The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

ADA’s slow climb under the 1 dollar mark has turned into a patience test, and the crowd that once chased every update is getting selective. Many traders are rotating into clearer momentum plays until ADA proves it can defend higher lows with convincing volume.

In a market that prizes speed, tiny fees, and culture, talk is shifting toward Bitcoin Hyper (HYPER) (https://bitcoinhyper.com/) as traders scan for the best crypto to buy now that blends utility with momentum. HYPER’s focus on fast confirmations and straightforward incentives fits a landscape where responsiveness often beats complexity.

Cardano Price Prediction: Will ADA Finally Clear the $1 Barrier?

The 1 dollar region is a psychological ceiling and a liquidity pocket. Recent pushes have faded before volume could compound, so bulls want to see higher lows hold and a decisive close above resistance. If you are checking structure in real time, compare price action and depth on ADA’s page at https://coinmarketcap.com/currencies/cardano/ and watch how pullbacks behave once momentum kicks in.

For a quick market pulse during volatility, many traders watch broad moves and relative strength to judge whether ADA’s breakout attempts align with risk-on conditions or face headwinds. They also track volume surges and order book depth as a fast proxy for genuine follow-through.

Bitcoin Hyper Prioritizes Speed With Straightforward Staking

Bitcoin Hyper (https://bitcoinhyper.com/) takes a simple approach built for daily use: keep transactions fast and inexpensive even when traffic jumps, then back that with clear, straightforward rewards that encourage participation. This helps keep throughput steady during peak periods and reduces friction for everyday transactions.

The result is a product feel that favors responsiveness over complexity, making it easier for newcomers to onboard while giving active users the snappy experience they expect. By minimizing steps and making incentives transparent, it shortens the path from first interaction to consistent engagement.

Why ADA Holders Are Eyeing Bitcoin Hyper in 2025

Throughput and cost control: Fast confirmations and low fees fit active trading, micro-payments, and on-chain social activity.

Community momentum: Meme-aware branding shortens discovery cycles, which can help with listings, liquidity, and tighter spreads.

Utility plus incentives: Practical features paired with rewards create a loop that keeps users engaged beyond one headline.

Simple UX: Smooth flows reduce friction, which often matters more than niche features when markets move quickly.

Final Verdict

Cardano’s path back to 1 dollar remains open, but conviction requires a breakout that sticks with sustained participation. Until that print arrives, traders searching for the best crypto to buy now will weigh alternatives that feel faster and more engaging, with Bitcoin Hyper (https://bitcoinhyper.com/) standing out for low-friction transactions and community-driven incentives.

If you prefer additional context on ranges and historical swings while you track ADA, the overview at https://www.coingecko.com/en/coins/cardano

can help you gauge whether momentum has room to extend.

Buchenweg 15, Karlsruhe, Germany

For more information about Bitcoin Hyper (HYPER) visit the links below:

Website: https://bitcoinhyper.com/

Whitepaper: https://bitcoinhyper.com/assets/documents/whitepaper.pdf

Telegram: https://t.me/btchyperz

Twitter/X: https://x.com/BTC_Hyper2

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

The United States government shutdown is beginning to affect the cryptocurrency market, especially in areas that depend on regulatory decisions. Several XRP-linked ETF applications have now been delayed, creating uncertainty in the short term.

Despite the holdup, confidence in XRP remains strong. The REX-Osprey XRP ETF (XRPR) has officially passed 100 million dollars in assets under management, showing that institutional investors are continuing to accumulate exposure.

That growth supports a bullish XRP price prediction, with traders watching for a potential breakout if buying momentum continues this week.

Government Shutdown Extends ETF Approval Timelines

The U.S. federal government has been shut down for 26 days, and the situation is slowing the approval process for financial products, including cryptocurrency exchange-traded funds (ETFs). A recent report from CoinDesk (https://www.coindesk.com/policy/2025/10/14/us-government-shutdown-delays-sec-crypto-etf-reviews) confirmed that the Securities and Exchange Commission (SEC) has postponed several ETF reviews due to the reduced operational capacity caused by the shutdown.

According to crypto analyst Xaif Crypto, who has more than 19,900 followers on X, the SEC has moved its decision date for multiple XRP-related ETF filings to November 14. This delay reflects the broader impact of the government impasse on financial market oversight.

Even with these delays, the REX-Osprey XRP ETF (XRPR) continues to grow, recently crossing the 100 million dollar mark in assets under management. The milestone underscores sustained institutional demand for XRP despite regulatory bottlenecks.

XRP Price Prediction: Resistance Levels and Key Targets

XRP has been trading around 2.60 dollars, showing a 22 percent increase in daily trading volume. Market data from CoinMarketCap (https://coinmarketcap.com/currencies/xrp/) indicates that liquidity has improved significantly following last week’s rebound.

The token is now approaching the 2.80 dollar resistance area, where the 200-day exponential moving average meets a key historical support level. Analysts at CoinCodex (https://coincodex.com/crypto/ripple/price-prediction) note that a confirmed breakout above this zone could push XRP toward 3.60 dollars in the short term.

If XRP fails to hold momentum, traders see 2.00 dollars as the next strong support level, keeping the market outlook cautiously optimistic while regulatory headlines continue to drive sentiment.

Bitcoin Hyper (HYPER) Gains Attention as a Parallel Opportunity

While XRP continues to consolidate, Bitcoin Hyper (HYPER) https://bitcoinhyper.com is emerging as one of the most talked-about new projects in the market. It is a Layer 2 protocol built on Solana that expands Bitcoin’s speed and scalability without sacrificing security.

