Dec. 17, 2025 — Solana’s U.S. dollar pair (SOL-USD) is trading around the $123 area as the broader crypto market remains cautious and risk-sensitive, while Solana-specific headlines range from a major network stress test (a large DDoS attack) to fresh security research around post-quantum signatures. [1]

Multiple pricing feeds show SOL down roughly ~3.6% to ~3.8% over the past 24 hours, with heavy turnover and an unusually wide intraday range — a setup that has kept short-term “breakout or breakdown” talk front and center in today’s technical commentary. [2]

SOL-USD price today (Dec. 17, 2025): live snapshot

At the time of writing, widely followed trackers place Solana around $123:

- Price: ~$123 [3]

- 24h change: about -3.6% to -3.8% depending on venue/data source [4]

- 24h volume: roughly $5.4B–$5.9B [5]

- Market cap: about $69.2B; ranked #7 on CoinMarketCap [6]

- Circulating supply: ~562.0M SOL (CoinMarketCap figure) [7]

- Intraday range (example feed):high ~$133.9 / low ~$121.4 on Investing.com’s daily data line for Dec. 17 [8]

Context: CoinGecko also shows SOL down about ~11% over the past 7 days, highlighting that the latest slide is part of a broader December pullback rather than a single-candle move. [9]

Why is Solana (SOL-USD) moving today? Key news and narratives dated Dec. 17, 2025

Today’s SOL price action is being pulled by two forces at once: (1) a risk-off crypto tape and (2) Solana-specific headlines that are, paradoxically, long-term constructive even as price chops lower in the short term.

1) The macro tape is still pressuring crypto risk

Reuters reports crypto investors have become more cautious after the market’s downturn from October highs, with greater emphasis on hedged/active strategies and risk management tools. That kind of positioning shift can reduce dip-buying urgency in large-cap alts like SOL. [10]

(Separate market coverage also points to crypto behaving more like a risk asset than a gold-like hedge in this phase, which can keep pressure on majors when sentiment turns defensive.) [11]

2) Solana “stress test” headlines: week-long DDoS attack, but no downtime

A widely discussed Solana story on Dec. 17 is the network’s ability to remain operational through a massive DDoS attack. Unchained reports the attack lasted over a week and peaked around 6 Tbps, yet the network appeared “unimpacted” and saw zero downtime or performance degradation in that account. [12]

Unchained also notes Solana co-founder Anatoly Yakovenko publicly framed the attack as “bullish” in the sense that an attacker was allegedly spending heavily to generate traffic without taking the chain down—adding to the narrative that Solana’s infrastructure resilience has improved. [13]

Why it matters for SOL-USD: In past cycles, Solana’s reliability has been a major investor talking point. Stories that emphasize resilience can strengthen long-term confidence, but they don’t always translate into immediate upside if the overall market is risk-off.

3) Post-quantum security enters the conversation: “quantum-resistant signatures” on testnet

Another major Dec. 17 headline: Cointelegraph (via TradingView) reports the Solana Foundation partnered with Project Eleven for a quantum computing threat assessment and prototyped a Solana testnet using post-quantum digital signatures, claiming end-to-end “quantum-resistant transactions” can be practical and scalable. [14]

BeInCrypto similarly reports Solana deployed post-quantum signatures on a testnet as a proactive security measure amid growing industry focus on quantum readiness. [15]

Why it matters for the forecast: This is not a “next week” price catalyst in most models, but it supports a longer-term investment narrative: Solana positioning itself as infrastructure that can evolve with future security standards.

4) Institutional rails keep expanding: Visa’s USDC settlement over Solana

Although announced Dec. 16, Visa’s move is part of what traders are still digesting on Dec. 17 because it directly references Solana in a TradFi settlement context. Visa says initial U.S. banking participants Cross River Bank and Lead Bank have begun settling with Visa in USDC over the Solana blockchain, with broader availability planned through 2026. [16]

Why it matters for SOL-USD: Even when SOL token price doesn’t respond immediately, the “Solana as payments/settlement infrastructure” storyline is strengthened when a global network like Visa names Solana as a settlement rail in an official release.

