The main tag of Forex News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Weekly Forex Forecast – 16th to 20th February 2026 (Charts)

I wrote on the 8th February that the best trades for the week would be:

- Long of the Dow Jones Industrial Average. This gave a loss of 1.09% over the week.

A summary of last week’s most important data in the market:

- US CPI (inflation) – this came in just a fraction lower than expected, showing a month-on-month increase of 0.2% compared to 0.3%. This had no discernable impact on the market.

- US Average Hourly Earnings – came in a tick higher than expected, which helped boost the greenback earlier in the week.

- US Retail Sales – this was considerably worse than expected, showing no change month-on-month while an increase of 0.4% was expected. This created a minor dovish tilt concerning the timing of US rate cuts in 2026.

- US Non-Farm Employment Change – somewhat better than expected, boosting the effect outlined above in 3.

- Swiss CPI (inflation) – no change was expected month-on-month but a deflation of 0.1% was the result, which helped strengthen the Swiss Franc.

- UK GDP – as expected.

- US Unemployment Rate – an unexpected tick lower from 4.4% to 4.3%.

- US Unemployment Claims– as expected.

Last week’s data had some minor effects upon the US Dollar and general outlook for risk appetite, with the US economy first looking more ready for rate cuts, but then at the end of the week still looking like its running slightly hot. Overall, the CME FedWatch tool has narrowly moved in favour of expecting three rate cuts in 2026 of 0.25% (June, September, and December), which is a dovish change for the US Dollar.

The other big news, in fact really the big news of the week in the market, was the huge gain printed by the Japanese Yen, which rose by almost 3% against the US Dollar and by a bit less against 4 other currencies. This was an unusually strong appreciation and was driven by the previous weekend’s stunning election victory by the current administration, which gives Japan its strongest government in many years. Investment has been flowing strongly into the Japanese stock market, which accounts for some of the Yen’s gain. There is also an expectation that the Bank of Japan will be hiking its interest rate soon, which is leading traders to get out of short Yen carry trade positions. However, there are strong questions as to how much further the Yen can rise over the coming days, as it looks very overbought and is due for a bullish retracement.

The US military buildup against Iran continues, although the USA and Iran will be holding a second round of talks in Geneva this Tuesday. President Trump has signaled that he will likely give talks about another 3 weeks to succeed before resorting to military action. Prediction markets such as Polymarket now suggest that a US attack on Iran by the end of June this year is unlikely to happen.

The coming week’s most important data points, in order of likely importance, are:

- US Core PCE Price Index

- US Advance GDP

- US FOMC Meeting Minutes

- UK Claimant Count Change

- UK CPI (inflation)

- Canadian CPI (inflation)

- RBNZ Official Cash Rate / Rate Statement / Monetary Policy Statement

- US / German / UK Flash Services & Manufacturing PMI

- UK Retail Sales

- US Unemployment Claims

- Australian Unemployment Rate

Monday will be a public holiday in the USA and Canada. The entire week is a public holiday in China.

Currency Price Changes and Interest Rates

For the month of February, I forecasted that the EUR/USD currency pair would rise in value.

February 2026 Monthly Forecast Performance to Date

Last week saw one cross with excessive volatility, so I made the following weekly forecast:

- Short AUD/JPY – this produced a win of 2.23%.

There were several Yen crosses which made excessive moves, so I forecast that these crosses will rise over the coming week:

- Long AUD/JPY

- Long EUR/JPY

- Long GBP/JPY

- Long NZD/JPY

- Long CAD/JPY

The Japanese Yen was the strongest major currency last week, while the US Dollar was the weakest. Directional volatility rose slightly last week, with just over one third of all major pairs and crosses changing in value by more than 1%. The Yen was extremely volatile and made a large move higher over the week.

Next week’s volatility is likely to be similar or maybe a bit less.

You can trade these forecasts in a real or demo Forex brokerage account.