The project has already raised more than 24 million dollars during its presale, making it one of the most active launches in the growing BTCFi sector.

Bitcoin Hyper increases transaction capacity from Bitcoin’s seven transactions per second to several thousand while keeping network fees extremely low. The system is built for real use cases, including decentralized apps, payments, and yield generation.

How the Hyper Bridge Expands Bitcoin’s Utility

The foundation of the project is the Hyper Bridge, which connects Bitcoin’s network to Solana’s high-speed infrastructure. Users can send BTC to a designated address and receive equivalent assets on the Hyper Layer 2. These tokens can then be used in staking, lending, and decentralized finance applications.

This bridge creates new utility for Bitcoin holders who want to earn yield or use their assets in DeFi without moving away from the Bitcoin ecosystem. As more wallets and exchanges integrate Hyper Bridge support, demand for the HYPER token is expected to grow.

The presale allows investors to buy HYPER directly using SOL, USDT, or a bank card. The process can be completed through the official Bitcoin Hyper website at https://bitcoinhyper.com.

Market Outlook

XRP remains a key focus as it tests important technical levels near 2.80 dollars. A clean breakout could send the price toward 3 dollars or higher, while consolidation may continue if resistance holds. The long-term picture remains positive with strong ETF demand and steady market inflows.

At the same time, Bitcoin Hyper (HYPER) is giving traders a second major narrative. By bringing faster performance and broader functionality to Bitcoin, the project represents one of the most ambitious attempts to merge Bitcoin’s security with Solana’s scalability.

Both XRP and HYPER highlight how the next phase of crypto growth is combining proven assets with innovation. XRP continues to serve as a measure of institutional confidence, while Bitcoin Hyper is showing what a performance-driven blockchain can do for the Bitcoin ecosystem.

Buchenweg, Karlsruhe, Germany

For more information about Bitcoin Hyper (HYPER) visit the links below:

Website: https://bitcoinhyper.com

Whitepaper: https://bitcoinhyper.com/assets/documents/whitepaper.pdf

Telegram: https://t.me/btchyperz

Twitter/X: https://x.com/BTC_Hyper2

Disclosure: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice.

CryptoTimes24 is a digital media and analytics platform dedicated to providing timely, accurate, and insightful information about the cryptocurrency and blockchain industry. The enterprise focuses on delivering high-quality news coverage, market analysis, project reviews, and educational resources for both investors and enthusiasts. By combining data-driven journalism with expert commentary, CryptoTimes24 aims to become a trusted global source for emerging trends in decentralized finance (DeFi), NFTs, Web3 technologies, and digital asset markets.

This release was published on openPR.

Dogecoin price today trades near $0.20, holding steady as traders weigh whether the recent pullback is a normal pause or the start of a deeper correction. Market action has tightened around the $0.197 support, while exchange flows and derivatives data reveal a divided sentiment across the board.

On the 4-hour chart, Dogecoin price action sits inside a narrow ascending channel after reclaiming ground from its October lows. The 20, 50, and 100 EMAs between $0.199 and $0.203 have merged into a compact support cluster that traders are actively defending.

The Supertrend line near $0.197 has held multiple times this week, giving bulls a short-term base. Above, the 200 EMA and upper channel line near $0.214 form the immediate resistance cap. A clean move through this ceiling could drive the next push toward $0.22–$0.23. Losing the $0.197 level, though, would expose the lower demand zone at $0.178 and risk breaking the channel structure.

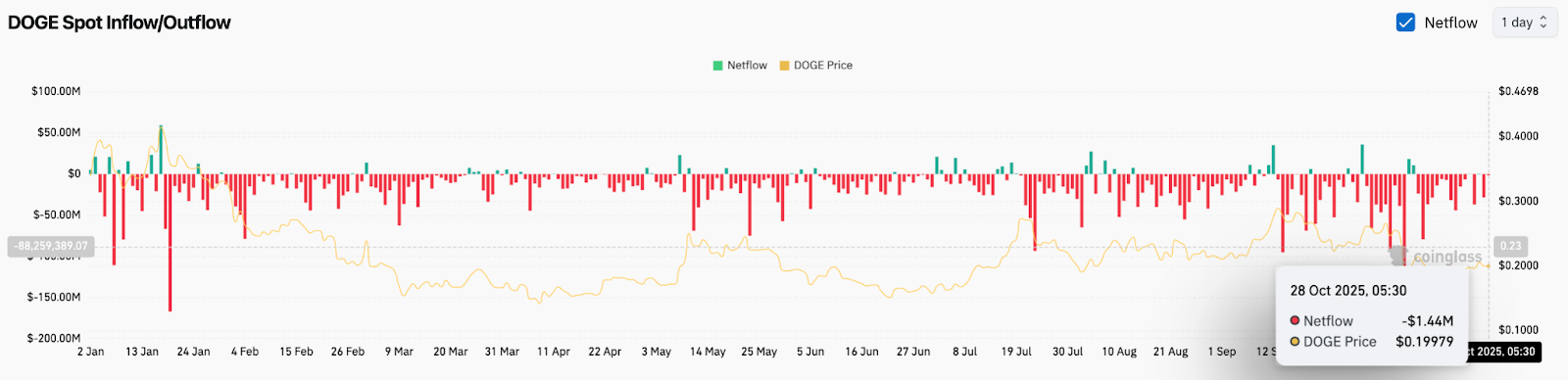

On-chain data shows net outflows of around $1.4 million on October 28, a modest figure compared with the heavy withdrawals seen earlier in 2025. The latest Dogecoin price volatility has been matched by softer outflows, hinting that traders are neither panic-selling nor heavily accumulating.

