The main category of All News Articles.

You can use the search box below to find what you need.

The main category of All News Articles.

You can use the search box below to find what you need.

The ADA crypto market is buzzing with speculation as analysts predict a potential rally for Cardano (ADA) to reach the coveted $2 mark.

According to crypto analyst Ali Martinez, ADA is forming a right-angled descending broadening wedge pattern. If ADA coin price manages to close above the key resistance level of $1.14, it could spark a significant bullish surge.

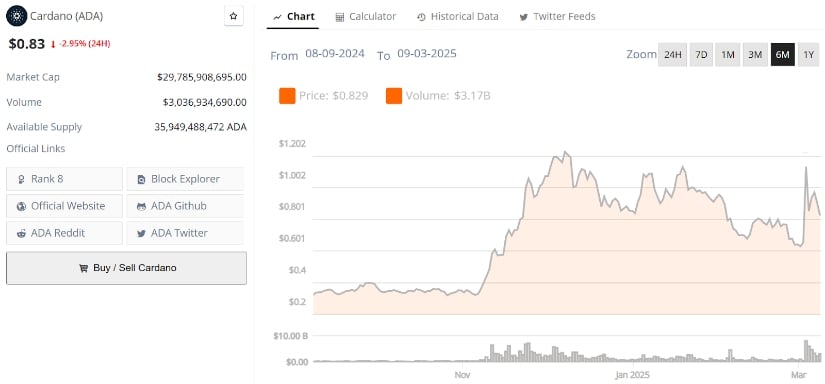

As of now, the ADA crypto price is experiencing a slight retreat, trading around $0.83 after a 3% decline over the past 24 hours. However, despite short-term fluctuations, market sentiment remains optimistic, with traders closely watching for a breakout.

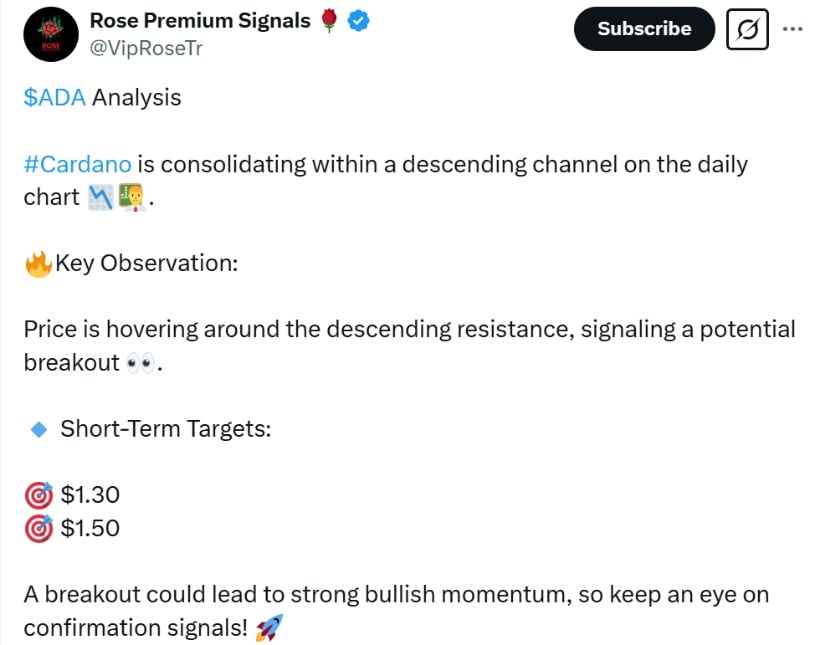

Several analysts are weighing in on the potential breakout of the ADA altcoin. Rose Premium Signals, a well-known market expert, pointed out that the ADA coin chart suggests the price is consolidating within a descending channel. With ADA coin value hovering near a key resistance level, a breakout could propel ADA crypto price today to short-term targets of $1.30 and $1.40.

Crypto analyst Ali Martinez (@ali_charts) has outlined how Cardano (ADA) could ignite a bull rally toward the $2 mark. Source: Ali via X

Additionally, analyst Coinvo noted that Trump’s announcement on ADA has triggered heightened speculation that the crypto coin ADA may soon witness parabolic growth. If the overall ADA market aligns with bullish projections, a run toward $2 seems increasingly plausible.

One of the major drivers of this rising interest in Cardano news is the speculation surrounding the U.S. government’s planned crypto reserve. Former U.S. President Donald Trump signed an executive order last week to establish a Bitcoin strategic reserve, which has brought hopes that some of the altcoins, including ADA coin, would be added to a separate digital stockpile. If ADA blockchain is added, it would boost investor confidence and push the ADA coin price chart higher.

Cardano (ADA) was trading at around $0.83, down 2.95% in the last 24 hours at press time. Source: Brave New Coin

Adding to the upbeat sentiment yet again, the U.S. Securities and Exchange Commission (SEC) has approved Grayscale’s Spot Cardano ETF filing.

