The main tag of Gold News Today Articles.

You can use the search box below to find what you need.

[wd_asp id=1]

Gold Price Forecast – Fed Cut Bets Lift XAU/USD To Record $3,659

Gold (XAU/USD) Extends Record Run Above $3,650 as Fed Cut Bets Surge

Spot and Futures Push to Historic Highs

Gold (XAU/USD) has broken into uncharted territory, climbing above $3,650 per ounce for the first time in history. Spot gold touched an intraday peak of $3,659.10, while futures on COMEX advanced to $3,687.30, marking a fresh all-time high. Earlier in the week, prices also spiked to $3,636.71, and U.S. gold futures settled near $3,676. The metal has now gained close to 38% year-to-date in 2025, building on an already hefty 27% rally in 2024.

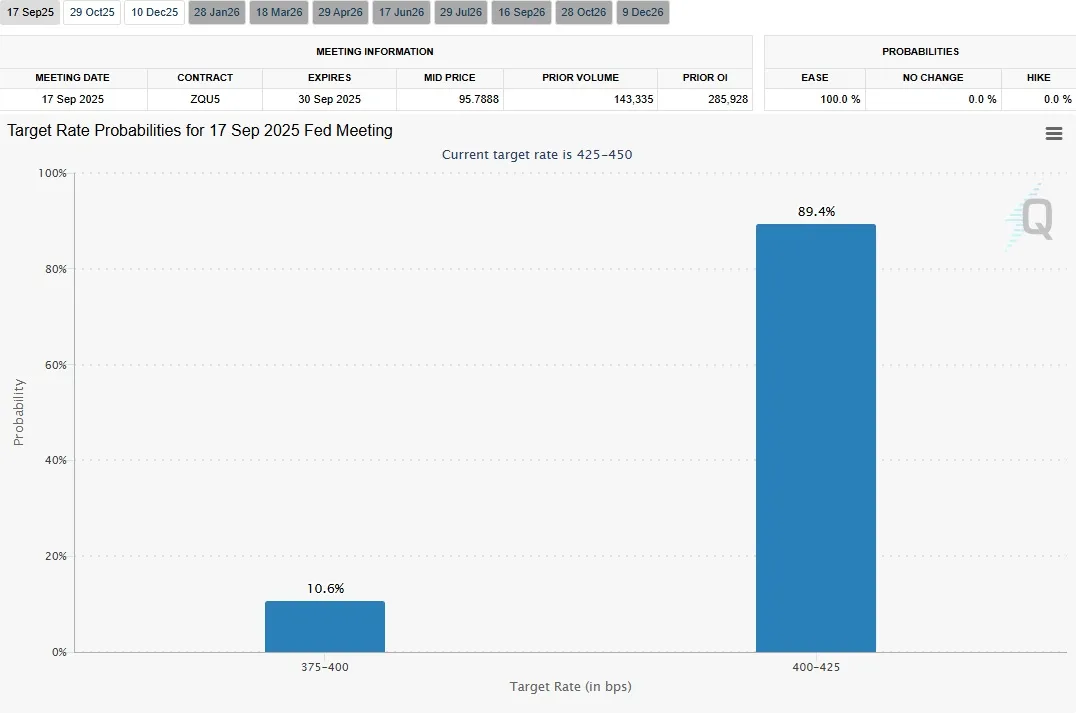

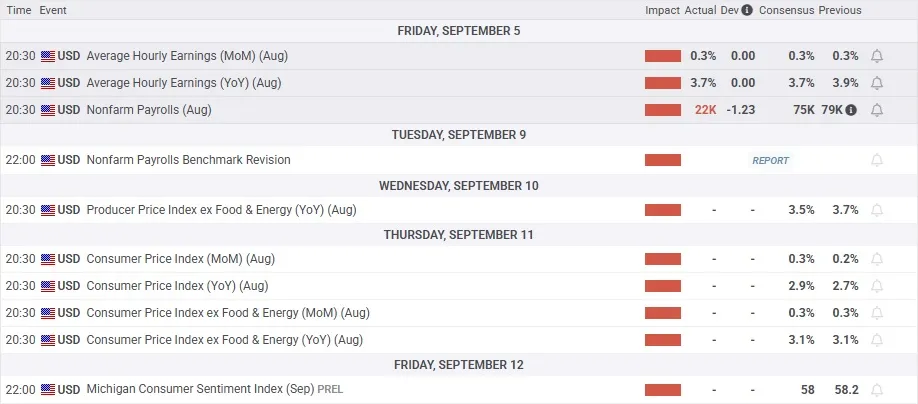

Labor Market Weakness Fuels Fed Pivot Bets

The rally intensified after the Bureau of Labor Statistics revised U.S. payrolls down by 911,000 jobs for the 12 months through March. With unemployment hitting its highest level since 2021 and August payrolls delivering only 22,000 new jobs, traders are nearly unanimous in expecting rate cuts. The CME FedWatch tool is pricing in an 88% probability of a 25 bps cut and a 10% chance of a 50 bps cut at the September 16–17 FOMC meeting. A weaker jobs backdrop has historically reinforced demand for non-yielding assets like gold, as lower rates compress real yields.

Central Bank Demand Adds Momentum