The neutral flow picture highlights a market waiting for conviction. Exchange wallets are seeing fewer large transactions, reflecting low urgency on both sides. A shift toward stronger outflows and higher spot volume would be the first sign of renewed confidence, but so far, the setup remains cautious.

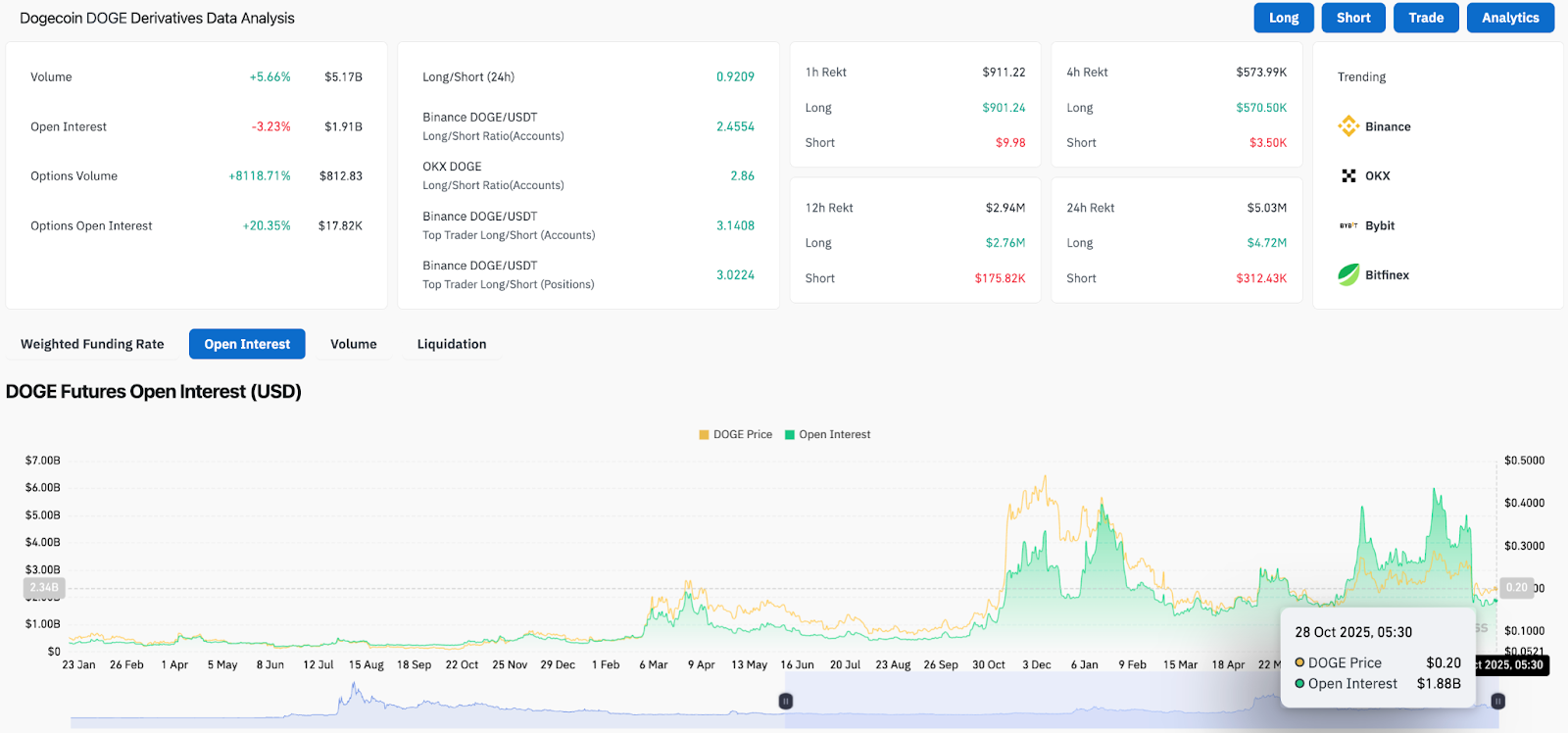

Dogecoin’s derivatives landscape reflects reduced leverage after last week’s liquidations. Futures open interest has slipped 3.2% to $1.91 billion, even as trading volume rose 5.6% to $5.17 billion. The mix points to short-term unwinding rather than fresh positioning.

The standout figure is options volume, which spiked sharply to $812 million — its largest daily rise this month. That surge came mainly from speculative upside plays, aligning with the Binance and OKX long/short ratios above 2.5. While sentiment leans bullish, overall participation remains below peak levels seen in midyear rallies.

This balance shows traders are staying selective: open longs are still dominant, but new leverage is entering slowly. Sustained buildup in open interest near $2 billion would mark a meaningful shift toward trend continuation.

On the broader daily view, Dogecoin price prediction centers around a compressing symmetrical triangle that has governed action since June. The lower trendline at $0.172 has contained every major correction, while the upper boundary near $0.23 remains the key breakout threshold.

Bollinger Bands have tightened to one of their narrowest widths this quarter, a sign of upcoming expansion in volatility. The Parabolic SAR still sits above price, keeping bias slightly bearish until a daily close above $0.21 reverses that signal. Historically, similar squeezes have preceded impulsive moves once price crosses a major boundary with volume.

Dogecoin price today holds its short-term uptrend as long as it trades above $0.197. A move through $0.214 could clear the path toward $0.23 and potentially $0.25, completing a medium-term reversal setup.

