The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

The main tag of Cryptocurrency price Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

A bullish Bitcoin Cash price prediction is gaining traction as BCH continues to print higher lows, fueled by a fresh wave of retail liquidity – an early sign that a broader uptrend may be taking shape.

While the altcoin is down 2.85% today, it’s still up 6% over the past week, pointing to strong underlying momentum.

The market warming catalyst now takes the forefront, with pro-crypto regulatory momentum unlocking sidelined capital for risk-on assets and easing the Geopolitical and macroeconomic FUD narrative.

With the GENIUS Act still under consideration in Congress and the CLARITY Act expected to follow in October, bullish catalysts now extend well beyond “Crypto Week” setting the stage for continued upside.

Bitcoin Cash does not directly benefit from the GENIUS Act without a native stablecoin in its ecosystem. Instead, it gains from the act as a broader market-warming catalyst.

Its core value proposition as a payment solution positions BCH well to benefit from the CLARITY Act. With clearer regulatory guidelines, BCH could see momentum as a viable option for U.S. merchant adoption.

Until then, it continues to ride the momentum of the wider market, with the altcoin season index rising from 20 to 53 since the start of the month—still shy of the 75 considered a full altseason.

Retail investors are re-entering the market with renewed appetite for alternatives to Bitcoin, positioning Bitcoin Cash for further growth.

With altcoin season gearing up, the ascending channel forming since the mid-April market bottom may finally have the momentum it needs to reach a breakout.

The Bitcoin Cash price currently trades within a consolidation zone between strong support at $490 and stiff resistance at $555, capping its latest upward move.

However, a consistent pattern of higher lows since mid-July suggests growing bullish momentum, setting BCH on track to retest resistance with stronger footing.

The RSI sets up the next higher low, now near the neutral 50 level after its most recent rejection saw buy pressure exhausted, breaching into oversold territory at 74.

The MACD line also shows early signs of a reversal as its histogram shows a slowdown, opening the doors for a crossover back above the signal line ahead of a new swing high.

A breakout above $555 remains the last barrier for a channel breakout. If successful, the next key resistance is the December 2024 high around $640.

If $640 flips to support, the push could go on toward its $720 all-time high, and potentially enter price discovery near $1,000, especially if momentum builds ahead of the anticipated CLARITY Act in October.

This milestone would represent a 90% upside from current levels.

Those who jumped to Bitcoin Cash over the original may be forced to reconsider as the Bitcoin ecosystem finally addresses its most significant limitation: scalability.

Slow transactions, high fees, and limited programmability have held it back from competing with EVM and Solana networks – until now.

And this shift starts with Bitcoin Hyper ($HYPER), Bitcoin’s first real-time Layer 2 that brings Solana-level speed and smart contracts directly to the Bitcoin ecosystem.

Powered by the Solana Virtual Machine (SVM) and anchored by a decentralized Canonical Bridge, it enables fast, cheap, and composable dApps while remaining secured by Bitcoin.

With over $4 million raised in its ongoing presale, investors are already rallying behind $HYPER, potentially credited to its high 231% APY on staking that rewards early investors.

You can keep up with Bitcoin Hyper on X and Telegram, or join the presale on the Bitcoin Hyper website.

The post Bitcoin Cash Price Prediction as Uptrend Continues – How Quickly Can BCH Hit $1,000? appeared first on Cryptonews.

Cardano

ADA

$0.87

24h volatility:

4.3%

Market cap:

$31.37 B

Vol. 24h:

$1.70 B

has recently experienced notable price gains, further extending its bullish outlook.

Within the last four weeks, the ADA price has seen a rally of more than 60%. The Cardano open interest (OI) has reached a record high. This signals improved sentiment for ADA and could pave the way for further price increases.

The ADA price was trading at $0.8725, down 1.39% over the last 24 hours at the time of writing. Despite the dip in price, it is worth noting that the coin has managed to sustain its bullish outlook in the mid-term.

On July 21, ADA’s price jumped past $0.92, marking a four-month high. DeFiLlama data shows that Total Value Locked (TVL) on Cardano surged past $412 million on Monday.

ADA’s open interest has climbed to a record high, while technical indicators point to a potential bull run. The weekly RSI stands at 58, slightly above the neutral 50, signaling growing bullish momentum.

Cardano Weekly Chart | Source: TradingView

Some indicators show an increasing likelihood that ADA will revisit the $1 psychological level in the short term. As of June 14, Futures’ OI in ADA at exchanges was at $1.18 billion.

From there, it rose to $1.66 billion on Monday, marking a new daily all-time high (ATH).

An increasing OI usually indicates that new or additional money is entering the market. It could also suggest new buying, a sentiment that could fuel the current ADA price rally.

