Few Hours Left For Best 5 Crypto Token Listings Today

Top 5 Crypto Token Listings Today: VOOI, BOIL, MOZ, WECAN, JSK Go Live

Key Highlights

-

Five crypto coins are going live on big exchanges today and it creates new trading possibilities.

-

Categories include DeFi, Web3 gaming, EnergyFi, infrastructure, and enterprise blockchain.

-

The current listings are characterized by multiple exchanges, airdrops, and powerful token utilities.

Few Hours Left For Best 5 Crypto Token Listings Today

On December 18, there are several key crypto listings on Binance Alpha, MEXC, BitMart, Gate.io, KuCoin, and Azbit. In the current day, the DeFi trading, Web3 gaming, and real-yield EnergyFi are receiving high demand in the market.

Overview of 5 Crypto Tokens

-

VOOI is an everlasting DEX aggregator that enables dealers to get leveraged trading in several decentralized markets through a single interface to enhance liquidity access, execution effectiveness, and the general trading experience.

-

BoilToken is an EnergyFi project that bridges real-world energy revenues with blockchain, providing staking, governance, and transparent allocation of real yields in a non-inflationary token structure.

-

Lumoz is a Web3 infrastructure protocol that offers AI computing, zero-knowledge services, scalable decentralized applications, node rewards, and advanced blockchain computation across ecosystems.

-

Wecan ($WECAN) is a Swiss blockchain platform that aims at secure data sharing, compliance, identity verification, and regulated digital transactions among banks, enterprises, and financial institutions across the globe.

-

Joysticklabs (JSK) is a Web3 gaming platform that assists developers to create, launch, and scale blockchain games with simple-to-use tools, reward systems, NFTs, and community-driven game economies.

Full Listing Dates & Trading Details of 5 Tokens

1. VOOI Listing Details

-

VOOI Listing Date: December 18, 2025

-

Exchanges: Binance Alpha, KuCoin, Gate.io, MEXC

-

Trading Pairs: VOOI/USDT

-

Gate.io & KuCoin Trading: 13:00 UTC

-

Binance Alpha Airdrop: Starts 12:00 UTC

-

Expected Price: $0.04–$0.06

VOOI is launched on four large platforms at the same time with a high level of initial demand and volatile volatility in the short term.

2. BoilToken ($BOIL) Listing Details

The listing of BOIL is correlated with its presale valuation, providing spot trading to the verified Azbit users with liquidity support and emphasis on the long-term exposure to real yields.

3. Lumoz ($MOZ) Listing Details

-

Lumoz Listing Date: December 18, 2025

-

Exchange: BitMart

-

Trading Pair: MOZ/USDT

-

Trading Time: 10:00 UTC

-

Deposits Open: December 17

Although the listing price is not disclosed, the BitMart launch will provide an important upgrade of MOZ liquidity and global access to users of AI and zero-knowledge infrastructure.

4. Wecan ($WECAN) Listing Details

-

Wecan Listing Date: December 18, 2025

-

Exchange: BitMart

-

Trading Pair: WECAN/USDC

-

Trading Time: 16:00 UTC

-

Initial Launch Price: 0.001 CHF

The list enhances the regulated blockchain presence of Wecan after previous Bitstamp and MEXC integrations, which intensify enterprise-level adoption.

5. Joysticklabs ($JSK) Listing Details

The listing price is not announced, but the MEXC launch will increase the visibility, liquidity, and access of Web3 gaming enthusiasts and developers across the globe.

Tokenomics and Roadmap of 5 Tokens.

1. VOOI Tokenomics and Roadmap

The total supply of VOOI is 1 billion tokens, and 244.21 million are in circulation during its launch. The distribution consists of 31% to the foundation, 27.82% to community growth, 17% to contributors, 13.65% to investors, and 10.53% to airdrops and community sales.

Source: Website

The roadmap is dedicated to platform upgrades, more intensive liquidity aggregation, governance tools, ecosystem growth, and performance optimization, in order to make perpetual trading more accessible and capital-efficient in decentralized markets.