Failure to hold $0.197 would weaken structure and likely bring a retest of $0.178 before bulls regroup. Exchange flows remain quiet, so a sudden rise in spot activity or a shift in derivatives funding would be key signals to watch.

At this stage, Dogecoin’s recovery hinges on sustaining higher lows while approaching the triangle’s apex. Breakout confirmation above $0.214 would tilt the bias firmly upward, while continued stalling would keep price locked in range through early November.

| Indicator | Bias | Key Levels |

| Short-Term Support | Bullish | $0.197, $0.178 |

| Resistance Zone | Neutral | $0.214–$0.233 |

| EMA Cluster | Support Band | $0.199–$0.203 |

| Bollinger Range | Compression Zone | $0.172–$0.226 |

| Overall Outlook | Neutral-to-Bullish | Watching breakout at $0.214 |

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Cardano price is showing renewed strength, trading near key resistance with growing volume as participants watch for confirmation of a sustained bullish breakout.

Cardano’s recent upswing has sparked fresh optimism across the market, with ADA Cardano price climbing nearly 5% in a single day and daily volumes surging past $1.1 billion. The move not only signals renewed trader confidence but also hints at a potential trend reversal.

Cardano continues to strengthen, with its current price at $0.69, up 4.8% over the last 24 hours. The daily volume has surpassed $1.12 billion, reflecting an uptick in market participation and growing investor confidence. ADA’s market cap now stands above $25 billion, placing it comfortably in the top 15 assets by size.

Cardano price is trading around $0.69, up 4.80% in the last 24 hours. Source: Brave New Coin

From a technical perspective, ADA’s intraday chart highlights a steady sequence of higher lows since mid-October, signaling sustained buying interest. The short-term resistance is near $0.71, while support has formed around $0.66 to $0.67. A confirmed breakout above the $0.71 zone could invite acceleration towards $0.78, aligning with Fibonacci expansion levels.

Cardano price has officially confirmed a trend reversal after breaking above its multi-day descending trendline, forming a new local high. Sssebi’s analysis shows a clear inverse head-and-shoulders structure, with neckline confirmation near $0.66, validating the bullish shift.

Cardano price confirms a bullish trendline breakout, signaling renewed momentum and potential continuation toward the $0.75 range. Source: Sssebi via X

The RSI is trending above 60, showing solid momentum without yet breaching overbought territory, a healthy indicator for potential continuation. The next resistance sits around $0.71, while a controlled retest towards $0.66 to $0.67 would serve as a constructive pullback before another rally leg. If ADA Cardano price holds this structure, it could sustain a broader uptrend into the $0.75 range over the next sessions.

Following a strong breakout confirmation, Chill Guy’s chart points to a brief consolidation or retest near $0.66, aligning with prior breakout resistance. Such retests are typical before continuation and can help reinforce structural stability for the next upward move.

ADA shows signs of healthy consolidation after breakout, with a potential 10–12% upside if momentum resumes. Source: Chill Guy via X

The measured target for this breakout sits between $0.74 and $0.77, marking a potential 10–12% upside if volume follows through. A sustained close above $0.70 would confirm momentum resumption, while holding above $0.65 keeps the bullish case intact. Despite possible intraday dips, the larger picture suggests ADA’s trend remains firmly constructive.

Charting Guy’s macro view underlines that ADA continues to form a higher high (HH) and higher low (HL) pattern, the hallmark of a healthy uptrend. Each major correction since 2023 has produced a new base higher than the last, confirming long-term accumulation.

ADA maintains a strong higher-high and higher-low structure, signaling that its long-term bullish trend remains firmly in place. Source: Charting Guy via X

The current structure is breaking out of a multi-month descending channel, similar to setups that preceded ADA’s previous bull runs. If momentum persists, the next significant resistance zones lie near $1.10 to $1.30, followed by a broader macro target around $2.00 to $2.40. As long as the price remains above $0.60, the Cardano Price Prediction remains firmly bullish.

Cardano’s recovery is becoming more technically supported, with consistent volume growth, positive RSI divergence, and clean structural breakouts across multiple timeframes.

Holding the $0.66 to $0.68 range remains critical for sustaining momentum, while a close above $0.71 would likely trigger renewed upside pressure towards $0.80 and beyond. Overall, market behavior reflects growing confidence and sets the stage for a potential bullish Cardano price prediction.

What’s next for cryptocurrency? The question that keeps crypto enthusiasts, analysts, and even financial students up at night. While giants like Bitcoin and Ethereum grab headlines, two coins have been sparking buzz for different reasons. XRP is fighting to reclaim its glory, while MoonBull ignites as the next 1000x crypto, stirring serious excitement. TXRP is trading at $2.63 today. Its 24-hour trading volume is $4,469,450,489, up 9.29% from the previous week.

The big question is simple yet vital: Will XRP rise high in 2025 or face downside fears? With investors watching closely, this could be the turning point that reshapes both coins’ futures.

Now here’s where the excitement skyrockets: MoonBull ignites as the next 1000x crypto, powering its ecosystem with massive staking and smart referral features. At Stage 10, MoonBull ($MOBU) unlocks an incredible 95% yearly staking reward, drawn from a 14.68 billion $MOBU pool, with daily rewards, zero minimum staking, and just a two-month lock-in. But the real kicker is the referral system: share your code, your invitee gets 15% more tokens, and you earn 15% instantly.

MoonBull ignites as the next 1000x crypto, offering 95% yearly staking from a 14.68B $MOBU pool with daily rewards and no lock-in. Referrers earn 15%, buyers get 15% extra tokens, plus monthly USDC bonuses of 10% and 5% for top leaders. Backed by an 8.05B $MOBU allocation, MoonBull delivers real rewards, real community, and unstoppable growth for early believers.

