The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

The main category of Forex News.

You can use the search box below to find what you need.

[wd_asp id=1]

After spending the first half of the day under bearish pressure on Wednesday, EUR/USD stage a late rebound to close marginally lower. The pair stays quiet near 1.1750 in the European morning on Thursday as investors stay on the sidelines ahead of the European Central Bank’s (ECB) monetary policy announcements and November inflation data from the US.

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.01% | 0.12% | 0.03% | 0.06% | 0.65% | 0.68% | -0.12% | |

| EUR | 0.00% | 0.13% | 0.02% | 0.06% | 0.69% | 0.69% | -0.10% | |

| GBP | -0.12% | -0.13% | 0.00% | -0.07% | 0.55% | 0.55% | -0.24% | |

| JPY | -0.03% | -0.02% | 0.00% | 0.04% | 0.64% | 0.64% | 0.08% | |

| CAD | -0.06% | -0.06% | 0.07% | -0.04% | 0.62% | 0.62% | -0.02% | |

| AUD | -0.65% | -0.69% | -0.55% | -0.64% | -0.62% | 0.00% | -0.79% | |

| NZD | -0.68% | -0.69% | -0.55% | -0.64% | -0.62% | -0.00% | -0.79% | |

| CHF | 0.12% | 0.10% | 0.24% | -0.08% | 0.02% | 0.79% | 0.79% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The ECB is widely anticipated to leave key rates unchanged after the last meeting of the year. Revised macroeconomic projections could influence the Euro’s valuation. In case there is a positive revision to Eurozone growth expectations, investors could see this as a sign of a neutral/hawkish policy outlook next year. In this scenario, EUR/USD could regather its bullish momentum. Conversely, a downward revision to inflation forecasts, combined with a weaker growth outlook, could weigh on the Euro with the immediate reaction.

Following the ECB event, investors will pay close attention to the US inflation data. On a yearly basis, the Consumer Price Index (CPI) and the core CPI are forecast to rise by 3.1% and 3%, respectively, in November. In case the headline CPI comes in above the market expectation, the USD could hold its ground and cause EUR/USD to stretch lower. On the other hand, a soft CPI print could revive expectations for another Federal Reserve (Fed) rate cut in January and trigger another leg lower in the USD, opening the door for a bullish EUR/USD action in the American session.

According to the CME FedWatch Tool, markets are currently pricing in about a 25% probability of a 25-basis-points Fed rate cut next month.

The 20-period Simple Moving Average (SMA) has flattened around price, while the 50-, 100- and 200-period SMAs rise at 1.1705, 1.1662 and 1.1608, keeping a bullish alignment with spot above them. The Relative Strength Index (14) stands at 54, neutral and edging higher.

Immediate resistance aligns at 1.1765 (mid-point of the ascending regression channel), followed by 1.1800-1.1810 (round level, upper limit of the ascending channel).

The lower limit of the ascending channel and the 50-period SMA form a support area at 1.1700-1.1700, followed immediately by the rising trend line near 1.1680. A close below the latter could attract technical sellers and trigger another lef lower toward the 100-period SMA near 1.1660.

(The technical analysis of this story was written with the help of an AI tool).

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Hindustan Copper Ltd (NSE: HINDCOPPER, BSE: 513599) surged in Thursday’s trade (December 18, 2025), climbing about 5% and hovering just shy of its 52-week high zone. By early afternoon, the stock was trading around ₹387–₹388, while the broader metal pack also stayed positive. [1]

What made the move stand out wasn’t only the price: it was the activity. Hindustan Copper featured among the day’s most actively traded names by value, with turnover around ₹401.8 crore and volume above 1.06 crore shares in the session’s early hours—classic “crowd just showed up” behaviour. [2]

Below is a detailed news-and-analysis wrap of what’s happening as of 18.12.2025, plus the major forecasts (commodity and company-related), broker views, and the key risks market participants are watching.

Intraday data points were loud and clear: buyers were willing to chase the stock closer to its 52-week ceiling.

At the sector level, the BSE Metal index was also higher (around +0.7% at the time of reporting), which matters because metals rallies often move in packs—macro tailwinds first, stock-specific momentum second. [7]

One caution flag inside the excitement: MarketsMojo noted that delivery volume (a proxy for “I’m holding this overnight”) on Dec 17 was lower than the 5-day average, even as intraday turnover spiked—suggesting a meaningful chunk of the day’s action could be short-term trading rather than long-term accumulation. [8]

Hindustan Copper is, at heart, a copper-linked business—so the global copper tape matters even when there’s no company-specific announcement on the day.