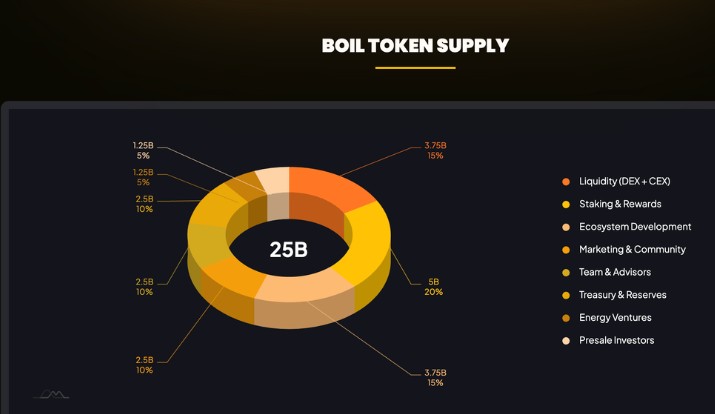

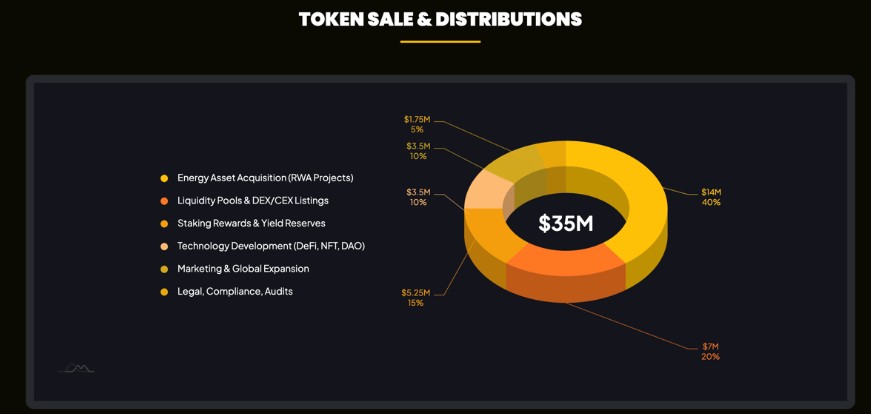

2. BoilToken (BOIL) Tokenomics and Roadmap.

There are 25 billion tokens that are fixed on the BASE network of BOIL. Distribution is comprised of presale (15%), staking and yield reserves (25%), ecosystem growth (20%), team (10%), treasury and buyback (10%), liquidity (10%) and community incentives (5%).

Source: Website

The roadmap involves presale finish, TGE, Azbit and mid-tier CEX listing, staking activation, real-yield payouts, DAO governance rollout and long-term expansion to institutional EnergyFi partnerships.

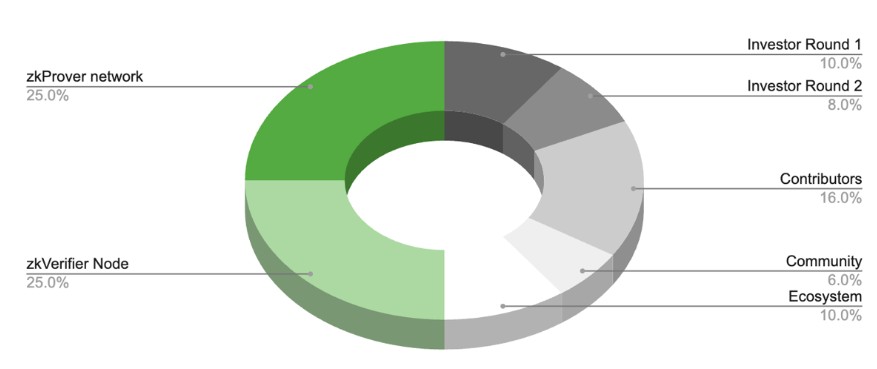

3. Lumoz ($MOZ) Roadmap & Tokenomics.

There are 10 billion MOZ tokens in total supply of Lumoz. The allocation consists of 25 percent compute and verifier rewards, 18 percent investors, 16 percent contributors, 10 percent ecosystem growth and 6 percent community incentives.

Source: Website

MOZ is applied to transaction fees, AI services, zero-knowledge applications, staking and governance through esMOZ. The roadmap has the staking features, NFT integration, launching of the mobile wallet in 2025, expansion of AI ecosystem, and the global partnerships.