The Cardano chain had recently recorded a surge in traders’ interest and liquidity. This event is believed to be a catalyst for the platform’s bullish outlook.

According to Token Terminal data, ADA Chain’s weekly token trading volume increased from $8.12 billion in the second week of July to $10.30 billion just last week. This marks the highest level that the Cardano platform has seen since mid-March.

With a positive liquidity boost, the chances of retesting the $1 mark in the coming weeks is high.

As ADA price action cools, all eyes are turning to TOKEN6900, one of the best crypto presales heating up the market. This bold new project is creating serious buzz with a value proposition that defies expectations.

TOKEN6900 tracks liquidity, GDP, oil reserves, and corporate earnings in a way that stands out from the crowd. It is not just another token following the same old roadmap.

There is no traditional utility here. As the project puts it, “If you buy TOKEN6900 expecting utility, congratulations, you’re the utility.” This is not just a presale. It is a wild ride, and it is gaining momentum fast.

Current Price: $0.006675

Amount Raised So Far: $977K

Ticker: TOKEN6900

Hard Cap: $5 million

End Price: $0.007125

TOKEN6900 brings bold tokenomics to the table. Forty percent is fueling aggressive marketing, five percent powers staking rewards, ten percent goes to liquidity, with more set aside for developer incentives and core coding development. This project is built to move fast and loud.

If you’re interested, now’s the time to act. The token price changes in just one day. Until then, you can still grab TOKEN6900 using crypto or even a credit card. Don’t sleep on it.

The post Is Cardano Price to $1 Finally Possible? appeared first on Coinspeaker.

XRP is making headlines again, and not just because of price action. Institutional interest is growing, whales are quietly accumulating, and analysts are starting to throw out bold numbers, including a potential $45 target.

Meanwhile, a new wave of early-stage crypto investments is stealing some attention. As the XRP price consolidates, PayFi alternatives like Remittix (RTX) are emerging with real-world use cases and presale momentum.

The XRP price is currently trading around $0.72, holding key support near the 200-day moving average. Momentum has been sluggish, but on-chain data reveals that whales scooped up more than 150 million XRP in recent days.

Source: TradingView

A respected technical analyst from Crypto Insight Channel recently predicted an eventual move toward $45 XRP price, based on historical Fibonacci extensions, past cycle behaviour, and a potential SEC settlement boost.

While most analysts are still eyeing $3 to $5 as a realistic target, some long-term holders are starting to buy into the $45 forecast, especially as the wider market shows signs of heating up again.

XRP investment products also saw fresh inflows last week, showing that fund managers and serious traders aren’t just sticking with Bitcoin and Ethereum, they’re quietly loading up on XRP too.

While XRP has strong fundamentals and a maturing investor base, newer tokens are capturing attention with high-growth crypto performance and concrete use cases.

One of the standout projects is Remittix (RTX), a crypto-to-FIAT payment platform designed for fast, cross-border transactions. It’s not a meme coin, and it’s not hype-driven. It’s a crypto with real utility targeting a $19T global payments market, and that’s why some investors are rotating from old giants like XRP into high-upside alternatives like RTX.

Why Remittix Is Being Called ‘XRP 2.0:

Remittix (RTX) has already raised over $16.7 million in its presale and is backed by working infrastructure. It supports over 40 cryptocurrencies and 30 FIAT currencies, making it a standout DeFi project in 2025. For many investors, it fits all the key narratives: best crypto presale 2025, low gas fee crypto, and next big altcoin 2025.

XRP has proven it can weather regulation, price crashes, and market fatigue. The fundamentals are solid, and the $45 prediction, while aggressive, reflects the potential if institutional adoption accelerates.

But while the XRP price climbs slowly, Remittix is racing ahead. With explosive presale growth, a live product on the horizon, and a massive global use case, RTX is becoming the PayFi token to watch.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250K Giveaway:https://gleam.io/competitions/nz84L-250000-remittix-giveaway

After rallying over 80% in the past two weeks, XRP price is showing signs of short-term exhaustion. XRP price today is trading near $3.45, down nearly 3% on the day, as bulls lose grip near the upper boundary of a major supply zone. The token is now testing crucial structural support with indicators suggesting mixed momentum.

XRP’s intraday structure shows a clear breakdown below a short-term ascending trendline visible on the 1-hour chart. The move follows a double rejection near $3.66, which aligns closely with the top of the red supply zone marked on the daily chart. Price has now fallen back into the previous consolidation band between $3.35 and $3.58.

RSI on the 1-hour chart has dropped to 38.94, suggesting weakening bullish pressure, while MACD shows a fading bullish crossover with histogram bars sliding toward negative territory. The rejection also invalidated the rising channel, and price is now testing the base of a horizontal range.

