The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

EUR/USD Price Forecast: Will 1.18 Break Soon?

EUR/USD Tests 1.17 as Fed Cuts Loom and ECB Holds Steady

The euro-dollar pair (EUR/USD) finished the week at 1.1717, up from earlier lows after U.S. labor market data came in far weaker than forecast. Nonfarm payrolls in August added only 22,000 jobs versus 75,000 expected, while June revisions showed a 13,000 contraction, the first negative print in four years. The unemployment rate climbed to 4.3%, matching the highest level since late 2021, and manufacturing jobs are down 78,000 year-to-date. These signals have markets fully pricing a 25-basis point Fed cut on September 17, with traders debating whether the move could be as aggressive as 50 points.

Technical Landscape: Symmetrical Triangle and Key Levels

EUR/USD has been locked in a tightening range with higher lows and lower highs forming a symmetrical triangle. Support holds at 1.1663 (50-day SMA), while the resistance cluster sits at 1.1741–1.1788. A daily close above 1.1741 would confirm a bullish breakout, opening a path toward 1.1828–1.1850, levels aligned with major liquidity pools. Failure to clear those barriers risks sending the pair back toward 1.1613 and possibly 1.1573. For now, Friday’s high near 1.1760 reflects that bulls are testing conviction, but the candles reveal indecision with dojis and mixed closes. RSI at 55.8 signals mild bullish momentum without tipping into overbought territory, leaving scope for continuation if buyers step in at retracement levels.

Fed vs. ECB: Diverging Policy Paths Shape the Outlook

The Federal Reserve is under pressure to cut rates amid slowing job creation and cooling demand indicators. U.S. CPI data due September 11 is expected at 0.3% month-over-month and 2.9% annually, which could decide whether the Fed signals a series of cuts extending into October and December. By contrast, the European Central Bank is expected to hold rates steady at 2.0–2.15%, with President Lagarde signaling caution on inflation despite sluggish eurozone growth. Germany continues to underperform, France is battling fiscal pressures, and eurozone inflation readings remain slightly higher than expected, leaving the ECB constrained. The result is a widening divergence: the Fed leaning dovish while the ECB hesitates, a mix that structurally supports EUR/USD in the near term.

Market Sentiment: Positioning Around 1.1700

For much of August, 1.1700 served as an inflection point, repeatedly tested as both support and resistance. Traders view this level as pivotal: maintaining closes above 1.1710 builds confidence in sustained bullish pressure, while failure reopens the downside risk zone. Sentiment data suggests institutions are beginning to lean into a stronger euro, expecting that the Fed’s dovish tilt will weaken the dollar, though concerns over tariffs and inflation still temper enthusiasm.

Short-Term Trading Scenarios

If EUR/USD holds above 1.1710 and pushes through 1.1748, buyers may accelerate toward 1.1790–1.1828, the first true breakout zone since July’s highs near 1.1830. In contrast, rejection at resistance would likely see short-term profit-taking back to 1.1686, a 76.4% Fibonacci retracement that aligns with the prior swing structure. Breaching 1.1613 would be the real inflection for bears, potentially shifting the narrative from consolidation into outright reversal, with 1.1550–1.1500 as deeper downside liquidity targets.

Macro Catalysts This Week

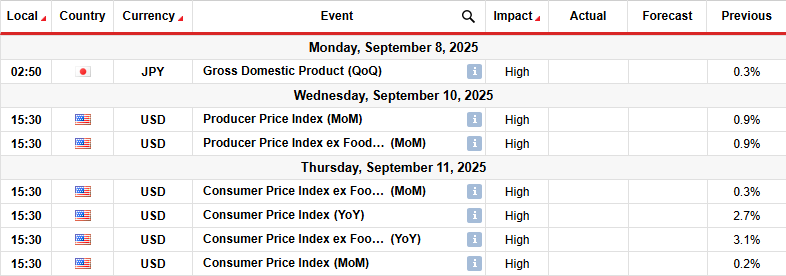

The coming calendar is stacked with pivotal releases. On Sept. 10, U.S. PPI will give an early read on wholesale inflation pressures. On Sept. 11, the ECB announces policy, followed immediately by U.S. CPI, creating a potential double catalyst. On Sept. 12, the University of Michigan’s sentiment and inflation expectations survey will help assess household inflation psychology. In Europe, weak GDP prints from Germany and France continue to weigh on investor confidence. Meanwhile, political tensions and tariff risks remain a wildcard for both currencies, likely to add volatility around key technical levels.

Verdict: EUR/USD Bias Turns Bullish With Risks of Pullback

With Fed cuts now fully priced and the ECB reluctant to ease, the bias for EUR/USD leans bullish, targeting 1.1740–1.1780 in the near term, with a stretch goal of 1.1828–1.1850 if momentum holds. However, failure to defend 1.1700 would invite sharp pullbacks toward 1.1660–1.1610. Given the technical triangle structure, macro divergence, and dovish Fed bets, the outlook tilts in favor of euro strength, but traders must brace for volatility around U.S. inflation data. At current levels near 1.1717, EUR/USD is best rated as Buy on dips, with tactical entries favored above 1.1685 and protective stops below 1.1607.

That’s TradingNEWS