Trump Web3 Gaming vs PepeNode Mine to Earn Model

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Friday 12 December 2025, a new crypto game carrying the name of U.S. President Donald Trump has been making headlines, but the details show something pretty unusual for what is supposed to be a Web3 launch. Players can simply skip the crypto side completely, so it feels more like a Web2 style game dressed up in blockchain branding than an actual Web3 title.

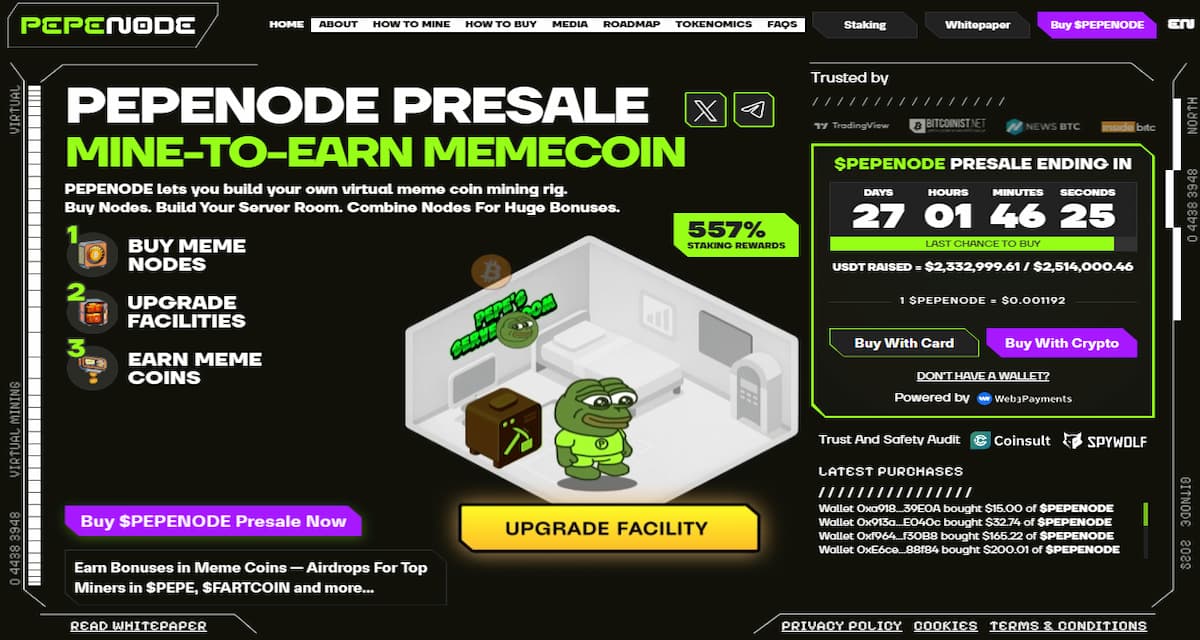

Pepenode (PEPENODE), on the other hand, goes in the opposite direction and is built as a fully Web3 native game where the blockchain rails hold up the whole system. Instead of recycling the same broken Play to Earn templates that came apart with Axie, StepN, and last year’s Telegram games, Pepenode is rolling out crypto’s first mine to earn meme coin setup that is designed with long term sustainability in mind.

While some projects are just tiptoeing around GameFi experiments, Pepenode is openly committing to the idea that if GameFi is going to move forward, then it should evolve in a serious and complete way.

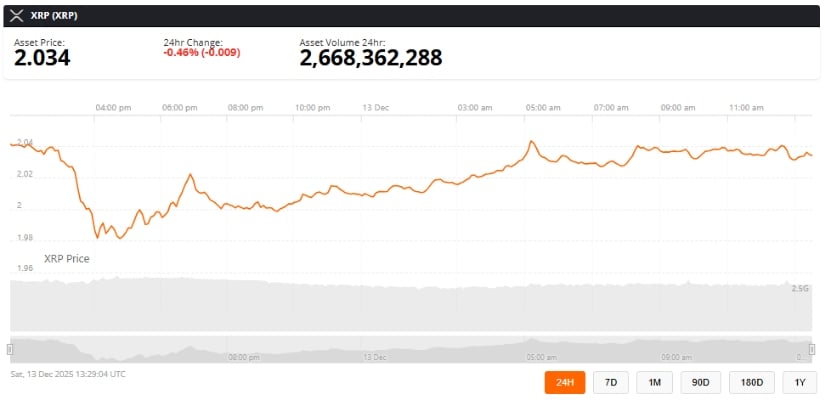

For investors who want to back what might end up as the first actually sustainable crypto game economy, the presale is already live at $0.0011873 per PEPENODE.

