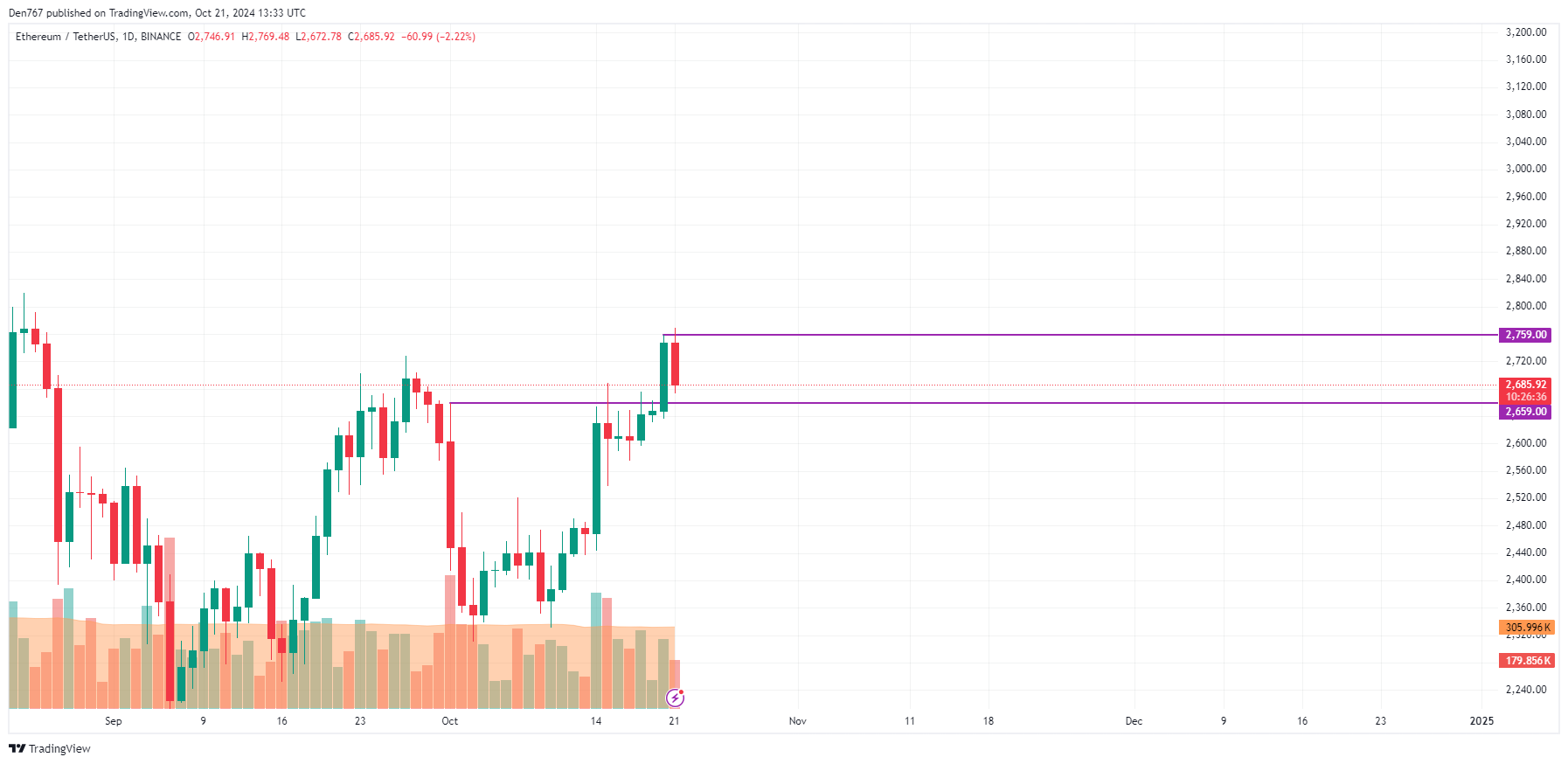

The price of Ethereum (ETH) has increased by 1.67% since yesterday.