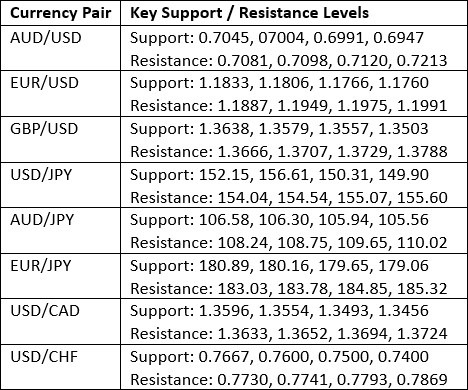

Key Support and Resistance Levels

Last week, the US Dollar printed a bearish candlestick which engulfed the real bodies of the previous two bullish candlesticks. However, there is a notable lower wick, and the price action taken together with previous candlesticks is only very marginally bearish.

Zooming out, we can see that although last week’s close was almost the lowest in more than a year, and although there is a clear long-term bearish trend in terms of the price, the action of the past year has been quite consolidative.

We certainly saw the interest rate outlook turn more bearish last week on the greenback, with markets now pricing in three rate cuts of 0.25% over the course of 2026 instead of two.

All in all, a weakly bearish bias looks sensible, but a minor rise in the greenback over the coming week would not be very surprising.

US Dollar Index Weekly Price Chart

The USD/JPY currency pair was at the heart of the Forex market last week, as it made an unusually strong move, with both the US Dollar dropping, plus the Japanese Yen gaining very strongly. The move really came from the Yen, and the Yen also gained excessively against several other currencies as well as the US Dollar.

The weekly candlestick shown below in the price chart completely engulfed the previous week, and most of the week before that. There is a very small lower wick, which could be a bearish sign, but there is a key support level close by. Shorter-term price action also shows a consolidation near the low.

The Japanese Yen gained over the past week as money flowed into Japan to invest in the strong stock market following the government’s landslide election win. There is also an expectation that the Bank of Japan will make more rate hikes soon, which will tend to boost the Yen.

Despite these factors, I expect that the Yen will give up some of its gains over the coming week. As well as the support level at ¥152.14 there is also a long-term bullish ascending trend line which is currently located at the support level below that, at ¥151.61.

Bullish bounces off either of these support levels could be excellent long trade entries with the kind of volatility we are seeing now. This kind of trade against the Yen will likely work even better in one or more of the Yen crosses over the coming week.

USD/JPY Weekly Price Chart

The S&P 500 Index has been in a strong bull market for a long time. However, although we did see a new record high price just a couple of weeks ago, a look at the weekly chart below shows that the price has just been consolidating, or topping out, for about the last 9 weeks. The support below at 6737 looks pivotal, and the support below that confluent with 6,500 looks even more so, especially when you consider the 200-day simple moving average is confluent with that major half-number.

It is still technically a bull market, and I would go long if we got a record high daily close above 7,025, but the choppiness and reluctance to make new highs suggests we are going to see a deeper drop, which may or may not be the beginning of the end of this bull market.

The NASDAQ 100 Index looks even more vulnerable to a significant fall.

S&P 500 Index Weekly Price Chart

BTC/USD has been making significant bearish breakdowns below some long-term support levels and reached a new 16-month low. This was technically very significant in a bearish way. However, this week’s candlestick is an inside bullish near-doji / pin bar, which suggests an end to the drop, even if temporary. So, we may have finally seen some long-term dip buying, although the price action here does not look confidently bullish.

I would be nervous to be bullish as Bitcoin has been such a standout bearish asset over recent weeks and months. If the price can get established above the resistance level near $81,000 then I would have more confidence that bulls were getting the upper hand.

Alternatively, if the price breaks below the recent low at about $60,000 that would be a very bearish sign, and one that might be worth trading short on the breakdown. That would probably trigger a further drop towards the $50,000 area soon.

