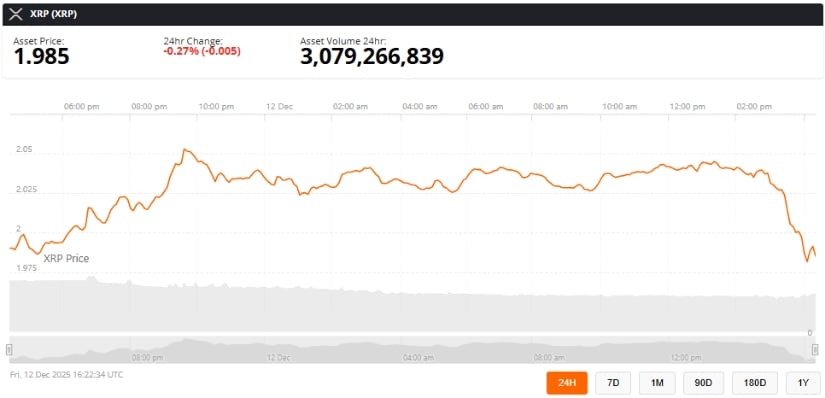

XRP price today: XRP is trading around $2.00 on Friday, December 12, 2025, down roughly 1.5% on the day in the latest aggregated feed, with an intraday range near $1.98–$2.05.

That dip is catching attention because it’s happening on a headline-heavy day for the Ripple ecosystem: U.S. regulators moved Ripple closer to a national trust bank, a new spot XRP ETF is hitting U.S. markets, and “wrapped XRP” is expanding XRP’s reach into DeFi on other major blockchains. The short version: today’s XRP weakness looks less like a single “bad XRP headline” and more like a mix of macro risk-off, profit-taking, soft on-chain/derivatives signals, and technical resistance near the $2 area—even as longer-term fundamentals get fresh catalysts.

Why is XRP down today?

XRP’s decline today is best explained as several pressures stacking at once rather than one decisive negative trigger:

1) Macro sentiment is weighing on crypto (even when individual tokens have good news)

A key backdrop is broader crypto market caution following what multiple analysts described as a hawkish rate cut and ongoing uncertainty about inflation and growth. FXStreet notes heightened volatility as investors digested the Fed decision and its implications for risk assets. [1]

Mainstream coverage echoed the same idea: a widely expected rate move can become a “sell the news” event in crypto if it was already priced in—or if investors don’t like the forward guidance. Fast Company specifically pointed to the idea that traders had fully priced in the cut and then sold anyway, adding broader macro concerns as contributors. [2]

2) “Good headlines” don’t always translate into immediate XRP buying

Ripple-related regulatory progress is meaningful—but it’s not a same-day demand switch for the XRP token.

For example, the U.S. Office of the Comptroller of the Currency (OCC) granted preliminary conditional approval for Ripple’s national trust bank charter (and other major crypto firms) — a major legitimacy milestone, but still conditionaland not a full bank in the traditional sense. [3]

BeInCrypto made the point directly: the move strengthens infrastructure and institutional positioning, but may not create an immediate XRP price surge by itself. [4]

3) On-chain and derivatives signals look “muted,” not euphoric

If a market is positioned aggressively long, big bullish headlines can trigger breakouts. But if positioning is cautious and activity is cooling, the same headlines can land with a shrug.

FXStreet reported slowing XRP Ledger activity (fewer active addresses compared with earlier November levels) and suppressed retail/derivatives demand, with XRP futures open interest stabilizing around $3.72B in its dataset. [5]

Separately, a Bitcoinist report citing Glassnode data said XRP’s total transaction fees (a proxy for activity) fell sharply from a February peak, describing an ~89% drop to levels not seen since 2020 in that metric’s moving average. [6]

And CryptoPotato highlighted a Santiment view that XRP looked “undervalued” on a 30‑day MVRV reading—often a contrarian setup—but it also described speculative activity as muted, reinforcing the idea of a market waiting for a stronger catalyst. [7]

4) Large wallet transfers can spook short-term traders

Crypto markets are extremely sensitive to perceived “supply events,” especially when coins move toward exchange-linked wallets.