MoonBull ignites as the next 1000x crypto, and the buzz is electric. The MoonBull presale is live right now, sitting at Stage 5 with a current price of $0.00006584, over $500K raised, and 1,500+ token holders already in. The current ROI is jaw-dropping,9,256% from Stage 5 to the listing price of $0.00616. Early entrants have already bagged a 163.36% ROI, and prices are climbing 27.40% per stage through Stage 22, then 20.38% through Stage 23.

Investing $600 at Stage 5 gets you 9,113,001.22 tokens, which could turn into $56,136.09 at listing. That’s the kind of number that turns heads and triggers FOMO. The clock’s ticking, every stage makes it pricier to join, and this train’s leaving the station fast.

So, what’s the XRP price prediction for 2025? Forecasts vary, but here’s the gist. If the crypto market stabilizes, Ripple wins further legal clarity, and institutions embrace its payment network, XRP could shoot toward the $4 -$6 range. CoinCentral even mentions extreme targets near $9.60 or $33 if sentiment turns wildly bullish. But if regulations tighten or investor confidence wanes, XRP might hover around $2 or lower.

Given the current XRP price, sitting below $1, even a conservative rally to $4 would mean substantial gains. Still, this coin’s story depends on what happens outside the charts, global adoption, regulatory wins, and macroeconomic flows. Analysts say that if Ripple lands new partnerships with payment networks or banks, XRP could see a bullish domino effect across the market. In short, 2025 could be the year XRP either soars or sinks. Investors need to watch the fundamentals like hawks.

XRP isn’t your average meme coin chasing trends. It’s a digital asset designed to enable faster, cheaper cross-border payments. Ripple Labs, the company behind it, has been working to integrate its ledger with banks and fintech players. That’s given XRP a more “real-world” purpose than most tokens. But crypto markets are as unpredictable as cats on roller skates; one move and everything can flip.

Analysts recently suggested that if XRP can hold above $1.91, it might climb toward the $4.43- $7.90 range. Others, like Nasdaq, warn of possible dips if momentum fades. That tension keeps traders on their toes and investors glued to charts.

Right now, the XRP price reflects cautious optimism. Volume remains high, and with a solid 7-day surge, bulls seem to be waking up. Yet skeptics argue that whales are waiting for clearer regulatory signals before returning to the market.

The crypto market’s memory might be short, but XRP’s journey has been wild. From explosive rallies to gut-wrenching crashes, it’s seen both sides of the coin. Historical trends show that XRP tends to move in strong waves. When it rallies, it runs, but when it drops, it tumbles like penguins on ice.

According to CoinCentral, some optimistic models suggest XRP could hit $5 to $15 by late 2025 if the market turns bullish and liquidity flows in. CoinDCX paints a more cautious picture, projecting that XRP will trade between $2.50 and $3.50 during the same period. Meanwhile, Brave New Coin analysts warn that a “death cross” pattern could push the XRP crypto price toward $1.93 before any rebound.

In plain English: the upside potential is there, but so is the downside. Like a game of poker, timing and patience matter as much as the hand you’re dealt.

The crypto market never sleeps, and neither should investors watching it. XRP stands as a veteran trying to reclaim its throne, while MoonBull ignites as the next 1000x crypto, offering something new and daring. For those weighing risk versus reward, XRP might be the “steady bet” with long-term potential, and MoonBull the thrilling play for early adopters chasing high returns.

As 2025 approaches, XRP’s next move could depend on adoption and regulation. But one thing’s clear, the world of crypto isn’t slowing down. Whether you’re analyzing charts or joining the $MOBU presale, this is the time to stay alert, act fast, and ride the next big wave.

For More Information:

Website: Visit the Official MOBU Website

Telegram: Join the MOBU Telegram Channel

Twitter: Follow MOBU ON X (Formerly Twitter)

A presale token offering 9,000%+ potential ROI from early joiners, like MoonBull’s current stage, tops that chart.

The best new crypto is one that combines high APY staking, a structured presale, and active community engagement — exactly what MoonBull offers.

A well-known digital asset with strong banking ties and new partnerships may see a rebound; XRP fits that narrative.

Presales with rising stage prices, transparent tokenomics, and referral systems often become breakout plays. MoonBull is one to watch.

Tokens offering high staking rewards with flexible lock-in periods, like MoonBull’s 95% APY staking, rank among the best for 2025.

Staking: Earning passive rewards by locking crypto tokens in a smart contract.

Presale: The early phase before a public listing, when investors buy at discounted rates.

ROI: Return on Investment, a measure of profit compared to the initial cost.

Whales: Large crypto holders capable of moving markets.

APY: Annual Percentage Yield showing yearly return from staking.

Next 1000x rypto, MoonBull, MoonBull presale, $MOBU presale, $MOBU, XRP price, XRP coin price prediction, XRP price today, top crypto to buy, best crypto to buy now

This article breaks down XRP’s live market action, its recent 11.32% rise, and the XRP price prediction for 2025, ranging from cautious $2.50 targets to bullish $9+ forecasts. It explains how investor sentiment, regulatory clarity, and institutional adoption will shape its fate. In contrast, it spotlights how MoonBull is poised to become the next 1000x crypto, detailing its explosive presale, 95% APY staking, and powerful referral system. For anyone scanning for the top crypto to buy or the best crypto to buy now, both XRP and MoonBull deliver lessons in opportunity, timing, and growth.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risks. Always conduct independent research before investing in any project.

Solana price is regaining bullish momentum as short positions vanish and price strength builds above key support, signaling potential continuation towards higher resistance levels.