Bitcoin Weekly Price Chart

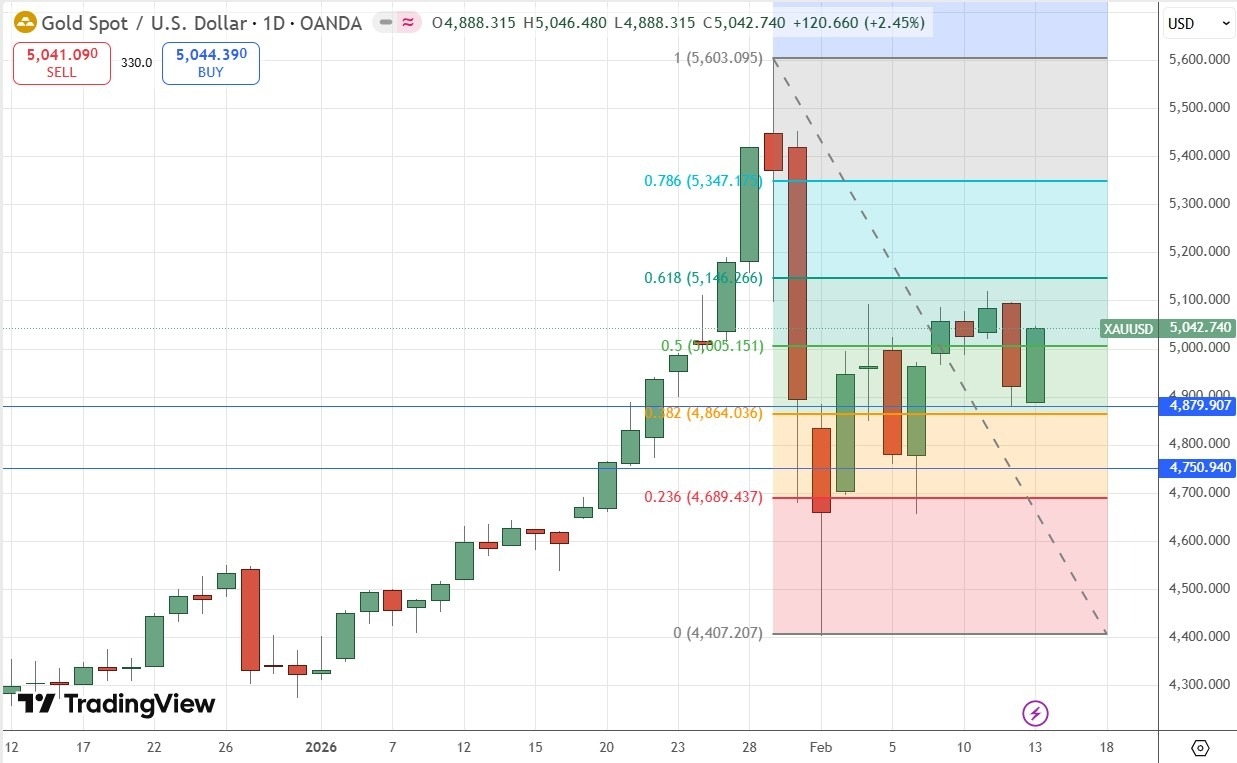

Gold, like Silver, saw a massive drop in just a day or two at the end of January. Gold fell quickly from a record high at about $5,600 to a low at $4,400 by the end of the week, but has been regaining ground with choppy, wide-swinging price action, as you can see in the daily chart below.

Applying a Fibonacci retracement study, we can see that the halfway level of this movement is very confluent with a major round number at $5,000 and this has been broken to the upside, although it has not managed to hold as key support – yet $4,880 has.

The price action suggests we are going to get a slowly rising consolidation on gradually declining volatility, like a struck tuning fork playing itself out.

Despite seeing Gold as likely to be weakly bullish, I am not interested in being long here again until the price makes a long-term, multi-month high closing price.

It is also notable that Gold is behaving more bullishly than any other precious metal.

Gold Daily Price Chart

I see the best trades this week as:

- Long of the S&P 500 Index following a daily (New York) close above 7,025.

- Long of any JPY currency cross except CHF/JPY.

Ready to trade our weekly Forex forecast? Check out our list of the top 10 Forex brokers in the world.