Coinpedia reported that 75M XRP (roughly $152M at the time of its report) was sent to a wallet tied to Binance after a broader internal shuffle involving hundreds of millions of XRP—activity flagged by Whale Alert. Whether or not it ultimately represents selling, traders often treat exchange-directed transfers as a near-term risk factor. [8]

5) Technical levels are capping rebounds around $2

From a purely market-structure standpoint, XRP is sitting at a psychologically important zone. FXStreet described XRP holding the $2.00 area while also noting overhead pressure from short-term moving averages and nearby resistance levels (with support markers not far below). [9]

In plain English: it doesn’t take much selling to push XRP down when it’s trapped under resistance—especially if the broader market is cautious.

XRP’s big headlines on Dec. 12, 2025 — and what they mean

Even with the dip, today’s news flow is substantial. Here are the major XRP/Ripple-linked developments dated Dec. 12, 2025:

Ripple moves closer to a U.S. national trust bank charter

Reuters reported that the OCC granted preliminary approval for several crypto firms—including Ripple—to establish or convert into national trust banks, enabling broader nationwide operations (but not traditional deposit-taking). [10]

Axios emphasized the same core point: these charters are a significant regulatory step, but they do not allow taking deposits, offering savings accounts, or providing FDIC insurance. [11]

The OCC’s own letter to Ripple (dated Dec. 12, 2025) confirms the approval is preliminary and conditional, with final authorization dependent on pre-opening requirements. [12]

Why this matters for XRP:

- Bull case: more regulatory integration can expand institutional rails for custody, settlement, and stablecoin infrastructure that Ripple builds (and potentially the ecosystem around XRP).

- Why it may not pump price today: conditional approvals are not final approvals, and bank-charter mechanics don’t automatically create spot XRP buying pressure in the short term.

GENIUS Act stablecoin framework is now part of the regulatory backdrop

Multiple reports tied the trust-bank approvals to the post‑GENIUS Act environment. Congress.gov shows the GENIUS Act became Public Law in July 2025, establishing a U.S. framework for payment stablecoins. [13]

Circle’s statement on its own OCC conditional approval explicitly described the charter milestone as aligned with GENIUS Act compliance, illustrating how stablecoin issuers are positioning for that regulatory regime. [14]

Why this matters for XRP:

- It reinforces that the industry is shifting from “legal gray zone” to “regulated infrastructure buildout.”

- But markets can still sell off short-term if macro conditions are sour.

Ripple Payments lands a first European bank adoption with AMINA Bank

Ripple’s press release (Dec. 12, 2025) announced that AMINA Bank became the first European bank to use Ripple’s licensed end-to-end payments solution, targeting near real-time cross-border payments for AMINA’s clients and bridging fiat and stablecoin rails. [15]

Ripple also stated Ripple Payments has broad global coverage and has processed more than $95B in volume. [16]

Why this matters for XRP:

- It’s a tangible “real-world adoption” narrative.

- Still, payments partnerships can be slow-burn catalysts; traders often want immediate volume/fee impacts that show up in market data.

Wrapped XRP (wXRP) expands XRP into DeFi across other blockchains

Hex Trust’s Dec. 12 release said it will issue and custody wrapped XRP (wXRP), a 1:1-backed representation of XRP designed for DeFi and cross-chain utility, launching with over $100M in stated total value locked (TVL) and supporting trading and liquidity pairing (including with RLUSD) across multiple chains. [17]

FinanceFeeds framed the rollout as a landmark cross-chain expansion for XRP’s liquidity and use cases beyond the XRP Ledger, using an institutional custody framework and LayerZero-based interoperability. [18]

Why this matters for XRP:

- Bull case: expands addressable DeFi liquidity and lets XRP participate where most DeFi activity lives.