5) Tokenization momentum (recent context still relevant today)

Earlier this month, Reuters reported J.P. Morgan arranged a $50 million short-term debt deal for Galaxy Digital on Solana’s blockchain, with USDC used in the flow—another signal of institutional experimentation on Solana. [17]

Separately, State Street Investment Management and Galaxy Asset Management announced plans (Dec. 10) for the State Street Galaxy Onchain Liquidity Sweep Fund (SWEEP), anticipating ~$200 million seed from Ondo Finance and an early 2026 debut on Solana, using stablecoins (including PYUSD) for subscriptions and redemptions. [18]

Galaxy’s own research recap from Breakpoint week framed these types of announcements as evidence of ecosystem maturation and increasing institutional traction around the “internet capital markets” thesis. [19]

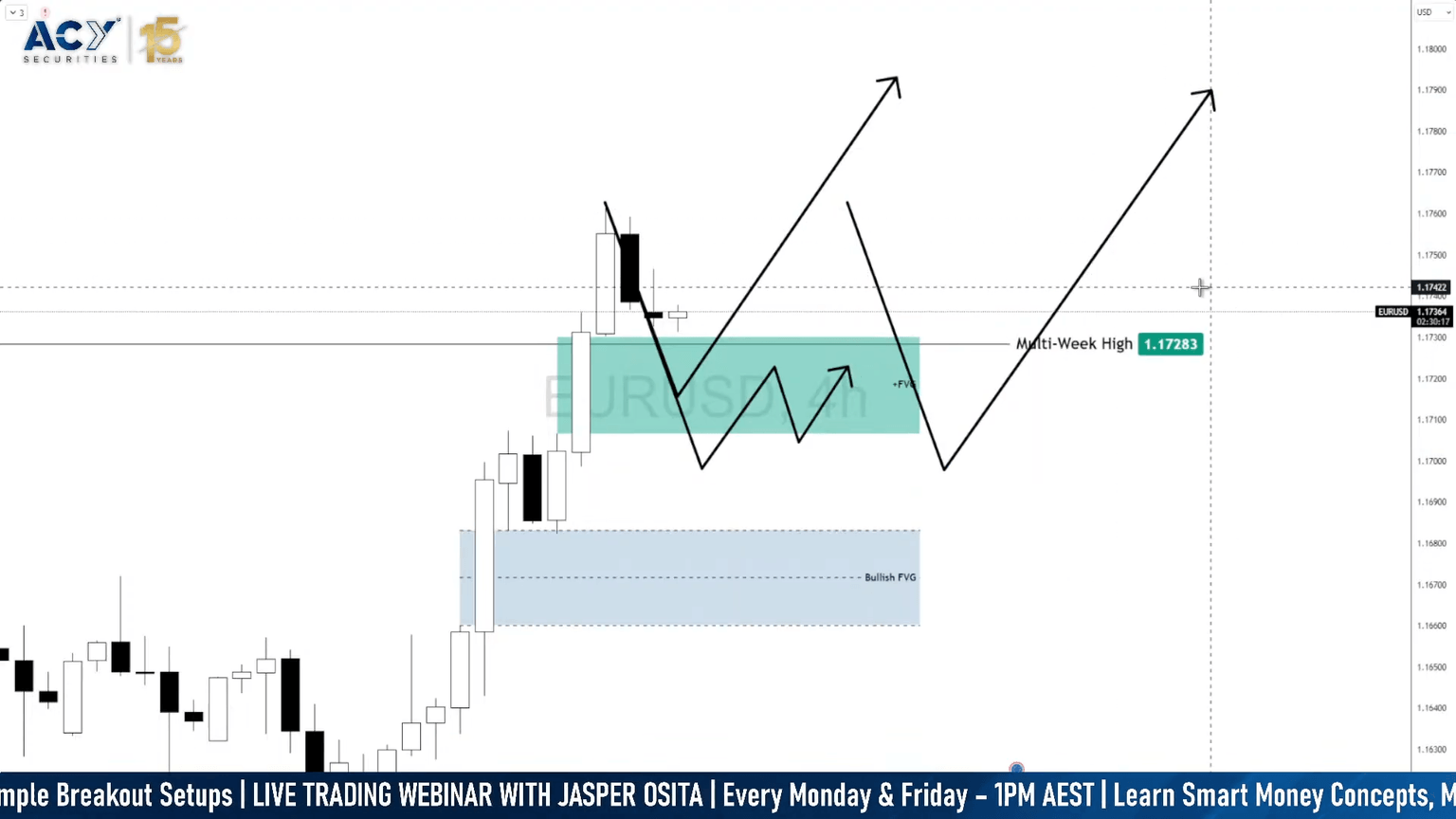

SOL-USD technical analysis today: the key levels analysts are highlighting (Dec. 17)

Today’s technical commentary is unusually aligned on one point: SOL is coiling, and the next big move likely depends on whether support breaks or holds.