Despite current price corrections, technical indicators provide mixed signals for ADA coin buy enthusiasts. The MACD and signal lines hint at a potential bearish crossover, while the daily RSI reflects a decline in bullish momentum. If a pullback continues, ADA current price could revisit the $0.73 support zone before resuming its upward trajectory.

Cardano is consolidating within a descending channel with potential breakout targets at $1.30 and $1.50. Source: VIPRoseTr via X

Nevertheless, historical ADA coin prices in USD trends suggest that a confirmed breakout above $1.14 could swiftly push ADA crypto to USD valuations closer to the anticipated $2 milestone.

ADA needs to hold the $0.75-$0.80 support zone and break above $1.30 to unlock further bullish potential. Source: VIPRoseTr via X

With multiple factors at play, including technical formations, regulatory developments, and the looming crypto stockpile, ADA news today remains highly dynamic. If market conditions favor ADA USD crypto and key resistance levels are breached, ADA token price could be on track for a significant rally. Investors and traders alike continue to monitor the ADA crypto chart for signs of a breakout that could make ADA USD price a headline-worthy development in the coming weeks.

March 9, 2025 – Written by Frank Davies

STORY LINK Euro to Dollar Forecast: 2 Factors Could Drive Additional Gains Over Next 1-3 Months

The US Dollar (USD) has remained firmly on the defensive versus the Pound Sterling (GBP) in global markets while the Euro (EUR) has made further net gains following German plans to unlock a huge fiscal stimulus.

The Pound to Dollar exchange rate (GBP/USD) has posted fresh 4-month highs just above 1.2930.

The US jobs data is likely to be pivotal in determining whether GBP/USD can test the 1.30 level today.

The Pound to Euro (GBP/EUR) exchange rate is close to 5-week lows just above the 1.1900 level amid a Euro surge.

According to Kirstine Kundby-Nielsen, FX analyst at Danske Bank, “It’s all to do with the broad-based euro optimism that we’ve seen with this shift in fiscal policy in Germany.”

ING added on the Euro, “A major re-rating is underway.”

Economic data and the equity market performance is likely to be crucial for the dollar.

President Trump made further concessions to Canada and Mexico on Thursday, but there are increased fears that the uncertainty and frequent policy changes will undermine confidence in the economy.

The US will release the latest employment data on Friday.

Consensus forecasts are for an increase in non-farm payrolls around 160,000 for February with the unemployment rate holding at 4.0%.

Markets are, however, expecting a soft set of data even though the rash of government firings will not yet show up in the data.

ING commented, “Some fear that weather plus changes in government education funding will be a drag on the headline number. However, the impact of the DOGE government job cuts may not emerge for another couple of months.”

According to MUFG, “Given the depreciation of the dollar is down to a shift in relative macro expectations in part due to weak economic data from the US, a weak payrolls report today would certainly further extend dollar losses and harden the view that the FOMC will cut sooner than expected.”

The ECB cut interest rates on Thursday but added an extra element with comments that policy is now much less restrictive.

In this context, there were doubts whether there would be a further cut in April.

ING commented, “A pause at the next meeting to come to terms with the new macro reality now looks like a possibility.”

EUR/USD has hit 4-month highs around 1.0870 amid the Euro surge. Further gains would provide a tailwind for GBP/USD.

According to Danske Bank, “While EUR optimism from increased fiscal spending may now be largely priced in, potential catalysts such as a ceasefire deal in Ukraine or a further deterioration in the US cyclical macro outlook – especially the latter – could drive additional gains in the pair over the next 1-3M.”

International Money Transfer? Ask our resident FX expert a money transfer question or try John’s new, free, no-obligation personal service! ,where he helps every step of the way,

ensuring you get the best exchange rates on your currency requirements.

TAGS: Euro Dollar Forecasts

A balanced diet is essential not just for overall health but also for supporting specific body functions. For instance, did you know that certain vitamins and supplements can support your eyes and vision health? Whether you’re dealing with nutrient deficiencies or have dietary limitations, your doctor can help you decide if you need to focus on getting more of the specific nutrients needed for peak eye health.

Though nothing can replace your regular eye exam, these are the vitamins and nutrients that can support your eye health — and the foods you can find them in.

In addition to a balanced diet, here are the best vitamins and supplements for your eyes. Luckily, you can get most of these added supplements for less than $10.

Vitamin A supports your vision, immune system, heart, lungs and overall growth and development. Specifically, vitamin A helps you see a full spectrum of light, as the vitamin produces pigments in the retina. It can also keep your eyes from drying out. You can find vitamin A in foods such as salmon, broccoli, eggs, carrots and fortified breakfast cereals.

You have probably heard of the magic of carrots. Yes, it’s true: Carrots are great for your eyes. Carrots (and other vividly colored fruits and vegetables) are high in beta-carotene, which is a compound that your body uses to make vitamin A. Beta-carotene is also available in a supplement form, although it isn’t as common as vitamin A and is often more expensive.

Vitamin C is found in foods like citrus fruit, bell peppers and tomatoes.