Reuters reported copper moving toward $12,000/ton, driven by tightening supply and demand growth linked to AI data centers and power infrastructure, with analysts projecting deficits continuing into 2026. [9]

But forecasts are not unanimous in tone:

Translation: copper’s structural story (electrification + AI + grid buildout) remains compelling, but the “straight line up” narrative is contested—even among big-name research desks.

A key reason Hindustan Copper continues to get “re-rated” attention in 2025 is the capacity-expansion storyline.

Moneycontrol previously highlighted the company’s plan to increase mining capacity to 12.2 MT by FY31 (from 3.47 MT in FY25) and outlined ~₹2,000 crore in capex over 5–6 years. [12]

Separately, credit rating agency ICRA reiterated an expectation of healthy FY2026 performance and referenced ongoing capex plans (₹2,000 crore) aimed at scaling mine capacity, while also flagging the dependence on copper prices. [13]

When a commodity producer pairs a favourable tape with a credible multi-year volume ramp, markets tend to do what markets do: price the optionality early and argue about execution later.

One of the most concrete recent corporate developments is the 02.12.2025 MoU with NTPC Mining Ltd.

In its exchange intimation, Hindustan Copper said it executed an MoU to jointly participate in copper and critical minerals block auctions, develop/operationalize blocks, and explore collaboration across domestic and overseas copper/critical mineral projects. [14]

For investors, this matters less as an immediate earnings trigger and more as a signal: the company is positioning itself as a broader “critical minerals” participant, not only a legacy copper miner.

Hindustan Copper’s Chile angle has been building through 2025.

A Government of India Press Information Bureau release (June 2025) noted that a CODELCO delegation visited India, following an MoU focused on knowledge sharing in exploration, mining, beneficiation, and capacity building. [15]

On the deal-speculation/strategic front, NDTV Profit reported in October 2025 that Hindustan Copper was assessing acquisition of two Chile copper mines via a JV with CODELCO, citing sources and noting an HCL team would visit Chile for assessment. [16]

And Business Today also reported (Nov 2025) that India’s mines secretary said HCL was in discussions with CODELCO, describing the possibility of a JV framework. [17]

For the stock, offshore optionality tends to function like narrative leverage: it can amplify optimism during upcycles, but it also raises the bar for execution discipline and capital allocation.

Even “other-company” news can be a breadcrumb for HCL capex activity.

On Dec 11, 2025, The Economic Times (PTI) reported SEPC settled a dispute with Hindustan Copper (₹30.45 crore settlement) and received a supplementary work order worth ₹72.5 crore tied to an ongoing vertical shaft sinking project. [18]

This doesn’t automatically mean a meaningful earnings impact for HCL, but it does reinforce that mine-related project execution is actively progressing in the ecosystem around it.

Hindustan Copper’s most recent quarterly print helped keep sentiment buoyant going into year-end.

The Economic Times (PTI) reported that for Q2 FY26 (Sep quarter), the company posted consolidated net profit of ₹186.02 crore (up ~85% YoY), with income rising to ₹728.95 crore. [19]

The same report also noted that some smelting/refining operations at Jhagadia and Ghatsila have been suspended since 2019 due to business considerations—important context when modelling how the company participates across the copper value chain. [20]

According to Trendlyne’s aggregation of broker research, Hindustan Copper has an average share price target of ₹450, implying about 16% upside from ~₹386.85, based on 1 analyst / 1 report. [21]

A single-analyst consensus is not a “consensus” in the way Nifty50 mega-caps have one—so treat it as a reference point, not a crowd-sourced truth.

Investing.com’s daily technical read (timestamped Dec 18, 2025) showed a “Strong Buy” summary across both technical indicators and moving averages. At the same time, some oscillators flashed overbought conditions (for example, RSI(14) ~71 and StochRSI showing overbought). [22]

This combination—strong trend + overbought signals—often translates into two plausible near-term paths:

ICRA’s Oct 2025 report said the rating reaffirmation factors in an expectation of healthy financial performance in FY2026, supported by firm copper prices and improving operating performance, while also acknowledging exposure to copper-price fluctuations and execution factors. [23]

With the stock trading within striking distance of its 52-week high band, the chart conversation gets simple (and intense):

Also notable: the stock’s run-up is happening with significant intraday participation, which can exaggerate both breakouts and shakeouts. [26]

A rally this strong naturally raises the uncomfortable dinner-table question: “Is it getting expensive?”