From the technical point of view, the rate of ETH is trading similarly to BTC. If the fall continues and the price goes below the support level of $2,659, there is a chance to see a test of the $2,500-$2,600 range shortly.

Ethereum is trading at $2,682 at press time.

XRP is the biggest gainer from the list today, going up by 2.24%.

Despite today’s growth, the rate of XRP has once again failed to fix above the resistance of $0.5556. If the daily bar closes far from that mark, traders may witness a drop to the $0.5350-$0.54 area.

XRP is trading at $0.5459 at press time.

Silver price (XAG/USD) jumps above $34.00 in Monday’s North American session for the first time in almost 12 years. The white metal strengthens on multiple tailwinds: continuing war between Israel and Iran, and growing uncertainty over United States (US) presidential elections.

Israel vowed to retaliate against Iran’s attack on October 1, as shown by leaked documents originating from the National Security Agency (NSA) and the Geospatial Intelligence Agency (GEOIN), which was authenticated by a US official, reported by The New York Times. The scenario of escalating geopolitical tensions improves the appeal of precious metals, such as Silver, as a safe haven.

The Silver’s safe-haven appeal has also been strengthened by neck-to-neck competition between US Vice President Kamala Harris and former US President Donald Trump for presidential elections on November 5.

Meanwhile, the US Dollar (USD) bounces back strongly after a mild correction on expectations that the Federal Reserve’s (Fed) policy-easing spell will be moderate in the remainder of the year. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, aims to recapture the 11-week high around 104.00.

Going forward, investors will pay close attention to the United States (US) flash S&P Global PMI data for October, which will be published on Thursday.

Silver price strengthens after a breakout above the horizontal resistance plotted from the May 21 high of $32.50 on a daily timeframe. Upward-sloping 20- and 50-day Exponential Moving Averages (EMAs) near $30.70 and $31.70, respectively, signals more upside ahead.

The 14-day Relative Strength Index (RSI) oscillates above 60.00, points to an active bullish momentum.

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold’s. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold’s moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

It’s no secret that consumer dietary supplement compliance can be a trick. Saying you take dietary supplements is one thing, actually sticking to a daily routine is another. But what if you could make your supplement routine fun? Today, slightly more consumers say they would rather eat or drink their vitamins and probiotics than swallow them in the form of a pill, according to the Nutrition Business Journal (NBJ) 2023 Functional Food and Beverage Report. And with NBJ projecting that the functional foods and beverage marketplace will reach more than $106 billion in 2026, these numbers mean, there’s a lot of room for fun and innovation.

Fx Chocolate® saw this increase in demand for new ways to take supplements as a sign to give consumers what they want. Created to transform how people view self-care, Fx Chocolate® turns the daily wellness ritual into a rewarding experience. By delivering therapeutic amounts of science-backed nutrients in delicious and indulgent forms, it makes self-care a pleasure rather than a chore.

Dr. David Brady, Chief Medical Officer at Designs for Health, is well-acquainted with the challenges patients face in sticking to their routines. “As a functional and naturopathic medicine practitioner for over 30 years, I am no stranger to the challenges of helping patients in their compliance with taking their supplements … If you can make taking supplements a treat or a bit of a healthy indulgence by placing them in a delicious healthy chocolate, then that is a home run. Fx products have been just that for my practice,” he says.

Fx focuses on innovation

Still, you might wonder, how do supplements in chocolate work? To start, Fx Chocolate® products source ingredients from Designs for Health® (DFH), a family-owned supplement company with 35+ years of experience. Throughout production, Fx Chocolate® adheres to strict quality standards, including verified Certificates of Analysis (COA) and thorough product testing. The latter means, whether it’s collagen peptides, magnesium or immune-support products, customers never have to guess if the amount of an ingredient listed on the package is actually included in the product. “Fx” draws inspiration from the word “Rx,” reflecting the brand’s commitment to providing clinically relevant supplements in a convenient, enjoyable format. “The ‘F’ stands for ‘functional’,” says Brady, highlighting the brand’s focus on delivering real health benefits.