Vitamin C is like sunscreen for your eyes: It helps protect them from UV damage. The more time you spend outside and under the sun, the greater the risk for damage. According to the American Academy of Ophthalmology, too long in the sun can cause irreversible damage. Vitamin C can also lower your risk of cataracts, a disease that causes the lens of your eyes to become cloudy.

While a recent study found that vitamin C supplementation was effective in patients who were already vitamin C deficient, more studies are needed to truly understand the relationship between vitamin C and a lower risk of cataracts. In addition to getting enough vitamin C, avoid tanning beds, and if you are outside, wear sunglasses and a hat to protect your eyes.

Optometrists regularly recommend their patients consume omega-3s, and if a patient isn’t getting enough of these fatty acids in their diet, try a supplement. Omega-3s are mainly found in fatty fish such as tuna, salmon, mackerel or herring and some nuts and seeds.

The American Optometric Association points to omega-3s as a nutrient that can slow the progress of age-related macular degeneration. Studies have also found that they can help prevent dry eye disease. These nutrients are great for both conditions due to their anti-inflammatory effects.

Read more: Best Multivitamins

Another powerful antioxidant, vitamin E is vital to all our cells and cell functions. It helps to protect our bodies from cancer-causing free radicals and plays an important role in vision. Studies have shown that vitamin E can help protect the retinas from free radicals that can cause eye disease.

Vitamin C, another antioxidant, has more properties that help regeneration. Vitamin E can only help to protect the cells already there. But vitamin E can slow the progression of age-related macular degeneration. The American Optometric Association recommends 400 IU of vitamin E a day.

Zinc is found in almost all multivitamins because it is such an essential nutrient to the body. It is used to boost the immune system and help the body heal from wounds quickly. Zinc also aids in eye health.

Zinc helps vitamin A create melanin (a pigment that protects the eyes) and may shield the eyes from age-related macular degeneration. The American Optometric Association recommends 40 to 80 mg a day to slow the progression.

Read more: Best Zinc Supplements

Lutein and zeaxanthin are known to be important to our eyes. Lutein and zeaxanthin are carotenoids found in red and yellowish fruits and vegetables, as these compounds give the produce their vibrant colors. Carotenoids, also powerful antioxidants, are vital to eye health. They protect the eyes from free radicals that can cause damage. Lutein and zeaxanthin, specifically, have been found to prevent damage to retinas.

These carotenoids can also slow the progression of age-related macular degeneration. The American Optometric Association recommends a daily amount of 10 mg of lutein and 2 mg of zeaxanthin. While you can find lutein and zeaxanthin in supplement form, one bottle is on the pricier side. You may find it better, easier and more affordable to just eat more fruits and vegetables.

| Vitamin/supplement | Foods |

|---|---|

| Vitamin A | Salmon, broccoli, eggs, carrots and fortified breakfast cereals |

| Vitamin C | Kale, broccoli, oranges, lemons, strawberries and Brussels sprouts |

| Omega-3s | Tuna, salmon, herring, mackerel, chia seeds, flaxseed and walnuts |

| Vitamin E | Sunflower seeds, almonds, peanuts, collared greens, red bell peppers, mangoes and avocados |

| Zinc | Meat, shellfish, chickpeas, lentils, pumpkin seeds, cashews, almonds, eggs, cheese and milk |

| Lutein and zeaxanthin | Kale, spinach, peas, broccoli, orange juice, red peppers, honeydew melons and grapes |

Most vitamins and supplements are generally considered safe for people to take, as they’re nutrients your body naturally requires. You should always talk to your doctor before starting any supplements. Some vitamins and supplements can interact with various medications. Check with your doctor or pharmacist before taking any new vitamins or supplements in conjunction with certain medications. Especially if you are pregnant or breastfeeding, consult a medical provider first. Your doctor should be able to safely guide you to the best vitamins and supplements for eye health, as well as proper dosages.

In addition to the best vitamins and supplements for eye health, there are other ways you can protect your eyes and preserve your vision health:

Vitamin A, vitamin C, vitamin E, omega-3s, zinc and lutein and zeaxanthin are all important vitamins for the eyes. If you are curious as to which vitamins you need more of, consult your doctor.

This can vary from person to person, but the best way to find out what vitamin is lacking for your eyes is to consult your doctor. Your doctor can schedule tests to help determine whether you are lacking a certain vitamin that could be beneficial for your eye health.

According to Eye MD Monterey, vitamins B12 and B6 can improve eye health, support the optic nerve, reduce your chances of having blind spots and reduce the chances of having age-related macular degeneration, which causes blurred vision.

Vitamins for your eyes are especially helpful when you are deficient in any essential vitamins for vision. These include vitamin A, vitamin C, vitamin E, omega-3s, zinc and lutein and zeaxanthin. Studies have found that these vitamins and nutrients can help protect your eyes and even slow the process of age-related eye diseases. While these supplements are not a cure, they support eye health.