The 4-hour chart confirms this with XRP trading below the 20 EMA ($3.4690) and just above t…

The post XRP Price Prediction for July 23 appeared first on Coin Edition.

Ethereum (ETH) price is making headlines again as it smashes through resistance levels with explosive momentum. The current price action shows ETH hovering around $3,731 with aggressive bullish sentiment across the board. With the Relative Strength Index (RSI) deep in the overbought zone and candles closing higher on the Heikin Ashi chart, the question now is—can Ethereum price break $4,000 this week, or is a correction on the horizon? Let’s dive deep into the chart to uncover what’s next.

Ethereum’s breakout is backed by strong bullish structure seen on the daily chart. The Heikin Ashi candles show consistent upward momentum with no visible upper shadows in the last 6 sessions—a powerful sign of trend strength. The recent Ethereum price movement from the $2,800 range to over $3,700 has been swift and fueled by momentum traders and institutional accumulation.

The RSI currently reads 86.13, which is well above the traditional overbought threshold of 70. This signals two key points:

That said, RSI can remain overbought during strong bull markets—like it did in 2021—so traders must combine this with price action analysis rather than treat it as a standalone sell signal.

Ethereum price has blasted through multiple Fibonacci retracement zones:

This $4,000 level is not just a psychological resistance but also aligns with the Fibonacci extension and prior ATH rejection zones. If bulls can push ETH price beyond this mark, we could see rapid acceleration toward $4,200.

Let’s estimate the next move using the most recent leg:

Assuming a breakout continuation above $3,800:

However, the $4,000 mark remains the most immediate hurdle to watch for this week.

Possibly. The chart shows ETH price has advanced nearly 33% in less than 3 weeks. Combined with the overbought RSI, this increases the probability of either:

A pullback to support near $3,500 – $3,600

Or a sideways consolidation that resets RSI before the next move

If the Ethereum price holds above $3,500, bulls retain full control. A drop below $3,200 would invalidate the bullish structure and open doors to $2,800 again.

Yes—Ethereum price can hit $4,000 this week, based on current price momentum and lack of strong resistance until that zone. However, traders should prepare for short-term volatility. A wick above $4,000 followed by rejection is a real possibility, especially given current RSI extremes.

Ethereum price is on a rocket trajectory. The only question is: Will it pause for breath or continue the vertical rally?

OKX is a top choice to buy ETH. With low trading fees, extensive token listings, and an intuitive interface, it’s a preferred platform for many crypto traders across Europe.

Special Promotion – Limited Time

Until September 14, 2025, OKX is hosting an exclusive McLaren F1 Team giveaway:

–> Receive a complimentary McLaren F1 Team cap<–

Enter to win a VIP trackside experience in Zandvoort (Aug 29–31)

This offer is open to all new European users who haven’t yet traded on OKX. Don’t wait – claim your reward today!

$ETH, $Ethereum, $ETHPrice, $EthereumPrice

But how realistic is this moonshot?

Over the past 30 days, Dogecoin has been on a bullish run. Between June 22 and July 22, 2025, DOGE surged from around $0.15 to $0.27, marking a +77% monthly gain. A few key price moments include:

This rise has revived retail and institutional interest, despite ongoing volatility.

In a major move, Bit Origin invested $500 million into Dogecoin, acquiring 40 million coins near the $0.24 level. However, even with corporate backing, DOGE remains volatile—sliding back after hitting local highs.

While momentum is in DOGE’s favor, resistance near $0.29–$0.30 could test investor patience in the short term.

Kaleo, a well-followed pseudonymous trader on X (formerly Twitter), says Dogecoin is gearing up for an “imminent God candle”—a dramatic upward spike. His long-term projection: DOGE could repeat its historic 10% market cap ratio to Bitcoin, assuming Bitcoin hits a $10 trillion cap (~$500,000 per BTC). That math leads him to a $1 trillion DOGE valuation, or roughly $6.94 per coin.

Short-term view: A decisive breakout above $0.26–$0.30 could lead to rapid upside, likely toward $0.40–$0.45.

According to Grok AI, Dogecoin has formed a bullish technical structure. The algorithm projects an ideal sell zone between $0.32 and $0.45, which translates to a 20–70% upside if current momentum continues.

This aligns with manual technical readings and volume spikes seen in recent days.

| Perspective | Details |

| Historical Ratio | DOGE once reached ~10% of Bitcoin’s market cap in past bull cycles. |

| Math adds up | A $1 trillion DOGE cap = ~$6.94 per coin = 2,600% from current levels. |

| Reality check | DOGE has no hard cap, minimal utility, and remains driven by sentiment. |

| Market challenge | Reaching $1T would require massive retail + institutional buy-in. |

In short: it’s possible in theory, but very difficult under current fundamentals.

| Timeframe | Scenario | Target Price |

| 1–6 weeks | Short-term breakout continues | $0.32–$0.45 |

| 3–6 months | Adoption + crypto rally extends run | $0.50–$1.00 |

| 1–2 years (peak) | Bitcoin at $500k, DOGE hits 10% of BTC market cap | $6.00–$7.00 |

Kaleo’s $1 trillion call is ambitious, but not impossible in a full-blown crypto supercycle. For now, most investors would be wise to target the $0.45–$1.00 range unless DOGE starts showing real-world utility.

