The main tag of Crypto News Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Solana Price Prediction: DeepSnitch AI Ranked Among Top Utility Coins With 100X Potential as Do Kwon Receives 15-Year Sentence

Terraform co-founder Do Kwon has been sentenced to 15 years in prison after pleading guilty to wire fraud charges. The news has left the crypto community divided, as many expected more years.

Meanwhile, Solana price prediction discussions have reduced given the current correction. Only a few altcoins like DeepSnitch AI have defied the downtrend, giving investors up to 81% in returns.

Many people still believe DeepSnitch AI has the potential to climb higher given its AI utility and massive adoption. With January on the way, you can take advantage of the 50% and 100% bonus codes.

Do Kwon is given 15 15-year sentence

U.S. District Court Judge Paul Engelmayer has sentenced Do Kwon, the co-founder of Terraform Labs, to 15 years in prison. The sentence comes after the crypto entrepreneur pleaded guilty to wire fraud and conspiracy to commit fraud.

The crash that took place in 2022 erased around $40 billion from the crypto market. Meanwhile, Kwon will be credited with time spent in the U.S and 17 months in pre-extradition custody. Kwon noted that he would love to serve the remainder of his sentence in his home country, close to his family.

Solana price prediction: 3 coins that could offer more ROI

1. DeepSnitch AI: Presale closing in on $800K

DeepSnitch AI is one of the most talked-about projects in the market right now. Whether you are a newcomer or a professional, the platform is offering you institutional-grade tools that can give you a competitive advantage over other traders.

With its AI-driven monitoring system and live dashboard already operational, the project is helping everyday traders make sharper decisions long before information becomes public. Three of its AI agents and the dashboard are currently live.

Also, you can earn rewards by staking your coins and be part of those who will enjoy the platform’s dynamic staking system. This combination of live features and early growth makes DeepSnitch AI a good crypto to buy right now before prices skyrocket.

The DSNT coin is currently priced at $0.02735, an 81% increase since launch. On Telegram and X, there are discussions about a potential Tier-1 and Tier-2 exchange listing in early 2026. If this happens, the value of DeepSnitch AI could soar by more than 100X.

2. Solana price prediction

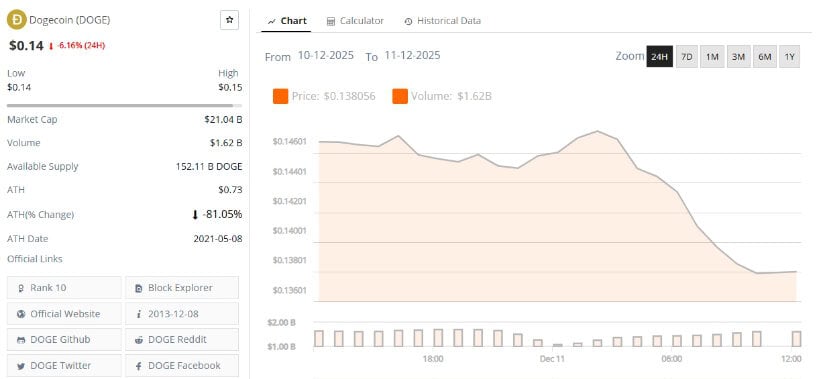

Solana has been trading sideways in the past week, owing to the downtrend in the market and likely selloffs by profit takers. On December 11th, the Solana coin was trading at $136.12.

Despite the downside, a SOL bull-case scenario is still possible. However, bulls have to break past the 50-SMA ($153.72) first. Crossing this level could attract more buyers to the market, which in turn may lead to a sustained uptrend. Meanwhile, CoinCodex’s Solana price prediction shows a target of $151 in the coming months.

3. Zcash price targets $500

The Zcash price has been on an upward trajectory since the beginning of December. Data shows the value of the privacy coin has increased by 26.2% on the weekly chart but remains bearish on the monthly timeframe.

If bulls continue to maintain the uptrend, Zcash could soar to $500 soon. As of December 11th, the Zcash price was valued at $454.34. CoinCodex forecasts that the Zcash price could climb to $651 in the coming month.

The bottom line

While the Solana price prediction making the rounds in the market shows promise, SOL is a high-cap coin. If you are looking for a crypto that has a high chance of growth, utility projects like DeepSnitch AI might be among the best to consider.

DeepSnitch AI is currently trading at $0.02735, which allows you to accumulate a large amount of tokens with small capital. A slight increase in price could push the DSNT coin to a high market cap, giving buyers up to 100X returns.

To reward committed purchasers, DeepSnitch AI offers a 50% bonus on purchases above $2,000 using the code DSNTVIP50. Purchases above $5,000 can get a 100% bonus with the code DSNTVIP100.

Visit the official website for more information, and join X and Telegram for community updates.

FAQs

1. What price will Solana be in 2026?

CoinCodex’s Solana price prediction displays a minimum target of $130.16 and a maximum price of $139.13 in 2026. However, high Solana adoption growth could push the SOL price higher.

2. Can SOL reach $1000?

A Solana future value of $1,000 is a long shot given its current price. The altcoin’s price would have to increase by about 7x to reach that mark, a move that is unlikely given its large market cap. Meanwhile, a low-cap utility-driven coin like DeepSnitch AI may reach this mark with massive adoption.

3. Is Solana worth buying?

While Solana might be a good investment for old investors, new investors who are yet to cash out from the market are better off investing in low-cap gems like DeepSnitch AI, which have enough room for expansion.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.