You can take vitamin A, vitamin C, vitamin E, omega-3s, zinc and lutein and zeaxanthin. While all are available in supplement form at various prices, you can naturally obtain these vitamins and nutrients in a balanced diet.

XRP has been at the center of bullish speculation in recent weeks, with analysts pointing to historical trends that suggest a major price surge could be on the horizon.

The latest XRP news indicates growing optimism among traders and investors.

Popular crypto market analyst Egrag Crypto has set ambitious XRP price targets, forecasting a potential 718% rally that could see the asset reach $27. This bold projection is rooted in Ripple XRP news and historical price movements, particularly its breakout performance during the 2017-2018 bull cycle.

While past performance is never a guarantee of future results, market cycles often show patterns that traders and analysts use to forecast potential price action. Egrag Crypto notes that if XRP USD mirrors its previous rally, it could first aim for $9.7 before targeting the more ambitious $27 level.

For the price of XRP to justify such a large move, it must first break through significant resistance levels. The asset is currently facing notable roadblocks at $2.62 and $3.00, with $3.40 being a significant one. The level is the local top of the current bull cycle, and a breakout above it could be the harbinger of a more prolonged rally.

If XRP replicates its 718% surge from the 2017-2018 bull run, a breakout from the $3.4 local top could propel it to $27. Source: EGRAG CRYPTO via X

Other than technical analysis, underlying market fundamentals will also drive Ripple price action. Increased buying pressure, institutional buying, and regulatory clarity are some of the factors that will drive Ripple cryptocurrency higher. Significantly, the ongoing XRP SEC lawsuit against Ripple continues to be a gigantic overhang, although there is speculation that an end is nigh.

Egrag Crypto is not alone in his bullish stance. Other market analysts, such as Dark Defender and JAVON MARKS, have also highlighted Ripple market strength. Dark Defender recently noted that Ripple ledger broke a multi-year resistance line in late 2024, a historically bullish signal.

XRP has broken multi-year resistance, confirmed new support, and remains bullish, making it the strongest setup seen yet. Source: Dark Defender via X

“I’ve never seen XRP more bullish than this before,” Dark Defender stated, emphasizing that past resistance levels are now acting as support. This shift in market structure suggests a potential breakout in the coming months.

XRP price must break the $3 psychological resistance to hit a new ATH. Source: Dark Defender via X

Meanwhile, JAVON MARKS pointed out that Ripple crypto price action resembles its 2017 pattern, which preceded an explosive rally. “If history repeats, we could see a bull run greater than many expect,” Marks commented.

Adding to the bullish case, whale activity around Ripple has been rising significantly. Crypto analyst Ali Martinez recently observed that large XRP transactions have surged, with nearly $6 billion worth of the asset being moved by whales in recent weeks. While large transactions can signal either buy or sell XRP pressure, increased whale activity often indicates heightened interest from institutional investors.

Additionally, the broader Ripple news sentiment remains optimistic despite recent price volatility. Reports indicate that the XRP price is consolidating within a symmetrical triangle pattern, a technical setup that often precedes major breakouts. Analyst CasiTrades highlighted that Ripple is testing the $2.54 resistance level, with a breakout above this range potentially triggering further gains toward $2.70 and $3.05.

One of the biggest overhangs looming over SEC Ripple is its ongoing court struggle with the U.S. Securities and Exchange Commission (SEC). The Ripple case, which began in 2020, has been one of the main sources of price suppression. However, recent gossip has speculated that the case is finally coming to a close.

Anthony Scaramucci, the creator of SkyBridge Capital, has recently indicated that the SEC may have quietly dropped its case against Ripple. While no confirmation is available, a favorable result could be a good bullish catalyst for Ripple Bank of America and other institutional partnerships.

Another cause of positive sentiment is the potential for an XRP exchange-traded fund (ETF). While still in the hypothetical realm, a Ripple ETF would bring greater market accessibility and institutional adoption, and could lead to a significant Ripple currency price boost.

Despite ambitious predictions, achieving a Ripple price USD of $27 would require an unprecedented market capitalization surge. With Ripple dollar valuation currently under $140 billion, reaching such levels would necessitate a valuation of over $1.5 trillion. While not impossible, this would require a combination of bullish market conditions, increased adoption, and a favorable regulatory environment.

XRP was trading at around $2.33, down 5.89% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

In the short term, XRP price prediction hinges on breaking key resistance levels. Investors must beware because increasing open interest in XRP futures reflects increasing volatility. CryptoQuant has recently warned that Ripple cryptocurrency rally has been powered by leveraged positions, which implies explosive price movements are looming.

Although the possibility of a parabolic move exists, traders need to manage risk and consider market conditions before they choose to invest. As history suggests, Ripple market has the potential for explosive moves—but whether it reaches $27 remains to be seen.

If you’re living with diabetes, you likely spend a lot of time planning what goes on your plate. But what about what you pour into your glass or mug? Drinks are easy to overlook. Yet, they can also have a big impact on your blood sugar. On the flip side, not drinking enough can also be a problem, as dehydration may contribute to high blood sugar.