Q1: Can Dogecoin really reach a $1 trillion market cap?

Yes, but it’s highly speculative and depends on a massive crypto market rally.

Q2: What is Crypto Kaleo’s Dogecoin price prediction?

He sees DOGE surging to $6.94, a 2,600% gain, if Bitcoin hits $500K.

Q3: Will Dogecoin keep bouncing around $0.26–$0.30 today?

Likely yes—DOGE often trades between resistance near $0.30 and support around $0.26 during short-term volatility.

Q4: Can trading signals help predict Dogecoin’s price today?

Yes, tools like RSI (overbought/oversold) and 50‑day moving average trends offer clues on potential short-term moves.

The

cryptocurrency market has witnessed a strong momentum in July 2025, with XRP

leading the charge among major digital assets. Why is XRP going up? The answer

lies in a perfect storm of regulatory breakthroughs, institutional adoption,

and technical breakouts that have propelled XRP to almost all-time highs above

$3.60.

Moreover,

the technical analysis now suggests that XRP’s price may continue to rise,

potentially heading toward levels above $6.

XRP has

established itself as a standout performer in the cryptocurrency space,

currently trading at $3.47 with a market capitalization of $204.39 billion. The

digital asset has demonstrated exceptional resilience, gaining over 474% in the

past year and maintaining its position as the fourth-largest cryptocurrency by

market cap.

XRP

price today. Source: CoinMarketCap.com

Recent

price action tells a compelling story. XRP hit a new all-time high of $3.84 in

January 2018, but the current rally has brought it tantalizingly close to those

levels. The token has surged 21% over the past seven days, with trading volumes

reaching $9.74 billion in 24-hour periods.

Market

dynamics reveal strong institutional interest. XRP rebounded sharply from the

$3.40 support zone following initial profit-taking, with buyers stepping in

aggressively at volume levels nearly triple the daily average. This pattern

suggests conviction buying at key technical levels.

You may also like: The Newest Ethereum Price Prediction Shows ETH Could Hit $15K in 2025

The most

significant catalyst behind XRP’s surge stems from regulatory clarity. In March

2025, Ripple Labs settled its long-standing lawsuit with the Securities and

Exchange Commission, agreeing to pay a $50 million fine. This resolution

effectively ended the legal battle that had suppressed XRP’s price for years.

The

settlement confirmed that XRP is not a security in the context of secondary

market sales. This clarification removed major regulatory uncertainty that had

previously led exchanges to delist XRP from their platforms. Following the

settlement, major U.S. exchanges resumed XRP trading with renewed confidence.

Ripple CEO

Brad Garlinghouse noted that institutions were “finally seeing Ripple with

confidence” and returning to partnerships. The regulatory green light has

unlocked institutional adoption that was previously hampered by compliance

concerns.

The launch

of XRP exchange-traded funds represents another pivotal development driving

price momentum. The ProShares Ultra XRP ETF received approval for listing on

the New York Stock Exchange under ticker UXRP. This marked a significant shift

in the SEC’s approach to cryptocurrency-based financial products.

Currently,

four XRP ETFs trade in U.S. markets, providing institutional and retail

investors with regulated exposure to XRP price movements. The ETF ecosystem has

experienced explosive growth, with XRP ETFs surging more than 50% in one month.

Bloomberg analysts suggest an 85% chance of spot XRP ETF approval in 2025,

which could trigger substantial additional demand.

The Purpose

XRP ETF also launched on the Toronto Stock Exchange under ticker XRPP,

expanding international access to XRP through regulated investment vehicles.

This institutional infrastructure development represents a fundamental shift in

how traditional finance views digital assets.

Related: Why Is Dogecoin Going Up Today? DOGE Price Predictions Eye Test of 5 Month Highs

According

to my recent technical analysis, the XRP price approached the $3.60 mark this

month and stalled, forming almost new historical high and establishing a key

resistance zone at this level.

However, if

we trust the Fibonacci extension levels based on the bullish trend from the

June lows to the current highs, and the subsequent correction, the medium-term

outlook suggests that XRP may continue its upward trajectory, potentially

surpassing $6.00.