Alongside monetary policy, persistent central bank buying continues to underpin prices. Institutions in China, Turkey, India, and Poland have been accumulating gold aggressively. UBS analysts project a climb toward $3,700 by mid-2026, while some strategists at Goldman Sachs suggest levels as high as $5,000 per ounce could be possible if confidence in U.S. Treasuries deteriorates further and even a modest share of capital rotates into bullion. The European Central Bank already confirmed that gold has overtaken the euro as the world’s second-largest reserve asset behind the dollar, highlighting its structural importance in reserve management.

Tariffs, Politics, and Fed Independence Risks

Geopolitical factors are also at play. President Trump recently exempted gold from global tariff lists, shielding bullion from trade disputes that have hit other metals like tungsten and uranium. However, Trump’s aggressive push to reshape the Federal Reserve board — including attempts to remove Governor Lisa Cook — has raised alarms about central bank independence. Analysts argue that a weakened Fed could accelerate capital flight from Treasuries into gold. Political uncertainty in Europe, including the collapse of France’s government, has further boosted the safe-haven appeal of bullion.

Global Market and Retail Dynamics

The surge in gold isn’t confined to U.S. markets. In the Philippines, prices rose to ₱6,670.28 per gram and ₱207,469.70 per ounce, while in Australia, spot values above US$3,599 have driven a rush of prospecting activity. Veteran prospector Brent Shannon noted that nuggets worth $350,000 in 2020 would fetch $650,000–$700,000 today. The Perth Mint reported surging inflows from institutional clients, even as retail buyers of minted bars slowed purchases amid higher costs. In Victoria, gold tourism has exploded, attracting prospectors from Europe as bullion fever spreads globally.

