I wrote on the 25th January that the best trades for the week would be:

- Long of the EUR/USD currency pair following a daily close above $1.1866. This gave a loss of 0.24%.

- Long of Silver. This gave a loss of 18.62%.

- Long of Gold following a daily close above $5,000. This gave a loss of 2.26%.

Overall, these trades gave a large loss of 21.12% (7.04% per asset). Despite the size of this loss, following my weekly forecasts over the past few weeks would still have been profitable, as the recent wins were enormous.

A summary of last week’s most important data in the market:

- US Federal Reserve Policy Meeting – no surprises, rates were left unchanged.

- US PPI – this was the major surprise of the week, as this inflation indicator came in much higher than expected, showing a monthly increase of 0.5% and a core monthly increase of 0.7%, when an increase of only 0.2% was expected for both. This is seen as a hawkish tilt for the Fed, and this news helped drive the US Dollar higher and accelerate the bursting of the Silver (and Gold) bubble. This has pushed back the expected timing of the second rate cut for 2026 to October and strengthened the US Dollar a bit.

- Bank of Canada Policy Meeting – no surprises, rates were left unchanged.

- Australia CPI (inflation) – this came in higher than expected, showing an annualized rate of 3.8% when 3.5% was expected, which strengthened the case a little for RBA rate hikes, boosting the Australian Dollar during the earlier part of last week.

- Canadian GDP – just a tick lower than expected, showing no month-on-month growth.

- US Unemployment Claims – as expected.

The PPI and Australian inflation data had some impact on markets last week, but there were two other events that probably had a stronger overall impact on the market:

- President Trump finally nominated his choice for the next Chair of the Federal Reserve: Kevin Warsh, who is seen as a hawk, but who is expected to believe now that interest rates should be lower. His appointed helped burst the Silver bubble and boost the US Dollar somewhat.

- The US continues its military build up near Iran, with tensions rising as a full-scale regional war looks increasingly likely. The prediction site Polymarket sees a US strike on Iran as likely to happen in March, with President Trump still talking about a potential deal with Iran in which it would commit to not building nuclear weapons. This is probably driving the price of crude oil higher, with WTI reaching a new 4-month high last week.

The US stock market’s broad S&P 500 Index briefly made a new record high above 7,000. The Index remains resilient, but it is showing very little upwards momentum. I see this as unlikely to change until the prospect of war between the USA and Iran is resolved one way or another.

The coming week’s most important data points, in order of likely importance, are:

- US Average Hourly Average Earnings & Non-Farm Employment Change

- Preliminary UoM Inflation Expectations

- European Central Bank Main Refinancing Rate & Monetary Policy Statement

- Bank of England Official Bank Rate, Votes, Monetary Policy Summary & Report

- RBA Cash Rate, Rate Statement, and Monetary Policy Statement

- US JOLTS Job Openings

- Preliminary UoM Consumer Sentiment

- US ISM Services PMI

- US ISM Manufacturing PMI

- US Unemployment Rate

- New Zealand Unemployment Rate

- Canada Unemployment Rate

- US Unemployment Claims

It will be a busy week, with three major central banks holding policy meetings, so it could be an important week. Friday is a public holiday in New Zealand.

Currency Price Changes and Interest Rates

For the month of January 2026, I forecasted that the USD/JPY currency pair would rise in value. Unfortunately, this was a losing trade.

January 2026 Monthly Forecast Final Performance

For the month of February, I forecast that the EUR/USD currency pair will rise in value.

Last week saw three crosses with excessive volatility, so I made the following weekly forecast then:

- Short NZD/JPY: this gave a loss of 0.57%.

- Short AUD/JPY: this gave a loss of 0.32%.

- Short NZD/CAD: this gave a loss of 0.39%.

The Swiss Franc and New Zealand Dollar were the strongest major currency last week, while the US Dollar was the weakest. Directional volatility fell significantly last week, with only 11% of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility is likely to be notably higher.

You can trade these forecasts in a real or demo Forex brokerage account.