Key

Fibonacci Extension Levels (from June lows to current highs):

|

Extension |

Price |

|

50% |

$4.20 |

|

61.8% |

$4.41 |

|

100% |

$5.09 |

|

161.8% |

$6.19 |

Given this,

my medium-term projection for XRP is around $6.19. From the current price

levels, that would represent an increase of $2.70, or approximately 80%.

The first

warning signal that bulls may be losing momentum would be a drop below the

psychological support level at $3.00, which aligns with the March 2025 highs.

If this support fails, the next likely target would be:

A confirmed

breakdown below $3.00 would open the door for a more significant bearish

retracement.

Whether XRP

moves higher or faces a deeper correction will likely be decided at the $3.60

resistance level. A breakout above this mark, without a sharp pullback below $3.40

(January 2025 highs), would strongly increase the odds of the bullish scenario

playing out.

The

prediction landscape reveals a clear bifurcation between institutional and

retail expectations. Traditional financial institutions like Standard Chartered

cluster around $3.40-$5.50 targets, while crypto-native influencers project

$10-$26.50 ranges. This divergence reflects different risk tolerances,

analytical frameworks, and market perspectives.

|

Source |

Type |

2025 |

2026 |

Key |

|

Standard |

Major |

$5.50 |

– |

Growing |

|

Jake |

Crypto Market |

$7.50 |

– |

New all-time high prediction based |

|

Peter |

Veteran |

$4.47 |

– |

60% rally potential from technical |

|

Arthur |

Financial |

$5.00 – $7.00 |

– |

Positive regulatory environment |

|

AbsGMCrypto |

Crypto |

$5.00 – |

$26.50 |

Growing utility, regulatory |

|

Bitget |

Exchange |

$5.00 |

– |

ETF momentum and institutional |

|

Zubic |

Crypto |

$10.00 |

– |

Conditional on Bitcoin reaching |

Others also read: XRP Price Could Reach $8 in 2025, According to Latest XRP/USDT Technical Prediction

Many

predictions include conditional triggers that could dramatically

alter outcomes. The most commonly cited catalysts include:

XRP’s price

surge stems from a perfect storm of regulatory clarity, institutional adoption,

and technical momentum. The $50 million SEC settlement in March 2025 removed

years of legal uncertainty, while XRP ETF approvals have opened institutional

floodgates with over $9.74 billion in daily trading volumes. Standard

Chartered’s $5.50 price target and record whale accumulation patterns

demonstrate growing institutional confidence, while Ripple ‘s expanding CBDC

partnerships and cross-border payment utility provide fundamental value drivers

beyond speculative trading.

XRP’s

trajectory suggests continued strong performance rather than parabolic

“skyrocketing,” according to institutional analysis. While crypto

influencers project targets up to $26.50, veteran trader Peter Brandt’s 60%

rally prediction to $4.47 and Standard Chartered’s measured $5.50 forecast

reflect more realistic expectations. The digital asset has already gained 474%

annually, and technical indicators show healthy consolidation around $3.47

rather than unsustainable bubble dynamics that typically precede dramatic

crashes.

XRP

reaching $5 appears highly probable based on convergent institutional and

technical analysis. Multiple credible sources including Standard Chartered,

ChatGPT algorithmic models, Arthur Azizov’s regulatory analysis, and Bitget’s

exchange data all center around $5.00 targets for 2025. This represents a

conservative 44% upside from current $3.47 levels, supported by ETF momentum,

institutional buying patterns, and the resolution of regulatory headwinds that

previously capped XRP’s growth potential.

XRP’s

realistic upside ranges from $5.50 to $10 depending on market conditions and

adoption speed. Conservative institutional forecasts cluster around Standard

Chartered’s $5.50 target, while technical analysis supports Jake Gagain’s $7.50

new all-time high prediction. Zubic’s conditional $10 target tied to Bitcoin

reaching $250K represents the upper realistic bound, as it assumes broader

crypto market momentum. Predictions beyond $15 enter speculative territory

requiring parabolic adoption curves that rarely materialize in traditional

financial markets, even within the crypto space.

The

cryptocurrency market has witnessed a strong momentum in July 2025, with XRP

leading the charge among major digital assets. Why is XRP going up? The answer

lies in a perfect storm of regulatory breakthroughs, institutional adoption,

and technical breakouts that have propelled XRP to almost all-time highs above

$3.60.

Moreover,

the technical analysis now suggests that XRP’s price may continue to rise,

potentially heading toward levels above $6.

XRP has

established itself as a standout performer in the cryptocurrency space,

currently trading at $3.47 with a market capitalization of $204.39 billion. The

digital asset has demonstrated exceptional resilience, gaining over 474% in the

past year and maintaining its position as the fourth-largest cryptocurrency by

market cap.