Luckily, there are plenty of blood sugar-friendly beverages out there. One of our favorite sugar-free beverages is tea, which happens to be the second most popular beverage in the world after water. Tea offers loads of health benefits, and better blood sugar is one of them.

With all the different types of teas to choose from, you may be wondering what are the best ones to drink for blood sugar management. To find out, we asked dietitians. Here’s what they told us.

Delicate, earthy green is consistently linked to a host of health benefits, including better blood sugar. In fact, research has found that it may help reduce fasting blood glucose and improve insulin sensitivity in people with diabetes. What makes it so effective? “The gut houses trillions of microbes that influence blood sugar levels,” says Kimberley Rose-Francis RDN, CDCES, LD, a registered dietitian and certified diabetes educator in private practice in Florida. “An imbalanced gut microbiota can lead to decreased glucose tolerance and insulin resistance. Green tea is rich in polyphenols, which are small plant-based compounds associated with various health benefits, including improvements in gut health.”

For a healthy afternoon pick-me-up, brew some soothing Orange-Ginger Tea. Or, enjoy a cup of our no-sugar-added ginger-lemon tea.

Although green and black tea look and taste quite different, they both come from the Camellia sinensis plant. So, it makes sense that they share many of the same health benefits. That includes better blood sugar. While there is not as much research on the benefits of black tea for blood glucose management, one review study reports that it may aid in glucose metabolism and improve the body’s sensitivity to its own insulin. Researchers aren’t sure exactly why. However, they note black tea’s abundant polyphenols may slow the digestion and absorption of sugars from food. This, in turn, may protect against weight gain, which is a powerful trigger for type 2 diabetes.

We don’t have to tell you how comforting a cup of black tea is. But it’s also our favorite tea for energy. For an afternoon pick-me-up, try it iced in this zippy peach iced tea.

“Ginger is well-known for its ability to relieve nausea, but it may also help improve blood sugar levels when crushed and brewed into a fragrant tea,” says Rose-Francis. “Research indicates that ginger contains nearly 40 antioxidant compounds, which can be beneficial for treating various inflammatory conditions and may positively impact blood sugar levels over time.”,

“Since chronically elevated blood sugar can lead to inflammation, ginger’s anti-inflammatory compounds could be considered a beneficial functional food for achieving better blood sugar balance,” she adds. Beyond the anti-inflammatory properties of ginger, this flavorful root may also help inhibit the absorption of carbohydrates, regulate glucose metabolism and protect the insulin-producing cells of the pancreas.

You may have noticed that ginger already plays a starring role in several recipes in this article. However, if you’re a purist, try our simple ginger tea. All you need is water and a few slices of fresh ginger.

Cinnamon is more than a beloved baking spice. It can also be brewed into a delicious tea. “Cinnamon has been studied for its potential benefits of enhancing insulin function and supporting blood sugar,” says Vandana Sheth RDN, CDCES, FAND, a registered dietitian and certified diabetes educator specializing in plant-based nutrition. “It’s a naturally sweet flavored tea without added sugar, and a good option for those with diabetes.” Like ginger, cinnamon is rich in antioxidants that tackle the chronic inflammation that can make it harder to manage your blood sugar. In fact, several studies have shown that cinnamon powder may help lower blood glucose in people with and without diabetes. And one older study found that cinnamon tea may help reduce blood glucose in people without diabetes.

You can easily brew a cup by steeping cinnamon sticks in water. Or, if you’re craving creamy comfort, combine it with black tea and other spices in a spicy cup of chai tea.

From better brain health to less heart disease, turmeric boasts a long list of health benefits. Research reveals that it may also reduce blood glucose and help with weight management. What makes it so powerful? Turmeric contains an active compound called curcumin, which is a potent anti-inflammatory and antioxidant. And, as you’ve already learned, inflammation and higher blood sugar often go hand-in-hand. No wonder researchers credit curcumin’s blood sugar-managing powers to its anti-inflammatory action.

While you can always brew a simple bag of turmeric tea, there are all kinds of creative ways to use it, like this iced Anti-Inflammatory Golden Tonic. It does contain a touch of honey, but you can feel free to omit it for a sugar-free, blood-sugar-friendly drink.

Relaxing with a cup of tea isn’t just a healthy, flavorful way to hydrate. Research reveals that some types of tea can do good things for your blood sugar. And dietitians agree! According to dietitians, green, black, ginger, cinnamon and turmeric tea are the best teas to drink for better blood sugar. For optimal blood sugar management, choose unsweetened teas or add a squeeze of citrus for natural sweetness. So, what are you waiting for? Get your teapot ready. It’s time to start sipping!

Solana (SOL) has a price formation pattern that indicates that it may be primed for a substantial price increase soon. In the recent X post, Martinez highlighted an indication given out by the TD Sequential on the 4-day chart. This signal is referred to as a strong trend, which is generally associated with bulls. The pattern here suggests that after consolidation, Solana may soon experience an uptrend.

