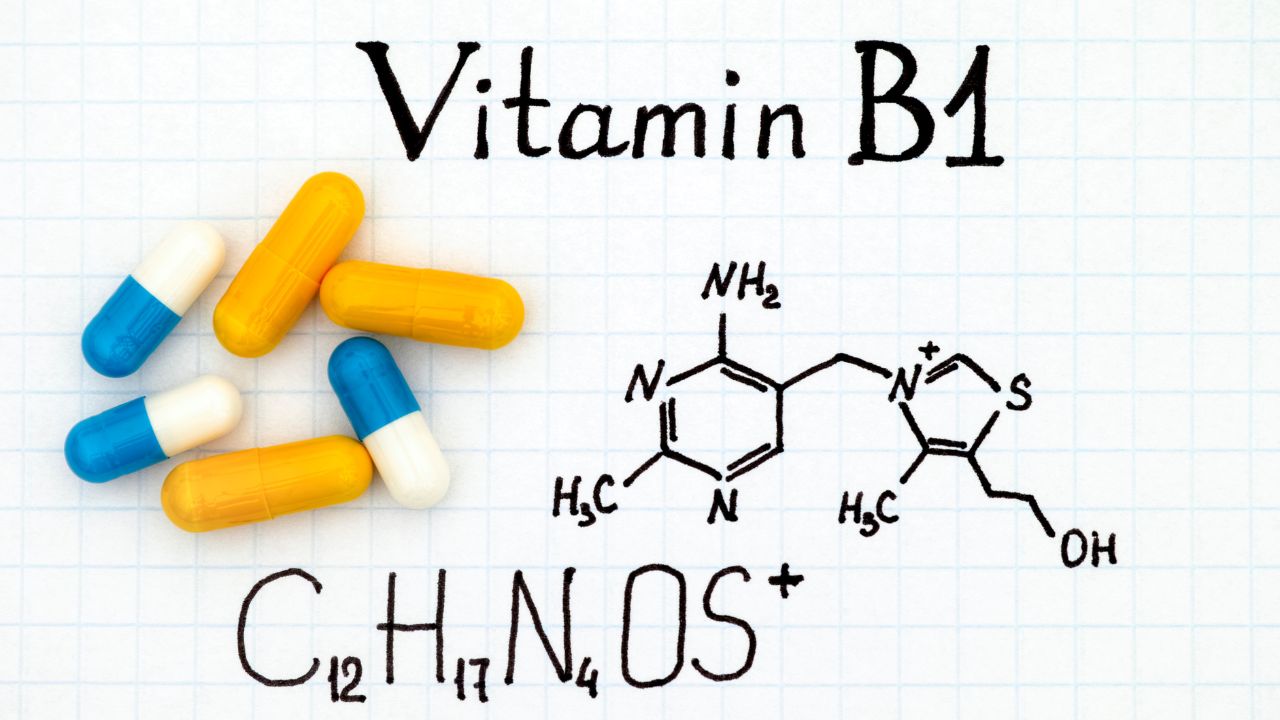

Are you taking vitamins wrong? Expert highlights 6 everyday mistakes

Vitamins are important for our health; they play a huge role in everything from immune function and metabolism to cell repair and clear thinking. Both the nutrient-dense diets of our forebears and modern research concur on the utility of these substances. Still, the health and wellness scenario is characterised by supplements, pills, powder and faux promises. This paradigm shift, however, can have unforeseen consequences.Misinformation and marketing hype on social media can typically cause people to take vitamins in the wrong way or too much. Typically done on the perception that they provide quick and easy fix for optimal health. However, without proper knowledge or any medical supervision, they can cause nutrient imbalances, organ stress, in some rare cases serious disease. Dr. Jaban Moore, functional medicine expert, highlights the most common vitamin errors.