XRP

price today. Source: CoinMarketCap.com

Recent

price action tells a compelling story. XRP hit a new all-time high of $3.84 in

January 2018, but the current rally has brought it tantalizingly close to those

levels. The token has surged 21% over the past seven days, with trading volumes

reaching $9.74 billion in 24-hour periods.

Market

dynamics reveal strong institutional interest. XRP rebounded sharply from the

$3.40 support zone following initial profit-taking, with buyers stepping in

aggressively at volume levels nearly triple the daily average. This pattern

suggests conviction buying at key technical levels.

You may also like: The Newest Ethereum Price Prediction Shows ETH Could Hit $15K in 2025

The most

significant catalyst behind XRP’s surge stems from regulatory clarity. In March

2025, Ripple Labs settled its long-standing lawsuit with the Securities and

Exchange Commission, agreeing to pay a $50 million fine. This resolution

effectively ended the legal battle that had suppressed XRP’s price for years.

The

settlement confirmed that XRP is not a security in the context of secondary

market sales. This clarification removed major regulatory uncertainty that had

previously led exchanges to delist XRP from their platforms. Following the

settlement, major U.S. exchanges resumed XRP trading with renewed confidence.

Ripple CEO

Brad Garlinghouse noted that institutions were “finally seeing Ripple with

confidence” and returning to partnerships. The regulatory green light has

unlocked institutional adoption that was previously hampered by compliance

concerns.

The launch

of XRP exchange-traded funds represents another pivotal development driving

price momentum. The ProShares Ultra XRP ETF received approval for listing on

the New York Stock Exchange under ticker UXRP. This marked a significant shift

in the SEC’s approach to cryptocurrency-based financial products.

Currently,

four XRP ETFs trade in U.S. markets, providing institutional and retail

investors with regulated exposure to XRP price movements. The ETF ecosystem has

experienced explosive growth, with XRP ETFs surging more than 50% in one month.

Bloomberg analysts suggest an 85% chance of spot XRP ETF approval in 2025,

which could trigger substantial additional demand.

The Purpose

XRP ETF also launched on the Toronto Stock Exchange under ticker XRPP,

expanding international access to XRP through regulated investment vehicles.

This institutional infrastructure development represents a fundamental shift in

how traditional finance views digital assets.

Related: Why Is Dogecoin Going Up Today? DOGE Price Predictions Eye Test of 5 Month Highs

According

to my recent technical analysis, the XRP price approached the $3.60 mark this

month and stalled, forming almost new historical high and establishing a key

resistance zone at this level.

However, if

we trust the Fibonacci extension levels based on the bullish trend from the

June lows to the current highs, and the subsequent correction, the medium-term

outlook suggests that XRP may continue its upward trajectory, potentially

surpassing $6.00.

Key

Fibonacci Extension Levels (from June lows to current highs):

|

Extension |

Price |

|

50% |

$4.20 |

|

61.8% |

$4.41 |

|

100% |

$5.09 |

|

161.8% |

$6.19 |

Given this,

my medium-term projection for XRP is around $6.19. From the current price

levels, that would represent an increase of $2.70, or approximately 80%.

The first

warning signal that bulls may be losing momentum would be a drop below the

psychological support level at $3.00, which aligns with the March 2025 highs.

If this support fails, the next likely target would be:

A confirmed

breakdown below $3.00 would open the door for a more significant bearish

retracement.

Whether XRP

moves higher or faces a deeper correction will likely be decided at the $3.60

resistance level. A breakout above this mark, without a sharp pullback below $3.40

(January 2025 highs), would strongly increase the odds of the bullish scenario

playing out.

The

prediction landscape reveals a clear bifurcation between institutional and

retail expectations. Traditional financial institutions like Standard Chartered

cluster around $3.40-$5.50 targets, while crypto-native influencers project

$10-$26.50 ranges. This divergence reflects different risk tolerances,

analytical frameworks, and market perspectives.

|

Source |

Type |

2025 |

2026 |

Key |

|

Standard |

Major |

$5.50 |

– |

Growing |

|

Jake |

Crypto Market |

$7.50 |

– |

New all-time high prediction based |

|

Peter |

Veteran |

$4.47 |

– |

60% rally potential from technical |

|

Arthur |

Financial |

$5.00 – $7.00 |

– |

Positive regulatory environment |

|

AbsGMCrypto |

Crypto |

$5.00 – |

$26.50 |

Growing utility, regulatory |

|

Bitget |

Exchange |

$5.00 |

– |

ETF momentum and institutional |

|

Zubic |

Crypto |

$10.00 |

– |

Conditional on Bitcoin reaching |

Others also read: XRP Price Could Reach $8 in 2025, According to Latest XRP/USDT Technical Prediction

Many

predictions include conditional triggers that could dramatically

alter outcomes. The most commonly cited catalysts include:

XRP’s price

surge stems from a perfect storm of regulatory clarity, institutional adoption,

and technical momentum. The $50 million SEC settlement in March 2025 removed

years of legal uncertainty, while XRP ETF approvals have opened institutional

floodgates with over $9.74 billion in daily trading volumes. Standard

Chartered’s $5.50 price target and record whale accumulation patterns

demonstrate growing institutional confidence, while Ripple ‘s expanding CBDC

partnerships and cross-border payment utility provide fundamental value drivers

beyond speculative trading.