The technical analysis indicates a downward trend leading up to the buy signal. The candle structure also highlights a black candle sticks which symbolise that it was a period of bear phase. However, as the TD Sequential indicators get to the buy signal, then this may be the end of the downtrend therefore the beginning of the uptrend. The main focus here is made to the “9” on the chart, which is a familiar spike that indicates possible reversal levels.

The price level also correlates closely with a significant price of approximately $137.62. This price level has emerged as a crucial levels of interest in the past and the chart clearly depicts that after touching lower levels, Solana is now on the recovery mode. Market participants are keen to see if the price will break through this area as it gets closer to it. Any further rise higher than this level could possibly turn the force to buy higher thus confirming the possibility of higher stock prices.

According to Martinez, sustaining above the 137.62 level may lead to a more pronounced uptrend on Solana’s chart. The current price movement corresponds to the previous point indicating that SOL is likely to experience an uptrend in the next few days. As of press time, SOL is trading at $136.86, showing a 1.23% decline over the past day.

Source: TradingView

Nevertheless, they should keep an eye on significant aspects that may hinder the continuation of this rally. Volume and market sentiment will determine if this price bounce is sustainable. If volume subscribes to the upburst, then it will cause further buying pressure. However, there is no charges to indicate that this trend will be permanent; it may reduce and may also shift to the opposite.

Solana is in the process of forming a bullish pattern after the formation of a TD Sequential buy signal which can be associated with a bullish divergence on the chart. The possibilities of experiencing a powerful upward movement for the token may be expected if the price remains above the support level. However traders should be on the look out for a confirmation of such a trend since it has been observed more in interday times.

I wrote on 2nd March that the GBP/NZD currency pair would likely fall in value. Unfortunately, it rose in value by 0.71%.

Last week saw several data releases affecting the Forex market:

Last week’s key takeaways were:

The coming week has a lighter schedule of important releases, so we are likely to see less volatility in the Forex market over the coming week.

This week’s important data points, in order of likely importance, are:

For March 2025, I made no forecast, as there were no clear trends at the start of this month.

Last week, I forecasted that the following currency cross would fall in value over the week:

This was not a profitable call.

This week, I forecast that the following currency crosses will fall in value:

The Euro was the strongest major currency last week, while the US Dollar was the weakest, putting the EUR/USD currency pair in focus. Volatility increased last week, with 70% of the most important Forex currency pairs and crosses changing in value by more than 1%. It is likely to remain at a similar level over the coming week, despite the lighter agenda, due to US inflation data due, and the ongoing trade war.

You can trade these forecasts in a real or demo Forex brokerage account.

Last week, the US Dollar Index printed the largest weekly bearish candlestick in almost 2.5 years. The Dollar was the worst performing major currency last week and suffered a big loss, closing back within its dominant recent range and well below its level from 3 months ago, invalidating its former long-term bullish trend. At one point, the price reached a new 4-month low.

These are bearish signs, although there is some lower wick suggesting a little buying at the low.

Global markets have entered a strongly risk-off mode, but the greenback does not benefit because of the uncertain trade war the US is now engaged in against Canada, Mexico, and China, with no end in sight.

Trades taken over the coming week will probably be best positioned against the US Dollar, at least until a deal is announced replacing reciprocal import tariffs involving the USA.

The EUR/USD currency pair made a huge gain over the week, rising by more than 4%, which is unusual. The key driver is certainly the US-centered trade war, which has sent the greenback flying lower, while the Euro has gained as a store of value.

Although the European Central Bank met last week and gave a slightly dovish report, as well as cutting rates by 0.25%, that was not enough to weaken the Euro at all.

Despite the strong bullish move, the daily price chart below shows that the bulls may have run out of steam towards the end of last week, with the final two daily candlesticks close to looking like bearish pin bars. Another factor is the tight cluster of resistance levels overhead which are confluent with a major bearish inflection point near the major round number at $1.1000.

Another bearish factor is that the moving averages are misaligned: although the price has made a bullish breakdown to new multi-month highs, the 50-day moving average is still below the 100-day moving average, and this is often used as a filter by successful trend traders, suggesting we are most likely to see a bearish reversal.

I caution traders positioned long here to think about exiting and suggest that other traders consider a short trade, if and when we get a reversal from a key resistance level.

The USD/JPY currency pair fell last week to trade at a new 5-month low. Trend traders would have got signals to go short here last week but this was stopped by one key filter still saying no short trade: the 50-day moving average remains above the 100-day moving average.

Note how the price rejected the low of the week Friday and the support level at ¥147.84 with a bullish pin bar. This is certainly not decisive, but until the price makes a stronger fall and erases that low with a strongly bearish close, it will be unwise to go short. Also, the moving averages need to cross.

The US Dollar is very weak due to the US-centered trade war, and the Japanese Yen typically benefits in this kind of risk-off situation where the greenback cannot. The Yen also has a tailwind as Japanese wage inflation is clearly rising and the Bank of Japan seems set to implement meaningful rate hikes for the first time since 2008.