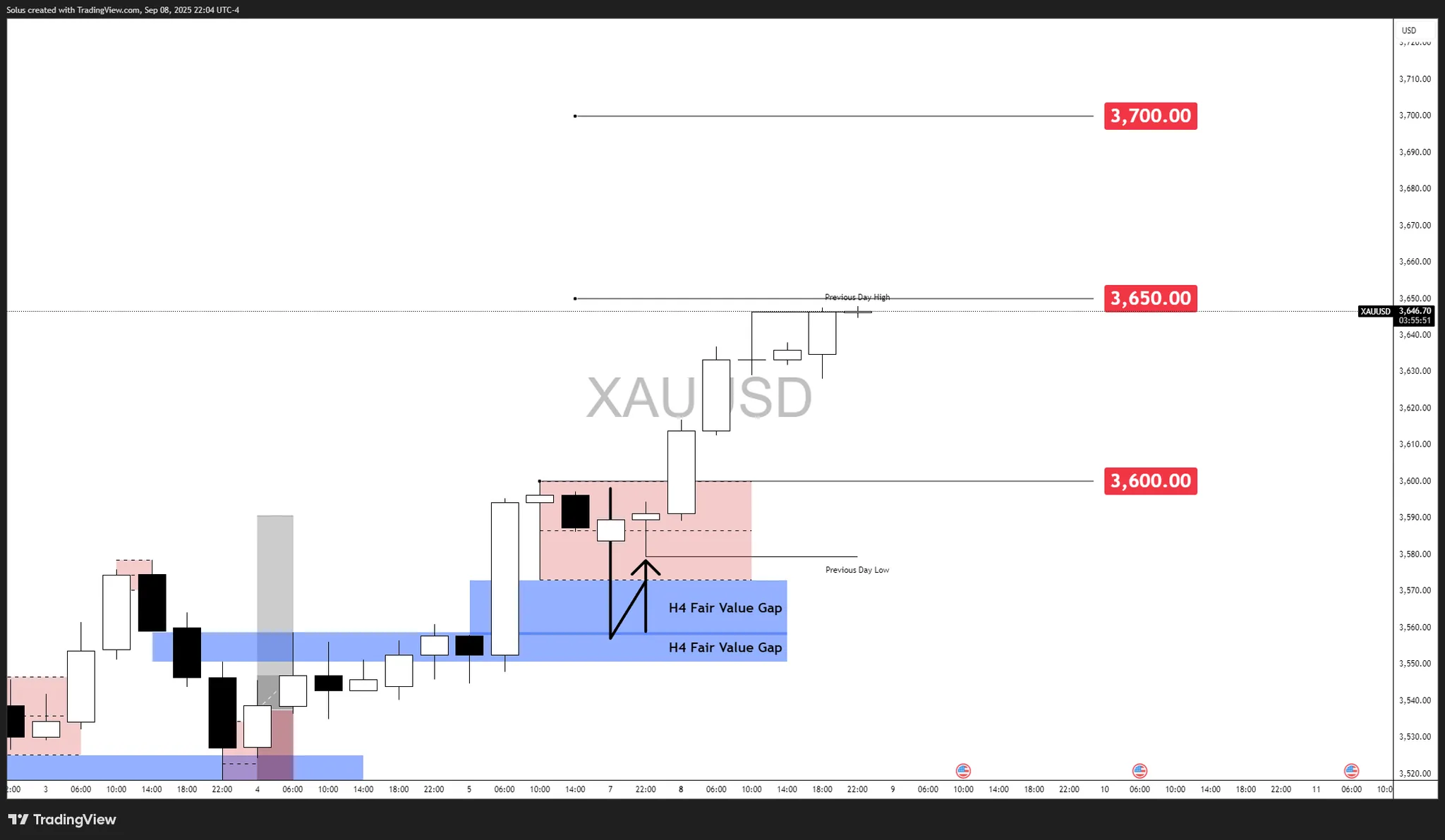

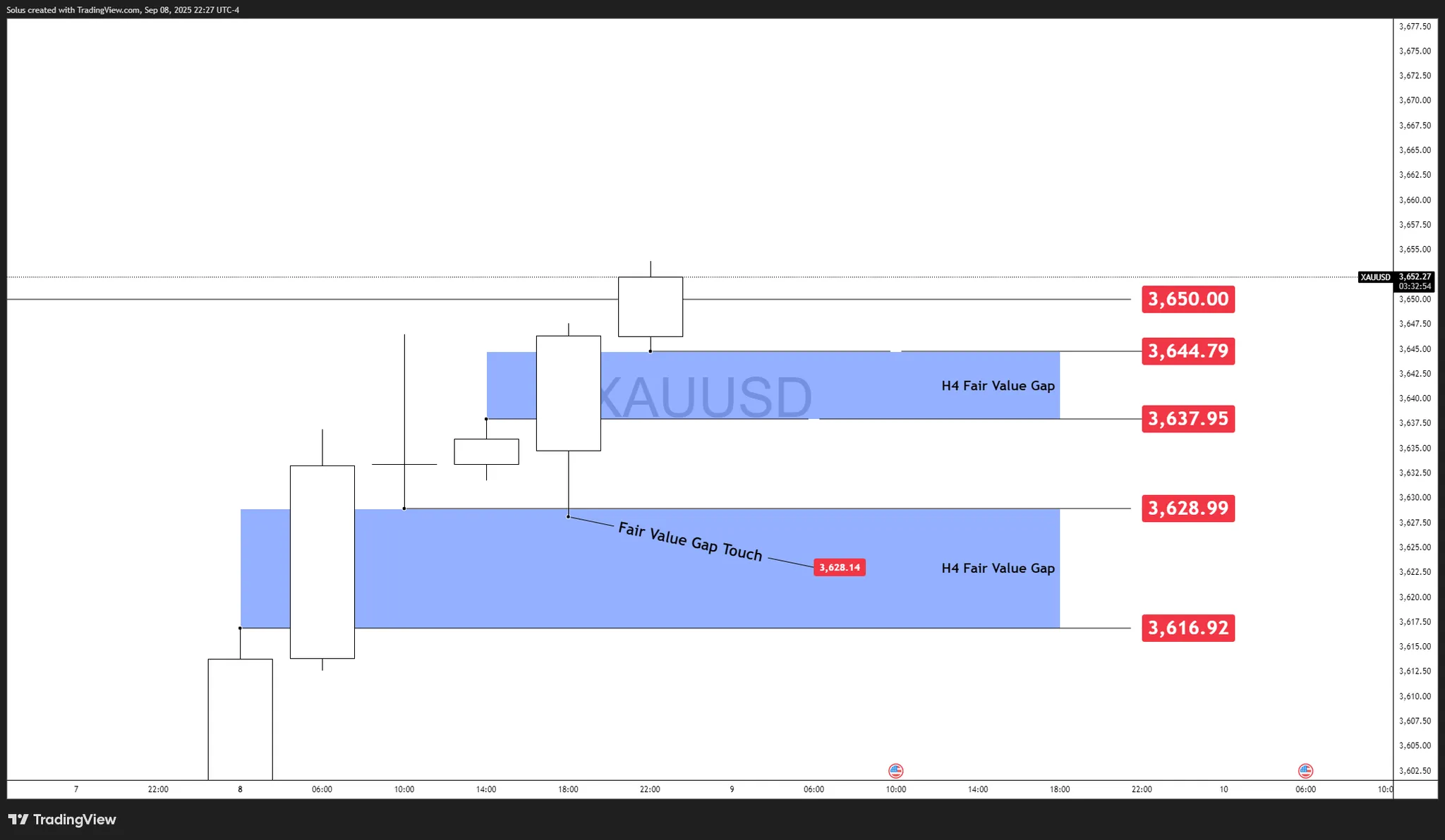

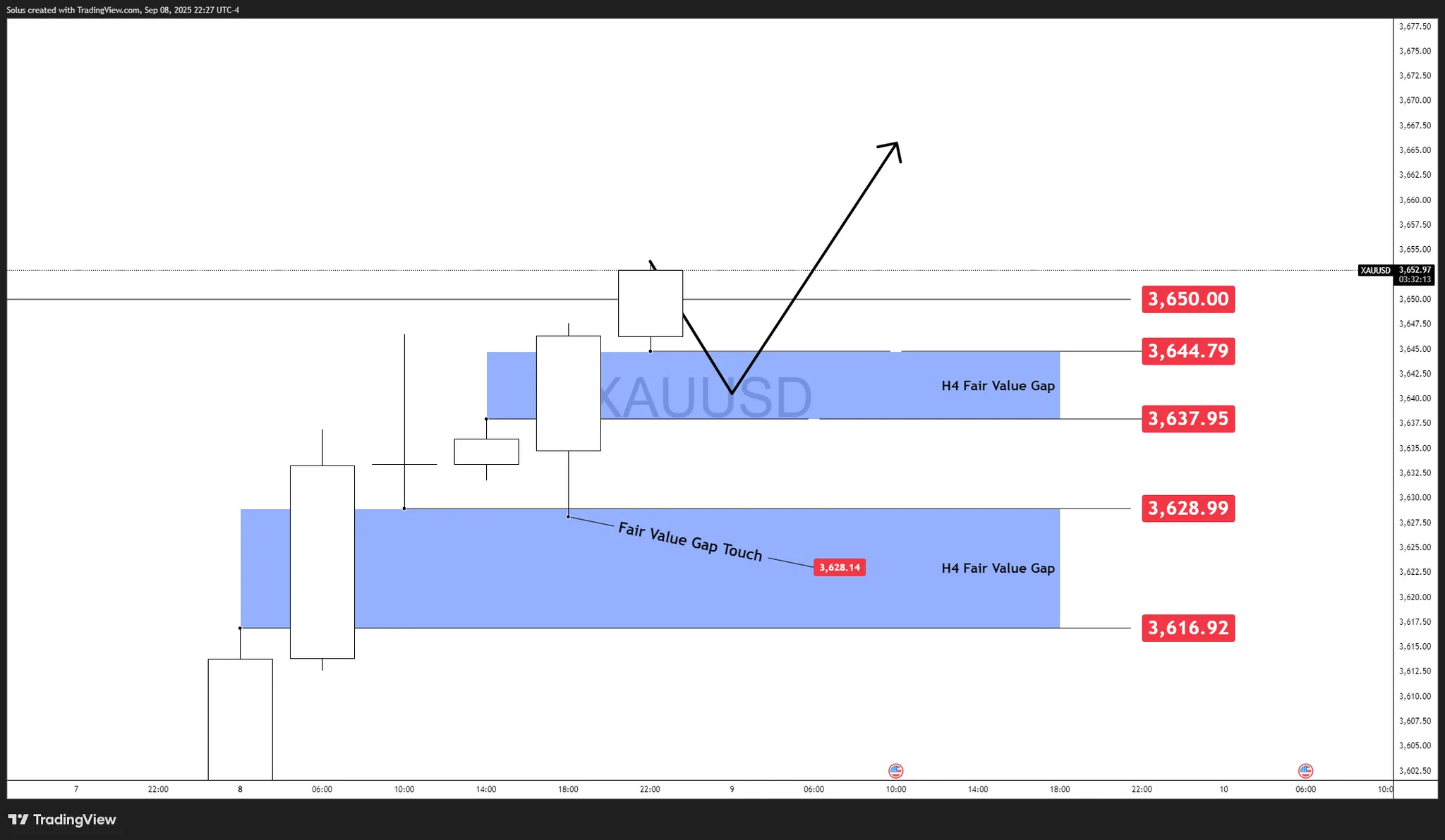

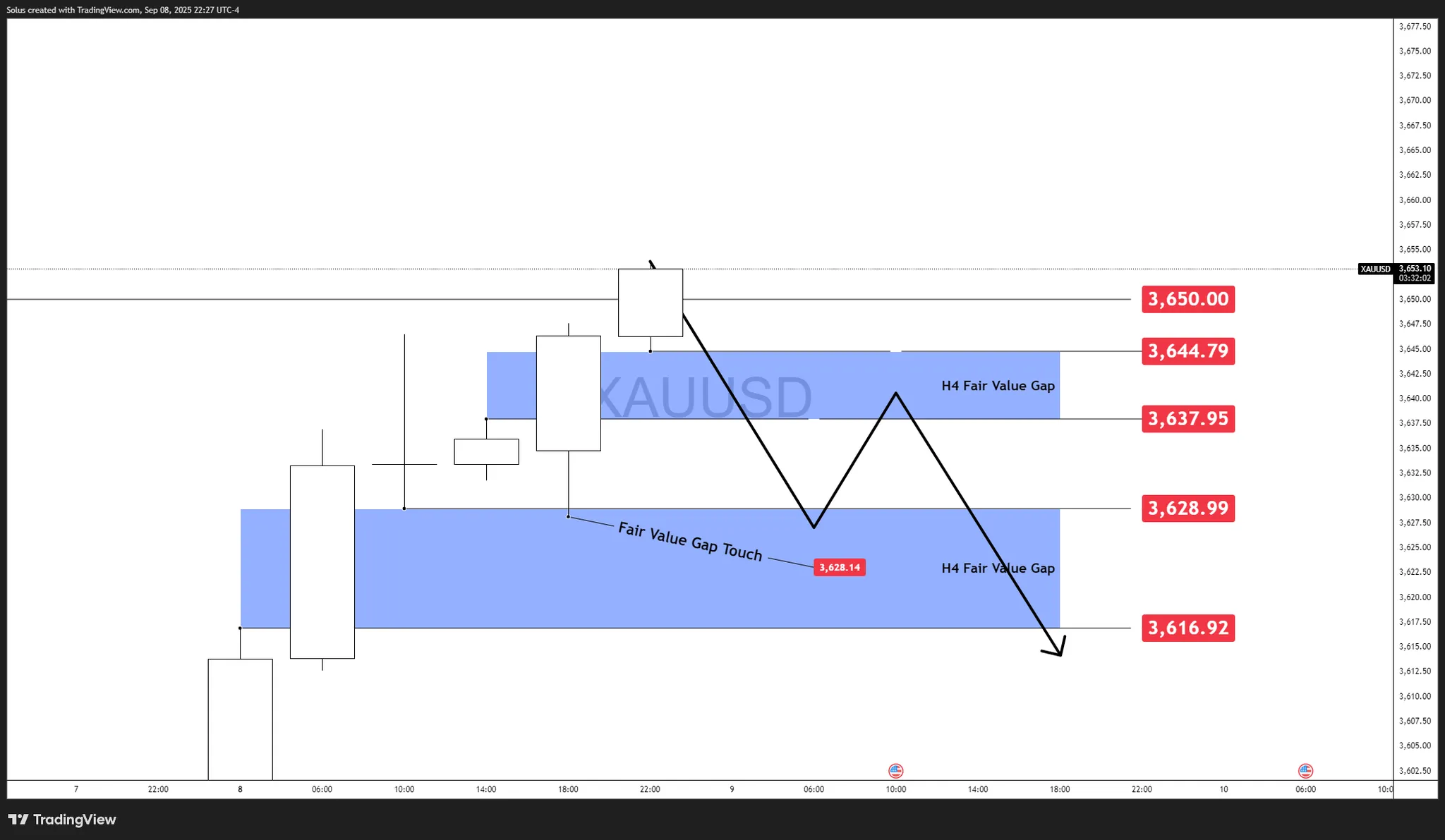

Technical Structure and Price Targets

Charts show gold breaking cleanly above a long-held ascending triangle, with $3,500 now acting as a structural floor. Analysts highlight $3,800 as the next measured target, with strong support forming between $3,570–$3,600. Momentum indicators confirm overbought conditions, but each pullback has been shallow, reflecting “buy the dip” appetite. As long as the Fed leans dovish, dips toward $3,550–$3,580 are likely to attract buyers.

Mining Sector and Equity Links

The surge in bullion has filtered into mining stocks. Companies like Kinross Gold (NYSE:KGC), which recently reduced its stake in Asante Gold to 5.2% but still holds 36.9 million shares, remain leveraged to spot gains. Centerra Gold (TSX:CG) boosted exposure in Idaho by acquiring 9.9% of Liberty Gold (TSX:LGD), underscoring industry positioning for sustained high prices. At the same time, Dundee Sustainable Technologies reported upgrades in concentrate grade by 31% while cutting arsenic content 99%, aligning with rising ESG scrutiny in gold mining.

Verdict on XAU/USD

Gold’s breakout above $3,650 confirms a structurally bullish regime. With monetary easing nearly guaranteed, central banks stockpiling reserves, and geopolitical stress intensifying, the metal’s trajectory favors further gains toward $3,800–$4,000. Risks lie in potential Fed hesitation if inflation runs hotter, but the balance of probabilities remains skewed to the upside. Based on price action, macro drivers, and institutional positioning, XAU/USD remains a strong Buy.