Equitymaster pegged Hindustan Copper’s trailing P/E around 65.5 at the time of its Dec 18 market update. [27]

High multiples don’t automatically mean “overvalued” in a commodity-linked name—sometimes they reflect peak-cycle earnings skepticism, sometimes growth optionality, sometimes pure momentum. But they do mean expectations are elevated, and disappointment gets punished faster.

A non-exhaustive reality check (because markets love humility):

As of Dec 18, Hindustan Copper is behaving like a stock the market wants to own right now: strong sector tape, strong intraday demand, and price action pressing into the 52-week high ceiling. [33]

The bull case continues to lean on a powerful trio:

The bear case is equally classic:

1. www.equitymaster.com, 2. www.marketsmojo.com, 3. www.equitymaster.com, 4. www.marketsmojo.com, 5. www.tickertape.in, 6. www.marketsmojo.com, 7. www.equitymaster.com, 8. www.marketsmojo.com, 9. www.reuters.com, 10. www.reuters.com, 11. www.goldmansachs.com, 12. www.moneycontrol.com, 13. www.icra.in, 14. nsearchives.nseindia.com, 15. www.pib.gov.in, 16. www.ndtvprofit.com, 17. www.businesstoday.in, 18. m.economictimes.com, 19. m.economictimes.com, 20. m.economictimes.com, 21. trendlyne.com, 22. www.investing.com, 23. www.icra.in, 24. www.tickertape.in, 25. www.investing.com, 26. www.marketsmojo.com, 27. www.equitymaster.com, 28. www.reuters.com, 29. www.investing.com, 30. www.moneycontrol.com, 31. www.marketsmojo.com, 32. www.ndtvprofit.com, 33. www.equitymaster.com, 34. www.reuters.com, 35. www.investing.com

Platinum price succeeded in forming a new bullish rally this morning, achieving the previously suggested main target by reaching $1973.00, facing a %161.8 Fibonacci extension level which forms strong barrier against bullish trading.

The stability of the trading below this barrier might activate the attempts of gathering some gains, to reach $1900.00 then attempts to test the extra support at $1860.00, while breaching the barrier and holding above it will ease the mission of recording new historical gains that might extend towards 2000.00 psychological barrier.

The expected trading range for today is between $1890.00 and $1970.00

Trend forecast: Fluctuated within the bullish track

Platinum price succeeded in forming a new bullish rally this morning, achieving the previously suggested main target by reaching $1973.00, facing a %161.8 Fibonacci extension level which forms strong barrier against bullish trading.

The stability of the trading below this barrier might activate the attempts of gathering some gains, to reach $1900.00 then attempts to test the extra support at $1860.00, while breaching the barrier and holding above it will ease the mission of recording new historical gains that might extend towards 2000.00 psychological barrier.

The expected trading range for today is between $1890.00 and $1970.00

Trend forecast: Fluctuated within the bullish track

Platinum price succeeded in forming a new bullish rally this morning, achieving the previously suggested main target by reaching $1973.00, facing a %161.8 Fibonacci extension level which forms strong barrier against bullish trading.

The stability of the trading below this barrier might activate the attempts of gathering some gains, to reach $1900.00 then attempts to test the extra support at $1860.00, while breaching the barrier and holding above it will ease the mission of recording new historical gains that might extend towards 2000.00 psychological barrier.

The expected trading range for today is between $1890.00 and $1970.00

Trend forecast: Fluctuated within the bullish track

Silver continues to trade near all-time highs, showing resilience even as other precious metals experience rotational pullbacks. Unlike gold, which is predominantly driven by monetary policy expectations and geopolitical hedging, silver benefits from a dual demand profile—acting both as a precious metal and a critical industrial input.

This unique positioning allows silver to sustain momentum during periods when gold consolidates. Current price behavior reflects acceptance at elevated levels, not rejection. Rather than sharply selling off from the highs, silver has transitioned into controlled consolidation, a hallmark of strong trending markets.

From a broader macro perspective, silver’s strength remains supported by:

As a result, silver has been able to hold premium pricing, keeping it near record levels while gold digests earlier gains.

Silver’s outperformance relative to gold is structural, not coincidental.

Silver plays a crucial role in:

This means silver demand persists even during periods of macro stabilization. Gold, by contrast, relies more heavily on fear-based or policy-driven flows.

Silver supply growth remains structurally constrained, with mine output struggling to keep pace with demand. Gold markets are deeper and more liquid, making silver more responsive to demand shocks and allowing trends to persist longer once momentum builds.

