The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

XRP Price Prediction: Can XRP Rebound from $2 Amid Ripple’s OCC National Trust Bank Approval?

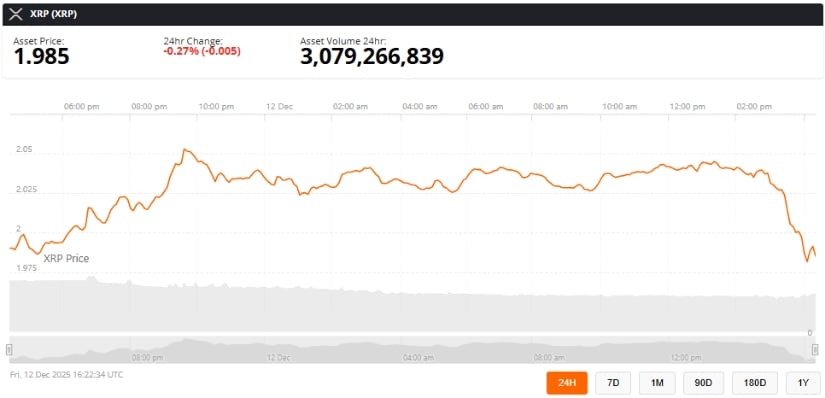

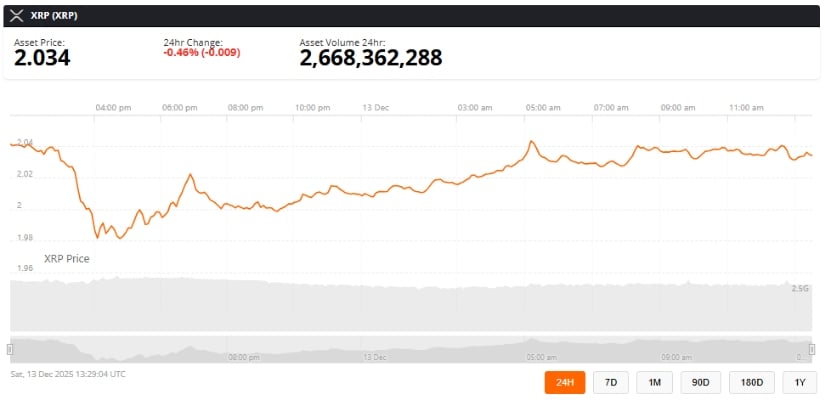

The XRP price today is consolidating just above a critical psychological threshold, trading near $2.03 following a modest daily decline. With spot volume contracting, the $2 region is acting more as a pressure point than a launchpad.

This pivotal zone now serves as a key reference for both short-term traders and longer-term holders, providing insight into market sentiment and momentum while anchoring near-term XRP price predictions.