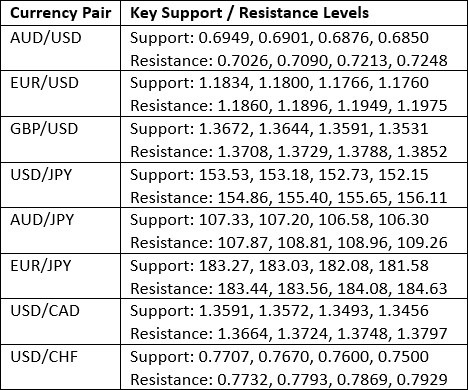

Key Support and Resistance Levels

Last week, the US Dollar Index printed fairly large bullish pin bar candlestick which rejected a new 4-year low. This is bullish by itself but we also have a long-term bearish trend with the price below its levels of both 13 and 26 weeks ago. This gives us a conflicted technical picture on the US Dollar.

The appointment of Kevin Warsh as Fed Chair helped strengthen the Dollar last week, but I see the outlook now as uncertain and the best market opportunities will probably not be US Dollar-dependent.

US Dollar Index Weekly Price Chart

The EUR/USD currency pair made a strong long-term bullish breakout a few days ago when the US Dollar started weakening at a faster pace and dropping a new 3.5-year low, but it quickly flopped right back down, finding very little support.

This suggest we have seen a spike, but I would not rule out a long-term bullish trend taking off – this pair does tend to trend reliably.

However, with the new Fed Chair and USD strength at the end of the week on higher inflation indicators, it makes sense to be cautious.

I will only take a long trade if we get a daily (New York) close above $1.2039.

EUR/USD Daily Price Chart

WTI Crude Oil has risen powerfully over recent days as the threat of a regional war centred on Iran has grown, with prediction markets currently seeing a US attack on Iran as likely to happen in March. This could seriously disrupt the supply of crude oil, so we have seen the price made a new 4-month high at the end of last week. A daily close above $66.25 would represent a new 6-month high.

Two notes of caution are necessary:

- Although a daily close above $66.25 would usually trigger a long entry from trend-following funds, the moving averages do not support a long trade. Even if war breaks out, this could just be a spike which flops back rapidly with a speedy American victory, leading to a losing trade.

- The Trump administration will move heaven and earth to bring down the price of crude oil, unlike recent Democratic administrations.

WTI Crude Oil Daily Price Chart

BTC/USD has finally made a very significant bearish breakdown below the long-term support level just above $81,000 and is now established below that level and reaching a new 9-month low. This is technically very significant in a bearish way.

While stocks and precious metals were rising strongly over recent months, Bitcoin fell from a record high a few months ago and continued to decline. It is clear the crypto sector is in decline, and that Bitcoin is in serious trouble. Bitcoin was meant to change the world, but outside of Africa, is just has not – you still can’t use it and it is unclear what value it really holds.

I do not like shorting assets, but Bitcoin looks weak and is well established within a bearish long-term trend. I certainly wouldn’t buy it now, and you might consider shorting it, but be very careful shorting is best done by experienced traders.

Bitcoin Daily Price Chart

Silver had a wild week, rising by well over 15% to reach a new all-time high and option target of $120, before making an epic crash on Thursday and Friday, mostly on Friday, on which day alone it declined by 28%.

I warned that this was prone to crashing, and that while it made sense to be long, a small position size should be used.

The size of the crash, despite the bullishness and mild resilience in the bounce at the weekly low, suggests we are not going to see a new high any time soon. This amazing trade is over, and we will probably now see wild consolidative swings with gradually declining volatility.

Silver Daily Price Chart

Everything I wrote above concerning Silver also applies to Gold. However, it can be added that the volatility here was somewhat less, and the resilience at the lows a bit stronger. It is likely that Gold will also trade sideways now for a while, but it is showing signs that it will recover more quickly to the upside than Silver will.

Gold Daily Price Chart

I see the best trades this week as:

- Long of the EUR/USD currency pair following a daily close above $1.2039.

Ready to trade our weekly Forex forecast? Check out our list of the bet Forex brokers in the world.