While both metals respond to inflation expectations, silver tends to outperform when growth and inflation risks coexist. Gold typically leads during crisis hedging phases; silver leads during inflationary expansion phases, which better describes the current environment.

Previous expectations for silver emphasized continuation rather than reversal, with pullbacks expected to remain corrective as long as structure held.

That view has been validated:

This confirms that recent price action reflects acceptance at higher value, not speculative excess.

From a technical standpoint, silver continues to validate bullish structure.

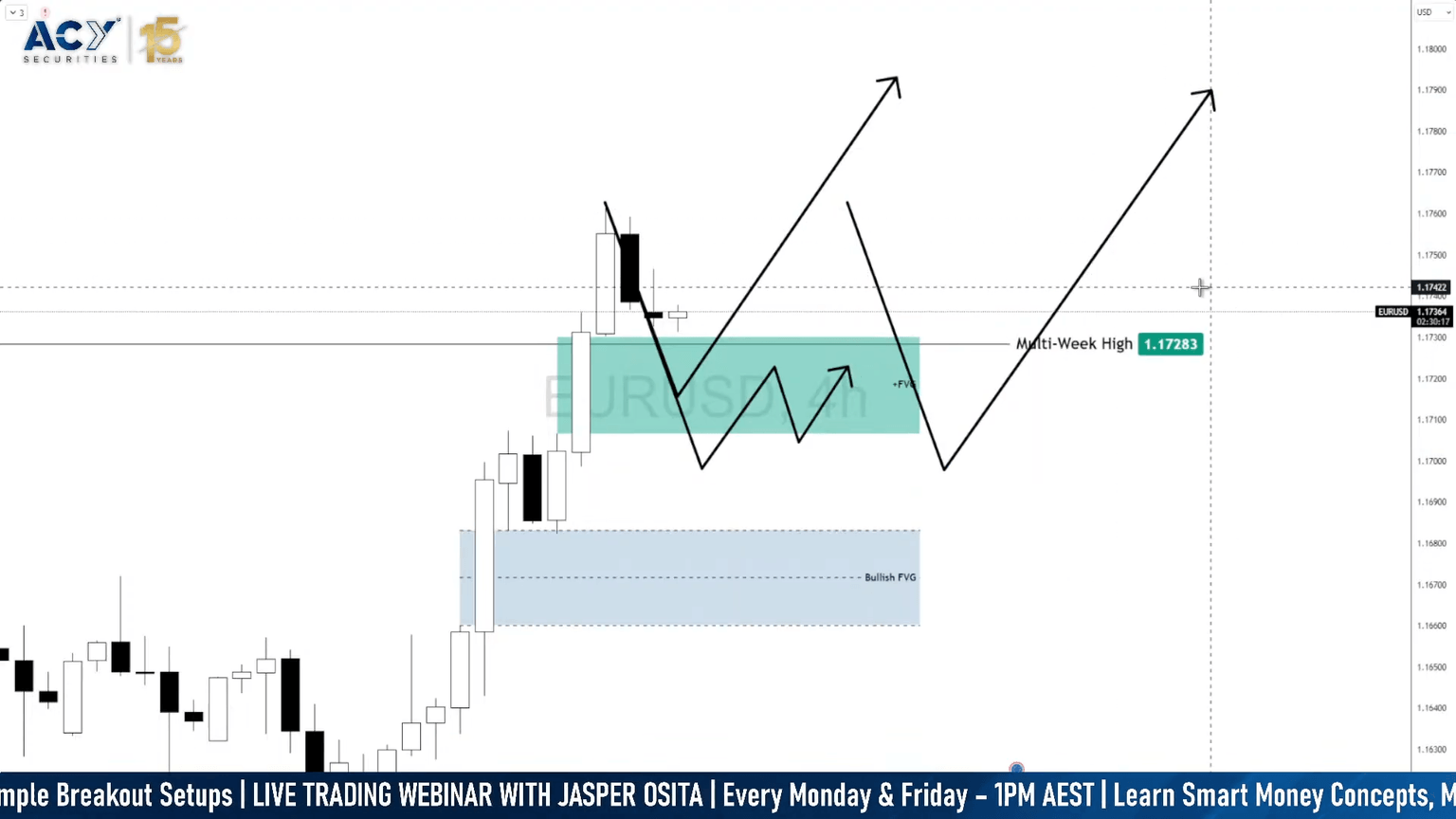

After the most recent impulsive rally, XAG/USD retraced into a clearly defined 4-hour Fair Value Gap (FVG) and reacted precisely as expected. Buyers stepped in aggressively, rejecting lower prices and pushing the market back into balance above the FVG.