Solana’s bulls are back in action, driving renewed optimism across the market. The token’s steady climb from $190 to $205 has erased much of the earlier fear, leaving short sellers with little room to maneuver.

Market data shows that short positions on Solana have dropped sharply, with liquidation heatmaps revealing a clear absence of sell-side pressure. The steady climb from the $190 to $205 range highlights that bears are running out of room, while liquidity continues to concentrate higher. CW8900’s observation confirms that shorts are nearly exhausted, giving buyers the upper hand in maintaining upward pressure.

Solana’s steady climb from $190 to $205 highlights growing bullish dominance as shorts rapidly vanish. Source: CW8900 via X

This pattern often marks the transition towards a sustained bullish phase. With open interest leaning long and volume spikes accompanying each breakout, Solana’s current positioning suggests that the path of least resistance is now upward. Any pullback into the $198 to $200 support zone may simply serve as a springboard for renewed buying momentum.

The latest 4-hour chart indicates Solana price breaking above its Ichimoku Cloud, a strong technical signal that often precedes trend continuation. Price is now holding firmly above both the conversion and base lines, suggesting clear bullish dominance. The cloud’s leading span is widening upward, a textbook confirmation of positive market structure.

Solana breaks above the Ichimoku Cloud, signaling renewed bullish strength with eyes set on the $230 target. Source: AliseeisW via X

As AliseeisW highlighted, the next resistance stands around $230, aligning with prior swing highs. If price maintains this breakout and continues closing above $198 to $200, it would validate the bullish signal and likely extend towards $230 to $238 in the short term.

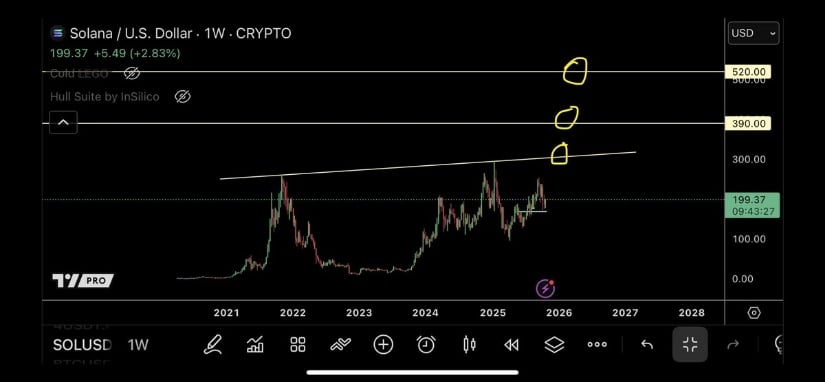

TraderSZ’s long-term Solana outlook remains unchanged, still firmly bullish. The weekly structure reveals consistent higher lows since early 2023, with the price currently rebounding from a key rising trendline. The chart identifies major resistance levels at $300, $390, and $520, suggesting a steady stair-step progression if momentum persists.

Solana’s long-term trend structure mirrors its 2021 accumulation phase, hinting at a potential run toward $300–$390. Source: TraderSZ via X

This long-term pattern resembles Solana’s 2021 accumulation phase, where breakouts led to exponential follow-through. As long as price remains above the $180 to $190 zone, macro bias stays bullish. The next expansion wave could be targeting the $300 to $390 range before any significant corrective phase.

Following a clean track-line test, Solana’s structure now looks increasingly constructive. ShardiB2’s chart shows price reclaiming the 50-day and 200-day moving averages with strength, confirming renewed bullish intent. RSI momentum sits in the mid-60s, hinting that room still exists for another upward leg before overbought conditions emerge.

Solana reclaims key moving averages, with momentum building toward short-term resistance at $216 and $227. Source: ShardiB2 via X

Immediate resistance is seen around $216 and $227, which mark the next major upside checkpoints. A daily close above $205 would confirm continuation, setting the stage for a run toward those targets. For now, Solana’s trend remains clearly bullish, with higher lows and strong demand supporting each move higher.

Across multiple timeframes, Solana’s outlook continues to strengthen. The fading short positions, breakout above the Ichimoku Cloud, and clear macro uptrend all align toward a consistent bullish narrative.

For short-term participants, maintaining the $198 to $200 support is crucial, while mid-term participants may eye towards $230 to $250 as likely continuation zones. If macro momentum continues, Solana could retest $300–$390 before year-end, confirming its leadership among high-cap altcoins.

Binance coin price analysis by Coinidol.com: the BNB price is declining, although it remains above the $1,000 support and below the $1,200 resistance.

The cryptocurrency has twice reached a high of $1,355 before being rejected. Since October 17, the price has been confined between the moving average lines. The altcoin will trend if either the 21-day SMA resistance or the 50-day SMA support is breached.

Today, the price is approaching the 21-day SMA resistance. If the 21-day SMA is broken, the price will return to its previous high of $1,355. However, if BNB loses the 50-day SMA support, it will fall towards the $891 support. BNB is currently trading at $1,126.

The 21-day SMA resistance and the 50-day SMA support have limited price movement. The rising slope of the moving average lines indicates a previous uptrend. On the 4-hour chart, the price bars are above the horizontal moving average. Price movement has remained steady due to the presence of Doji candlesticks.

BNB/USD daily chart – September 26, 2025

BNB remains in a sideways trend, above the $1,040 support but below the $1,160 resistance. Today, the price is rising towards $1,160. The latest peak previously resisted upward movement. The signal remains range-bound as the price is situated between the moving average lines on the daily chart.