The support zone: $120–$122 is the market’s “line in the sand”

- Crypto.news describes SOL compressed near $122 support, warning repeated retests can weaken support and that a breakdown could open a move toward $100. [20]

- Brave New Coin similarly emphasizes $120 as a critical support zone, describing price compression in the $120–$130 area and highlighting downside risk if $120 fails. [21]

The “range floor” many are watching: ~$124–$126

- Altcoin Buzz notes support near $124.5 being tested amid weak momentum and EMA resistance overhead. [22]

- A NewsBTC technical write-up syndicated on CryptoRank points to supports around $126 and $124, describing SOL trading below ~$130 with resistance around $132. [23]

Overhead resistance: $130–$132 first, then $135+

- CryptoRank/NewsBTC flags the $130 and $132 area as the near-term hurdle, with $132 highlighted as a trendline-type resistance in its framing. [24]

- Altcoin Buzz similarly references overhead moving-average resistance and identifies a mid-range area that has stalled price action. [25]

Takeaway: Market structure is “compressed.” In practice, that often means traders watch for a decisive move below ~$120–$122 (bearish expansion) or a reclaim above ~$132 (bullish relief rally). [26]

Solana price forecast (SOL-USD): outlook for the next 24 hours, this week, and into early 2026

No forecast is guaranteed—crypto is notoriously headline- and liquidity-driven—but today’s mix of price structure and news flow lends itself to scenario-based expectations.

