Copper is closing out 2025 with the kind of price action usually reserved for crisis commodities: sharp rallies, sudden air pockets, and a market that looks tight in some places and oddly comfortable in others. Midway through December, London Metal Exchange (LME) copper is still trading at historically elevated levels after repeatedly printing new highs this month—supported by supply disruptions, policy-driven shifts in global inventory, and a fresh narrative that “AI infrastructure is the new mega-demand driver.” [1]

So what’s the most realistic copper price forecast for December 2025—not next year, not “the decade of electrification,” but the final stretch of this month?

Based on the latest price signals, inventory movements, and the newest forecasts and analyst notes published over the past several days, the most defensible view is this: copper prices are likely to remain high and volatile through the rest of December 2025, with a market bias to hold above $11,000/ton—unless a risk-off shock or a sudden reversal of U.S.-centric stockpiling breaks the spell. [2]

Copper price right now: the key levels shaping December 2025

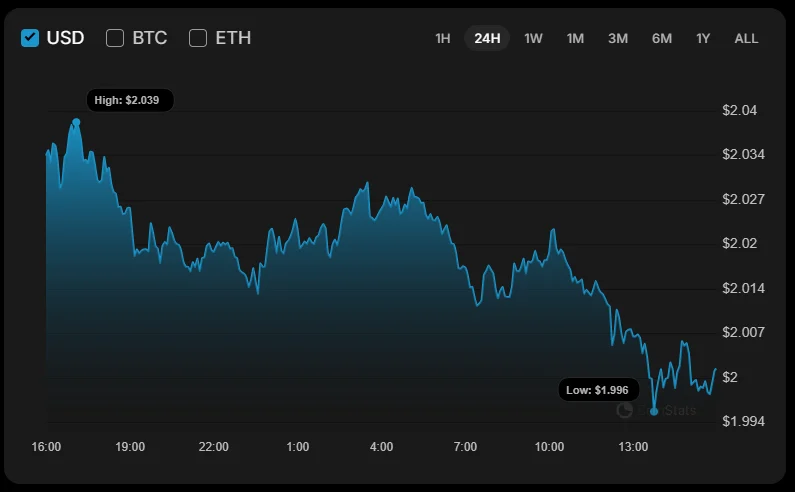

The latest day-delayed LME three-month closing price shows copper at $11,515 per metric ton (down 3.01% on the day shown). [3]

But the bigger signal for December is the ceiling copper has been testing: Reuters reported LME three-month copper touched $11,952/ton in intraday trading this month, keeping the market within reach of the psychologically important $12,000 threshold that traders and procurement desks watch closely. [4]

Shanghai has been reinforcing the bullish tone. Reuters also reported the most-traded Shanghai Futures Exchange (SHFE) copper contract hit fresh records around 94,570 yuan/ton during the same rally, highlighting that the bid isn’t purely a London or U.S. story. [5]

What this means for a December 2025 forecast: the market has already proven it can trade in the high-$11,000s and flirt with $12,000. The real question is whether it can stay there into month-end as liquidity thins and macro headlines hit.

Why copper is surging in December 2025: three forces dominating the tape

Copper’s late-2025 strength isn’t a single narrative. It’s a triangle: (1) supply disruptions, (2) tariff-driven stock movements, and (3) demand stories that are bigger than construction.

1) Supply shocks are stacking up—and the market is treating them as structural

Recent analysis from ING points to a year of disruptions tightening the near-term balance, naming major incidents and outages at key global operations (including Indonesia’s Grasberg, the DRC’s Kamoa-Kakula, and Chile’s El Teniente), while also flagging broader issues like declining ore grades and operational setbacks in top-producing regions. [6]

The market takeaway: even when demand is debated, supply uncertainty is real—and it’s being priced like a risk premium.

2) The copper market is “fractured” by U.S. tariff uncertainty and inventory pull

One of the most important December 2025 dynamics is that the copper market is tight outside the United States—while U.S. exchange inventories have swelled.