BNB/USD 4-hour chart – September 26, 2025

Disclaimer. This analysis and forecast are the personal opinions of the author. The data provided is collected by the author and is not sponsored by any company or token developer. This is not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by Coinidol.com. Readers should do their research before investing in funds.

A flurry of analyst notes today puts fresh focus on Cardano price prediction ranges while hinting that a $0.11 rival could sprint to $1 first. That rival is Remittix, a PayFi network priced at $0.1166, where more than 40,000 investors have joined in recent months. We will cover the Cardano price prediction setup first, then explain why some experts think Remittix could outpace ADA on the road to $1.

Source: Lingrid

The Cardano price prediction narrative remains cautious. ADA is trading inside a descending channel after a sharp rejection at the upper boundary. Bulls also failed to sustain momentum near $0.85, setting up lower highs and lower lows. On this basis, several traders say the Cardano price prediction path favors a move toward the $0.55 target zone unless momentum flips.

The $1 race is not only about charts. Utility and distribution matter. Analysts who are cautious on ADA’s near-term technicals are highlighting new payment-focused projects with low gas fees, simple user flows, and strong listings. That is why the Cardano price prediction debate now includes a serious look at alternatives that could climb faster from a lower base.

Remittix is a PayFi DeFi project designed for fast, low-cost cross-border transfers. The wallet beta has launched, the team is fully CertiK-verified, and it is ranked #1 for Pre-Launch Tokens on Skynet. Remittix has raised over $27.5M with more than 679M tokens sold, and listings on BitMart and LBank are confirmed, with another major CEX reveal on the way. You can currently buy the RTX token at $0.1166. For readers comparing momentum plays, this profile is why some believe it could reach $1 before ADA.

Why Remittix is tipped to pass the $1 mark soon:

A conservative Cardano price prediction still targets $0.55 unless ADA breaks the channel to the upside. At the same time, Remittix is making the case for the ‘best crypto project 2025’ short list with centralized exchanges access, a path to decentralized exchange liquidity, and a strong payments focus. For those scouting upcoming crypto projects, Remittix offers utility plus network-driven growth. If it fits your plan, explore RTX while the Cardano price prediction story waits for confirmation.

Disclaimer: The content above is presented for informational purposes as a paid advertisement. The Tribune does not take responsibility for the accuracy, validity, or reliability of the claims, offers, or information provided by the advertiser. Readers are advised to conduct their own independent research and exercise due diligence before making any decisions based on its contents and not go by mode and source of publication. Investments in cryptocurrencies are subject to high market risks and volatility; readers should seek professional advice before investing.

After months of quiet accumulation, XRP has finally broken free from a multi-year consolidation, confirming one of its most significant bullish patterns in years and reigniting investor optimism across the crypto market.

The XRP price today holds near $2.65, and analysts say a confirmed breakout from the multi-year cup-and-handle formation could pave the way for a rally toward the $5–$10 range. This structure, which has been developing since 2020, is now showing signs of completion, marking a potentially decisive moment for the XRP price prediction 2025 outlook.

Technical analysts have long observed the evolving cup-and-handle pattern on XRP’s weekly chart. Recent data from Binance Research highlights a breakout above $2.63, a move often seen as a confirmation of bullish continuation. The projected target, derived from the depth of the cup formation, points to an upside range between $5 and $10, reflecting renewed optimism in the XRP market.

A multi-year cup-and-handle pattern on XRP’s weekly chart, formed since 2020, has broken above $2.63, signaling a potential bullish continuation toward the $5–$10 range. Source: @Steph_iscrypto via X

The current XRP price has been consolidating between $2.60 and $2.80, with traders closely watching for sustained momentum above the $2.80 resistance zone. According to market data, XRP recorded a 10.25% weekly gain as of October 26, 2025, following a successful retest of the $2.50 support level—a key confirmation of underlying strength.

“XRP is at a critical decision point here,” wrote market observer @chad_ventures, noting that the breakout from the handle formation could drive prices past the $3 mark if buying pressure persists.

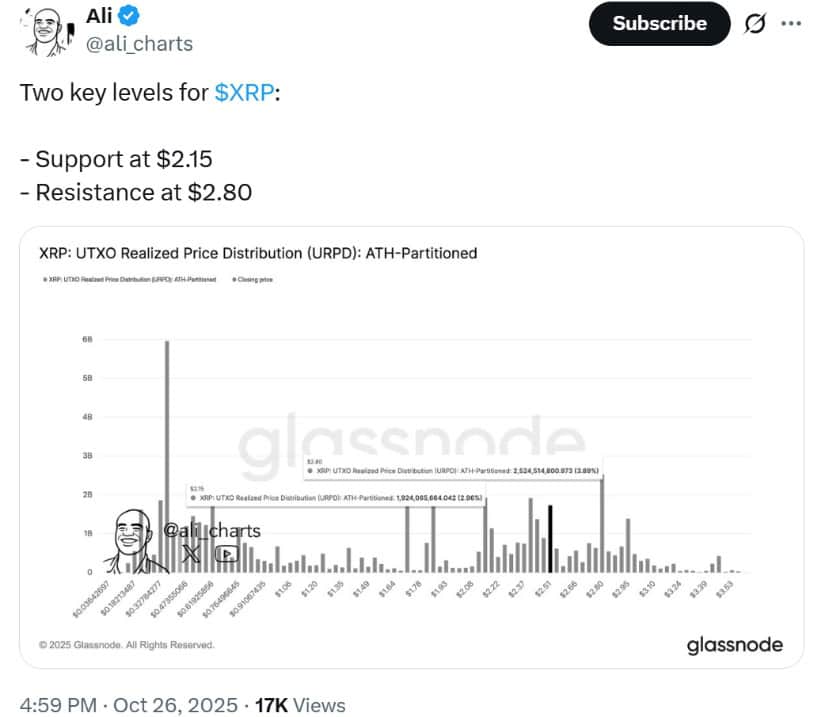

Analyst Ali from @ali_charts identified two important zones to watch: support at $2.15 and resistance at $2.80. Data from Glassnode’s Realized Price Distribution indicates that these price clusters represent heavy accumulation points, often serving as psychological barriers.