Still, the time frame is tight, because Pepenode has recently confirmed that the presale will finish in 27 days. Once that date passes, the only way to get PEPENODE will be through exchanges, where the price might never revisit the low levels seen during presale.

If Blockchain Is Optional, Is It Really GameFi At All?

A recent post from the TrumpMeme X account announced that pre registration has opened for an officially licensed Trump themed game. Named Trump Billionaires Club, the site shows Trump in an Apprentice style role, and the gameplay is described around rolling dice, picking up properties, getting involved in the stock market (strangely skipping the crypto market), and climbing up a flashy high roller style ladder.

Players are told they will get the chance to “Live the High Roller Lifestyle as you race to become the Ultimate TRUMP Billionaire!” but the real hook is the share of $1 million worth of Official Trump (TRUMP) tokens on offer.

The game plugs into Open Loot to handle digital collectibles, something crypto natives will instantly recognize as a pretty classic Web2.5 mechanic dressed in Web3 language. But if you look a bit closer at the website, it becomes clear that the whole game keeps running perfectly fine even if nobody touches the blockchain part at all.

In fact, Web3 participation is clearly marked as optional, and players are allowed to use regular non crypto payment options for transactions. So when the game proudly says “Your empire, on chain,” but everything works off chain anyway, it raises the question where this so called empire is actually supposed to live.

All of that underlines that the game, even if it turns out fun, is not really trying to fix any of the long running GameFi problems that pushed millions of newcomers into crypto through gaming, only for them to bail out again when token economies fell apart.

If blockchain gaming is really going to advance, those issues need proper answers, not just a new theme or famous face. And right now, the project that is seriously trying to tackle them is not a Monopoly style rebrand, but the mine to earn ecosystem being built around Pepenode.

The First GameFi Economy Aimed To Grow Stronger Over Time

Pepenode starts with a simple pitch, it is crypto mining turned into a virtual strategy game. But once you look past the surface, it is clear the project is quietly trying to strip out the broken foundations of old school GameFi.

The planned gameplay does not drop users into a dull loop of tapping, clicking, or running around the same track. Instead, it throws them into a silent, empty server room that more or less challenges them to build something that actually works.

Every action a player takes, like buying new nodes or upgrading parts of the facility, is paid for using PEPENODE, and every decision has real consequences. If you pair up the wrong nodes, your rig turns unstable and starts crawling, but if you find the right combinations, suddenly your setup is pushing out tokens like a well tuned farm, which makes the whole thing feel closer to engineering than casual playing, and that is very much the idea.

Unlike a title that leans on a Web3 label and a Trump inspired costume to feel relevant, Pepenode treats the word simulation literally. The team is already hinting at mechanics that mirror the problems real miners face every day, from heat spikes and power drain to system stability issues, basically the whole messy package, just without sending your home electricity bill through the roof.

And yes, players do earn PEPENODE from the setups they build, but the token’s job does not end there. The more PEPENODE is spent in game to fine tune a rig, the more chance there is to unlock higher tier rewards, including big meme coin assets like Pepe (PEPE) and Fartcoin (FARTCOIN).

The crucial part is that every upgrade also burns PEPENODE, with 70% of those tokens taken out of circulation for good. That means player progress does not blow up supply, it actually tightens it, so the busier the game becomes, the more scarce PEPENODE turns over time.

This mix of thoughtful base building, meaningful spending decisions, and rewards that crypto users actually want is why Pepenode is already being talked about as a serious contender for the first GameFi model that is really built with long term durability in mind.

Only 27 Days Left To Buy PEPENODE

Right now, while the presale is still open, early supporters can grab PEPENODE and directly support the ongoing development of the game. Tokens are available through the Pepenode presale site, where buyers can pay with ETH, BNB, USDT (ERC-20 or BEP-20), or even regular credit and debit cards.

Buyers are free to connect through pretty much any major wallet, including Best Wallet, which many users see as one of the top crypto and Bitcoin wallets available today. Pepenode is already listed inside Best Wallet’s Upcoming Tokens discovery feed, so users can buy, track, and later claim their tokens inside the app without extra hassle.

The project’s smart contract has also gone through a full Coinsult audit, giving early participants added confidence in the security and integrity of the underlying code.

Anyone who wants to stay in the loop can follow Pepenode on X and Telegram for fresh news and updates.