This reaction confirms that:

Following the bounce, silver entered a tight consolidation just below recent highs. Rather than breaking down, price is coiling—suggesting liquidity absorption and position building, not exit.

As long as silver continues to hold above the 4-hour FVG, the probability favors directional expansion, not deeper rotation.

The bullish scenario remains favored if silver:

In this scenario:

This outcome aligns with:

A clean upside resolution would reinforce silver’s role as the higher-beta expression of precious metals strength.

The bearish scenario only develops if silver fails to hold the 4-hour FVG and price begins accepting below it.

If that occurs:

Importantly, this would still be viewed as rebalancing, not reversal, unless daily structure breaks decisively. As long as silver remains above major breakout levels on the daily chart, downside moves remain corrective in nature.

|

Factor |

Silver |

Gold |

|---|---|---|

|

Industrial Demand |

High |

Minimal |

|

Inflation Sensitivity |

High |

Moderate |

|

Supply Constraints |

Tight |

More Flexible |

|

Volatility |

Higher |

Lower |

|

Trend Acceleration |

Faster |

Slower |

This structural advantage explains why silver continues to hold near all-time highs while gold consolidates.

Silver’s strength is not accidental. It is driven by structural demand, constrained supply, and favorable macro conditions.

The clean reaction from the 4-hour FVG and ongoing consolidation near highs suggest the market is preparing for its next expansion, not rolling over. As long as price holds above key value zones, the broader bullish narrative remains intact.

Silver continues to lead—not lag—the precious metals complex.