XRP is currently trading between key levels, with strong support at $2.15 and resistance at $2.80. Source: @ali_charts via X

As of October 28, 2025, XRP is trading above the $2.61 support, reflecting steady market participation. The XRP RSI currently hovers around 74, suggesting a brief cooldown could occur before any major continuation. Analysts note that a temporary dip to $2.15 could reset momentum, potentially setting the stage for a stronger push above $2.80.

Beyond chart formations, Ripple’s fundamentals continue to reinforce long-term optimism. Institutional participation has grown steadily since the debut of CME Group’s XRP futures, which have now surpassed $26.9 billion in traded volume. Open interest reached a record $1.4 billion in September, with 29 large institutional holders actively managing exposure to Ripple XRP—a clear signal of deepening market confidence.

Ripple’s $1 billion acquisition of GTreasury further bolsters its corporate expansion. The integration adds more than 1,000 enterprise clients across 160 countries, combining treasury management tools with blockchain liquidity solutions. This strategic move strengthens Ripple’s reach into regulated finance and positions XRP as a critical asset for institutional-grade payments and settlements.

Regulatory developments have also played a key role in the latest XRP news today. Ripple executives recently met with Luxembourg’s Finance Minister Gilles Roth to discuss licensing and compliance frameworks in Europe. The region has become a priority for Ripple’s global strategy, aiming to establish greater clarity amid the lingering XRP SEC lawsuit in the United States.

Luxembourg’s Finance Minister met with Ripple to discuss the company’s licensing progress and reaffirmed support for its European expansion and digital innovation goals. Source: Gilles Roth via X

Adding to the optimism, the SEC’s no-action letter for Ripple’s Standard Custody & Trust unit allows it to operate as a qualified crypto custodian, a move expected to enhance institutional trust. However, analysts caution that delays in potential XRP ETF approvals could temporarily weigh on investor sentiment.

The XRP forecast 2025 remains cautiously optimistic. Ripple’s growing institutional traction, expanding European presence, and ongoing DeFi development on the XRP Ledger all contribute to a strong long-term foundation. Monthly stablecoin transfers on XRPL now exceed $1 billion, with upcoming enterprise-focused upgrades designed to attract traditional financial players.

XRP was trading at around $2.63, down 0.33% in the last 24 hours at press time. Source: XRP price via Brave New Coin

While macroeconomic headwinds—such as Fed rate decisions and regulatory challenges—may introduce volatility, XRP’s underlying momentum appears intact. Analysts suggest that a successful break above $3 could mark the beginning of a sustained bull phase, setting the stage for the next major advance toward $5–$10, echoing the pattern seen in previous XRP price cycles.

For now, the price of XRP remains steady around $2.65, with investors and traders alike watching closely to see whether this breakout marks the start of a long-awaited resurgence in the XRP crypto market.

Volatility is back, and traders want clarity fast. Today’s Solana price prediction hinges on one line that matters: $200. Momentum is building across top networks, and a fresh payments-focused altcoin is quietly pulling attention with real usage and fast-rising demand. If SOL clears $200, bulls can breathe. If not, funds could rotate toward projects showing hard adoption and rapid exchange traction.

At the time of writing, SOL trades around $183. The core Solana price prediction from technical desks is simple. Win back $200 soon, or risk a slide that can stretch into the low $100s in Q4.

A daily close above $200 would put $210 to $220 back in play and keep trend traders engaged. Fail there, and the Solana price prediction tilts defensive as liquidity thins and momentum chases strength elsewhere.

Macro flows, DeFi activity, and throughput upgrades remain the swing factors. If network usage expands and spot demand firms, the Solana price prediction improves quickly. If buyers hesitate at $200, the path of least resistance becomes a step down to retest demand pockets and force capitulation entries.

Remittix is now advancing from story to execution, and that is why it stands out among the best crypto to buy now candidates. Independent security due diligence by a leading auditor has fully verified the team, with the project ranked number one in its pre-launch category.

Beta testing for the mobile wallet is live with community users, and the first tier one exchange listing is secured on BitMart with the next listing planned on LBank. You can currently buy Remittix for $0.1166 and management has signaled that this entry point will not last as adoption scales.

More than 40,000 investors have acquired RTX in recent months, over $27.5 million has been raised, and more than 679 million tokens have been sold.

The next Solana price prediction hinge is clear. Reclaim $200 fast or risk a deep Q4 reset into the low $100s. If bulls deliver closes above $200 and then $210 to $215, momentum can flip. If they fail, capital will keep hunting for utility and clearer upside.

That is where Remittix currently wins quiet votes, pairing real-world payments with growing exchange access and a still modest $0.1166 entry before the next pricing step.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

Disclaimer: The content above is presented for informational purposes as a paid advertisement. The Tribune does not take responsibility for the accuracy, validity, or reliability of the claims, offers, or information provided by the advertiser. Readers are advised to conduct their own independent research and exercise due diligence before making any decisions based on its contents and not go by mode and source of publication. Investments in cryptocurrencies are subject to high market risks and volatility; readers should seek professional advice before investing.