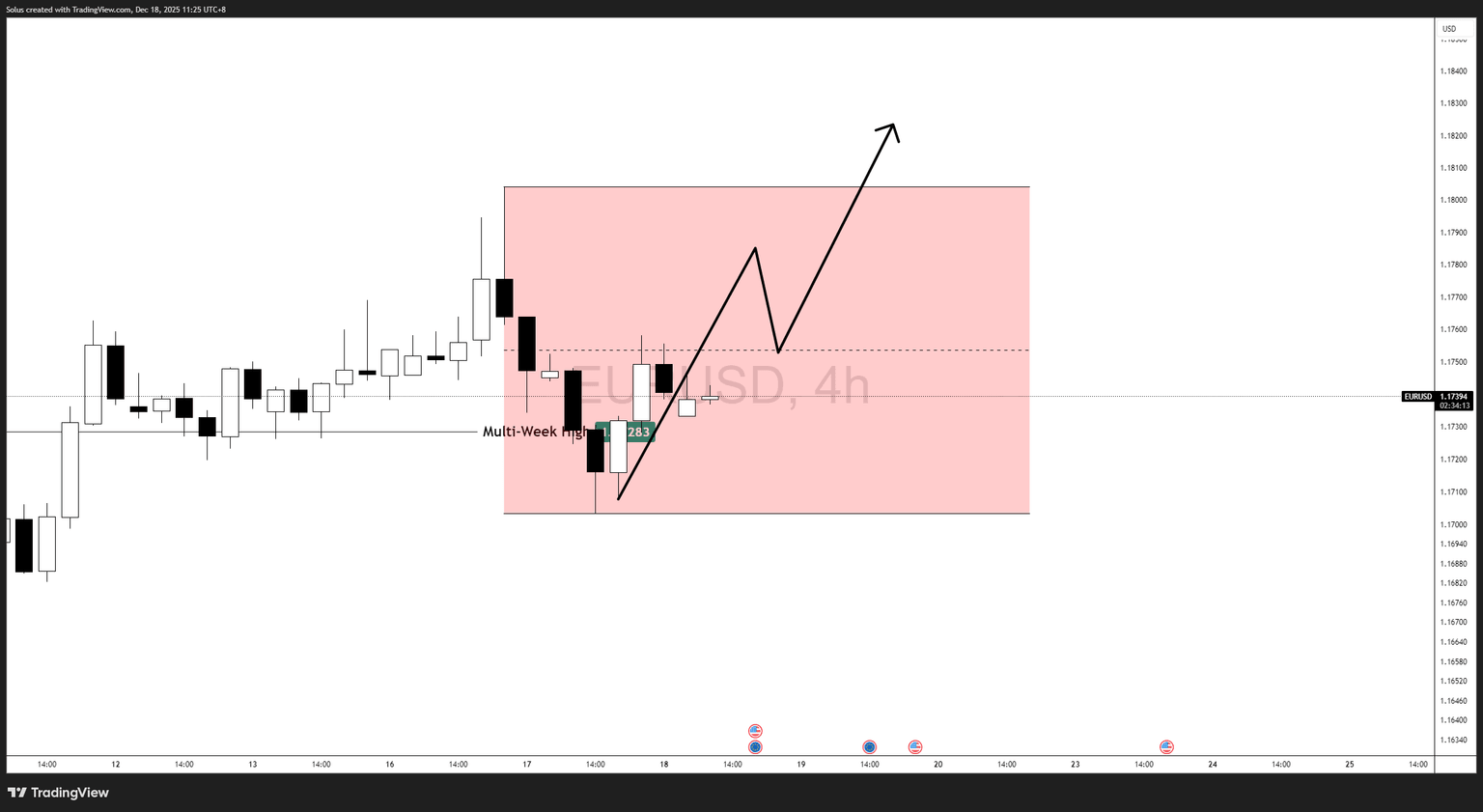

Base case (near-term): choppy range trading while SOL holds $120–$122

Given the tight compression highlighted by multiple analysts, a common near-term path is continued sideways-to-choppy trade as long as SOL holds the widely watched support band. [27]

In this base case, traders often look for mean reversion toward the $130–$132 area (the first meaningful resistance cluster) rather than an immediate trend reversal. [28]

Bullish scenario: reclaim $132, then aim for mid-$130s and higher

A bullish break typically requires SOL to:

- Clear ~$130, and

- Flip ~$132 from resistance into support (a level repeatedly cited in today’s analysis). [29]

If that happens, some technical roadmaps start pointing toward $135 and beyond (with higher resistance levels mentioned in certain write-ups), though follow-through will likely depend on whether the broader crypto market stabilizes. [30]

