The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Extends win streak to four days, eyes on 166.00

- EUR/JPY trades at 165.16, up 0.06% early Tuesday, extending 4-day rally.

- RSI favors buyers, but lack of momentum points to wait-and-see mode.

- Break above 165.30 could expose Nov. 6 high at 166.09, then 167.00.

- Drop below 165.00 opens path to support at 164.03 and 163.60.

EUR/JPY prolongs its rally to four straight days as Tuesday’s Asian session begins. At the time of writing, the cross-pair exchange hands at 165.16, up 0.06%, and is up 0.09% in the week so far.

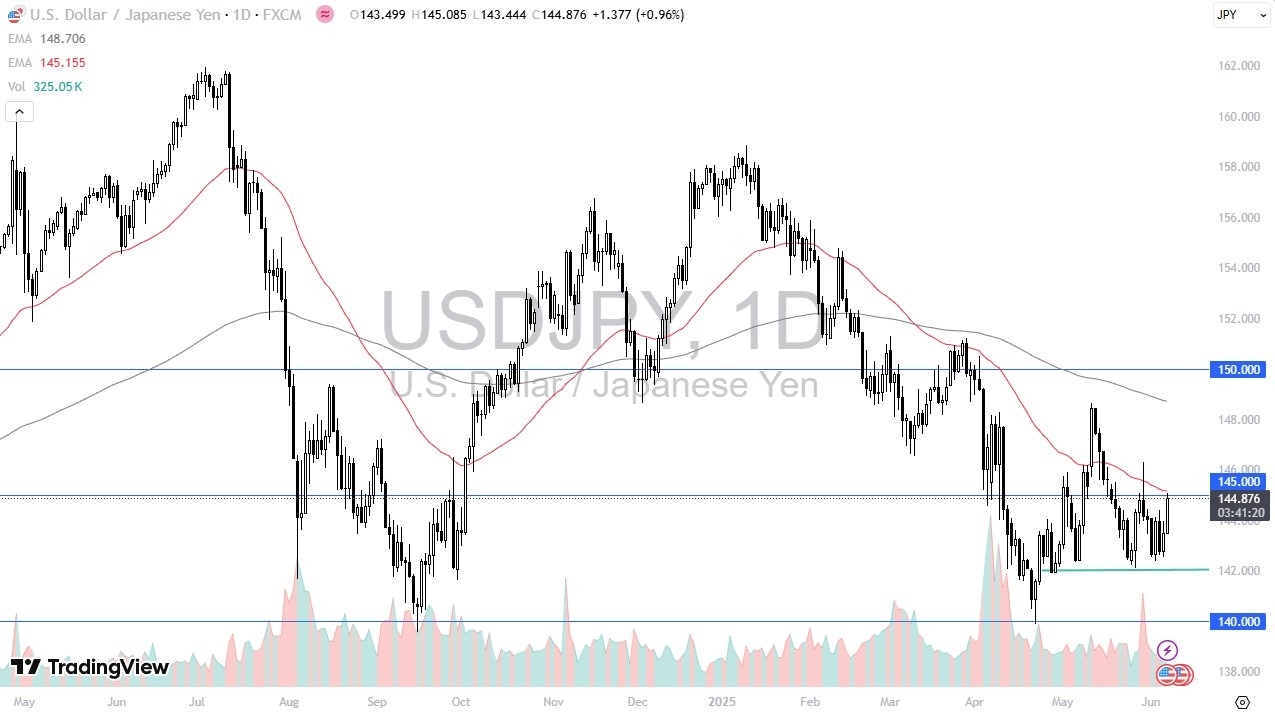

EUR/JPY Price Forecast: Technical outlook

The EUR/JPY is neutral to upward biased, but so far, it has remained trapped within the 164.50-165.30 range for the last three days, indicating a lack of conviction among buyers and sellers regarding the cross-pair. Momentum-wise, the Relative Strength Index (RSI) suggests that buyers are in control but are taking a respite, awaiting a fresh catalyst.

If EUR/JPY clears the year-to-date high, this would pave the way for a test of the November 6 high at 166.09. Once surpassed, the next stop would be 167.00. On the other hand, if EUR/JPY tumbles beneath the 165.00 mark, look for a test of the Tenkan-sen at 164.03, followed by the Senkou Span A at 163.60.

EUR/JPY Price Chart – Daily

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.01% | -0.02% | 0.01% | -0.02% | -0.01% | -0.05% | -0.03% | |

| EUR | 0.00% | -0.00% | 0.00% | 0.02% | 0.00% | -0.03% | 0.00% | |

| GBP | 0.02% | 0.00% | -0.06% | 0.02% | 0.02% | -0.03% | 0.01% | |

| JPY | -0.01% | 0.00% | 0.06% | -0.01% | -0.06% | -0.14% | -0.12% | |

| CAD | 0.02% | -0.02% | -0.02% | 0.00% | -0.01% | -0.05% | -0.01% | |

| AUD | 0.01% | -0.01% | -0.02% | 0.06% | 0.00% | -0.03% | -0.01% | |

| NZD | 0.05% | 0.03% | 0.03% | 0.14% | 0.05% | 0.03% | 0.04% | |

| CHF | 0.03% | -0.00% | -0.01% | 0.12% | 0.00% | 0.00% | -0.04% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).