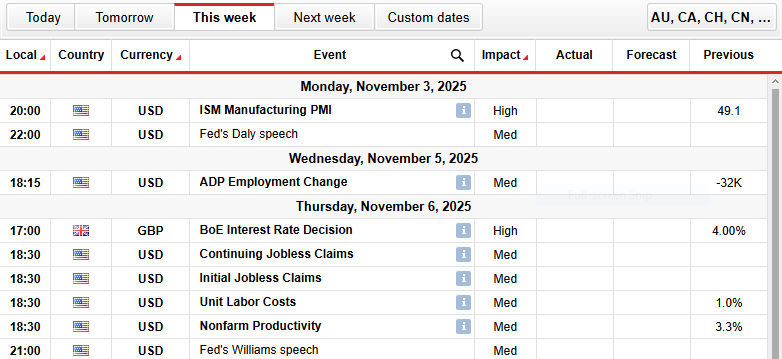

Taking the wrong form of Vitamin B1

Vitamin B1 or thiamine is available in a variety of forms, and not all are created equal in terms of absorption or efficacy for all conditions. Most supplements contain the basic form of this vitamin but some people, because of their genetics or gut health, cannot absorb or convert it properly. For example, some people require more specialised, bioavailable forms of vitamin B1, such as benfotiamine or thiamine tetrahydrofurfuryl disulfide, for their cells to actually get some benefit. Taking the incorrect form can mean your tissues aren’t actually receiving what they require, even if blood levels appear normal. This is a frequently made error by people self-medicating with supplements without medical testing or advice.

Taking vitamin D3 without vitamin K2

Vitamin D3 is crucial for calcium absorption and strong bones, but without enough K2, taking D3 supplements can do more harm than good. When the body lacks K2, calcium can end up in the wrong places, like the arteries or soft tissues, where it is not needed. Wondering why K2, because K2 acts like a traffic controller, guiding calcium to where it needs to be, keeping it away from the arteries.

Consuming fat-soluble vitamins (A, D, E, K) on an empty stomach

Fat-soluble vitamins will not be absorbed if taken without dietary fat. Taking them on an empty stomach results in a lot of the dose going through the digestive system unabsorbed. This frequent error results in ongoing deficiency despite regular supplements. Dr. Moore says that absorption levels can significantly increase when fat-soluble vitamins are taken with meals rich in healthy fats like olive oil, ghee, or avocado.Most vitamins need “cofactors”, other nutrients that assist them in their function or absorption. Magnesium, for instance, is essential for converting vitamin D, and vitamin C assists in iron absorption. Not paying attention to cofactors can cause your supplement to be less effective, or nutrients to build up somewhere they shouldn’t. Holistic physicians focus on the synergy of nutrients and will sometimes prescribe whole panel blood tests to determine cofactor imbalance.

Mixing beta-carotene with Vitamin A

Beta-carotene is found in all sorts of colorful fruits and veggies and it is a precursor to vitamin A, but not everyone can convert it efficiently. For people with certain genetic conditions and a weak gut, the conversion can be poor, meaning they may not get enough usable vitamin A, even after consuming plenty of it, this is because, beta-carotene solely depends on the body’s ability to convert it, this is why vegans who rely on plant based food sources can unknowingly develop a deficiency.

Not recognising vitamin D is more of a hormone

Vitamin D acts more as a hormone than a mere nutrient, controlling hundreds of genes and functions in the body. Its influence goes far beyond the bone, controlling immunity, mood, and metabolic function. Most people underestimate its strength, assuming it acts like other vitamins. Doctors such as Dr.Moore advise that autonomous supplementation without checking for levels can cause toxicity, particularly with the high-dose ampoules widely employed in India. Signs like thirst, weakness in muscles, and kidney problems can fast emerge.

Assuming vitamin B12 supplements are exclusive to vegetarians

A common myth is that only vegetarians require B12 supplementation since animal foods are the primary source. But B12 deficiency arises due to digestive disorders (such as gastritis, Crohn’s disease, or even prolonged use of acid blockers), independent of diet. Many people who consume non-veg find it astonishing that they have a low B12 count. A sophisticated understanding is required, and holistic physicians screen B12 status in a wide array of patients