The S&P 500 Index fell strongly last week and reached a level nearly 8% below its record high which was made barely more than 2 weeks ago. The main reason for the strong drop in most global stock markets, and the major US indices in particular, is of course the large tariffs President Trump has imposed on US imports from Canada and Mexico, and the fact that neither country seems close to capitulating or to make the kind of deal President Trump would want to call off the tariffs. The US tariffs are just negotiation by another means.

Technically, what is most interesting here is that the price on Thursday and Friday traded below the 200-day moving average, which is drawn within the daily price chart below. This indicator is used to establish a technical bear market, and it is interesting we have not yet had a daily close below it. This suggests that this moving average may be acting as a mobile pivotal point. If the price keeps refusing to close below it, we may see the start of another bullish rally, and if a tariff deal were then concluded, that would give a big tailwind to any bullish push.

Personally, as a trend trader, I will not be entering any new long trades until we see the price make a new record high, and that might not happen for quite a long time.

It was a poor week for commodities generally, with the possible exception of Gold, which mostly traded not far away from its recent all-time high just above $2,950.

One of the very few exceptions is Natural Gas. The nearest futures contract of Henry Hub natural gas rose during last week to make a new 2-year high and ended the week not far from that.

So, what is driving Natural Gas higher? Most analysts see it as a combination of extreme cold weather, seasonality, and strong demand plus weak supply.

March can be a pretty cold month in the Northern Hemisphere, and the cold can even stretch into April, so there is reason to believe this long-term bullish trend might continue for a while longer yet.

If you are worried about the generally poor environment for commodities and start of the spring season later this month, you could pass on this long trade or take an unusually small position.

I see the best trades this week as:

Ready to trade our Forex weekly forecast? Check out our list of the top 10 Forex brokers in the world .

Crypto analyst EWT has made a bullish case for the Dogecoin price, predicting it could rally to as high as $8.5. His analysis explained why the foremost meme coin could reach such an ambitious price target.

In an X post, EWT predicted that the Dogecoin price could rally to $8.5. This prediction followed his analysis of DOGE’s daily chart, in which he claimed that the current price action shows that the meme coin is in a 1 to 2 subwave set-up, which increases the likelihood of a rally to $6. His accompanying chart showed that Dogecoin could correct to as low as $1.2 once it hits $6.

Following the corrective move to $1.2 in wave 4, Dogecoin would witness another impulsive move to the upside, which would send it to the $8.5 price target in Wave 5. The chart also suggested that the foremost meme coin could surpass the $8.5 price target and possibly reach double digits.

EWT had earlier told market participants to prepare for huge moves from the Dogecoin price this year while analyzing the meme coin on the higher timeframe. Back then, his accompanying chart showed that DOGE could reach $20 or even $45 if it got to the upper boundary of the ascending channel.

These targets hint that DOGE’s bull run isn’t over, seeing as the Dogecoin price could still reach a new all-time high (ATH) in this market cycle. The foremost meme coin is currently struggling to reclaim the psychological $0.2 level as support. However, crypto analysts like Trader Tardigrade have predicted that a bullish reversal could happen soon enough, sending the meme coin to new highs.

Crypto analyst DOGECAPITAL has also predicted that the Dogecoin price could rally above $10 in this market cycle. His latest analysis noted that DOGE’s weekly candle continues to hold above the same parallel line level, mirroring its behavior during the 2017 and 2021 cycles. The analyst remarked that once the meme coin’s bottom is fully confirmed, the second phase is expected to begin, marking a dramatic surge as Dogecoin moves toward the range between $2 and $5.

DOGECAPITAL stated that his target for phase 3 is the parallel red zone, which mirrors previous cycles where the Dogecoin price reached its peak before starting a new cycle. He noted that as of today, the bottom of that red zone sits at $26 and is gradually increasing over time due to the slope of the line. The analyst asserted that this represents his minimum target for this cycle.

At the time of writing, the Dogecoin price is trading at around $0.19, down in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

When your energy levels are low, you might intuitively brew a cup of joe—but tea can offer similarly high levels of caffeine to help boost your energy, and there are multiple options to choose from. Black tea is a dietitian-approved favorite for boosting energy levels, according to Tiffany Bruno, MS, RDN. “It has a great combination of caffeine (40 to 70 mg per cup), plus l-theanine (about 25 mg per cup),” she explains. “It’s also affordable and incredibly easy to find anywhere from grocery stores to gas stations, hotel lobbies to coffee shops, making it an accessible option for your everyday energy needs.” According to a nutrition expert, here’s what you should know about black tea, its energy-related benefits, and additional options for caffeine-infused teas.

Unlike many popular teas, black tea is especially high in l-theanine. “L-theanine is an amino acid that has a relaxing effect that counters the effects of caffeine,” Bruno says. “It eases jitters that often occur from coffee or energy drinks, plus helps prevent a crash when the caffeine wears off.” In fact, one study found that a standard cup of black tea contained the most l-theanine compared to other popular caffeinated teas, with green tea containing the lowest amount of l-theanine.