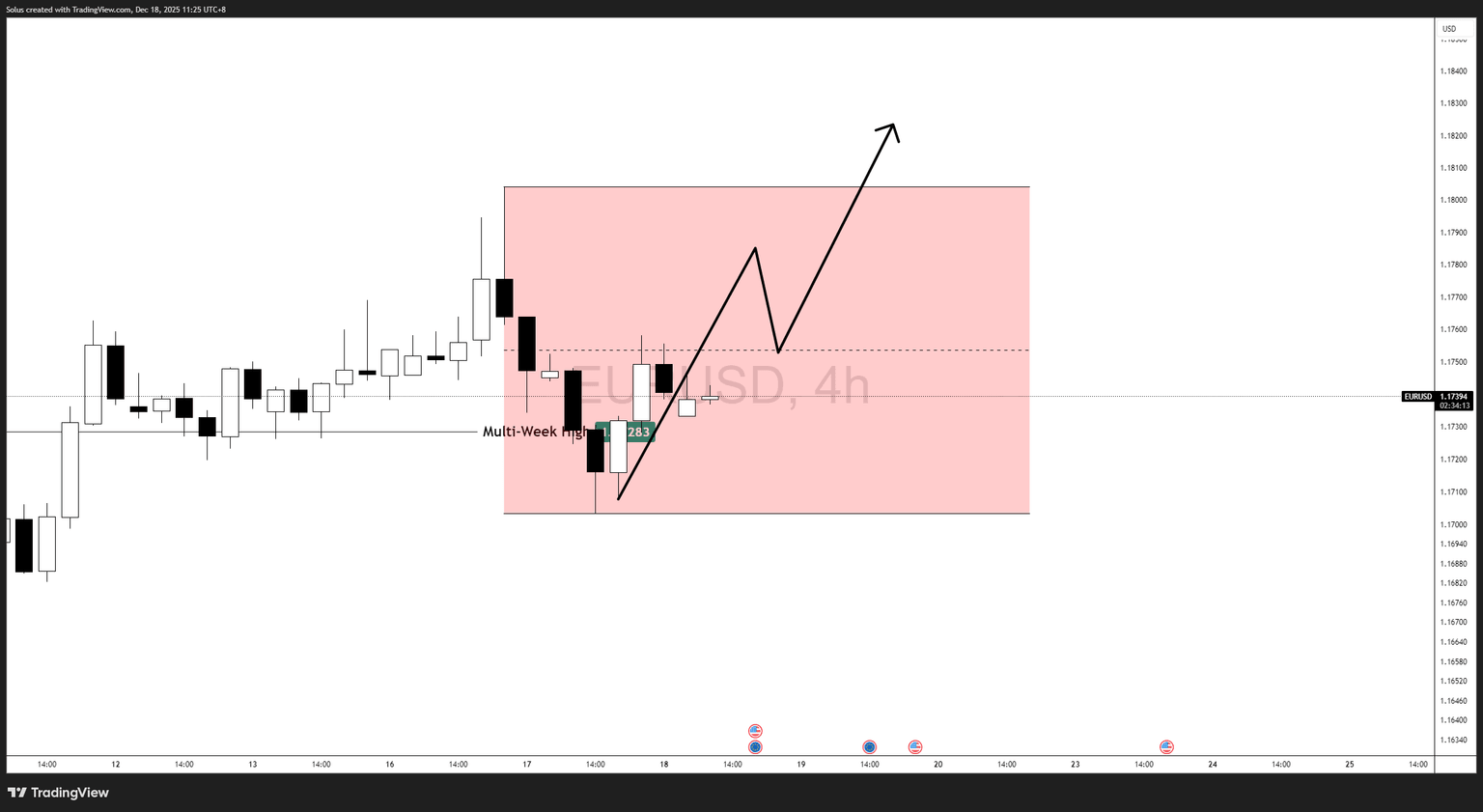

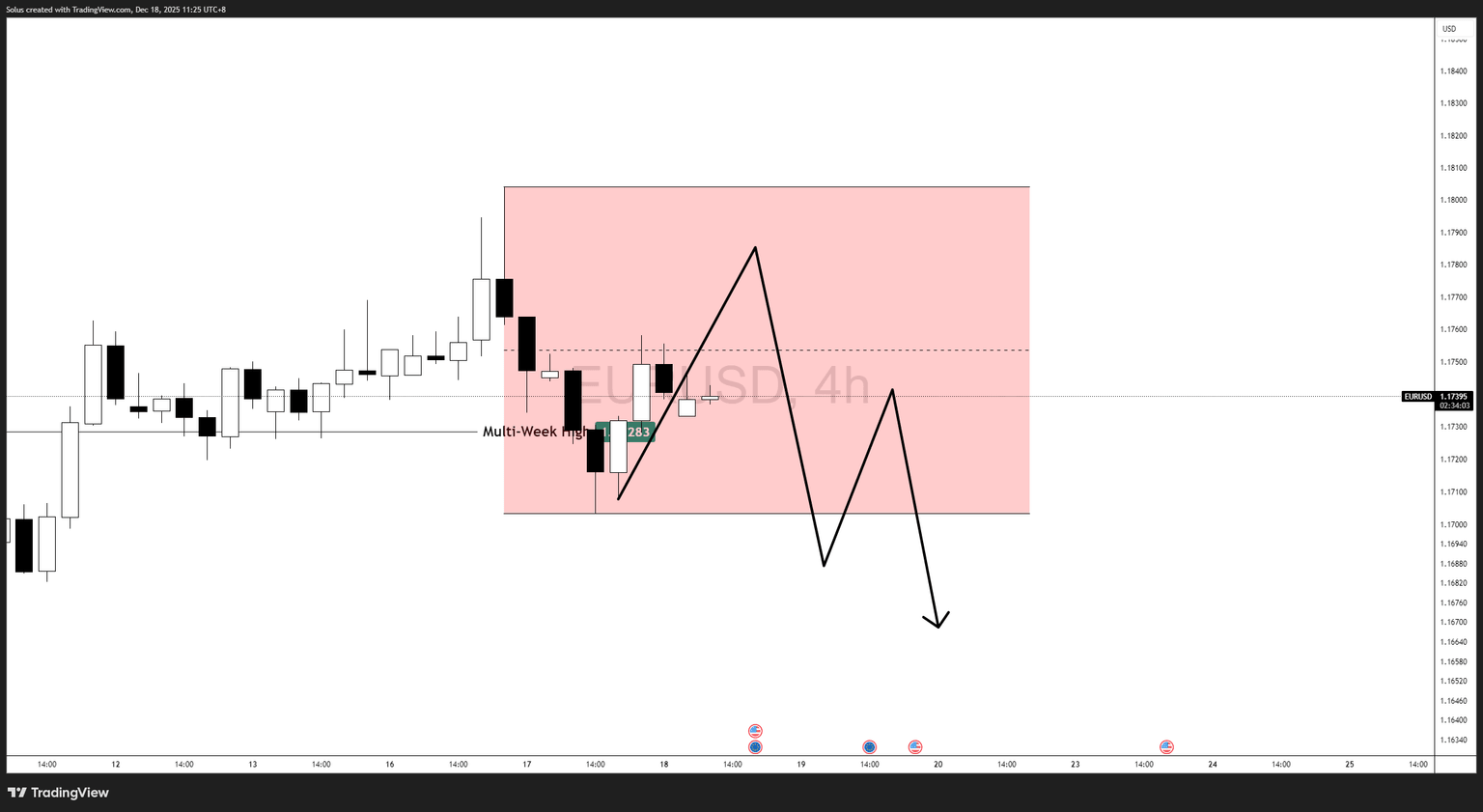

EUR/USD is currently transitioning from impulsive expansion into balance, consolidating above the 1.1728 multi-week high. This behavior reflects acceptance at higher prices, rather than exhaustion or trend failure.