Technical Structure Signals Heightened Risk

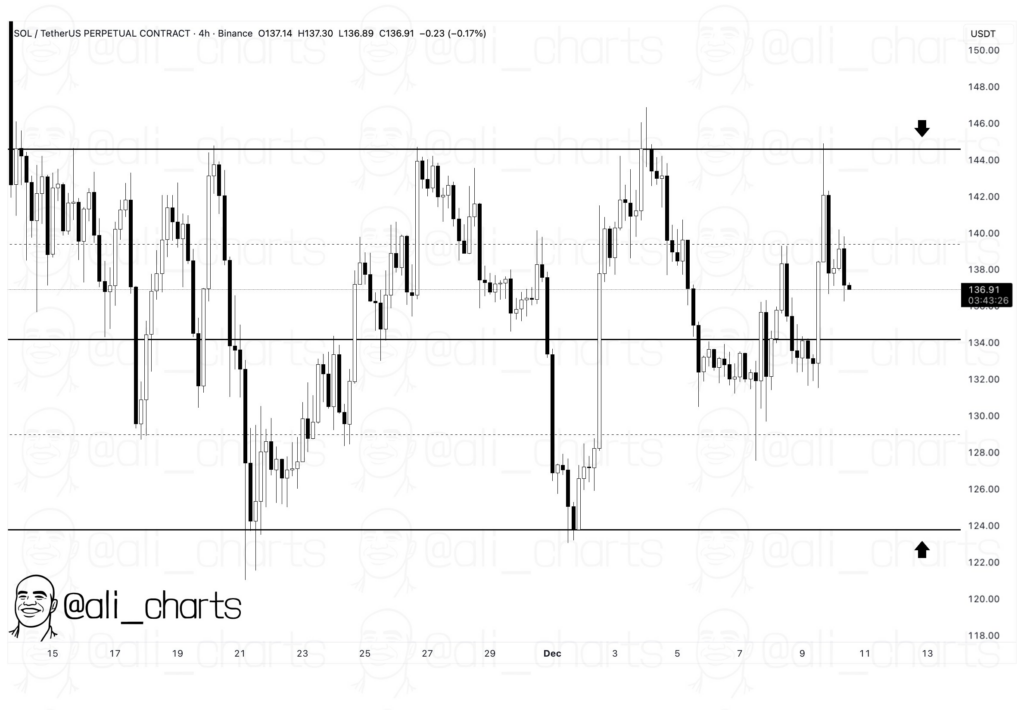

Crypto analyst Ali Martinez (@alicharts) highlighted XRP’s position on a three-day XRP/USDT chart, a timeframe that helps identify sustained trends rather than intraday fluctuations. On such higher timeframes, breakdowns often have more follow-through because they reflect prolonged buying or selling pressure. “XRP must hold $2 to avoid a drop toward $1.20,” Martinez said.

XRP hovers near $2, a critical support level that must hold to prevent a deeper drop. Source: @alicharts via X

The $1.20 level aligns with prior consolidation zones and historical demand from previous cycles, providing context beyond a short-term projection. XRP has trended lower since peaking near $3.65 in 2025, with a series of lower highs signaling that momentum has not yet fully recovered. A confirmed breach of $2 on higher timeframes would therefore indicate structural weakness rather than temporary volatility.

Meanwhile, derivatives positioning remains relatively neutral. Funding rates have not turned sharply negative, indicating caution rather than aggressive bearishness. This suggests the market is watching the key $2 level closely but has not committed heavily to downside bets.

TradingView Analyst Maps Short-Term Scenarios

Adding nuance to the technical outlook, TradingView analyst karimdanish30 outlined a cautious trading plan based on current momentum and price structure. The analysis identifies nearby demand-and-supply zones, suggesting XRP remains range-bound rather than trending decisively.

XRP trading plan targets near-term upside while protecting downside, emphasizing demand-supply zones and a favorable risk-reward setup. Source: karimdanish30 on TradingView

Limited upside toward nearby resistance remains possible if buyers defend current support. However, the focus is on disciplined risk management, with clear invalidation points defined to protect capital amid ongoing uncertainty in the XRP price chart.

Ripple News Offers Fundamental Contrast

While technical charts indicate caution, recent Ripple news introduces a significant fundamental development. CEO Brad Garlinghouse confirmed that Ripple has received conditional approval from the U.S. Office of the Comptroller of the Currency (OCC) to establish Ripple National Trust Bank in New York.

Ripple scores a regulatory win as the OCC approves its National Trust Bank, putting XRP under the spotlight for compliance, innovation, and market confidence. Source: @bgarlinghouse via X

“This is a massive step forward—first for $RLUSD, setting the highest standard for stablecoin compliance with both federal and state oversight,” Garlinghouse said.

The approval enhances Ripple’s regulatory standing and signals deeper institutional integration. However, the immediate impact on XRP price has been muted, indicating that broader market structure and liquidity are currently driving price behavior more than long-term fundamentals.

XRP News Today Reflects Market Caution

Despite regulatory clarity and ongoing discussions around XRP ETF approval prospects, trading activity remains selective. Observable behaviors, such as staggered limit orders just below key support and muted follow-through on rebounds, show that market participants are bracing for volatility rather than taking aggressive positions.

This cautious approach aligns with broader crypto market dynamics, including capital rotation and macro uncertainty, which continue to influence altcoin performance and XRP market cap stability. Present caution appears tactical, not a sign of lost confidence in XRP’s long-term potential.

Final Thoughts

From a structural perspective, the $2 level remains the critical reference point for XRP in the near term. Acceptance above this zone, particularly with improving volume, could reduce breakdown risk and support ongoing consolidation. Conversely, a sustained close below $2 on higher timeframes would increase the probability of a deeper retracement, rather than guarantee one.

XRP was trading at around 2.03, down 0.46% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Looking forward, XRP price prediction scenarios are balanced between technical pressure and longer-term regulatory developments. Short-term traders are likely to monitor volume and price acceptance near $2, while longer-term holders may focus on whether Ripple’s banking initiatives translate into increased participation. Upcoming sessions should clarify whether support holds or if a corrective phase is underway.