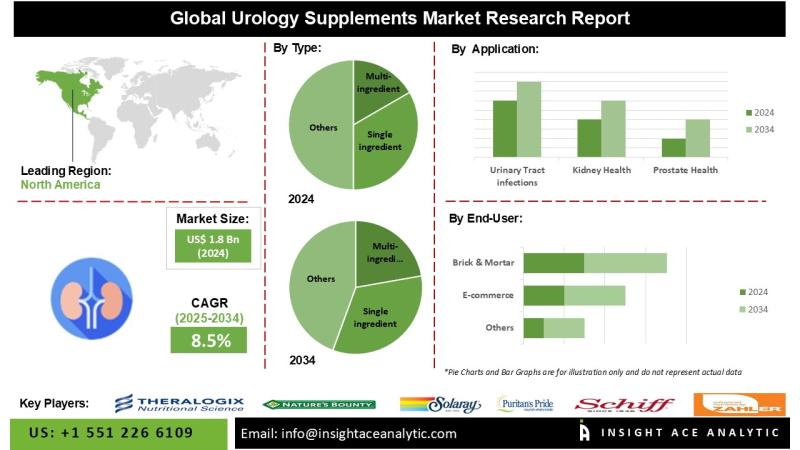

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Urology Supplements Market- By Type (Multi-ingredient, Single Ingredient), By Application (Urinary Tract Infections, Kidney Health, Prostate Health, Bladder Health and Others), By Formulation (Capsules, Softgels, Tablets, Liquid and Others), By Distribution Channel (Brick & Mortar, E-Commerce)) Trends, Industry Competition Analysis, Revenue and Forecast To 2034.”

According to the latest research by InsightAce Analytic, the Global Urology Supplements Market Size was valued at USD 1.86 Bn in 2024 and is predicted to reach USD 4.16 Bn by the year 2034 at an 8.5% CAGR during the forecast period for 2025-2034.

Request For Free Sample Pages:

https://www.insightaceanalytic.com/request-sample/2368

Urology supplements are dietary formulations designed to support urinary tract health. These products often include a combination of vitamins, minerals, botanical extracts, and other active ingredients. The market for urological supplements has experienced significant growth in recent years, driven by factors such as an aging population, increased awareness of urinary health, and a rising prevalence of kidney-related disorders.

Furthermore, growing consumer preference for safe and effective alternatives to prescription medications is expected to further propel market expansion. The rise of e-commerce platforms has also played a crucial role in enhancing the availability and accessibility of these supplements. Despite challenges associated with online purchasing, such as concerns about product compatibility and limited consumer knowledge, the demand for specific urology supplements continues to grow.

List of Prominent Players in the Urology Supplements Market:

• Theralogix

• Puritan’s Pride

• Nature’s Bounty

• Solaray

• Natrol, LLC.

• Himalaya Wellness.

• Biotexlife

• Schiff Nutrition

• ZAHLER

• Himalayan Organics

Market Dynamics:

Drivers-

The increasing focus on preventive healthcare is a significant factor driving the urology supplements market. Consumers are adopting these supplements as a proactive measure to maintain optimal urinary health and minimize the risk of related complications. Additionally, ongoing research and development efforts are leading to innovative formulations that enhance the efficacy and safety of urological supplements.

Curious about this latest version of the report? @ https://www.insightaceanalytic.com/enquiry-before-buying/2368

Challenges:

The limited scientific evidence supporting the efficacy of certain urology supplements poses a challenge to market growth. Additionally, the COVID-19 pandemic temporarily impacted the industry, primarily due to disruptions in supply chains, reduced product availability, and delays in elective medical procedures. The closure of healthcare facilities during the pandemic also led to a decline in demand for urological supplements, further affecting market expansion.

Regional Trends:

The North American urology supplements market is expected to hold a dominant revenue share and experience strong growth in the coming years. The increasing prevalence of lifestyle-related urological disorders, easy access to supplement-based treatments, and heightened awareness of urinary health are key factors driving regional market expansion.

Additionally, there is a growing trend among consumers seeking sustainable and non-invasive approaches to improve overall urological health, driven by lifestyle modifications and increased health awareness.

Recent Developments:

• January 2024: Theralogix is pleased to announce the release of Mannose One, a revolutionary that provides improved protection for the urinary system. Theralogix presents Mannose One, the only content-certified and independently tested d-mannose supplement.

• August 2023: With its ‘Well’ brand of Sci-Vedic products, Modicare Limited, a well-known direct-selling company in India, targets specific nutrition and wellness needs for both men and women. This growth demonstrates Modicare’s dedication to providing a wide array of solutions designed to address different health needs. This is expected to support market expansion.

Get Specific Chapter/Information From The Report:

https://www.insightaceanalytic.com/customisation/2368

Segmentation of Urology Supplements Market

By Type

• Multi-ingredient

• Single ingredient

By Application

• Urinary Tract infections

• Kidney Health

• Prostate Health

• Bladder Health

• Others

By Formulation

• Capsules

• Softgels

• Tablets

• Liquid

• Others

By Distribution Channel

• Brick & Mortar

• E-commerce

By Region

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Get More Information: @

https://www.insightaceanalytic.com/report/urology-supplements-market/2368

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.https://www.insightaceanalytic.com/images_data/148861653.

Contact Us:

info@insightaceanalytic.com

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 607 400-7072

Asia: +91 79 72967118

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

Twitter: https://twitter.com/Insightace

This release was published on openPR.