After reclaiming a key structural level, the market has paused to allow two-sided trade — a natural and healthy process in trending environments. Importantly, price has not collapsed back below prior resistance, nor has it shown aggressive distribution. Instead, EUR/USD is oscillating within a defined range, signaling re-pricing rather than rejection.

From a macro perspective, this consolidation is occurring against a backdrop of persistent USD softness. The Federal Reserve’s shift toward rate cuts and a more data-dependent stance has reduced the dollar’s yield advantage, while expectations for aggressive ECB easing remain restrained. This narrowing policy divergence continues to favor EUR/USD on a medium-term basis.

As a result, the current price action should be viewed as digesting gains, not undoing them.

The prior EUR/USD forecast did not call for immediate continuation higher. Instead, it emphasized that acceptance above the multi-week high would be more important than chasing momentum.

Specifically, the expectation was for:

That scenario has materialized cleanly.

Following the breakout, EUR/USD pulled back into the highlighted re-pricing zone, held above the multi-week high, and formed higher lows rather than accelerating lower. Sellers failed to force acceptance back below prior resistance, while buyers consistently absorbed downside pressure.

This confirms that the breakout was structural, not false. The current consolidation reflects controlled digestion, aligning with the original expectation that the market would pause before determining its next expansion leg.

In short, the market followed process, not prediction — rewarding patience and structural alignment rather than aggressive positioning.

EUR/USD is now trading inside a defined range, with both buyers and sellers actively participating. In this environment, the most important reference is no longer the highs or lows — but equilibrium, or the middle of the range.

Equilibrium represents fair value. How price behaves around this level reveals intent.

The bullish scenario re-engages if EUR/USD breaks above the equilibrium level and holds above it.

Acceptance above the midpoint of the range signals that buyers are willing to transact at premium prices, not just defend the lows. In strong trends, equilibrium often acts as a launchpad, not resistance.

If price reclaims equilibrium and stays above it:

Bullish expectation:

Rotation toward the range high, followed by a potential continuation toward new multi-week highs if momentum builds.

The bearish scenario develops if EUR/USD fails to reclaim equilibrium and consistently trades below the midpoint of the range.

In this case, equilibrium acts as resistance, suggesting sellers control fair value. This would likely lead to:

However, it is critical to distinguish correction from reversal. Even a sustained move below equilibrium would still be considered rebalancing, unless broader daily structure breaks decisively.

EUR/USD is not weakening — it is pausing with structure intact.

The market is currently balanced, and equilibrium is the line that separates continuation from deeper correction. Acceptance above it favors renewed strength, while failure keeps price rotational.

Until that decision is made, patience remains the edge.

A new higher swing high for the short-term advance at $4,353 was reached last Friday, resulting in three tight days of consolidation near that high. Wednesday’s high of $4,349 marked the third recent test of that resistance zone. A decisive breakout above triggers resolution of the four-day range and continuation of the short-term uptrend. Retained bullish momentum thereafter positions gold for a new trend high breakout above $4,381.

The bull trend in gold has been rebounding from an October retracement low of $3,886 with strength confirmed by breakouts above the 20-day and 10-day averages, subsequently defended as support during pullbacks. The advance also delivered a second bull breakout of two rising trend channels—one long-term and the other measuring the advance begun in March 2024—after the first October attempt failed and produced the brief bearish correction.

Gold is expected to resolve to the upside if it remains above the key dynamic support area. The 10-day average at $4,256 is rising and about to advance above the top of the shorter channel. Momentum has been lacking overall during the recent advance, but momentum could be triggered once the 10-day average meets up with price. In its current location, it represents potential support along with the top channel line and near-term uptrend line, which cross in a day. Three indicators identifying a similar potential support area strengthens its significance either as support or a pivot that breaks to the downside.

Gold’s persistent tight range near the $4,353 high and advancing averages keep the bull case dominant with buyers positioned to deliver the strongest close in months. Clearance of $4,353–$4,381 unlocks new record territory; hold the converging 10-day/channel/uptrend support on any weakness and the path of least resistance stays higher.