- Short-term ambiguity: new wrappers and cross-chain routes can also increase arbitrage flows and make it easier for some holders to deploy (or exit) positions in new venues—so initial price reactions can be choppy.

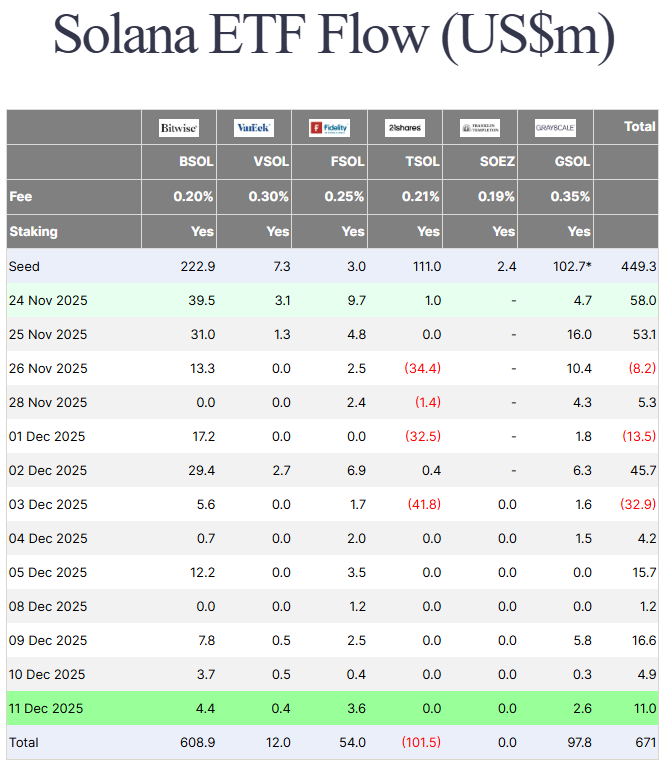

New U.S. spot XRP ETF product expands access (TOXR)

Crypto Briefing reported that 21Shares launched its XRP ETF (ticker TOXR) on Cboe BZX after the SEC declared the registration effective, and noted the fund tracks a regulated XRP benchmark with a 0.3% annual fee. [19]

The 21Shares factsheet lists TOXR with an inception date of Dec. 11, 2025, an expense ratio of 0.30%, and shows it as a digital asset ETF trading on Cboe BZX (with the stated pricing benchmark). [20]

Meanwhile, FXStreet reported XRP spot ETF inflows around $16M on Thursday, with cumulative inflows near $971Mand net assets around $930M in its cited dataset—suggesting ETF demand has not disappeared even as spot price softens. [21]

Why this matters for XRP:

- ETFs can be a structural source of demand over time.

- But ETF inflows don’t guarantee green days—especially if macro and technical conditions drive short-term selling.

What analysts and traders are watching next

Here are the most widely referenced “next checkpoints” from today’s market analysis coverage:

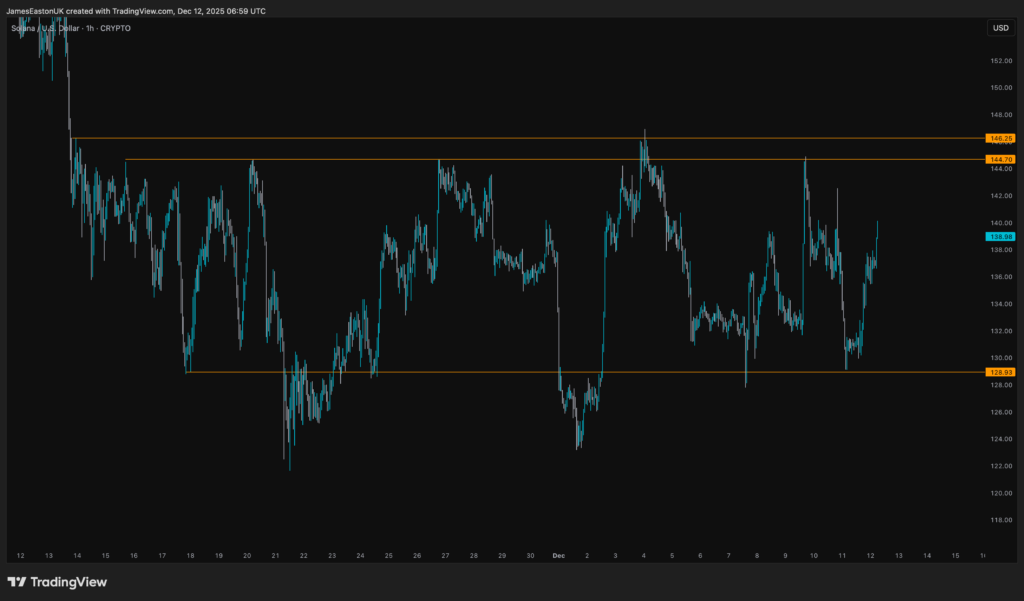

Key support and resistance zones

FXStreet’s technical commentary repeatedly centers the market around the $2.00 area, with nearby downside levels flagged just beneath and overhead resistance zones that must be reclaimed for momentum to flip. [22]

A reasonable way to frame the setup for readers:

- If $2 holds: XRP may remain in consolidation and attempt rebounds into nearby resistance.

- If $2 breaks cleanly: traders will look to the next support zones quickly, especially if macro risk-off returns.

The “data reality check”: are users and traders returning?

Beyond headlines, analysts are watching:

- Active addresses / on-chain activity (FXStreet highlighted a downtrend from November levels). [23]

- Derivatives open interest (low or stagnant OI can signal low conviction and limited retail participation). [24]

- ETF flow consistency (steady inflows can cushion dips, but abrupt flow reversals can accelerate them). [25]

Regulatory follow-through: conditional approvals are not the finish line

The trust bank story is big, but it’s also procedural. The OCC letter makes clear Ripple’s approval is preliminary, and final authorization depends on meeting conditions. [26]

That means future “catalyst moments” could include:

- updates on final approvals,

- clarity on what products/services are prioritized (custody, settlement, stablecoin infrastructure),

- and how quickly institutions actually integrate.

Bottom line: XRP is down today, but the news cycle is not “bearish”

XRP’s dip near $2 on Dec. 12, 2025 is happening despite a cluster of ecosystem-positive developments—OCC conditional trust-bank progress, new ETF access, a European banking integration, and DeFi expansion via wrapped XRP. [27]

The more consistent explanation is that short-term market structure and sentiment (macro uncertainty, cautious derivatives positioning, on-chain softness, and technical resistance) are overpowering the immediate price impact of longer-horizon headlines. [28]

As always in crypto: big infrastructure headlines can be the beginning of a narrative, not the moment the chart turns green.

Disclosure: This article is for informational purposes only and is not financial advice.

References

1. www.fxstreet.com, 2. www.fastcompany.com, 3. www.reuters.com, 4. beincrypto.com, 5. www.fxstreet.com, 6. bitcoinist.com, 7. cryptopotato.com, 8. coinpedia.org, 9. www.fxstreet.com, 10. www.reuters.com, 11. www.axios.com, 12. www.occ.gov, 13. www.congress.gov, 14. www.circle.com, 15. ripple.com, 16. ripple.com, 17. www.hextrust.com, 18. financefeeds.com, 19. cryptobriefing.com, 20. cdn.21shares.com, 21. www.fxstreet.com, 22. www.fxstreet.com, 23. www.fxstreet.com, 24. www.fxstreet.com, 25. www.fxstreet.com, 26. www.occ.gov, 27. www.reuters.com, 28. www.fxstreet.com

:max_bytes(150000):strip_icc()/FE3F9AD2-9085-40B8-8E8E-AF95656B0B37-048bcc651b0f4063b40038d3df45e712.jpeg)