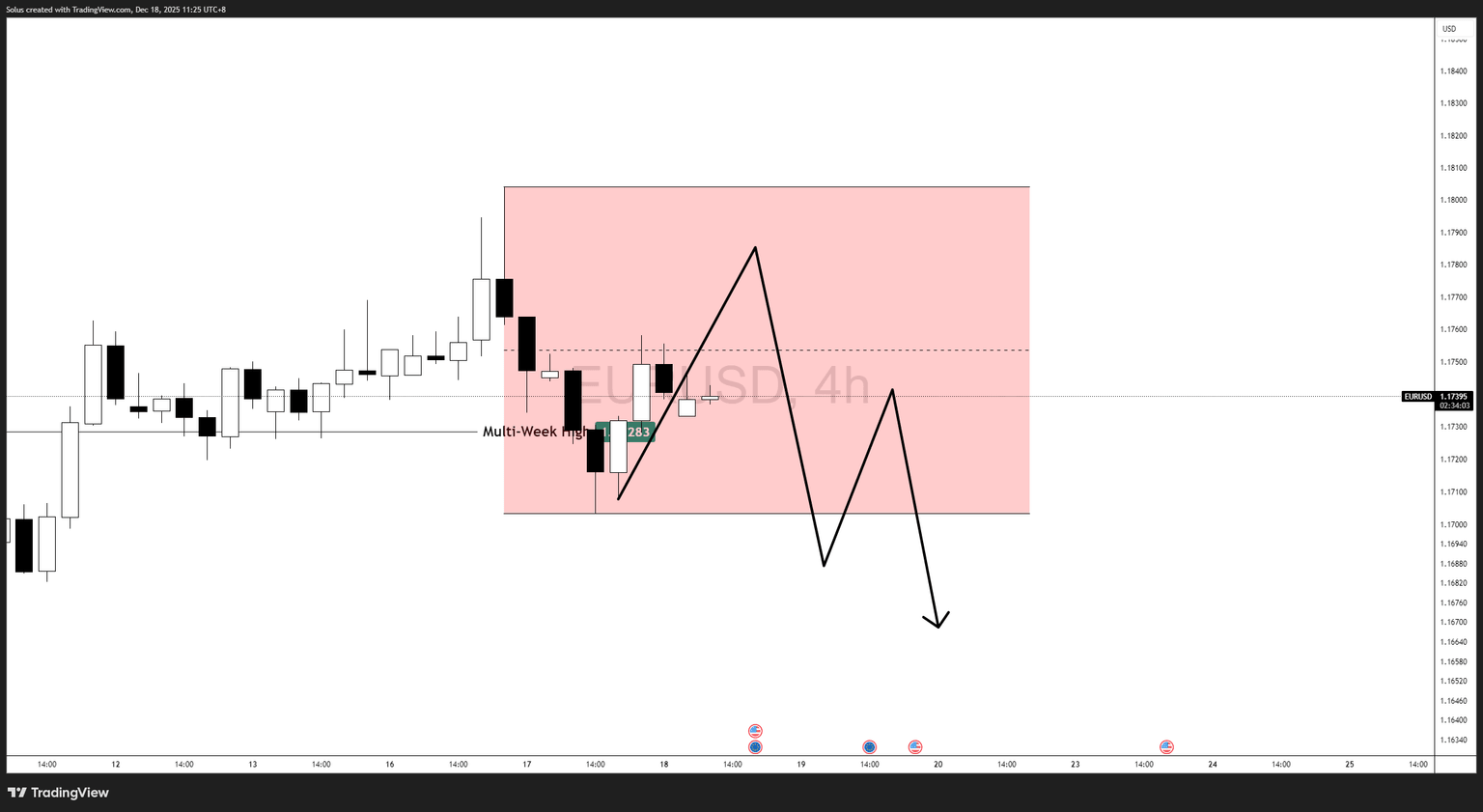

Bearish scenario: lose $120–$122 and momentum targets $100 psychology

If SOL loses the $120–$122 support area decisively, analysts highlighting the compression pattern argue the move could accelerate, with $100 often cited as a psychological downside target from the current structure. [31]

This scenario becomes more plausible if macro-driven crypto weakness persists and risk appetite remains subdued. [32]

What “forecast models” are saying today (and why they differ)

A number of widely circulated SOL price prediction pages updated around this period broadly cluster around “low $120s to low/mid $130s” for late December, but they vary meaningfully on timing and volatility assumptions.

- Changelly projects a December 2025 range roughly $126.57 to $133.90, with an average near $130.24. [33]

- CoinCodex suggests SOL around $131.09 by Dec. 18, 2025, and presents a higher target around $145.94 by mid-January 2026 in its forward path. [34]

Important nuance: These models can lag real-time developments (macro shocks, security headlines, liquidity events) and may not “understand” Solana-specific catalysts like Visa settlement rails or post-quantum testnets in a fundamental sense. Treat them as reference points, not promises. [35]

What to watch next for SOL-USD (the short checklist)

If you’re tracking SOL-USD into the end of 2025, today’s coverage suggests five practical watch items:

- Support integrity: does SOL continue defending $120–$122, or do repeated tests finally break? [36]

- Resistance clearance: can SOL reclaim $130–$132 and hold it? [37]

- Network confidence headlines: follow-ups on the DDoS story and any additional technical disclosures about mitigations. [38]

- Institutional adoption signals: progress or additional partners around Visa’s USDC settlement rail on Solana. [39]

- Macro risk sentiment: whether the broader crypto market continues to de-risk (which tends to hit alts) or starts to recover. [40]

Bottom line

On Dec. 17, 2025, Solana USD (SOL-USD) sits at a technically sensitive spot near $123, with analysts largely converging on a simple framework: $120–$122 is key support; $130–$132 is the first major resistance. [41]

Meanwhile, Solana’s news cycle is unusually infrastructure-heavy—DDoS resilience, post-quantum signature experiments, and large institutional rails name-checking Solana for settlement—suggesting the ecosystem story remains active even as price stays tied to a cautious, risk-off crypto tape. [42]

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency prices can change rapidly, and different data providers may show slightly different prices due to exchange and methodology differences. [43]

References

1. coinmarketcap.com, 2. coinmarketcap.com, 3. coinmarketcap.com, 4. coinmarketcap.com, 5. coinmarketcap.com, 6. coinmarketcap.com, 7. coinmarketcap.com, 8. www.investing.com, 9. www.coingecko.com, 10. www.reuters.com, 11. www.barrons.com, 12. unchainedcrypto.com, 13. unchainedcrypto.com, 14. www.tradingview.com, 15. beincrypto.com, 16. usa.visa.com, 17. www.reuters.com, 18. investors.statestreet.com, 19. www.galaxy.com, 20. crypto.news, 21. bravenewcoin.com, 22. www.altcoinbuzz.io, 23. cryptorank.io, 24. cryptorank.io, 25. www.altcoinbuzz.io, 26. crypto.news, 27. crypto.news, 28. cryptorank.io, 29. cryptorank.io, 30. cryptorank.io, 31. crypto.news, 32. www.reuters.com, 33. changelly.com, 34. coincodex.com, 35. usa.visa.com, 36. crypto.news, 37. cryptorank.io, 38. unchainedcrypto.com, 39. usa.visa.com, 40. www.reuters.com, 41. coinmarketcap.com, 42. unchainedcrypto.com, 43. coinmarketcap.com