Reuters commentary described a “market fracture” where the U.S. has become a magnet for copper due to lingering tariff uncertainty and pricing distortions between COMEX and the LME—encouraging physical metal to flow into U.S. warehouses. [7]

In parallel, Reuters reporting this month highlighted that COMEX stocks now account for a large share of exchange-traded copper, reinforcing the idea that a significant slice of “visible inventory” has been effectively ring-fenced in the U.S. system. [8]

ING’s latest note adds more color: it argues that tariff risk and arbitrage have distorted global flows, leaving ex-U.S. inventories low, and warns that if tariff expectations change, stock could flow back out—potentially flipping the price dynamic quickly. [9]

3) AI and grid investment have become a headline catalyst (even when traditional data is mixed)

Reuters’ latest round-up on the copper rally explicitly linked the move toward $12,000 to surging demand tied to AI-powered data centers and power infrastructure, alongside renewable energy and electrification themes. [10]

At the same time, the “Doctor Copper” signal is complicated: manufacturing data in several regions has not been uniformly strong, yet copper is behaving as if demand is roaring—because the market is also pricing future infrastructure buildouts and near-term supply risk. [11]

China check: the biggest swing factor for the rest of December 2025

No December copper forecast is credible without a China reality check—because China remains the world’s dominant copper consumer and a major force in refined metal flows.

Two recent developments matter:

- Chinese refined copper imports weakened in November as prices surged, which Reuters framed as an example of high prices reshaping trade behavior as much as “real demand” does. [12]

- Meanwhile, more Chinese-origin copper has been showing up in LME warehouse stocks, with Reuters reporting that the share of on-warrant copper of Chinese origin rose to 85% and that absolute Chinese copper stocks on the LME increased (linked to profitable export economics). [13]

Those signals can coexist: China can be price-sensitive at the margin (imports dip) while still exporting or repositioning refined metal when arbitrage windows open.

On the policy side, sentiment got a lift after Chinese leaders signaled continued support for fiscal policy heading into 2026—news that Reuters said helped propel both SHFE and LME copper during the latest leg higher. [14]

Bottom line for December: China is unlikely to be a straight-line demand story. For the rest of the month, traders will watch whether policy optimism translates into sustained buying—or whether high prices keep triggering demand resistance.

Copper price forecast for December 2025: base case, bull case, bear case

Here’s a forecast framework that matches what markets are signaling right now—and what the latest analyst notes suggest about support, upside, and the risks that could break the trend.

Base case (most likely): elevated range, with $11,000 acting as the market’s “line in the sand”

Forecast range:$11,000–$11,900 per ton for LME three-month copper into late December

Most likely month-end zone:mid-to-high $11,000s, assuming no major macro shock

Why this is the base case:

- ING explicitly argues that near-term disruptions should help keep a floor around $11,000/ton, while also suggesting prices may remain rangebound without stronger demand confirmation. [15]

- LME pricing in mid-December (day-delayed close around $11,515) supports the view that the market is consolidating at very high levels rather than collapsing. [16]

- Reuters’ reporting around the recent record highs shows the market already tested the upper end near $12,000—so a broad high-$11,000s range is consistent with observed trading. [17]

Bull case: a clean break above $12,000 if inventory tightness deepens or another supply surprise hits

Forecast range:$11,900–$12,400 per ton (with brief spikes possible)

Catalysts that could trigger the bull case before month-end:

- Further visible inventory draws or sudden cancellations in LME stocks, extending the “ex-U.S. tightness” narrative. [18]

- Another supply disruption headline (or slower-than-expected recoveries at major mines) that forces short covering. [19]

- Continued policy optimism from China coupled with a supportive macro impulse (lower rates / weaker dollar).

Bear case: pullback toward (or below) $11,000 if risk sentiment snaps or if demand destruction becomes the dominant story

Forecast range:$10,700–$11,200 per ton

Bear-case triggers:

- A broader “risk-off” episode—especially if markets extend fears around tech valuations and speculative positioning unwinds. Copper has already shown it can drop sharply after record highs when macro sentiment flips. [20]

- Clear evidence that high prices are shutting down physical buying in key markets (China in particular), echoing the price-driven import weakness Reuters highlighted. [21]

- Any surprise shift in the tariff/stockpiling dynamic that suggests U.S. inventories could be released back into global circulation sooner than expected (a risk ING specifically flags as meaningful). [22]

What the newest analyst forecasts say: the market is split into two camps

A key feature of December 2025 is that forecasters are not aligned. Some see this as the start of a multi-year supercycle move. Others see a near-term peak that will cool once stockpiling fades and surplus asserts itself.

The “tightness persists” camp: $12,000+ is plausible again, and $13,000 is being modeled for 2026

Over the past week, multiple bullish forecasts have been circulating:

- ANZ Research expects copper prices to remain above $11,000/ton in 2026, with inventories potentially drawing down by 450 kt, and sees scope for prices to near $12,000 by end-2026. [23]

- Citi has been cited in market reporting as targeting $13,000/ton over the next 6–12 months. [24]

- J.P. Morgan has been referenced in mining-sector coverage projecting an average around $12,500/ton in Q2 2026, driven by tightness and supply-side constraints. [25]

- Fastmarkets has argued copper remains “uniquely strained” among base metals, pointing to low inventories, physical tightness and squeezed treatment charges as a continuing theme. [26]

Even if those are primarily 2026 forecasts, they matter for December 2025 because the market trades forward: when banks raise targets and deficits are discussed, it can keep dips shallow into year-end.