For a look at all of today’s economic events, check out our economic calendar.

The GBP/USD exchange rate dropped by 0.75% on Wednesday after the UK published encouraging consumer inflation data. Sterling dropped to a low of 1.3327, down from this week’s high of 1.3460.

The GBP/USD exchange rate pulled back and erased some of the recent gains as investors reacted to the latest UK inflation data. This also explains why the UK bond yields dropped as the FTSE 100 Index rose.

A report by the Office of National Statistics (ONS) showed that the headline Consumer Price Index (CPI) dropped from 3.5% in October to 3.2% in November.

UK’s inflation dropped by minus 0.2% on a MoM basis after rising by 0.3% in the previous month.

Meanwhile, core CPI, which excludes the volatile food and energy prices, dropped by 0.1% on a MoM basis, bringing the annual inflation figure to 3.2%.

More data shows that the retail price index (RPI) dropped from 4.3% to 3.8%, while the Producer Price Index (PPI) dropped from 3.6% to 3.4%.

These numbers mean that the country’s inflation is moving in the right direction, a move that confirms that the Bank of England will cut interest rates by 0.25% in the final meeting of the year on Thursday this week.

The BoE has delivered several interest rate cuts in the past few months, moving from a high 5.25% in August 2024 to the current 4%. As such, a cut will bring the headline interest rates to 3.75%, even as the inflation remains above 2%.

The bank will cut rates as the economy has remained under pressure in the past few months. For example, a report released on Tuesday showed that the unemployment rate rose to 5.1% from the previous 5.0%. The average earnings with bonus dropped to 4.7% from the previous 4.9%.

The next important catalyst for the GBP/USD exchange rate will be the upcoming US consumer inflation report, which will come out on Thursday.

Economists polled by Reuters and Bloomberg expect the upcoming US inflation report will come in at 3.0%, much higher than the Federal Reserve’s target of 2.0%.

Data compiled by Polymarket also places the odds of inflation coming in at 3.0% rising to 44%. It is followed by 3.1%, which is at 42%.

The US inflation report comes a week after the Federal Reserve delivered the third interest rate cut of the year and pointed to one more in 2026.

The daily timeframe chart shows that the GBP/USD exchange rate rose from the psychological level of 1.3000 in November to a high of 1.3460.

It pulled back to a low 1.3327, its lowest level on October 10. It has dropped to the 50-day and 100-day Exponential Moving Averages.

The pair has formed an inverse head-and-shoulders pattern, which is a common bullish reversal sign. Therefore, the pair will likely rebound as bulls target the next psychological level at 1.3500. A move above that level will point to more gains, potentially to the year-to-date high of 1.3725

The post GBP/USD forecast as odds of BoE interest rate cut jump on Polymarket appeared first on Invezz

Tuesday’s decline was confirmed with a daily close below both dynamic trend indicators, but Wednesday’s swift response turned it into a potential false breakdown. The completion of the key Fibonacci retracement, together with this quick reclaim, suggests a counter-trend rally may have started. Tuesday marked the seventh consecutive day of lower daily highs and lows that followed a minor three-year high of $5.02 reached earlier this month.

The 50-day average was broken a week ago Tuesday, followed by a drop through the lower trendline of a rising channel that accelerated the decline to the 200-day average. Sharp moves commonly follow failed breakouts, and the rapid recovery on Wednesday fits that classic pattern.

The most obvious potential resistance zone if natural gas continues strengthening short-term spans from a November swing low of $4.09 up to the 50% retracement at $4.32. Included within that band is the 50-day average at $4.26 currently, while the falling 20-day average at $4.34 will soon enter the range. The 38.2% Fibonacci retracement also sits inside at $4.15. A swing back to test prior support areas as resistance is a natural progression following the breakdown of an advancing trend channel.

Key near-term support now rests at Wednesday’s low of $3.69; a drop below shows weakness rather than additional strength. A rally above Monday’s high of $3.92 further confirms the bullish reversal and raises odds that the higher resistance zone gets tested on this bounce.

Natural gas has flipped from a confirmed breakdown of the 200-day average with Tuesday’s close below the average, to a potential false breakdown with the rapid reclaim of the 200-day average and trendline off the 61.8% Fib completion. Hold $3.69 and push above $3.92 to target $4.09–$4.32; failure to defend current lows re-exposes deeper correction, while the counter-trend rally case stays favored until proven otherwise.

For a look at all of today’s economic events, check out our economic calendar.