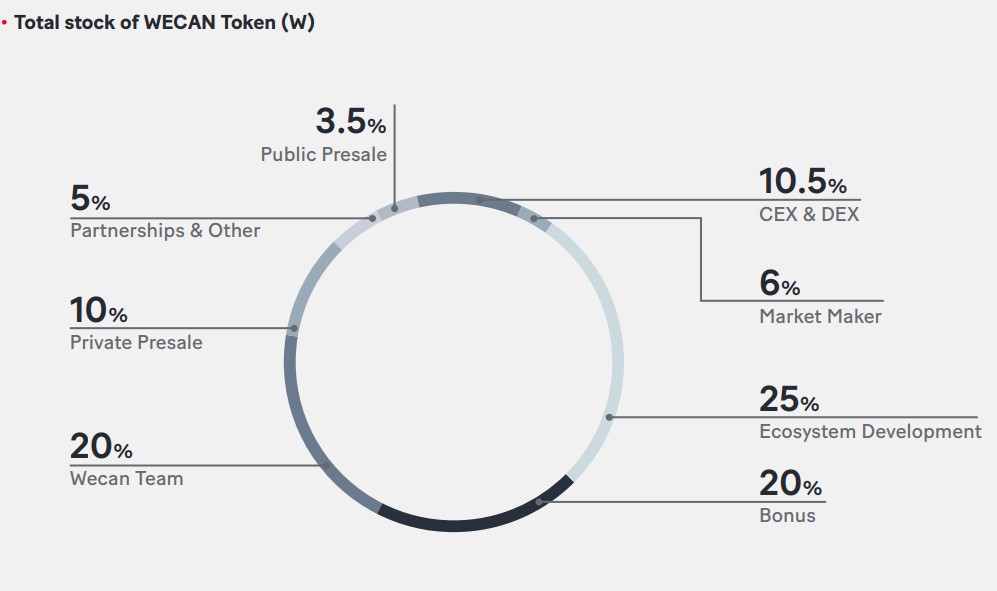

4. Wecan ($WECAN) Tokenomics & Roadmap.

WECAN is fixed to 6 billion tokens that are used in blockchain anchoring fees, data hash storage, and validation of transactions on Wecan Chain. A part of all transactions is burnt, which forms a deflationary model.

Source: Website

Wecan was established in 2015 and released its blockchain and token in 2022, achieving a big listing, and keeps growing internationally. The BitMart listing of 2025 is in favor of enterprise adoption, compliance partnerships, and regulated blockchain developments.

5. Joysticklabs ($JSK) Tokenomics & Roadmap.

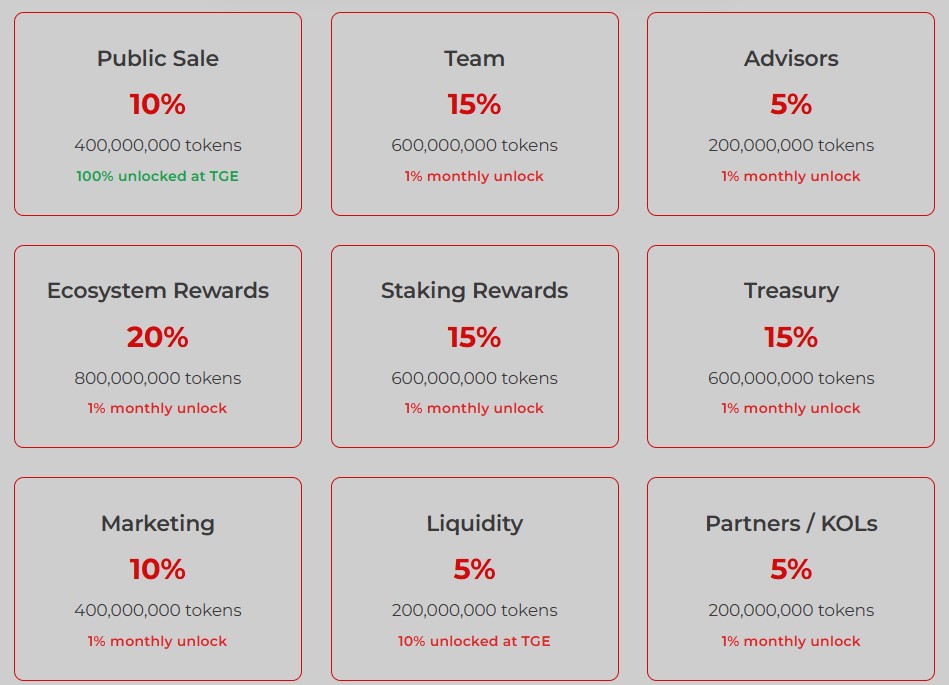

The total supply of Joysticklabs is 4 billion JSK tokens distributed in the public sale, team, advisors, ecosystem rewards, staking, treasury, marketing, liquidity, and partnerships. Public sale tokens are unlocked at TGE and other allocations are vested over 1% monthly.

Source: Official JSK Website

The roadmap includes the development of the platform, the launch of the MVP, general testing, NFT tools, cross-chain integration, the integration of staking, and the features of the game aimed at mass adoption of Web3 gaming.

Which Token could Be Successful After Listing?

Opinion: VOOI and Joysticklabs are the best in terms of momentum today. VOOI enjoys the advantage of multi-exchange exposure and the active trading demand, whereas Joysticklabs accesses the rapidly expanding Web3 gaming market. In the short run, it should be volatile, but in the long run, it will be a matter of adoption, utility, and execution.

Conclusion

The current crypto listings are a good indication of high diversity in sectors. Since trading infrastructure to gaming and real-yield assets, December 18 provides traders and investors with new opportunities supported by real use cases.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.