XRP’s

trajectory suggests continued strong performance rather than parabolic

“skyrocketing,” according to institutional analysis. While crypto

influencers project targets up to $26.50, veteran trader Peter Brandt’s 60%

rally prediction to $4.47 and Standard Chartered’s measured $5.50 forecast

reflect more realistic expectations. The digital asset has already gained 474%

annually, and technical indicators show healthy consolidation around $3.47

rather than unsustainable bubble dynamics that typically precede dramatic

crashes.

XRP

reaching $5 appears highly probable based on convergent institutional and

technical analysis. Multiple credible sources including Standard Chartered,

ChatGPT algorithmic models, Arthur Azizov’s regulatory analysis, and Bitget’s

exchange data all center around $5.00 targets for 2025. This represents a

conservative 44% upside from current $3.47 levels, supported by ETF momentum,

institutional buying patterns, and the resolution of regulatory headwinds that

previously capped XRP’s growth potential.

XRP’s

realistic upside ranges from $5.50 to $10 depending on market conditions and

adoption speed. Conservative institutional forecasts cluster around Standard

Chartered’s $5.50 target, while technical analysis supports Jake Gagain’s $7.50

new all-time high prediction. Zubic’s conditional $10 target tied to Bitcoin

reaching $250K represents the upper realistic bound, as it assumes broader

crypto market momentum. Predictions beyond $15 enter speculative territory

requiring parabolic adoption curves that rarely materialize in traditional

financial markets, even within the crypto space.

Deepseek AI predicts Solana could hit $200-500! Learn how Snorter Token ($SNORT), a Telegram trading bot, joins the rally with utility.

The crypto market’s buzzing right now, and at the centre of that attention is Solana.

Fueling this entire rocket is a fresh forecast from Deepseek AI, which predicts $SOL could hit anywhere between $200-$500 by the end of 2025. It even mentioned a higher end estimate up to $1K if a bullrun maintains.

This optimistic outlook is thanks to Solana’s lightning-fast transaction speeds and its ecosystem that’s exploding with new projects.

We know Solana’s had its little hiccups (network outages), but recent fixes are really aimed at making it rock solid. If it can keep that stability, Deepseek’s prediction might just come true.

If you look at Solana’s charts, you can see why people are getting excited. After a bit of a tumble earlier in the year, $SOL has had a strong comeback trail.

Source: CoinMarketCap

Crypto analysts like Ali Martinez speculate on X that after breaking above $189, ‘there’s little standing in the way of a rally.’

The positive vibe around Solana isn’t happening in a vacuum. The network has become a hotbed for new tokens, especially meme coins and utility projects. Take LetsBonk.fun, for example. This platform, built on Solana, has blown up, pulling in serious revenue by letting people launch their own meme coins.

It shows how hungry investors are for new, exciting projects on Solana’s super-efficient blockchain. And this booming ecosystem sets the stage perfectly for innovative new tokens like Snorter Token ($SNORT).

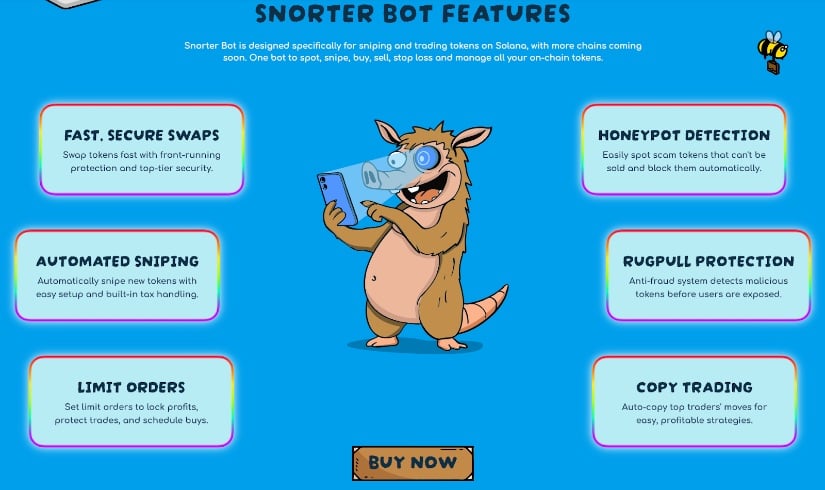

At its core, Snorter Token ($SNORT) isn’t just another digital collectible with a funny name. It’s the native token powering the Snorter Bot, a super-slick crypto trading bot built right into Telegram.