Beyond using clinically relevant and patented ingredients, Fx focuses on nutritional integrity and clean ingredients. For example, the brand uses conscientiously traded cocoa in its chocolate products and is mindful of sugar, exclusively using the sweetener Allulose— a sweetening agent found in many sweet-tasting fruits like jackfruit, figs and raisins, with no bitterness or unpleasant aftertaste. Allulose has a glycemic index of zero, meaning it won’t impact blood glucose levels, and it’s also nearly calorie-free, with 1/10th the calories of traditional table sugar.

New product, new use case

An increasing number of Americans are making functional foods and beverages part of their daily, or at least weekly, routines. According to NBJ’s 2023 Functional Food and Beverage Report, nearly half of consumers say they purchase functional products at least once a week, while 14% do so every day. Fx aimed to develop products that effortlessly integrate into consumers’ lives, making it not only easy to stick to a routine but also enjoyable.

This is where the fun begins. With a supplement bar, instead of having to remember to take a pill or powder and then eat a protein bar after a workout, Fx Chocolate® has combined the functional benefits of a chosen supplement with a delicious and enjoyable bar, catching two birds with one stone.

For consumers looking for a little more fun and flavor in their supplement routines, FX Chocolate® has chocolates, gummies and bars that fit the bill. The brand’s dedication to clean, functional ingredients and innovative product formats sets it apart from other supplement brands and appeals to the changing consumer mindset around functional foods—proving that supplements can be appetizing and enjoyable, while being beneficial, too.

“Consumers may be unfamiliar with trying supplements in a new format like this. We worked hard to formulate these bars so that they not only taste good, but they provide the outcomes consumers are looking for. The functional amounts and innovative ingredients we include do just that,” shares Sara Orrego, brand manager at Fx Chocolate®.

Fx’s new lineup of bars features inviting flavors and impressive benefits, with just 1g of sugar and sweetened with allulose:

Yes Whey!!!™, a chocolatey flavored whey and creatine bar.

Peanut Butter Joint Power™, a PB and chocolate flavored joint and muscle bar.

Cocommune™, a chocolate-coconut flavored bar with prebiotic fibers.

Bone Broth Chocolate Crunch, a bone-broth protein bar with a chocolatey oat milk coating and hot cocoa flavoring.

Bold Beauty Collagen, a birthday-cake-flavored bar with science-backed Lustriva®, plus collagen peptides.

Plant Powered Magnesium™, featuring 20g of vegan protein, 150mg of magnesium glycinate and a white chocolate caramel flavor.

Different format, same proven benefits

While bars are the newest product in Fx Chocolate’s lineup, the brand has multiple products, based on its original supplement chocolates, which perfectly blend indulgence with functionality and fit into other routines, too. These offerings include products with patented and clinically trialed ingredients, as well as classics like Vitamin D3. In the lineup, you’ll find Exhale, made with ingredients like GABA and L-theanine for the ultimate chill pill, Defend, which features Reishi mushroom and GanoUltra™ for immune support, and Dream, which contains melatonin and 5-HTP, while Vitamin D3 and K are served together in Sunshine*. No matter your preference, each easy-to-consume, zero grams of sugar, result-focused chocolate supplement is backed by science and rigorous testing.

For those who prefer gummies, Immune Champ™ and Everyday Multi gummies, both feature Allulose. Specifically, Immune Champ™ contains more than the percent daily value (%DV) of Vitamin C and D, 5mg of zinc and 100mg of elderberry extract, all with a tangy passionfruit flavor. While Fx’s multi offers daily support and includes 19 essential vitamins and minerals inspired by ancestral diets, along with organic Canadian wild blueberry extract, citrus bioflavonoids, a unique form of Vitamin E and other goodies combined in a mango orange flavor.

For consumers looking for a little more fun and flavor in their supplement routines, Fx Chocolate® has chocolates, gummies and bars that fit the bill. The brand’s dedication to clean, functional ingredients and innovative product formats sets it apart from other supplement brands and appeals to the changing consumer mindset around functional foods––proving that supplements can be appetizing and enjoyable, while being beneficial, too.