The “surplus and normalization” camp: 2026 could cool into a $10,000–$11,000 range

Goldman Sachs Research published a more cautious view in the last few days:

- Goldman expects copper prices to decline somewhat in 2026 from record highs, forecasting an LME range of $10,000–$11,000 and an average of $10,710 in H1 2026—arguing a global surplus limits sustained upside above $11,000 next year. [27]

- Goldman also expects the global copper market to end 2025 in a surplus (their estimate: 500 kt), which directly challenges the idea that today’s high prices are purely “shortage pricing.” [28]

Why this matters for December 2025: if traders begin to believe the “surplus” framing into year-end, rallies can fade faster—especially during thin holiday liquidity.

M&A is heating up—and it’s part of the copper story now

When copper prices surge, miners get pressured to secure long-life, high-quality assets. This month’s deal headlines are reinforcing the market’s long-term conviction—even if they don’t change December spot balances overnight:

- Teck Resources shareholders approved a merger with Anglo American in an all-stock deal intended to create a major copper producer, with Reuters noting the consolidation is linked to expectations of rising copper demand tied to AI and electrification. [29]

- China’s Jiangxi Copper sweetened its bid for SolGold, another signal of a global scramble for copper assets as producers and state-linked players compete for future supply pipelines. [30]

For the December 2025 forecast, M&A is mostly a sentiment factor—but sentiment matters when the market is already stretched near records.

The rest-of-December watchlist: the headlines most likely to move copper next

If you’re tracking copper prices through the remainder of December 2025, these are the catalysts that can realistically shift the market within days—not quarters.

- LME inventory changes and cancellation activity

December has already shown that visible inventory signals can move prices rapidly. [31]

- COMEX/LME spread and U.S. policy/tariff expectations

The “U.S. stockpiling vs ex-U.S. tightness” theme remains one of the most important drivers of current structure. [32]

- China demand indicators (imports, premiums, and stimulus follow-through)

Imports weakening on high prices versus policy-driven optimism is a central tug-of-war for the remainder of the month. [33]

- Supply disruption headlines (or credible resolution timelines)

Markets are trading supply risk aggressively; clarity can cool volatility, while fresh problems can reignite it. [34]

- Risk sentiment around AI and broader markets

Copper has been tied into the “AI buildout” narrative—and that means shocks to tech sentiment can spill into copper positioning. [35]

Outlook: where copper is most likely to land by late December 2025

Copper’s December 2025 setup is unusual: it’s bullish for reasons that are partly fundamental (real supply disruptions, tightness outside the U.S.) and partly structural/policy-driven (tariff uncertainty and inventory relocation). [36]

That mix typically produces two things:

- High prices persist longer than skeptics expect

- But volatility stays elevated, because a single policy clarification or a shift in macro mood can unwind part of the move quickly

Putting it together, the most realistic forecast for the remainder of December 2025 is a high but choppy market, with $11,000/ton as the key support area and $12,000/ton as the level that defines whether copper ends 2025 in full breakout mode—or in consolidation. [37]

This article is for informational purposes only and does not constitute investment advice.

References

1. www.lme.com, 2. think.ing.com, 3. www.lme.com, 4. www.tradingview.com, 5. www.tradingview.com, 6. think.ing.com, 7. www.reuters.com, 8. www.reuters.com, 9. think.ing.com, 10. www.reuters.com, 11. www.reuters.com, 12. www.reuters.com, 13. www.reuters.com, 14. www.tradingview.com, 15. think.ing.com, 16. www.lme.com, 17. www.tradingview.com, 18. www.reuters.com, 19. think.ing.com, 20. energynews.oedigital.com, 21. www.reuters.com, 22. think.ing.com, 23. www.tradingview.com, 24. www.tradingview.com, 25. www.northernminer.com, 26. www.fastmarkets.com, 27. www.goldmansachs.com, 28. www.goldmansachs.com, 29. www.reuters.com, 30. www.reuters.com, 31. www.reuters.com, 32. think.ing.com, 33. www.reuters.com, 34. think.ing.com, 35. energynews.oedigital.com, 36. think.ing.com, 37. think.ing.com