The Snorter Bot is built for speed and efficiency, especially for fast-paced meme coin launches on Solana. It gives everyday traders the edge, usually only afforded to big players.

Lightning-fast swaps, automated sniping where the bot buys tokens the moment liquidity appears, and a crucial scam detection that helps users avoid honeypots and rug pulls (it boasts an impressive 85% success rate in beta testing), are exactly what you can expect from Snorter Bot.

Source: Snorter Token

This focus on practical, real-world trading tools sets Snorter apart from the vast majority of meme coins that rely solely on social media hype.

Holding $SNORT tokens isn’t just about community; it unlocks a whole suite of benefits within the Snorter ecosystem.

One of the biggest draws is the reduced trading fees when using the Snorter Bot. While competitors might charge 1.5% or more per trade, $SNORT holders can drop that down to a much lower 0.85%, making it one of the most cost-efficient trading bots.

This directly incentivizes you to hold onto $SNORT, creating consistent token demand.

Source: Snorter Token

Beyond fee reductions, $SNORT holders can also snag attractive staking rewards (currently sitting at 186%). This means you can earn more $SNORT by just holding it, adding passive income potential. Who doesn’t love something for doing nothing? Investors do!

Snorter Token is cross-chain running on both Solana and Ethereum, with plans to extend to BNB Smart Chain, Polygon, and Base, making Snorter Bot truly versatile.

Snorter Token’s combination of meme coin branding with real-world utility, all wrapped in a user-friendly Telegram bot, makes it a great project for those looking for an edge in the competitive trading market.

Deepseek has given us these optimistic predictions for Solana and then you’ve got innovative Solana based projects like Snorter Token ($SNORT) popping up. If Solana keeps cleaning up its act and its ecosystem keeps blowing up, the bullish forecasts might just hit the mark.

And for Snorter Token ($SNORT), by focusing on helping traders it could carve out its own little empire. But before you jump in, always remember to do your own research . Crypto’s a wild ride and you’ve got to be smart about it.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

Ethereum price has extended its upside, registering gains for the ninth consecutive day and trading at $3,842 and up by 2.2% at the time of writing. The day also saw the coin hit year-to-ate highs of $3,876, underlining the bullish hold of the momentum. However, its RSI is at 88, denoting overbought conditions, which could limit gains in the coming days.

ETH has outperformed market leader Bitcoin in the last week, gaining 26% against BTC’s 1.75% decline during that period. Furthermore, among the top ten largest crypto coins, Ethereum price has only been outperformed by Dogecoin’s 37% rise in that time. Altcoins have certainly stolen the thunder from Bitcoin, with substantial gains by XRP, Cardano and Solana, both of which have registered strong double digit growth above 20%.

Alongside the price rise, Ethereum’s trading volume rose by 36% in the last 24 hours, pointing to strong bullish appetite and adding credence to the likely continuation of the upside. Underlying this upsurge is a strong support from spot ETF market. The nine US traded Ethereum spot ETFs brought in $2.12 billion worth of inflows last week-its best week on record. That points to a strong institutional confidence in the coin’s growth potential, and that sentiment has permeated into the retail market.

The next key milestone for Ethereum price is the $4,000 mark and a US-EU trade deal before the August 1 deadline could be the spark that triggers that move.

The momentum on Ethereum price favours the buyers to stay in control if action is maintained above $3,786. The coin will likely meet initial resistance at $3,848. However, an extended control by the buyers will breach that barrier and could push ETHUSD higher to test $3,900.

Alternatively, breaking below $3,786 will shift the momentum to the downside. That will likely see the first support established at $3,722. The upside narrative will be invalid below that level. Meanwhile, the resulting momentum could push the action lower and test $3,670.

Cryptocurrencies keep rising at the beginning of the week, according to CoinStats.CoinStats” />

Bitcoin BTCUSD is the exception to the rule, falling by 0.11%.TradingView” />

On the hourly chart, the rate of BTC is in the middle of a narrow channel, between the support of $116,594 and the resistance of $119,682.

As most of the ATR has been passed, ongoing sideways trading around current prices is the most likely scenario.TradingView” />

On the longer time frame, the situation is similar. At the moment, the price is closer to the support than to the resistance level. If the breakout of the bottom line happens, the accumulated energy might be enough for a move to the $112,000-$114,000 area.TradingView” />

From the midterm point of view, the price of the main coin has once again bounced off the $119,482 resistance. If the weekly bar closes far from that mark, bears may seize the initiative, which may lead to a correction to the $112,000 zone.

Bitcoin is trading at $118,301 at press time.