Bruno explains that although “most people associate green tea with l-theanine, its content is not actually that high,” she says. “In my professional opinion, black tea is the best for boosting energy.”

Although black tea is Bruno’s preferred choice when trying to boost energy levels, she offers three more tea selections that can help you feel energized when that inevitable midday crash occurs.

“Matcha tea has more l-theanine than black tea because of the way it is processed and consumed, which might help some people feel more alert,” Bruno explains. However, she offers some advice for those looking for a matcha energy boost: avoid all the added sugars. “While the sugar might contribute to giving you some energy, it can also lead to a crash and low blood glucose level later in the day. So if you want to try matcha for an energy boost, try to minimize the added sweeteners.”

“White tea is pretty underrated in my opinion,” Bruno says. “My personal favorite is peach white tea that tastes like a warm summer day, and is sweet without adding any sugar. It has a moderate amount of caffeine and l-theanine as well, giving that balanced energy boost.” The best part? White tea has added benefits, including lowered blood pressure and improved circulation, along with a reduced risk of developing heart disease.

For those who are sensitive to high levels of caffeine—but still want that energy boost—Bruno recommends ginseng tea. “It contains active compounds called ginsenosides, which have been shown to help reduce fatigue,” she says. Plus, it helps strengthen immunity, decrease stress, and fight off infections and diseases.

While traditional altcoins like Cardano grapple with the recent market downturn, Rollblock’s breakout continues to raise eyebrows in the altcoin space, as its strong performance signals a shift in market trends.

With their potential to alter the current landscape, many investors are paying more attention to promising projects with low market cap entries. This article explains why thousands are swapping their ADA tokens for RBLK, and what investors can expect in the coming months.

The $540 billion gambling industry has been proven to be notorious for issues like fraud and lack of accountability. However, for a project that only recently made its debut in the global crypto market, Rollblock is rewriting this story by addressing these problems and building trust through transparency.

Unlike traditional casinos, Rollblock operates with full transparency, breaking away from the industry’s reputation for opacity. Powered by blockchain, it allows players to verify every transaction on-chain, ensuring their bets remain untouched and legitimate. Moreover, the platform employs blockchain verification to prevent fraud, ensuring fair outcomes.

Rollblock has something for everyone as its platform offers over 7,000 exciting games, from poker and Monopoly to slots and sports betting. Transactions are processed quickly, removing delays common in traditional gambling platforms, and smart contracts govern payouts, reducing reliance on centralized entities.

By bridging DeFi and online gaming, creating new opportunities for users looking to earn while playing, too. Rollblock has also introduced a sustainable revenue-sharing model. Instead of passive holding, token holders receive up to 30% of weekly revenue, with 40% redistributed as staking rewards to holders, while the remaining 60% are burned to drive scarcity and strengthen long-term value.

Many established altcoins operate in regulatory gray areas, but Rollblock’s transparency is clearly appealing to risk-averse investors. Ultimately, Rollblock’s breakout signals a shift in crypto utility. By merging revenue-driven incentives with an engaging platform, it disrupts conventional altcoin narratives, setting a new standard for token-backed ecosystems.

Since December 2024, there’s been a gradual decline in ADA’s value and market cap. Between January and March 2025, Cardano has plummeted from $1.13 to $0.92. March’s figure would be lower if not for the recent announcement of a plan to implement a crypto strategic reserve consisting of ADA, XRP, ETH, SOL, and BTC.

Despite all these challenges, there are still some analysts who are optimistic about ADA’s future performance. Projections suggest a potential price increase of 16.53%, which would encourage ADA to initiate a bullish turnaround such as analyst CobraVanguard predicted on February 26. However, it’s important to note that these predictions depend on market conditions and the potential US crypto reserve.

Failure to maintain key support levels could lead to a further decline, potentially bringing the ADA price closer to $0.8. Investors are advised to monitor these developments closely, considering the nature of the crypto market. While there is always room for a reversal, the current trend is a reminder of the importance of prudent and research-driven investments.

As ADA faces increased selling pressure, Rollblock is gaining momentum thanks to its innovative and transparent GambleFi model. With passive income opportunities, RBLK is attracting high-value investors ahead of the next bull run. In the meantime, there’s still an opportunity to join the presale and purchase RBLK tokens for just $0.06.

And the best part? Rollblock currently has a limited-time special bonus offer on purchases. For a limited period, Rollblock March bonus if you refer a friend tokens will be available to you and your friend with a 30% bonus, providing an excellent opportunity to acquire RLBK.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

Disclaimer: This content is provided by a sponsor. FinanceFeeds does not independently verify the legitimacy, credibility, claims, or financial viability of the information or description of services mentioned. As such, we bear no responsibility for any potential risks, inaccuracies, or misleading representations related to the content. This post does not constitute financial advice or a recommendation and should not be treated as such. We strongly advise seeking independent financial guidance from a qualified and regulated professional before engaging in any investment or financial activities. Please review our full disclaimer for more details.